Scrappy New Year: Bitcoin Bid But Big-Tech Pumps'n'Dumps To Start 2026

2026 started 'mixed' with overnight gains in big-tech stocks being quickly erased (while the broad equity market managed gains), crypto rallying strongly, oil & metals unch (platinum strong), and TSY yields and the dollar higher.

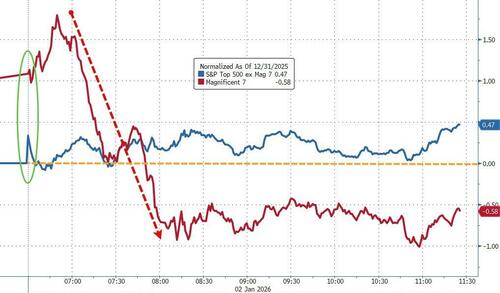

Mag7 stocks were monkeyhammered from big gains to losses as the S&P 493 outperformed...

Source: Bloomberg

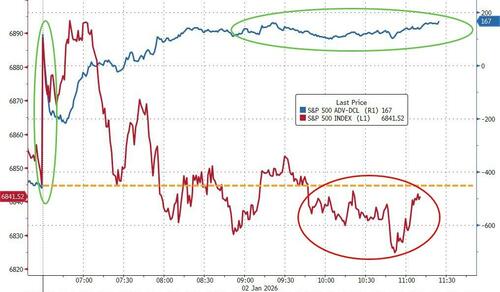

Breadth was dramatically positive, despite the S&P ending unch...

Source: Bloomberg

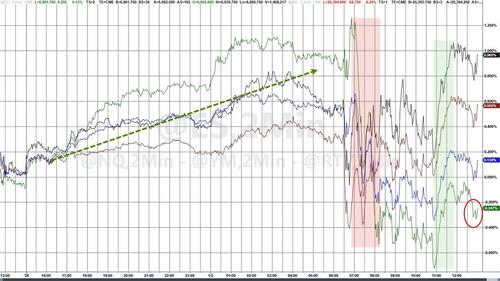

Nasdaq swung from being up over 1.2% shortly after the US cash open to end down over 0.6% at its worst of the day. Small Caps were big gainers and the S&P desperately tried to end green (ending its losing streak at 4 days)...

As Goldman's Chris Hussey notes, the laggards today are familiar: Consumer Discretionary, Communication Services, and Tech are the three worst performing sectors in the S&P 500, exacerbated by underperformance across the Mag-7. Interestingly, other more pro-cyclical areas of the market -- including Energy, Materials, and Industrials (as well as Utilities) are trading higher. Some of the weakness could be attributed to lower TSLA deliveries, but fewer Americans buying EVs doesn't really explain the broader weakness in tech and consumer discretionary names

This should not be a total surprise as since 1953, the S&P 500’s median change to kick off a new year has been a 0.3% drop, with gains less than half the time, according to Bespoke Investment Group.

“The first trading day has been an incredibly poor guide in recent times to how the rest of the year plays out,” wrote Deutsche Bank AG strategists including Henry Allen.

In fact, “2022 saw an all-time high on the first day, before the index fell into a bear market and its worst year since 2008. Whatever happens today, we really shouldn’t overegg the day one moves.”

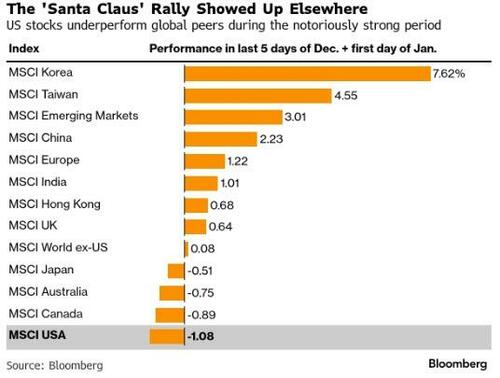

The so-called ‘Santa Claus’ rally has epically failed to materialize in US stocks this year...

...sending them to the bottom of the list in a global ranking of late December performance...

In theory, that window hasn’t closed yet as it goes from the last five trading sessions of the year to the first two of the new year (so Monday needs a big win to end this period positive).

To see why Nasdaq lagged and Small Caps led the day today, the following two charts will help:

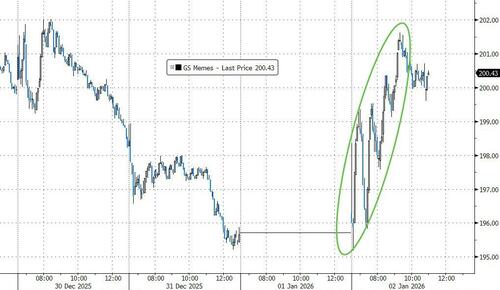

A giant short-squeeze to start the year...

Source: Bloomberg

...continued to (meme stock) dash-for-trash...

Source: Bloomberg

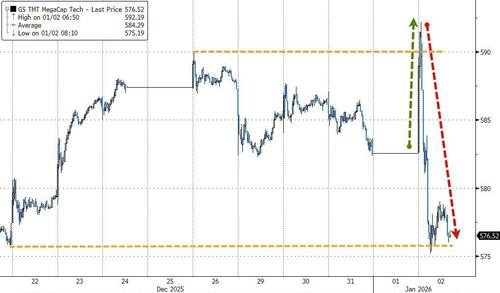

While the early surge of buying in Mega-Cap tech was very quickly eviscerated...

Source: Bloomberg

Treasuries followed the same path as stocks - bid overnight and then dumped during the early US day session - with the long-end underperforming - but didn't stage a comeback like stocks...

Source: Bloomberg

The yield curve steepened once again (now 2s30s at its steepest since Nov 2021)...

Source: Bloomberg

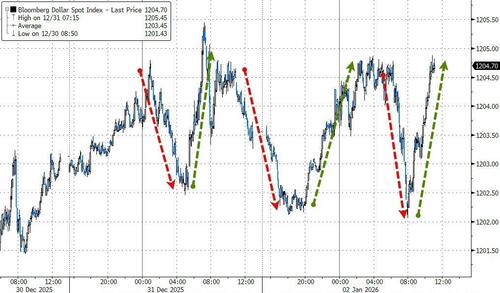

FX markets were choppy with the dollar pumping, dumping, and jumping again...

Source: Bloomberg

Crypto markets were strong to start the year with Ethereum outperforming Bitcoin...

Source: Bloomberg

Bitcoin broke back above $90,000, near three-week highs...

Source: Bloomberg

Metals were also a wild ride today with everything rallying overnight... only to give it all back during the US session. Only Platinum managed to hold on to gains...

Source: Bloomberg

Gold's reversal occurred right at the $4400 level (again)...

Source: Bloomberg

Oil ended unch on the first trading day of 2026 as expectations for a swelling supply surplus offset geopolitical risks to production in several OPEC+ nations...

Source: Bloomberg

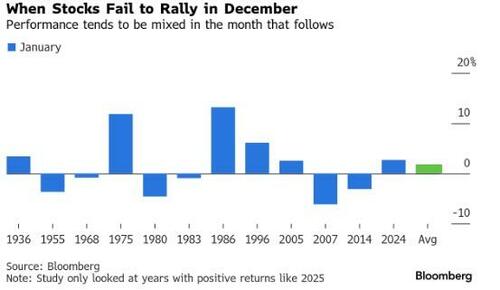

Finally, while January is historically positive, Bloomberg's Tatiana Darie notes that in years when the S&P 500 failed to rally in December, returns were pretty mixed...

While the index rallied more than 1% on average, stocks rose only about half the time, so there’s weak conviction in this signal.

Monday should bring back some more liquidity to the markets as the world returns to work after a two-week hiatus.

We get a slew of important macro data next week, including the December ISM manufacturing and non-manufacturing surveys, November JOLTS data, the UMichigan Consumer confidence survey for January, and December Nonfarm Payrolls.