"Room To Run, But On A Tighter Leash": Goldman Hedge Fund Honcho Reflects On A "Highly Kinetic Start" To 2026

Not breaking any news, Goldman Sachs head of hedge fund coverage Tony Pasquariello, notes that it’s been a highly kinetic start to 2026.

The newsfeed has been exceedingly active, and each day has been something of its own ecosystem.

Despite all of the noise -- and with appreciation for the challenges that come with managing money in that context -- the fact is this: global equities have continued to push higher in the new year.

Specific to the US market, I can tell myself a few different stories.

-

In one light, given how wild any given day can be, it’s hard NOT to be impressed with how bulletproof the tape has been.

-

In another light, one can argue that the market hasn’t seen all that much progress since the end of October, certainly not the tech space.

-

In the end, however, the S&P has made higher highs, breadth continues to improve and the hunting has been very good in several corners.

Here’s another way to characterize the early action: it’s a bull market and the primary trend is clearly higher, yet the degree of difficulty is rising.

Here I’m nodding to an increase in volatility, which is somewhat observable at the index level, and very observable at the single stock level. to be sure: on a 1-week lookback, the average single stock -- relative to S&P -- is realizing a level of volatility that’s rarely been seen in recent years.

Fundamentally, Pasquariello still believes the big dynamics are friendly for risk.

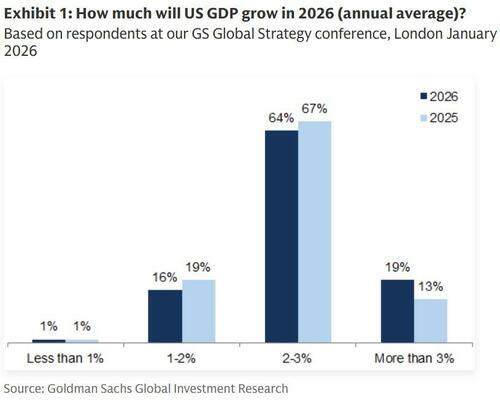

GS is above consensus on the outlook for US GDP growth (2026 +2.8%) and below consensus on the path of inflation (core PCE to 2.1% by year-end), while still calling for two more cuts this cycle (now calibrated to June and September). This all translates to a 1-in-5 probability of recession in the next twelve months (it also translates to our expectation of 12% earnings growth).

The technical setup is a bit trickier.

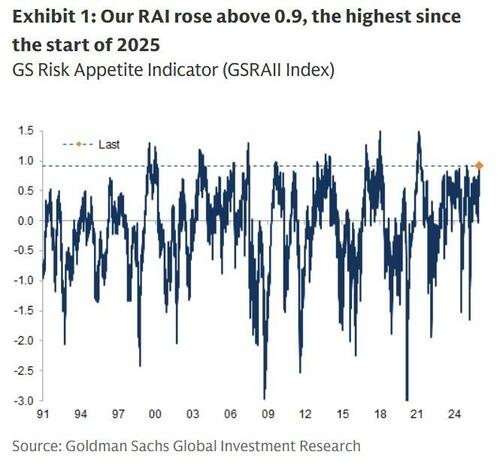

On a scale of -10 to +10, I’d also argue the trading community is carrying length that registers as +8. this is far from an exact science, but it’s a reflection of my franchise mosaic. for example, all of the GS PB metrics that I care about -- inclusive of both gross and net exposures -- measure in the 80th to 90th percentile. for a more formal assessment, note that one of our measures of investor risk appetite is in the 96th percentile of a data set that goes all the way back to 1991.

The hedge fund honcho also found the polling at a recent client conference to be telling. Here’s the upshot:

“82% expect positive global equity returns in 2026 -- the highest ever -- with 42% anticipating double-digit gains, also a record.”

In addition:

“US GDP optimism is at a multi-year high. over 80% of surveyed clients expect US GDP growth around at or above consensus (2.1% for 2026), with recession fears nearly vanishing.”

While he directionally agrees with all of this, it’s a marker of sentiment that can certainly be described as sanguine.

So, the bullish argument has plenty of merit. the Fed is increasing the provision of liquidity into an economic acceleration. part and parcel of that is procyclical government policy. alongside that is an ongoing boom in realized innovation. at the same time, I think stock operators have taken credit for much of this good news. and, I can see a scenario where the reflation trade brings moments that feel a bit more complicated for S&P.

So, the backdrop is friendly, but the setup is demanding and not uncomplicated.

A handful of additional items that I find interesting right now:

In the last few months of last year, the character of the market could best be described as a reflation trade. in the new year, the pro-cyclical tone remains squarely intact. don’t take my word for it: industrials have been ripping. materials have been ripping. even the more highly debated parts of the market -- consumer discretionary, homebuilders, small cap -- have been ripping. I don’t know when this story ends, but it’s consistent with our franchise flows. here I’d note the Atlanta Fed is calling for Q4 GDP growth of -- ahem -- 5.1% (GS is more conservative at 2.2%; we measure things a bit differently).

Following from there, precious metals have begun 2026 where they left off in 2025: screaming higher. whether this is a story of central bank demand, or worries about global fiscal largess, or geopolitical sparks, the market speaks for itself: gold +7% ... silver +27%.

As nodded to earlier, this whole reflation narrative invites a question on the cat-and-mouse risk of higher yields impinging on stocks (at some point). a reminder from US Portfolio Strategy: a 2 standard deviation backup in US 10-year note yields over one month is where rates usually push around the stock market. given that’s equivalent to around 50 bps in today’s terms, and given that 10s have barely moved this year, this suggests there’s some headroom.

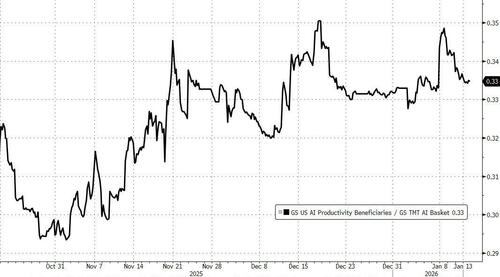

Mega cap tech earnings aren’t for another few weeks, but in the context of the AI trade, I found this sentence to be worthy of mention: “consensus estimates show hyperscaler YoY capex growth slowing from 75% in 3Q to 54% in 4Q and to 24% by the end of 2026”. that is a very big deceleration in the second derivative. now, the market has been far too skeptical of hyperscaler capex growth in recent years, so one should NOT take this as a guarantee of anything. furthermore, we’re still talking about HUGE sums of revenue that are flowing to the purveyors of AI infrastructure.

A related point: I do find it interesting that our basket of companies that are set to benefit from AI productivity in their core businesses (ticker GSXUPROD) has been outperforming the basket of companies who supply the picks and shovels (ticker GSTMTAIP).

Asian equities have also picked up where they left off. it’s been a strong start for China (on record volumes and thanks to outperformance of tech exposures). it’s been a very strong start for Japan (as Takaichi ponders a snap election, much to the delight of domestic exposures). and it’s been a ferocious start for the fastest horse in the 2025 race, Korea (note KOSPI has closed higher in nine straight sessions).

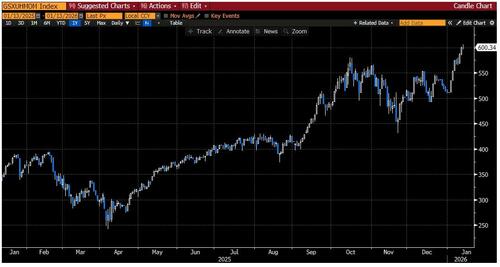

Three charts that illustrate the present day:

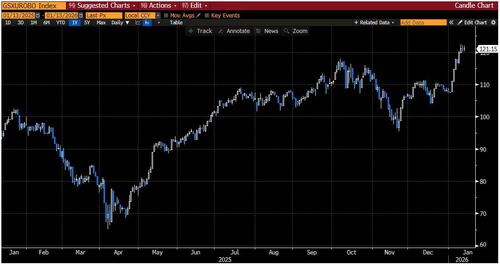

While the mix of the market has been shifting a bit, the momentum factor is breaking out to cycle highs. this plots our basket of high beta 12-month winners:

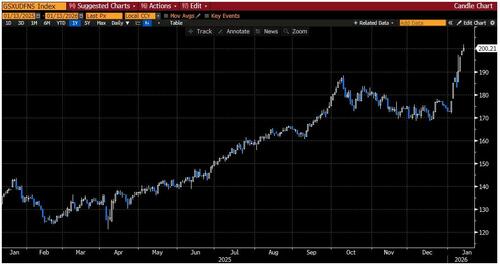

This is our basket of US companies levered to the robotics and automation theme:

Finally, this is the basket of US defense contractors that I referenced last week:

Here’s where I’m going with all of this.

There are times to go for the gas, there are times to go for the brake, and there are times to do neither.

My instinct is the right judgement for the next few months is door number three. Or, to borrow a different metaphor from the great Tim Moe: “room to run, but on a tighter leash.”

Professional subscribers can read much more from Goldman's Sales & Trading team here at our new Marketdesk.ai portal