'Some Like It Hot': Goldman's 2026 Markets Outlook Sees A Cyclical Tailwind Extending The Cycle

It's that time of year again... as bulge bracket firms drop their prognostications for the year-ahead, from markets to macro and everything in between.

Goldman Sachs Dominic Wilson and his global markets analyst team just issued their must-read Markets Outlook for 2026 and the theme is a simple 'Some Like It Hot'.

There are 10 core investment themes that drive many of Goldman's market views...

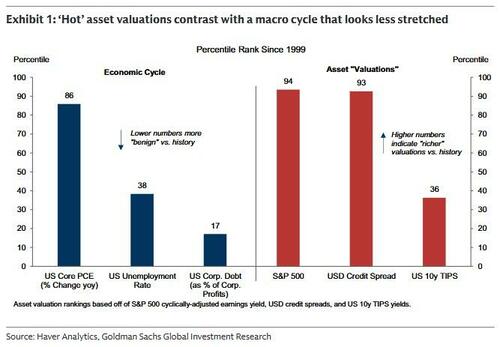

1. The cycle extends: Sturdy global growth coupled with non-recessionary Fed cuts should be positive for global equities, but tensions with 'hot valuations' may increase volatility.

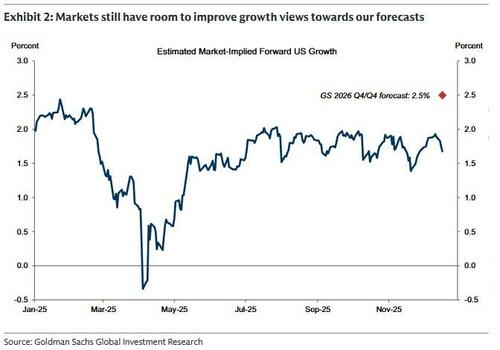

2. A cyclical tailwind: Our US growth view still looks higher than market pricing, but vulnerable to US labour market cracks.

3. Disinflation back on track: Inflation set to fall back to target levels by end 2026, as tariffs fade and medium-term forces (AI, China supply) come into view.

4. More differentiation at the tail end of the global easing: DM easing narrows to US, UK, and a bias towards lower rates, but better growth could challenge cut pricing.

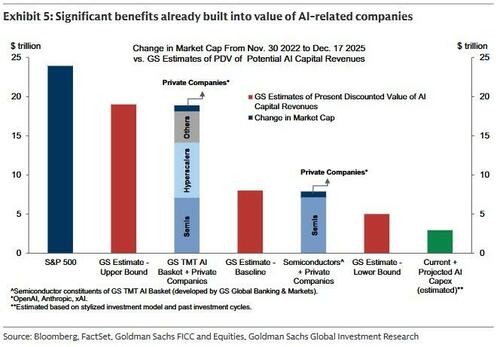

5. AI—markets ahead of the macro: AI capex boom set to extend but valuations have run ahead, so higher volatility, wider credit spreads likely even with equity upside.

6. The reverberations of China Shock 2.0: China trade surplus set to grow to new records, putting gradual appreciation pressure on CNY.

7. Fiscal worries dormant, not disappeared: Benign inflation should limit upward pressure on long-dated yields. Fiscal positions still extended and fresh impulses could spark new worry.

8. The cycle and FX—sturdy growth, shallow Dollar: A more procyclical flavour to global FX, and still modestly USD bearish; hawkish Fed shift the main risk.

9. EM—good after great: A supportive backdrop from EM assets, rotate some risk from tech-sensitive markets to domestic exposures for balance.

10. Late-cycle risks and hedges: Alongside diversification, protection available in rates, FX, gold and equity volatility.

And we dive into a select few below (Pro subs can read the full report here at our new MarketDesk.ai portal)

The cycle extends

Goldman's baseline macro outlook is fairly benign. Despite stagnant job growth, we expect policy rate cuts to limit labour market weakness and help extend the economic cycle further. Rate-cutting trajectories are more mature, so while it is natural for markets to price a wider distribution of outcomes, low energy prices, fading tariff price pressures, and China's low-cost exports should keep inflation anchored. That should allow for lower front-end yields in several markets, including the US, and restrain sell-offs in others.

Taken together, another year of solid global growth coupled with non-recessionary Fed cuts should be a friendly backdrop for global equities and EM assets, and a modestly negative one for the Dollar.

But the challenge is that, in many respects, markets are well ahead of the macro—so there is a tension between 'hot valuations' in equity and credit markets and a macro cycle that does not quite show the imbalances and leverage typical of late cycles. Likewise, there is more debate about the market upside from AI-related investments, even as competition and leverage is picking up here too. Ultimately, if the economy weathers the near-term concerns around weak labour markets, the constructive cyclical backdrop should dominate valuation concerns, and equities should offer continued upside as better growth is realised. But the tensions here mean that we are likely to see volatility rise alongside equity price increases, and greater focus on re-leveraging could be more problematic for historically tight credit spreads.

The deeper risk for richly valued assets is if dormant fiscal or institutional risks resurface and lead to steeper curves, or simply if economic growth or market overheating put the rate cuts we expect at risk and make rate hikes a realistic prospect. As a result, optimal portfolio hedges may need to oscillate between protecting the left tail and the right tail.

A cyclical tailwind

2026 is likely to be a year of healthy growth, both for the US and the world. As the tariff headwinds fade and fiscal policy turns supportive—not just in the US, but in Germany and Japan too—the growth backdrop should feel more secure. Our global growth views are meaningfully above consensus, driven most clearly by substantially more optimistic forecasts for the two largest economies, the US and China. As always, the critical question is the degree to which markets have already reflected this. Investors were quick to look through the growth pressures from tariffs; there are few signs of meaningful recession risk in market pricing of most assets; and, after a patch of worry in November, cyclical assets—including cyclical equities and copper—have been rallying again.

But even after these recent moves, we think our more optimistic growth views are not fully reflected in markets.

Our regular US growth benchmarking exercises put the current estimate of US GDP growth priced into bonds and equities at around 1.7%. This is well below our 2.5% 2026 Q4/Q4 GDP growth forecast, and further below our forecasts for the first half of the year. Our proxies for market views of China growth have also been rising. We have less confidence in our ability to benchmark those, particularly given the export-led nature of expected growth, but we still see good reasons to think our more optimistic growth view there is not fully reflected either.

If we are right that markets will need to upgrade their cyclical views, that should help to support risk assets in general. The composition of that upgrade likely favours assets that are geared to improving US demand, China's export engine and some recovery in global trade. European equities, which were the locus of cyclical optimism early in 2025, may lag this upgrade without fresh earnings optimism. By contrast, some cyclical assets that saw more weakness in 2025—including US housing and consumer-related areas—may also find more support in 2026 with a more secure growth backdrop.

The main vulnerability remains a crack in the US labour market, if jobs softness tips into a more pernicious feedback loop. Because markets are only priced for limited recession risk, the impact of that on risk markets could be large, as we saw temporarily in August 2024 and April 2025.

AI - markets ahead of the macro

The AI boom is likely to remain a central focus for markets in 2026. The good news is that the productivity benefits are probably only just beginning and there is room for AI investment spending to continue in anticipation of those benefits. The macro imbalances that contributed to the end of the late-1990s tech bubble are also less visible so far. Markets have (as is typical) run further ahead of the macro. Aggregate valuations are not as high as they were at the end of the tech bubble but are further along that path than the macro story. And the market has already built in significant benefits from AI into equity prices, especially in areas that are directly involved in the provision of models and related infrastructure.

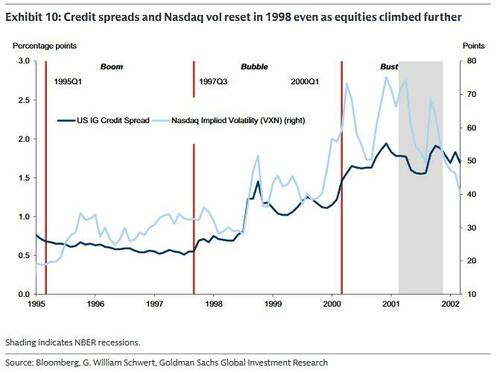

As the capex boom extends, we think some of the imbalances that characterised the late 1990s may become a little more visible. Debt financing is becoming more important to the data center roll-out. And while corporate balance sheets remain quite strong overall, that strength is less exceptional than it was, and a tail of weaker balance sheet companies in the space is under more scrutiny. And as valuations have risen, there is more vulnerability to disappointment about the pace of innovation or monetisation, or to shifts in the technology that reduce the capital or energy intensity of AI model training. We think positive cyclical news is most likely to dominate elevated valuations (both for the economy as a whole and around the AI theme) and to result in further equity upside. But, as in 1998-2000, we think that rising equity prices are more likely to be accompanied by a shift higher in equity volatility and by (at least somewhat wider) credit spreads.

Longer-dated US equity volatility has already been moving higher from its 2024 low point, and we think that trend can continue. Despite quite healthy corporate balance sheets, tight spreads make the asymmetry in US credit less attractive than in equities, in part because of the risks of higher leverage and more issuance ahead.

Late-cycle risks and hedges

Our macro baseline is a friendly one. But as the cycle extends and there is less of a buffer in valuations, there are macro and micro risks that need to be navigated through the year. The key downside risk is still the prospect that the US labour market deteriorates in a way that brings recession risk back onto the table. This would be the biggest macro challenge to risk markets, which are pricing low recession risk. With the market priced for less than a single Fed cut out to the April meeting, downside in the front end of US rate curves (and likely in the rate curves now pricing hikes outside the US) offer good protection against that outcome, as does USD/JPY downside.

If that recession risk is put to rest on the back of better growth news, the focus is likely to be more on the risks from higher rates, as we have seen recently in Australia and Canada. For the US, 2027 and 2028 pricing (and 5-year rates on the Treasury curve) are most vulnerable to worries about the Fed’s ability to cut further, supporting the case for front-end (Z6/Z7) steepeners. But optionality on higher longer-dated yields (in the US and elsewhere) should be more protective against renewed worry about fiscal sustainability and global spillovers. Both may have a role to play in portfolios.

Alongside these standard macro risks, the biggest micro risk to the US equity market is a challenge to the AI theme. The ongoing tension between high valuations and a friendly cyclical backdrop in the US reinforces our preference for diversified equity exposures both internationally (including to EM and Japan) and across sectors (to include some more classically cyclical sectors or cheaper defensive areas such as healthcare).

Rate downside should again be protective against that risk, but we think positioning for higher longer-dated equity volatility, and possibly underperformance in credit, is a good late-cycle addition to a long risk portfolio.

Professional subscribers can read the full "Global Markets Outlook 2026" report here at our new MarketDesk.ai portal.