"On Seemingly Nothing": Wealth Names Whacked As AI Anxiety Spreads

In equity land, it was 'more of the same, but different this time' as AI fears spread and have created a trigger-happy 'sell first, think later' crowd to emerge.

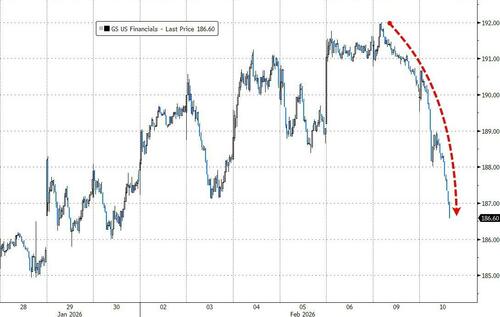

The majors have all slid back to the lows of the day as losses mount in a different sector today...

First it was SaaS firms, then it was (and still is) insurers, and today it's financials as 'existential threats' from 'AI disruption' wreak havoc in over-crowded segments of the market as Goldman Sachs traders note that "anxiety around AI-headline risk seems to be at a maximum (Inbounds are high)."

Specifically, Goldman's Christian DeGrasse points out that wealth names (SCHW AMP LPLA RJF SF) are down dramatically on seemingly 'nothing'...

Sure, there's a headline getting passed around ('Altruist Launches AI-Powered Tax Planning Feature in Hazel Platform' - "The new capability analyzes client documents to generate personalized tax strategies and interactive scenario modeling for advisory firms regardless of custody" )...

...but after reading the article it sounds (to us + feedback) like a product that's ADDITIVE to advisors (they're the customer here), not subtractive (separately...don't we already have robo-advisors?).

Can we stretch "lower cost AI-enabled capabilities in a high fee rate business = have to pass along savings to customers"... sure?

But in our view this most likely is either:

1) people saw 'AI' and 'Advisory firms' together in a headline and moved fast without actually considering the implications of the article, or

2) this was a pre-traded "what’s next" move that got out of hand (and we're all just trying to slap a headline on a story).

Either way, it points to a significant degree anxiety/nerves across the sector, and the TOP question we’re getting right now is ‘what are they going to come for next’

Professional subscribers can read much more from Goldman's Sales & Trading team here at our new Marketdesk.ai portal