Stocks, Bonds, Bullion, & Bitcoin Bid As Bad Data Lifts Rate-Cut Odds

Is bad news back to being good news again?

From weak industrial capacity utilization, mixed Services ISM data, and ugly jobs data including the biggest manufacturing job losses since COVID and major small business job losses (ADP)...

US macro data took a big dive today...

And that encouraged the doves with Dec rate-cut odds steady at 100% but January rising above 30%...

Source: Bloomberg

The dovish shift on the bad news was good news for bonds, stocks, bitcoin, and gold (and bad news for the dollar).

All the US Majors were higher today, led by Russell 2000. Nasdaq lagged on MSFT sales scare (unable to recover from its pre-MSFT level)...

Small Caps outperformed on the back of a big short-squeeze...

Source: Bloomberg

That squeeze was not the friend of Momentum traders as the short-leg (12M Losers) dramatically outperformed the long-leg today...

Source: Bloomberg

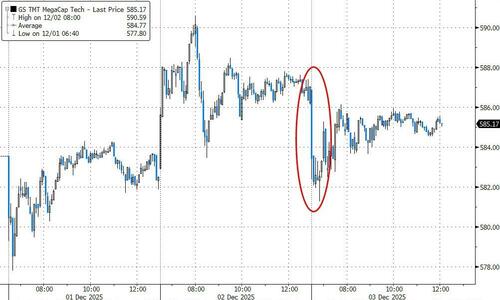

Mega-Caps underperformed...

Source: Bloomberg

...as shortly before the cash equity open, futures stumbled following this headline: "*MICROSOFT LOWERS AI SOFTWARE SALES QUOTAS: INFORMATION". MSFT quickly denied and The Information clarified their clickbait headline but MSFT shares did not bounce back much...

We do note that AI-specific stocks outperformed on the day though...

Source: Bloomberg

But the MSFT pain did nothing to help close the gap between the Google and OpenAI AI ecosystems...

Source: Bloomberg

Mag7 were notable underperformers today as the S&P 493 was straight line bid all day...

Source: Bloomberg

After an spike right before the cash open, VIX was slammed lower all day, back to a 15 handle (and stocks tracked it tick for tick)...

Source: Bloomberg

Both equity and bond vols fell notably today back to one month lows... Just between us girls, The FT attempted a scare-mongering post this morning: "*BOND INVESTORS WARN TREASURY ABOUT HASSETT AS FED CHAIR: FT" - given the collapse in bond vol expectations, that sounds like utter bullshit (and did they ask the short-end bond traders, or crypto traders, or gold traders, or growth stock traders how they felt?)

Source: Bloomberg

Treasuries were bid alongside stocks today (QE trade is back?) with the whole curve down around 3bps. Today's decline in yields pulled the 2Y lower on the week...

Source: Bloomberg

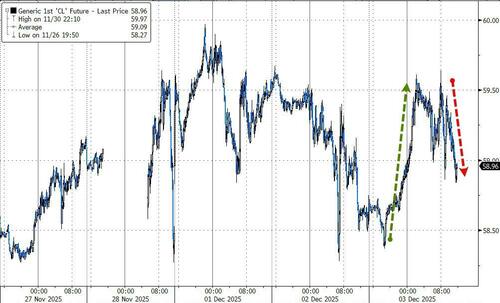

Crude prices were higher on the day (amid a lack of progress on a peace deal) but well off the highs of the day amid the weak macro data (tracking bond yields lower) and a big build across crude and products. It's been a choppy week for WTI..

Source: Bloomberg

The price of gas at the pump has tumbled to $3.00 - the lowest since May 2021...

Source: Bloomberg

The dollar extended its decline today, almost back to completely erasing the post-Powell hawkish comments from the last FOMC meeting...

Source: Bloomberg

Gold managed very modest gains today, but continues to under-perform relative to dollar weakness..

Source: Bloomberg

Silver was unchanged on the day, trading between $58 and $59 all day...

Source: Bloomberg

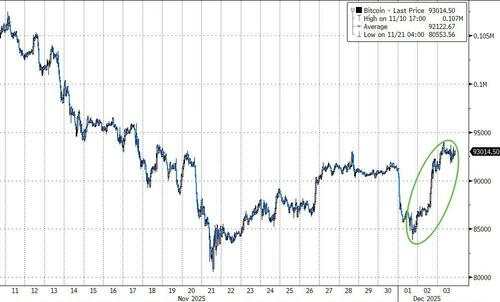

Bitcoin topped $93,000 today, extending yesterday's bounce-back...

Source: Bloomberg

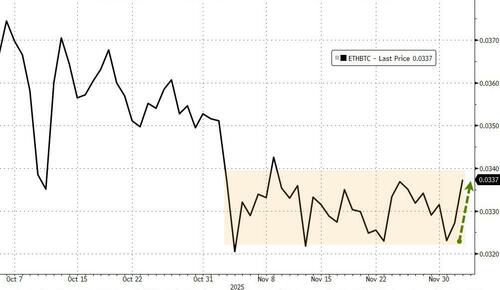

Ethereum notably outperformed bitcoin on the day, rising above $3140

Source: Bloomberg

Which pushed ETH to the top of its recent range relative to BTC...

Source: Bloomberg

Finally, amid the noise in AI stocks recently, Goldman asked "Where the Market Would be without ChatGPT?" The answer is - a very different place to where we are...

Specifically, Goldman trader Louis Miller notes the S&P ex-AI is basically in line with the equal-weighted S&P 500.