"The Setup Remains Fragile" - Top Goldman Trader Says "Hedges Make Sense Here"

If you zoomed out after last week, the takeaway looked familiar, according to top Goldman Sachs trader, Lee Coppersmith.

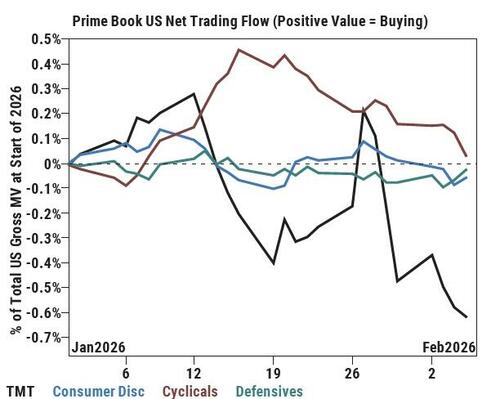

US equity price action continued the same rotations that have defined 2026 – cyclicals over secular growth, value over duration, cashflows over narratives.

Housing, infrastructure, onshoring and other domestically levered themes kept working. Software, long-duration growth and crypto did not…

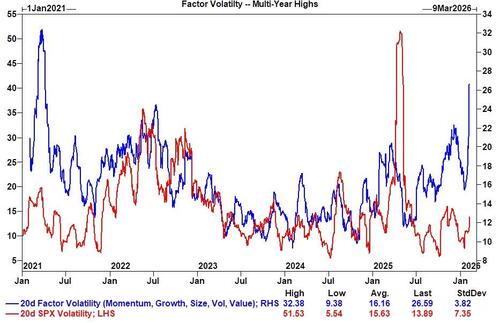

What changed was the violence under the surface. Over the past few sessions, 20-day factor volatility (Momentum, Growth, Size, Vol, Value) jumped to the highest level since 2021. That’s a fast repricing of leadership, and one you typically only see when positioning is being actively unwound. Stress at the single-stock level was real.

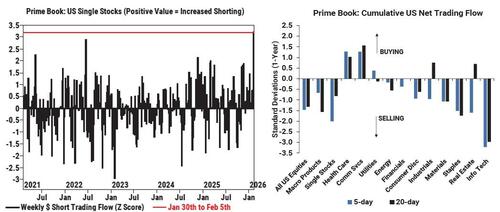

Flows reinforced that story. From Jan 30 to Feb 5, hedge funds net sold US equities for a fourth straight week – and at the fastest pace since Liberation Day (-1.5 SDs, 1y). This wasn’t long de-risking; it was short-led. Shorts outpaced long buys by 2.5:1. Macro products were sold for a second week (-0.7 SDs), but the real pressure was concentrated in single stocks, which made up ~70% of total net selling (-2.0 SDs). Notional US single-stock shorting was the largest on record (since 2016).

Tech sat at the center again. Info Tech was both the worst-performing sector and the most net sold, with the second-largest dollar outflow of the past five years (-3.2 SDs). Shorts overwhelmed longs by 5.4:1. Software alone accounted for ~75% of net selling within Tech. Net exposure to Software now sits at just 2.6% of US net market value, with a 1.3 long/short ratio – both new lows.

When positioning gets that lopsided, it cuts both ways. On Friday, the GS Most Short basket squeezed nearly 9% - the biggest one-day rally since April 9. Five-day volatility on the basket is now >100, the 99th percentile over the last decade. Elevated factor vol plus crowded shorts is a recipe for violent counter-moves, even if the broader rotation remains intact.

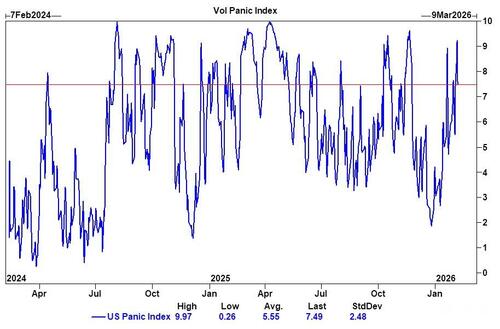

Vol and liquidity are telling the same story. Our Vol Panic Index briefly pushed above 9 (out of 10) on Thursday before settling closer to ~7.5 by week-end. Implied vol reset lower, but put-call skew remains steep. Liquidity was shaky as well – S&P futures depth fell to the 7th percentile on a one-year lookback mid-week before snapping back.

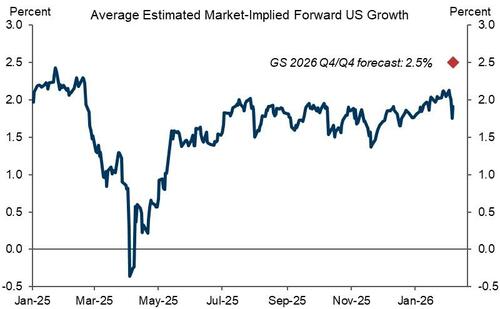

Against that micro stress, macro isn’t breaking – but expectations are drifting lower. Our cross-asset measure of forward implied U.S. growth now sits around 1.9% (down from 2.1% on Feb 2 and ~1.8% intra-week), versus our 2.5% Q4/Q4 2026 forecast.

The backdrop is still fine. The market is simply less willing to pay up for duration while leadership and positioning reset.

Bottom line

The setup remains fragile. Hedges make sense here, and it argues for running a bit smaller until technicals rebuild – better liquidity, less crowded shorts, more balanced positioning.

That said, the big picture hasn’t changed.

The same rotations are still in place, even if volatility under the surface is materially higher.

This remains a stock- and style-driven tape.

Professional subscribers can read much more from Goldman's Sales & Trading team here at our new Marketdesk.ai portal