Stocks, Bonds, Bullion, & Bitcoin Bid as Fed Cuts Rates, Launches 'Not QE'

Stocks were treading water heading into this afternoon's FOMC meeting, where the Fed delivered its third consecutive 25bp (risk management) rate cut.

While the cut was widely expected, this afternoon's meeting was still a focus for markets as they tried to read the tea leaves of the Fed's - and rates' - path from here.

Notably, Powell did not do anything during the presser to spoil the party either; playing it out well with elements for both hawks vs doves to hang on ( including no real nod to either pause/cut for Jan but at the margin a high bar to move) and Goldman's Giulio Esposito notes that given investors positioning had moved somewhat defensive into the event, both the statement and Powell comments are to be taken as risk positive.

Markets made a choice and undertook the 'QE trade' today - buying in bonds, stocks, bitcoin, gold, and crude, with the dollar weaker - even though for The Fed and the purists today's news of balance sheet purchase adjustments are just that and 'Not QE'.

As we noted, "remember when the Fed launched 'NOT QE' in Sept 2019 to tame the repo market crisis... and 6 months later it was doing $1 trillion daily injections... Good times."

Powell says the Fed wasn’t “concerned” per se with tightness in money markets, when asked about the decision to resume purchases of Treasury bills.

“We knew this was going to come,” and it just came a little quicker than expected, he said.

The fact that the Fed is kicking off the Treasuries purchases right away and expects “elevated” buying for a while suggests officials really did get concerned about a liquidity squeeze.

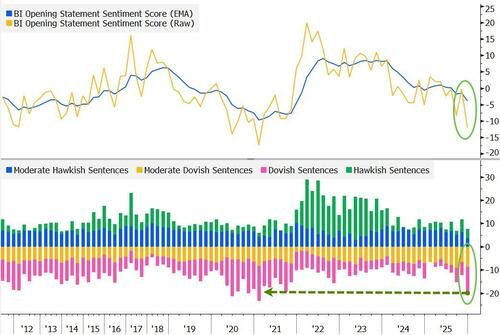

The Fed was more dovish (less hawkish) than expected...

Bloomberg's Rates Strategy natural-language processing model for Fed sentiment showed that Powell’s opening remarks were more dovish than the October meeting, and the most dovish since 2021, according to Bloomberg's Jersey. The comments around the asset purchases were a big driver of this move...

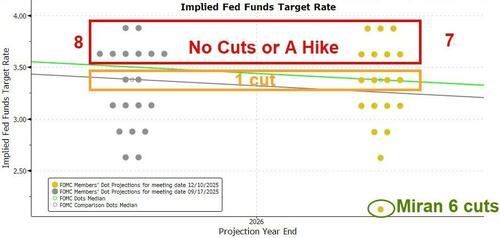

The Fed is now “within a range of plausible estimates of neutral, and leave us well-positioned to determine the extent and timing of additional adjustments” to rates, Powell says.

Hearing Powell just now talk about how 9 out of 12 voters supported the rate reduction drives home the point how each of the cuts made this year has received less support from the Federal Open Market Committee.

Votes in favor of the move have gone from 11 in September, to 10 in October, to 9 today.

On the dissents, Powell says the two goals of the Fed, right now, are “a bit in tension.”

“Interestingly, everyone around the table at the FOMC agrees that inflation is too high and we want it to come down, and agrees that the labor market has softened and that there is further risk. Everyone agrees on that. Where the difference is, is how do you weight those risks and what does your forecast look like?”

“It’s very unusual to have persistent tension between two parts of the mandate.”

The Fed appears to have joined Trump and the Silicon Valley elite in betting on the AI revolution with growth forecast to accelerate notably next year and Unemployment forecasts only marginally firmer in the out-years, suggesting a more resilient labor market, with inflation expected to fall notably.

*POWELL: IMPLICATION OF FED FORECASTS IS HIGHER PRODUCTIVITY

“We’re well positioned to wait and see” where the economy evolves from here, after today’s move, Powell says.

Read the full FOMC Breakdown here...

So where does all that leave us...

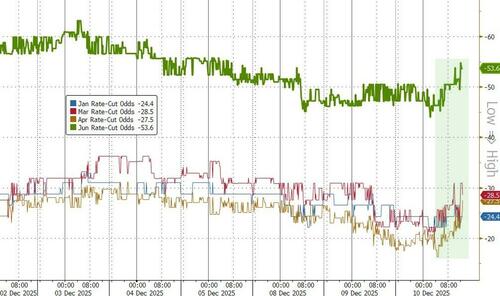

Rate-cut odds for the next few months were hugely unchanged (except for in June (after Powell's gone)...

Source: Bloomberg

Equity markets are moving higher following the Fed's announcement, led by Small Caps (mega-squeeze) with Nasdaq lagging (but all solidly green)...

Nearly every sector in the index is in the green, with markets assuming a pro-cyclical tilt: Industrials, Consumer Discretionary, and Health Care are leading the index higher, while Tech, Utilities, and Communication Services are the only sectors lagging.

Source: Bloomberg

Interestingly, given the broad strength, momentum continued its downward trend...

Source: Bloomberg

As the 'short' leg was squeeze notably higher...

Source: Bloomberg

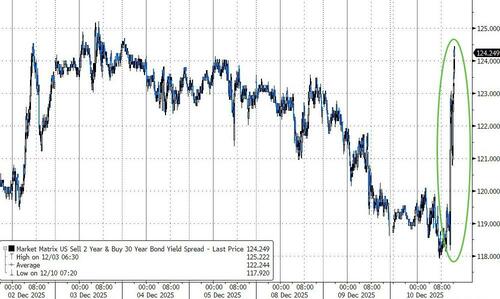

Bonds were bid with the short-end outperforming (2Y -8bps, 30Y -3bps)...

Source: Bloomberg

The yield curve (2s30s) steepened significantly..

Source: Bloomberg

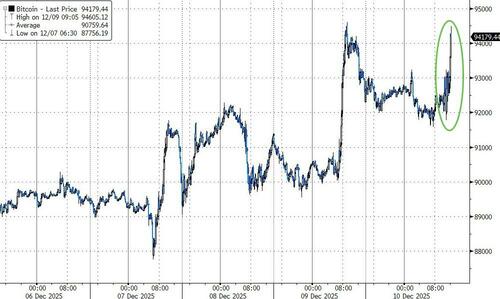

Bitcoin surged back above $94,000...

Source: Bloomberg

Gold is notably higher, blowing back above $4200...

Source: Bloomberg

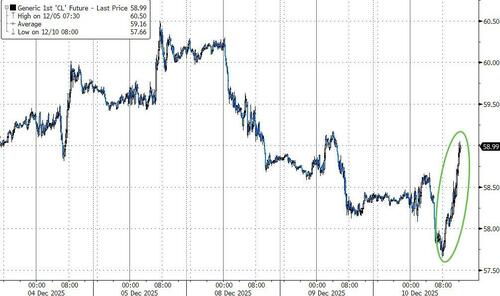

Crude prices were also higher - pro-cyclical - but were juiced by reports that the US had seized a Venezuelan tanker (prompting more geopolitical risk premium)...

Source: Bloomberg

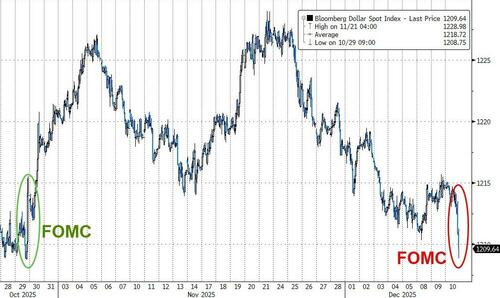

Finally, while everything else was rising, the dollar was notably weaker after The Fed (fully erasing the post-Powell hawkish comments spike from October)...

Source: Bloomberg

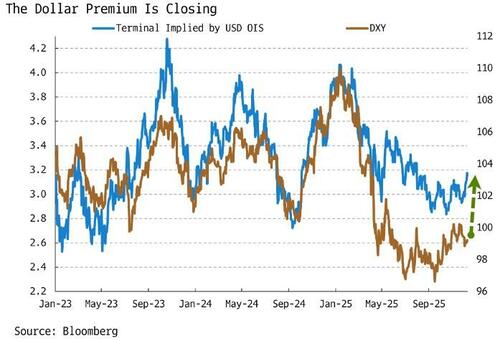

But, as we pointed out earlier, that dollar selling pressure may not last:

Part of the explanation is that rates markets have gotten too excited about the prospect of ECB tightening. With 2026 growth expected to slow from 2025, inflation risks tilted to the downside, and little indication that the aggregate of the Governing Council is contemplating hikes, the hawkish shift looks premature.

More importantly, in a global environment where investors can plausibly discuss hikes elsewhere, the idea of the Fed delivering another three to four cuts becomes increasingly difficult to justify. It makes more sense to pare back Fed easing expectations, with US inflation near 3%, than to expect the ECB to lead the next hiking cycle with inflation closer to 2%.

For the dollar, we appear to be near the limit of how much dovish pricing can act as a headwind, with markets still assuming a terminal rate near 3%. That aligns with Fed projections and represents the floor for pricing absent recessionary weakness, but it is far from the ceiling with the market having looked for a terminal closer to 4% three times this cycle.

At the same time, the sizeable risk premium embedded on “Liberation Day” has partially compressed as confidence improved and the US growth outlook proved less negative than feared, but there is room for further compression.

Taken together, a more hawkish global backdrop points to dollar upside in the medium term.

The weighted average of real rate differentials of the currencies in the DXY basket is also not dollar bearish.

Unlike in the currency-by-currency case mentioned above, the basket does show a more reliable relationship. The real rate for the DXY is barely negative just now, suggesting there is not a strong impulse to drive the dollar lower.

Taken with the real yield curve, where the Fed’s real rate is versus that of other currencies together implies the DXY (which is a DM currency basket) should remain supported, while the dollar will remain under pressure versus many EM FX pairs.