"A Shoot First, Think Later" Market, As Both Goldman & JPM See Feverish Rotation Out Of Digital Into Physical World

AI contagion was the theme of the week, with victims of "AI disruption" extending beyond the usual suspects (Software), and slamming Private Credit, Insurance Brokers, Financials/Broker/Wealth Managers, Real Estate Service stocks, and finally, Logistics and Truckers.

And then it got worse: yesterday’s broad-based risk off - which culminated into the biggest shorting of software stocks since the global financial crisis - extended into Precious Metals and the Asia session this morning (before recovering), while Defensives and Bonds benefitted from the flight to safety (or rather, flight out of AI). Today, Macro came back into the mix, with mercifully soft US CPI short-circuiting the relentless selling.

So where are we now?

Well, extending on Goldman's analogy that there was "nowhere to hide today with a 'sell now - ask questions later' type of feeling out there", JPMorgan's Market Intel team writes in its morning note (available here) that we seem to be in a "shoot first, think later" environment, with the list of AI casualties expanding rapidly.

The latest disrupted sectors were identified as Transport & Logistics, and Office REITs. While not all of these casualties are genuine dying fields (even within Software there are some green spurts like Industrial Software), it is clear that anxiety is driving at the moment, with many unknowns on who are the true disrupted.

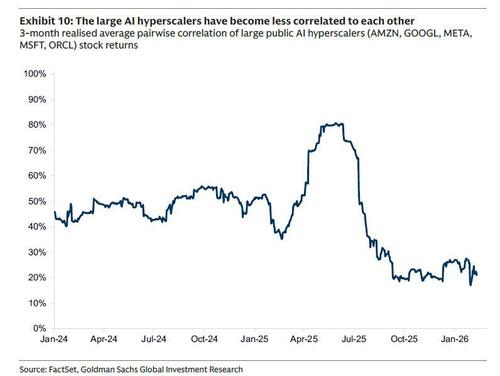

Mag7 has also not gone unscathed, and this points to the argument that JPMorgan's trading desk has been making on the fierce competition in Tech, with hyperscalers increasingly punished for Capex spend.

The corollary to this is being coined as HALO stocks – Heavy Assets Low Obsolescence. This includes Capex & Supply Chain Bottleneck Beneficiaries (Memory ended the day higher despite the broad Tech carnage), Robotics (clear winners from automation), and sectors like Staples (2nd best performing sector YTD).

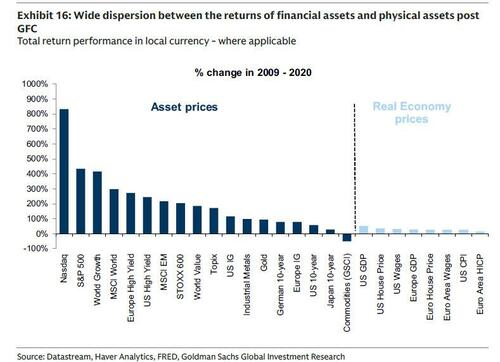

Overall, JPM - and Goldman too, - is starting to see a rotation from the Digital world back into the Physical one.

And speaking of Goldman, the shifting interest away from Digital and back toward Physical Assets was the core topic of his latest note.

Below we excerpt some of his top thoughts (full note available to pro subs):

Oppenheimer touches upon many of key debates:

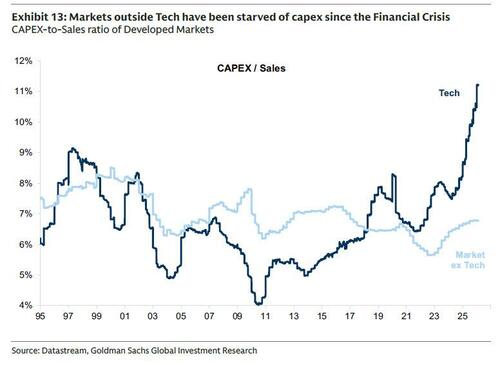

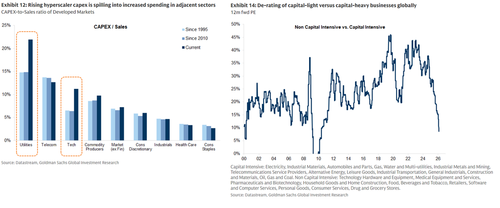

- how increasing hyperscalers’ capex anchors the duration of future growth to a much shorter horizon;

- with increasing interest by investors for other capex intensive sectors that have higher certainty on expected returns; and

- what to do in terms of equity portfolio construction.

His answer is to continue diversifying away from the US and Tech, into other geographies/factors/themes (e.g. EM, Value, Real Assets / Capex Intensive), and – most importantly – understand that this cycle is not different: the structural trends that we envisage in technology and the expected productivity uplifts might not benefit those who invested in the infrastructure, but those who used it: it was the case with steam engines, railways, and the internet…"why should it be different" Oppenheimer asks, echoing literally what we said over a year ago.

The report has plenty of key charts but the ones worth highlighting are the following:

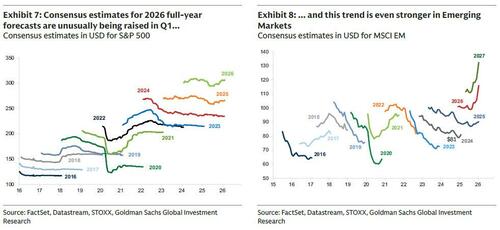

- Equity broadening: the rotation we saw in 2025 should continue, across geographies, sectors, and factors. This broadening was driven by optimism, as much of last year’s non-US returns were driven by multiple expansion…and optimism warranted by the strengthening of global economic confidence.

- Underlying profit growth remains robust and broader as well: US EPS growth this season saw a 12% increase (5% above consensus), 5th consecutive quarter of double-digit growth and no longer dominated solely by Big Tech: the median S&P company grew 9% y/y and 59% beat estimates. Consensus EPS for FY26 is unusually being raised in Q1 – see chart 1

- The S&P concentration debate diminished: Mag7 are less correlated: Consensus estimates for 2026 AI hyperscaler capex have increased to $659 billion, reflecting 60% growth vs. 2025, up from $539 billion at the start of earnings season but questions remain on the ability to generate returns. In 2025, Google generated roughly 66% returns, accounting for 15% of the S&P total, while Microsoft, Meta, and Tesla saw low double-digit returns, and Apple and Amazon were in single digits (underperforming the market). Stock correlations among hyperscalers have sharply fallen.

- AI is leading other sectors to invest: While emerging AI innovations are increasing the dispersion of returns within technology, they are also reconnecting the virtual and physical worlds. For the first time since the internet's commercialization a quarter-century ago, future technology growth prospects are increasingly dependent on physical assets like data centers and energy supplies…

- and investors in those companies are much more used to the balance between the capex you put vs the returns you get…this is probably why the preference for capex-intensive over capex-light keeps increasing.

More in the full JPM and Goldman notes available to pro subs.