A Reflation Butterfly Is Beating Its Wings

Authored by Simon White, Bloomberg macro strategist,

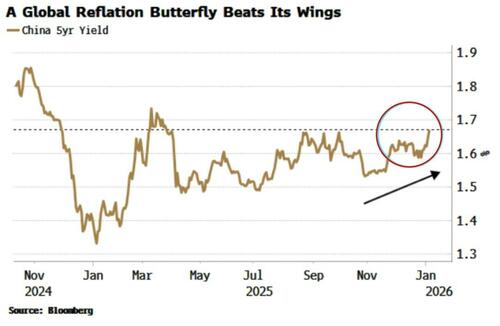

Low volatility and building pressure in Chinese yields suggests they are on the verge of breaking out to the upside, with reflationary consequences for the US and the rest of the world.

The US economy is proving a bit of a conundrum. Leading data suggests a slowdown is on the way, but it has started to turn back up. And there is weakness in the jobs market as annual growth in payrolls continues its steady decline, even as temporary help, typically a leading indicator for employment, rises.

Which direction the US takes is set to be resolved by China, where the hallmarks of a reflation are becoming clearer. That will be pivotal for US assets. The 4-4.2% range that Treasury yields have been stuck in would likely break out to the upside, while stocks should gain further support. Commodities would be poised to move decisively higher too.

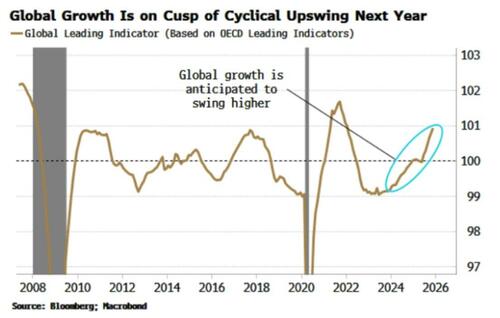

A reflation in China is consistent with a reflation in global growth anticipated by the median of 22 OECD country leading indicators, as the chart below shows.

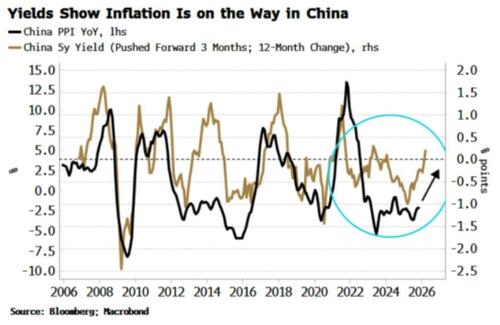

The lagged effects from a year of accelerating money growth in China are beginning to feed through to the domestic economy. The giveaway that this is now proving to be reflationary is the rise in Chinese yields, after their persistent decline followed by sideways movement for the several years since pandemic restrictions were fully lifted.

But the steady increase in yields (they are lower today) we now see points to higher PPI, as in the chart below.

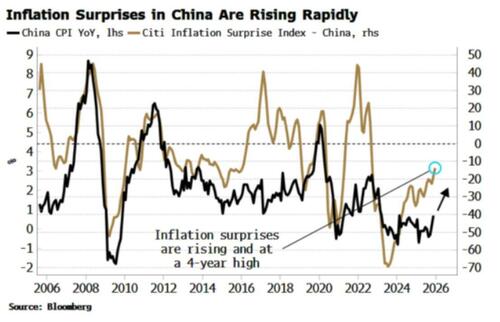

An increase in PPI would be following in the footsteps of CPI. Its rise has been driven by food and, more recently, consumer goods. If the message from rising inflation surprises is anything to go by, the rebound has more to go.

Global assets felt the initial impact of China’s liquidity surge. There is ample evidence to support the notion that capital leakage from China grew as new liquidity bypassed border controls to find profitable opportunities abroad. It would also explain the impressive performance of global risk assets last year despite the relentless bombardment on sentiment from tariffs.

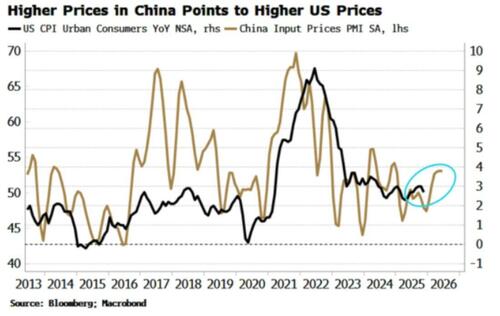

But liquidity typically takes longer to percolate into the real economy. We are seeing that now, with inflation and bond yields rising, as mentioned, while the annual growth in total social financing is nearly positive again. Input prices have been rising too. This has typically led turns higher in US CPI by about six months.

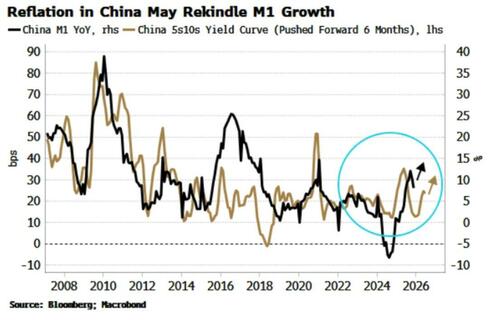

As noted in December, it will be essential to monitor money in China as its acceleration eases back, which has potential consequences for asset prices around the world. But if reflation spreads its wings, it should also short-circuit the easing in M1. As the chart below shows, a steeper yield curve in China has typically led to growth in narrow money.

Moreover, this week the PBOC in its 2026 Working Conference affirmed its commitment to loose monetary policy and ample liquidity.

Why should we expect the nascent rise in China’s yields to continue?

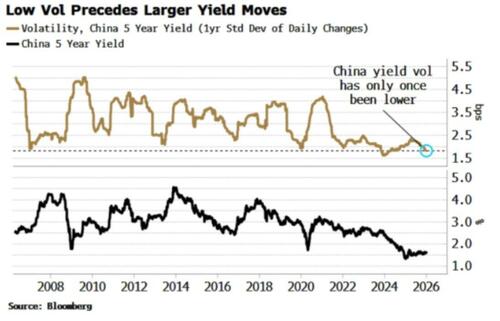

First, a bigger move could be afoot as their volatility is almost as low as it has ever been.

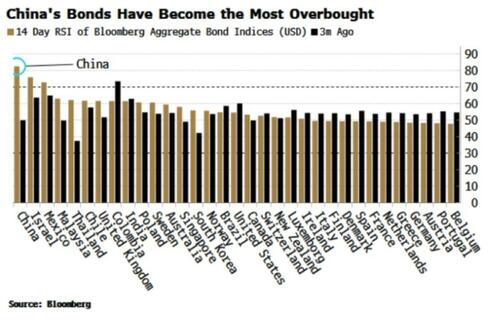

Coiling markets typically burst into a new range, either lower or higher (see chart above). But for China, the latter is favored as a) that is the direction they are already moving in, and b) China’s bonds are very overbought, both relative to their own history, and to other countries.

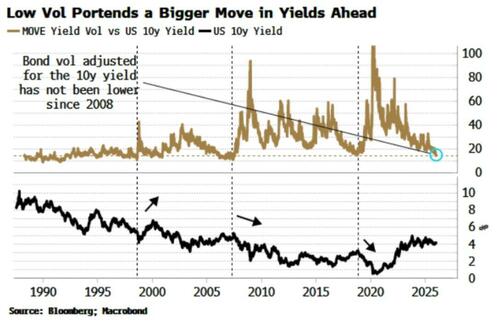

The minuscule volatility in Chinese yields is mirrored in the US. Volatility in Treasuries is low, and adjusting it for the level of yields, it has only been as low or lower on three occasions in the last 25 years. Twice that has precipitated a quickening in the pace of declines in yields, and once, in the late 1990s, a rise, with the 10-year yield climbing from 4.5% to 6.5%.

A reflation in China and a concomitant increase in US inflation would point in the direction of each country’s low bond volatility resolving with a move to higher yields.

It may seem “courageous” to put forward reflation in China and a reacceleration in US growth as plausible possibilities when China is at risk of a debt trap, and the world is going through significant geopolitical flux.

First, however, any reflation in China is set to be cyclical. China’s economy remains chronically unbalanced, with consumption repressed, while it is beset by one of the largest debt loads in the world, much of it in the property and local government sectors and of dubious quality. A debt deflation remains a structural vulnerability.

I’ve got this far without mentioning Venezuela or Greenland, by design. As, to the second point, we don’t know for sure where we will end up after the Trump administration’s latest ruffling of the international order. Furthermore, we also can’t be sure what impact this will have on asset prices, compounding any forecast error — although many will speak convincingly as though the implications are clear, making sweeping assumptions in the process.

It’s prudent to focus on what we do know, on what has a closer, identifiable relationship with risk assets, and requires as few assumptions as possible. On that basis, a protracted increase in money growth in China looks to be catalyzing a reflation, which tilts the risks toward higher inflation in the US, favoring higher yields and supporting stocks over the next 3-9 months.

Geopolitics is said to be like playing three-dimensional chess. That doesn’t mean you shouldn’t incorporate it into your view. But it’s not so wise to make a game with its odds stacked against you a central part of your investment strategy.