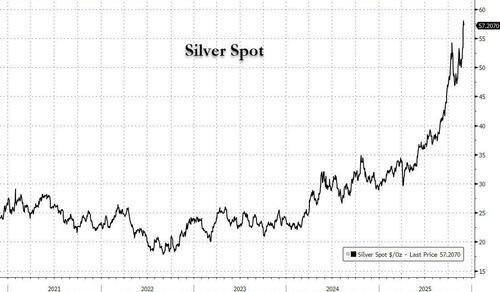

Silver Erupts To Record High As Shanghai Inventories Crater To Critical Levels

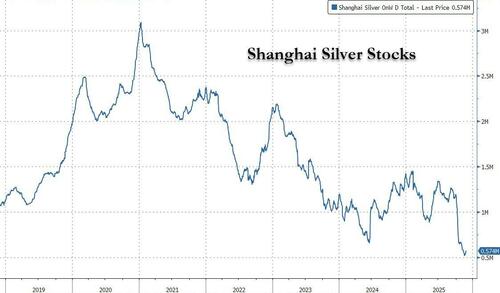

Last Friday we observed that silver's latest breakneck surge to record highs was in large part due to collapsing inventories of the precious metal in Chinese warehouses linked to the Shanghai Futures Exchange, which just hit the lowest level since 2015.

It has only gotten worse since then.

At a time when "digital gold" bitcoin and the crypto complex are melting down, non-digital silver jumped to a new all time high on Monday with traders placing speculative bets on ongoing global supply tightness.

The white metal rose as high as $58.84 an ounce after soaring almost 6% on Friday. It has climbed for six consecutive sessions and has nearly doubled in value this year, outpacing the roughly 60% rally in gold.

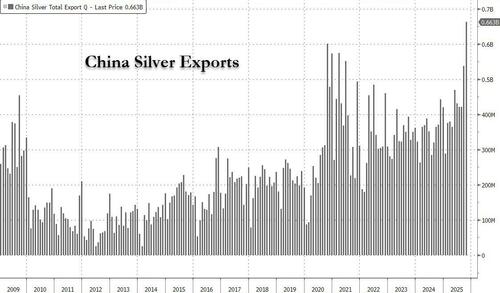

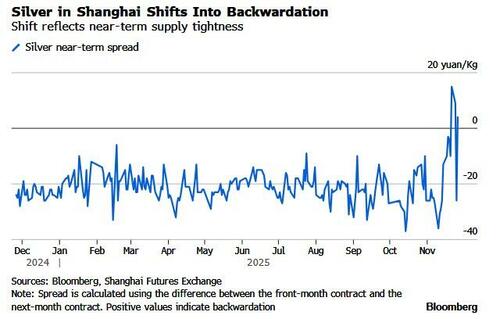

While a record amount of silver flowed into London in October to ease a historic squeeze (discussed here two months ago) in the world’s biggest trading hub for the metal, like connected vessels, this has only put other centers under pressure. And as noted last week, inventories in warehouses linked to the Shanghai Futures Exchange recently hit the lowest in nearly a decade, and the cost of borrowing the metal over one month remains elevated.

The drawdowns came after Chinese exports of the precious metal surged to more than 660 tons in October, the highest volume on record: “The tightness stems from rising exports to London,” said Zijie Wu, an analyst at Jinrui Futures Co., who also cited industrial and fabrication demand. The shortage may ease in about two months, he said, although by then silver may be triple digits if the prices increases continue at the current rate.

“Shortages in the global market as a result of the recent squeeze in London are still being felt,” said Daniel Hynes, a commodity strategist from ANZ Group. "With gold taking a breather, it appears investors have turned their attention to silver."

Silver has had a tumultuous year, with prices rallying 80% to a series of highs. The spike came as gold surged, and traders also wagered that the Trump administration may introduce a tariff on the cheaper metal. That pulled silver into the US, tightening the London market just as Indian demand boomed, triggering a historic squeeze. Now, the slump in Chinese holdings means the country may not be able to provide a backstop in the near term, while silver demand persists.

“If silver is tariffed, then it will lock up the silver that has already made its way to the US,” said Daniel Ghali, commodity strategist at TD Securities. “If that were to occur while Shanghai markets are still reeling from the last instance in which they backed up London, then the impact will be significant.”

Reflecting the tightness in China, Shanghai silver prices have moved deep into backwardation - i.e., near-term silver prices topping later-dated contracts - signaling short-term pressure. Given the low inventories and so-called inelastic - or sticky - supply, concerns remain elevated , according to Jinrui Futures’ Wu.

On the demand side, Chinese consumption of silver for photovoltaic components — one of the metal’s primary uses — has risen. “The fourth quarter is typically peak season for solar installations,” Wu added.

In an unintended twist, Bloomberg notes that a recent tax revamp has also spurred demand. New rules ended a long-standing rebate on input value-added tax for some gold sold outside exchanges, prompting some retailers to switch to silver.

The impact can be seen in Shenzhen’s sprawling Shuibei market — where many transactions had traditionally involved non-exchange gold. “Many merchants are uncertain how to price their products after the new rules,” said Liu Shunmin, head of risk at trader Shenzhen Guoxing Precious Metal Co. “So some shifted focus to silver, especially if they already have some silver business.”

Outside China, silver-market liquidity remains a concern, with borrowing costs still elevated in London despite a record inflow into the UK capital. Traders are also monitoring any potential US tariff on silver after the precious metal was added to the US Geological Survey list of critical minerals.

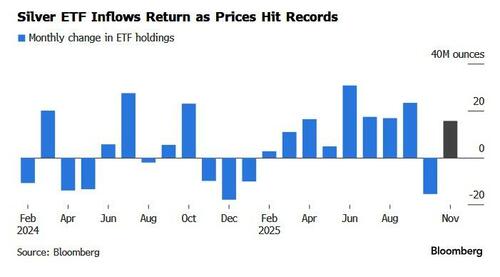

“Most of the physical demand today for silver out of London is associated with pure speculative demand,” said TD Securities’ Ghali. The volume in exchange-traded funds - which typically can’t be lent out - has held firm, with no major redemptions even after prices eased from their recent record.

There's more: both metals have been boosted by increased expectations that the Fed will cut interest rates this month, leading to further fiat debasement.

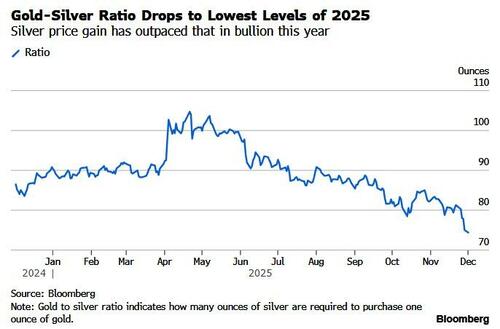

“The move last week has been speculatively driven, with accelerating upside momentum attracting more and more fast money,” said David Wilson, director of commodities strategy at BNP Paribas SA. “Key to watch is the fact that the gold-silver ratio has got down close to 70,” he said, adding that investors will be watching how expensive silver is getting relative to gold.

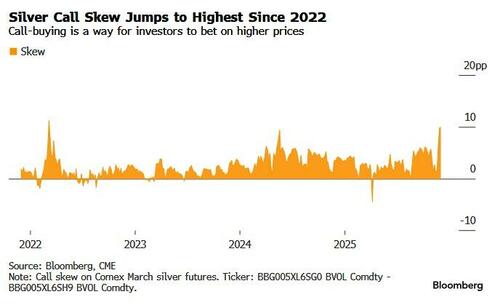

Meanwhile, speculators are piggybacking on the rolling global shortages, and silver call options volatility jumped to the highest premium over puts since 2022, indicating a surge in the cost of betting on higher prices.

Additionally, inflows into silver ETFs, traditionally an indicator of retail demand, surged back to positive in November after a lone decline in October, the first since January.

Traders are also monitoring any potential tariff on silver after the precious metal was added to the US Geological Survey list of critical minerals last month. Fear of a sudden premium in America has made some traders hesitant about sending the metal out of the country, offering little prospect of relief should the global market tighten further.

Silver mining stocks also advanced on Monday. Coeur Mining Inc. gained as much as 3.5% while Pan American Silver Corp. rose 2.5%. London-listed Fresnillo Plc jumped more than 8%. In Australia, Sun Silver Ltd. jumped as much as 21% and Silver Mines Ltd. nearly 13%, while Hong Kong-listed China Silver Group Ltd. rose 14% before paring some gains.