"Slumdog Billionaires": Why Hartnett Is Going Long Main Street, Short Wall Street Into The Midterms

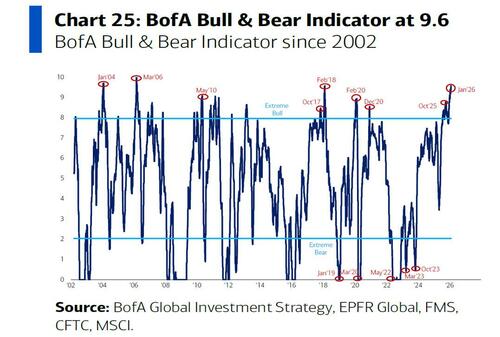

One month ago, Bank of America CIO Michael Hartnett, who had recently redesigned the bank's closely watched Bull and Bear Indicator found something troubling: as of the start of 206, the (new and improved) Sell signal had been triggered as it stood at a "very bullish 9.0 as outflows from tech stocks & EM debt offset by very strong global equity breadth (98% of country indices above 200dma), super-low BofA Global FMS cash positions (record low 3.3%), hedge funds adding to S&P 500 longs via futures." And this is how the indicator rose to its highest level sinc 2018: 8.5 on Dec 17th, 8.8 on Dec 24th, 9.0 on Dec 31st. (incidentally, in the latest week, the Bull/Bear index rose from 9.4 to a stunning 9.6- the highest since Mar'06 on strong inflows to tech & high-yield bond funds, record-low FMS cash, strong global stock index breath, offset by EM debt outflows, hedge funds cutting gold longs & VIX shorts; positioning excess bullish…contrarian “sell signal” for risk assets).

Regardless, the market plowed on... until about the end of January, when suddenly the wheels fell of the market, and everything went crazy with Software stocks tumbling first (and sliding for a record 8 days in a row), followed by silver crashing the most on record, followed by bitcoin plunging the most since SBF's massive fraud at FTX, followed by multi-strat funds degrossing and putting basis trades in jeopardy, followed by semi stocks sliding and Mag 7 names like GOOGL and AMZN plunging on soaring capex projections, and on, and on... as contagion reemerged after a nearly year-long hiatus.

Yet what makes the recent market unwind curious, is that even though he himself highlighted the triggering of the Sell Signal, Hartnett did not urge his clients to sell (and considering how levered up they all were, he probably should have), and in fact said that "this time was different."

It wasn.'t.

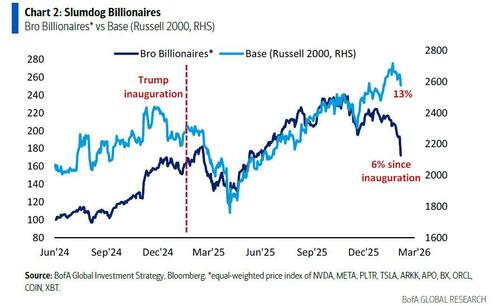

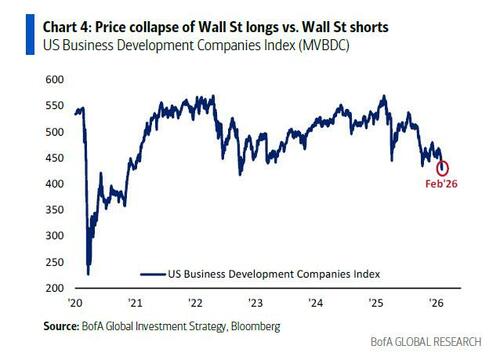

So what happened? As Hartnett writes in his latest Flow Show note (available to pro subs), it had to do with the combination of "peak positioning, peak liquidity, peak inequality"… and is why the “Bro Billionaire” plays (namely NVDA, META, PLTR, TSLA, ARKK, APO, BX, ORCL, COIN, XBT), are now up just 6% since inauguration (and bitcoin is well below Nov 2024 levels), vs small cap stocks up 13%. It's why Hartnett continues to press a trade he recommended first a few weeks ago, namely "long Main St, short Wall St"... and will be so until Trump's approval rating go up on policy pivot to address affordability.... He may be waiting for a while.

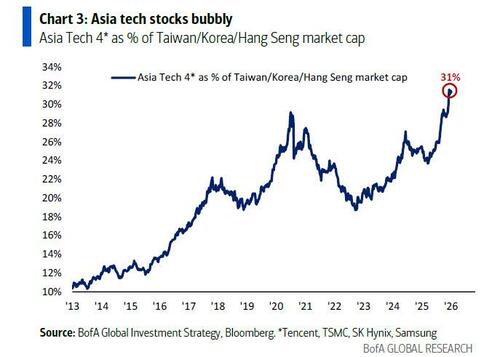

With the market starting to crack, the next thing to look at are the key "froth" support levels to see if the unwind will reverse: these are i) big tech XLK $133, ii) bitcoin 58k, and iii) gold $4550/oz.... so long as no US dollar (DXY to 100) surge. Yet one last deleveraging flush will be bubbly Asia tech.

Meanwhile, Japan real bond yields swinging from -1.5% to 1.5% over the past year are ominously mirroring the US real yields flip from -0.5% to 1.5% that crushed crypto and tech in ’22.

Taking a closer look at the recent market rout - which we warned would be triggered by Trump's mention of Kevin Warsh who is incorrectly viewed as hawkish...

*TRUMP ADMINISTRATION SAID TO BE PREPARING WARSH FED NOMINATION

— zerohedge (@zerohedge) January 30, 2026

crashing his own crypto fortune is a bold choice, cotton

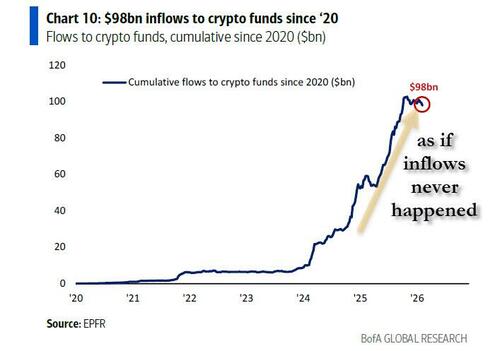

.... with bitcoin plunging as much as 30% in the past week since the Warsh nomination was official, Hartnett warns that the $2tn crypto market cap loss since Oct = 10% of US consumer spend, so yeah: the economy will be badly hit in the coming months.

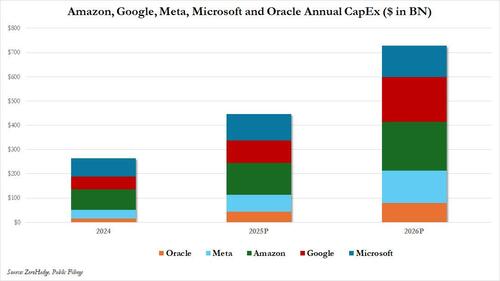

Meanwhile, Wall Street is rotating from big AI spenders - just note the collapse in both GOOGL and AMZN after their shocking capex guidance...

... to beneficiaries, services to manufacturing, US exceptionalism to global rebalancing, bond-bear losers to “peak yield” winners (REITs).... but - Hartnett warns - if the wealth surge at top of K-shape US economy reverses at same time payrolls start falling…biggest meltdown could be US Treasury yields. And all that would take is for bitcoin not to rebound and the stock market to keep falling.

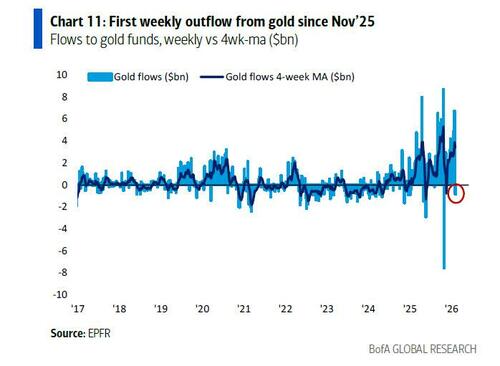

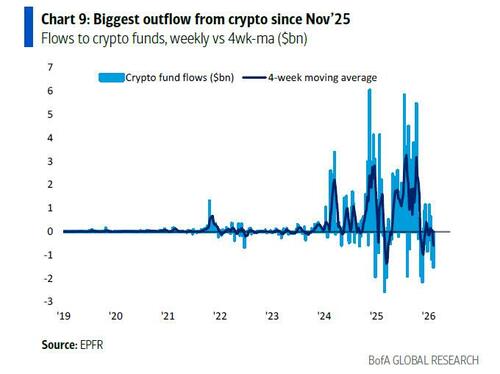

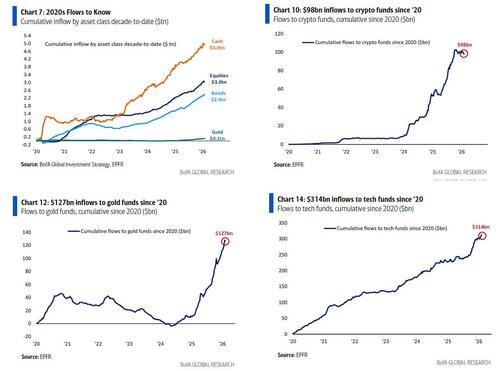

While we usually leave the weekly fund flow data up to readers to unpack, this week there were some notable changes, especially for gold and crypto. Here is Hartnett's breakdown of the latest EPFR fund flow data: Weekly Flows: $87.2bn to cash, $34.6bn to stocks, $23.0 bn to bonds, $0.8bn from gold, $1.5bn from crypto.

And these are the flows to Know:

Gold: first weekly outflow since Nov'25 ($0.8bn), note record $3.7bn daily outflow from gold funds on Tues Feb 3rd

- Crypto: biggest weekly outflow since Nov’25 ($1.5bn);

- What is more remarkable is that it's as if the $70BN of inflows into crypto ETFs since the Trump election never happened.

- IG bonds: 41st consecutive week of inflows, biggest since Aug’25 ($17.1bn);

- TIPS: biggest inflow since Oct'25 ($0.7bn);

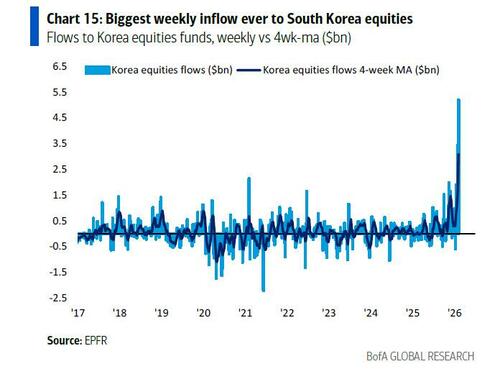

- Europe equities: biggest inflow since Apr'25 ($4.2bn);

- Korea equities: biggest weekly inflow ever ($5.2bn);

- Energy: 2nd biggest weekly inflow ever ($4.2bn);

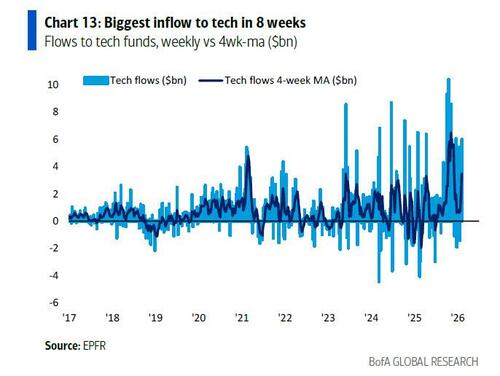

- Tech: biggest inflow in 8 weeks ($6.0bn);

- Utilities: biggest outflow past 2 weeks since Nov'24 ($1.2bn).

Recent violent moves notwithstanding, here are the Flows to Know since 2020: the cumulative inflows decade-to-date are: cash $5.0tn, stocks $3.0tn, bonds $2.4tn, gold $128bn, crypto $98bn. Needless to say, both gold and bitcoin have miles and miles to go... and will get there.

Hartnett then takes readers through his favorite 3Ps... only this week it's just 2: Positioning and Price (assume there was nothing exciting in the Policy columng).

On Positioning: positioning metrics that end the BofA Bull & Bear Indicator “sell signal” are:

- a. a jump in cash levels in the BofA Global Fund Manager Survey (released Feb 17th) from 3.2% to >3.8%.

- b. big outflows from stocks (>$100bn) & tech funds (>$4bn) next 4 weeks.

- c. HY CDX credit spreads >350bp,

- d. “overbought” global equity indices ended by 3-5% price drop.

On Price Hartnett expects key levels for “froth assets” to hold, e.g. XLK (big tech) $133, XBT (bitcoin) 58k, XAU (gold) $4550/oz; As noted at the top, the painful price collapse of Wall St longs (Mag7, crypto, precious, private credit) vs. Wall St shorts (small cap, staples, energy) was driven by combo of peak positioning, peak liquidity (less rate cuts, more rate hikes), peak politics (low approval for equity-friendly Trump)...

Yet absent a systemic event - such as a surge in the US dollar (DXY to 100) and associated meltdown in Treasury yields - Hartnett says "this is a big, healthy, overdue unwind in froth.”

Which bring us back to the top, namely stay long Detroit (Wall Street) and short Davos (Wall Street): long Main St plays, e.g. EM, small cap, banks, REITs, and other assets punished in the first half of the 2020s by big bond bear market; Hartnett expects that 2026 inflation surprises downside as AI chills labor market, and politicians address voter concerns over affordability; it's why Trump aggressive intervention to reduce price of energy, healthcare, credit, housing, electricity via Big Oil, Big Pharma, Big Banks, Big Tech means small & mid-cap best play for "boom" on Main St in run-up to US midterms; plus flip from asset-light to asset-heavy business model suggests major threat to 2020s market leadership of Big Tech/Magnificent 7…

And indeed, the projected AI hyperspend on 2026 capex at $670bn (or 96% of their combined cash) vs $150bn (just 40% of cash) in ’23 means tech giants "no longer have the best balance sheets, and no longer the biggest stock buybacks"... something we first pointed out after the AMZN earnings.

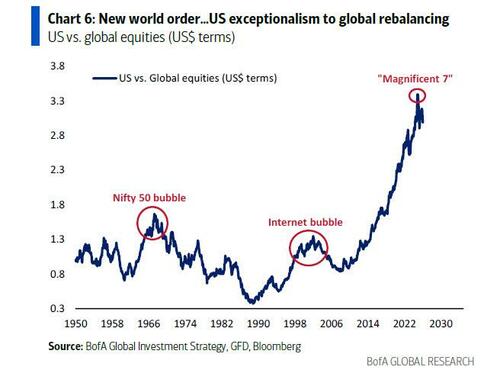

Hartnett concludes this week's Flow Show with one final point, namely stay long International stocks: "big political, geopolitical, financial events…big asset market leadership changes…"

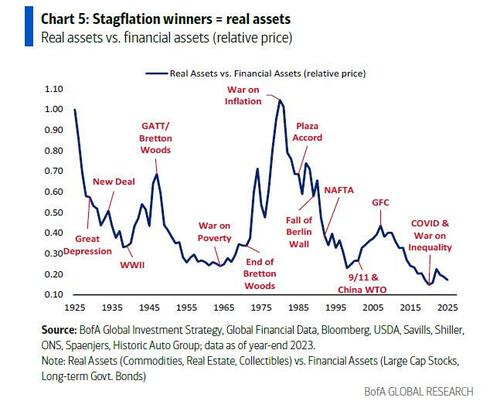

- 1971: end of Bretton Woods…era of stagflation…winner gold & real assets (Chart 5);

- 1980: Reagan/Thatcher/Volcker…peak inflation…secular winner bonds;

- 1989: fall of Berlin Wall…“era of globalization”…secular winner US stocks (Chart 6), loser gold (fell in 8 of following 10 years);

- 2001: 9/11 + China joins WTO…"rise of China"…secular winner commodities & “BRICS,” secular loser US dollar;

- 2009: Global Financial Crisis…era of QE…winner US stocks & private equity;

- 2020: COVID…era of fiscal excess…winner “Magnificent 7”, loser bonds & China;

- 2025: MAGA…new world order = new world bull…US exceptionalism flips to global rebalancing…winner international stocks…China consumer & EM commodity producer = best 2026 plays

More in the full Flow Show note available to pro subs.