'Stability Is Session-By-Session': Risk Of Vol Spasm Hangs Over S&P 500 Rebound

Authored by Michael Ball, Bloomberg macro strategist,

As dip-buying and short-covering stabilize US equities after last week’s historic internal moves, the path higher for S&P 500 is open again -- traders will just have to navigate volatility-related risks.

Tech outperformed Monday while the momentum factor was notably higher - a follow-through from Friday’s relief rally.

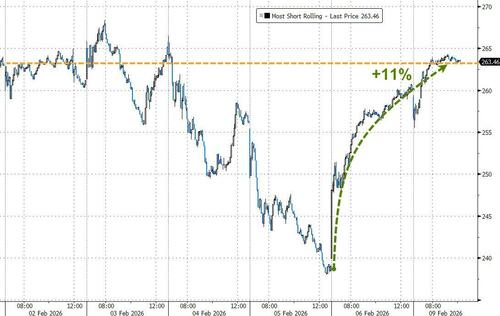

Further short covering was seen with Goldman Sachs’ short basket outperforming notably for a second session.

This shows last week’s historic under-the-surface volatility is healing.

Goldman Sachs noted that aggregate performance between their quant, multi-strategy, and fundamental long short equity communities was the worst they had seen since COVID last Wednesday, which was remarkable given the index was barely off highs. Their prime data showed the largest aggregate selling of US equities since last April and the largest shorting of single stocks ever in the history of the prime data since it began in 2016. Positioning was caught wrong footed and risk had to be reduced in certain factors and sectors quickly.

Fast forward to Tuesday and a good chunk of the turbulent selling has reversed as capitulation signals flashed and cooler heads stepped in.

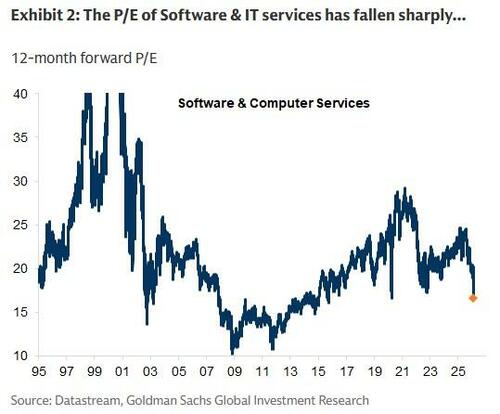

The re-rating of the disrupted sectors provided attractive enough valuation propositions to garner attention again. For example, the software sector fell from 35 forward PE a few months ago to 20 at the lows last week.

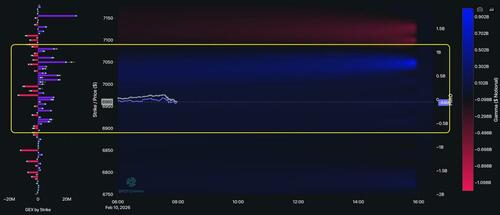

Option positioning tells a similar story.

SpotGamma cites 6,950 as a risk pivot for the SPX.

If the index dips below that level, it would be prone to faster, two-way moves given the longer-dated, negative-gamma backdrop.

Above it, the gauge would be more stable, with positive gamma positioning near 7,000 providing gravity into February’s option expiration.

The catch is sector-level pricing.

Many software names still have high implied vol and elevated put skews, indicating crowded downside hedging remains. This can reinforce selling on weakness, but also turbo-charge squeezes when new negative catalysts dissipate.

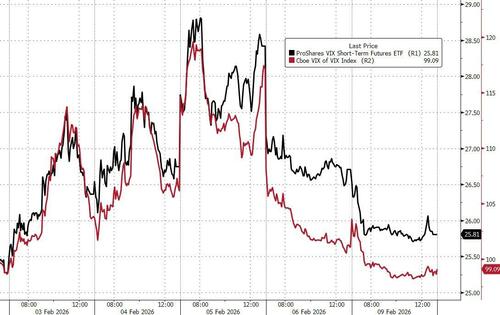

Looking at the vol backdrop, the VIX and VVIX are trending lower as put selling has risen while implied correlations reset lower...

...these are classic conditions for a vanna-driven upside grind, as seen over the last two sessions.

The problem is that the stability is session-by-session.

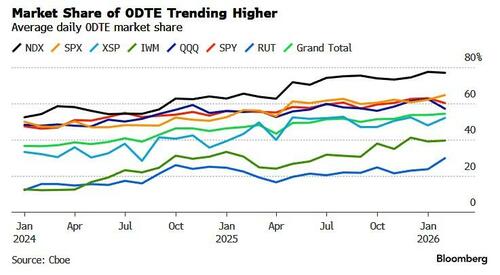

With 0DTE so dominant, dealer gamma support can appear and then disappear quickly, leaving the tape vulnerable to sudden air pockets.

Last week’s vol spasm also indicates systematic strategies may still be forced to sell.

Vol control strategies a near-term worry even if CTAs stay largely long, according to Nomura.

Volatility echoes, leaving traders with plenty of reasons to not over-chase the relief bounce.