Stocks Dip; Gold, Oil, & Crypto Rip As Trump Triggers Chaotic Week

A tumultuous week of trading that saw the resurgence of AI optimism, geopolitical (de)escalation, tariff talk, Fed independence woes, and a choppy start to earnings season.

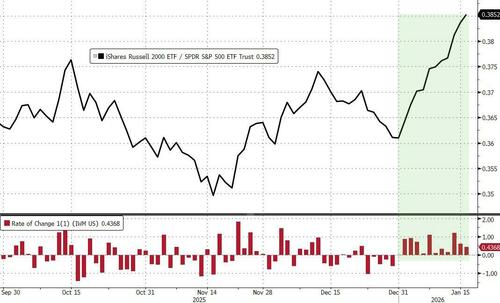

Nasdaq was the laggard on the week while Small Caps soared on the back of yet another big short-squeeze (broadening out trade). The Dow and S&P ended impressively unchanged-ish on the week...

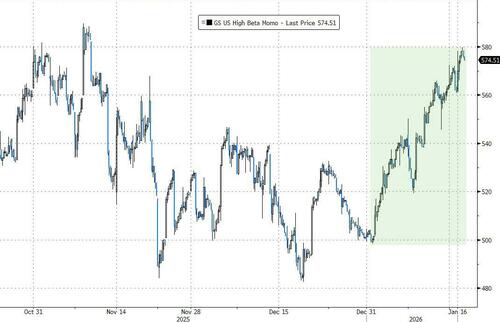

Hedge funds are feeling the most pain this year (today's tumble is one of the top 10 worst days in the past year with beta shorts driving the short side pain today). This is the worst start to a year for hedgies since 2021...

Source: Bloomberg

But momentum is back baby with the long-side outperforming bigly...

Source: Bloomberg

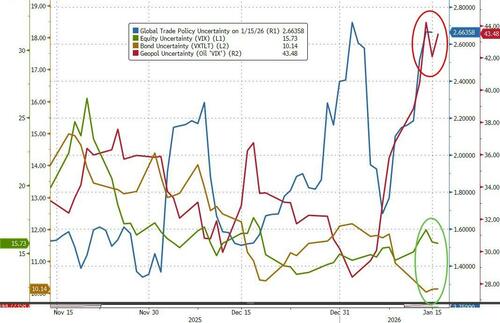

Geopolitics has undoubtedly been the biggest theme so far this year, but this week saw the chaos go to '11'.

The week was dominated by Trump-initiated headlines - from Iran threats (and then praise), Venezuela discussions, Greenland shenanigans (and tariff threats), Affordability warnings (credit card caps, energy caps, institutional home-buying bans), and Fed Chair flip-flops (Kevin W >> Kevin H, Powell punished) - prompting relatively violent swings in various asset classes (both higher and lower).

Geopolitical and Trade policy uncertainty have soared while bond and equity risk remains unmoved...

Source: Bloomberg

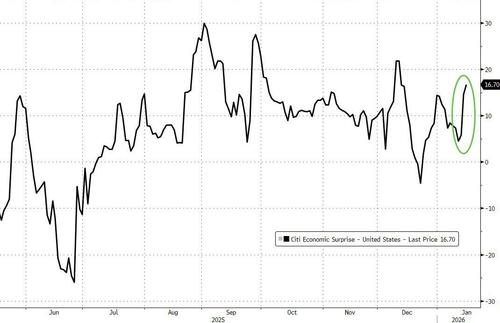

The good news of the week was concentrated in continued signs that the 2025 tariff-driven inflation scare has faded before it ever really got out of hand, and signs that business sentiment is coming back even as regulatory risks proliferate.

US data this week has all been firmly supportive of the Goldilocks narrative in markets (stable growth + declining inflation + ongoing policy support). US CPI came in softer than expected at 24bps unrounded, supportive for risk given some clients were worried on increasing inflation with the ongoing challenged at the Fed (DOJ subpoena for Powell not helping). We also had better Jobless Claims along with higher Empire Manufacturing, Philly Fed, Import Price Index, Industrial Production.

US Macro Surprise index hits one month highs...

Source: Bloomberg

This all but adds to the Fed soft landing story, where Goldman expects the FOMC to deliver two 25bp cuts in June and September (moved back from March and June previously). The market is now pricing a slightly more hawkish position (45bps)...

Source: Bloomberg

Despite all the noise, Goldman's trading desk highlights that sentiment & positioning are both fairly elevated to start the year. We have seen significant re-grossing and meaningful risk redeployment, making the market all the more sensitive to upcoming data and guidance as we move deeper into earnings.

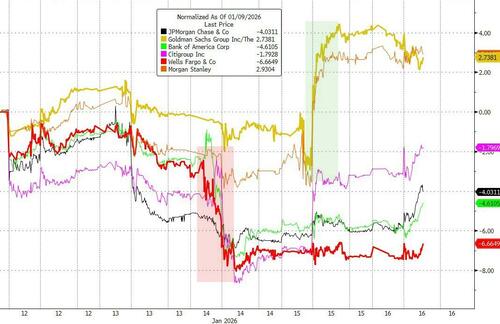

Financial stocks had a fairly high bar to ascend into earnings this week, having outperformed in 2H25, and the big money center banks failed to sustain that outperformance for the most part this week...

Source: Bloomberg

As Goldman's Chris Hussey notes, earnings was not the only thing impacting the Banks stocks, however, this week. White House efforts to quell 'affordability' concerns across the economy also played a part as President Trump discussed a potential 10% cap on credit card interest rates and pushing passage of the Credit Card Competition Act which calls to restrict interchange fees.

Mag7 stocks undeperformed S&P 493 once again this week...

Source: Bloomberg

In AI-land, the GOOGL ecosystem continues to outperform the OpenAI ecosystem...

Source: Bloomberg

Software stocks continued to be clubbed like a baby seal this year...

Source: Bloomberg

Small Caps strength is supported not just by 'rotation' but by the biggest short-squeeze start to a year since at least 2007...

Source: Bloomberg

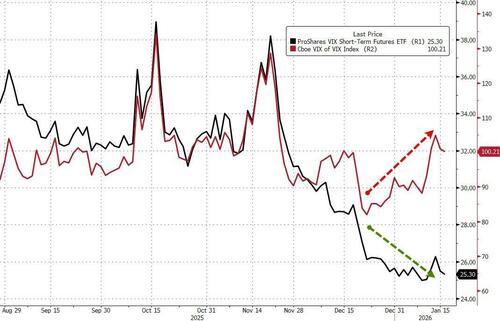

Before we leave equity-land, we do note that while short-term vol expectations remain muted, there is a bid for upside vol protection (VVIX back above the 100 Maginot Line)...

Source: Bloomberg

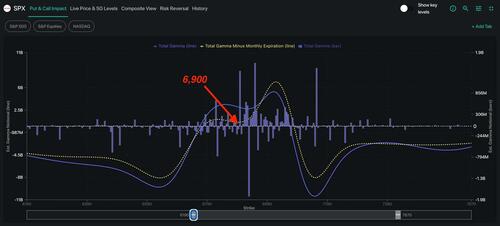

Bloomberg macro strategist, Michael Ball, noted that January’s equity option expiration today looked to be a non-event given the limited gamma shift at the index level, but higher single-stock vol and the potential for higher implied correlations are where the real risk lurks.

The SPX is in the middle of its recent range. That matters because the index is still sitting on a thick layer of positive gamma that keeps dips shallow and rallies contained. January’s opex will not material change this rangebound dynamic given the limited shift in SPX gamma exposure, which suggests little change in dealer hedging flows.

But it could matter more given the recent rise in dispersion, as the elevated level of single-stock vol puts the tape at risk if implied correlations jump on any macro shocks, such as a more Hawkish Fed Chair pick.

Said another way, the divergence between low index vol and high single-stock vol only works if the macro backdrop remains tame.

The line to watch is still 6,890 for the SPX, according to SpotGamma.

-

Above it, dip-buying makes sense given the positive gamma backdrop creating a shallow pullback regime.

-

Any sustained move below that level and things could change fast, especially if correlation between single stocks rise.

For now, S&P Futs have struggled at 7,000 all week...

Yields were higher across the curve this week with the long-end outperforming...

Source: Bloomberg

...prompting a big bear flattener in the curve (erasing all the steepening since the Dec FOMC)...

Source: Bloomberg

The 10Y yield surged to its highest since early September, testing its 200DMA for the first time since Aug 2025...

Source: Bloomberg

The dollar was volatile but ended the week unchanged...

Source: Bloomberg

Gold rallied for the 5th week in the last 6 (despite today's dump and pump after the Hassett headlines from Trump). Notably all the gains were on Monday and since then the barbarous relic has chopped around $4600...

Source: Bloomberg

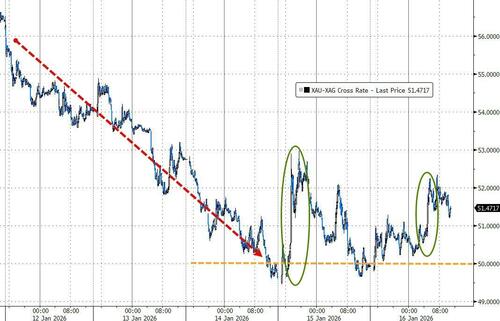

...and while copper dipped on the week, silver massively outperformed its precious peers...

Source: Bloomberg

...but we note that while the Gold/Silver ratio dropped below 50x this week (for the first time since 2012), the end of the week saw gold outperform (modestly)...

Source: Bloomberg

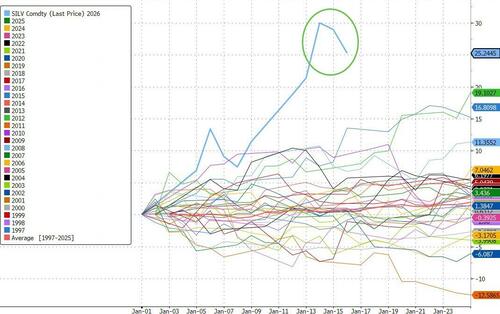

This is by far the best start to a year for silver in at least 30 years...

Source: Bloomberg

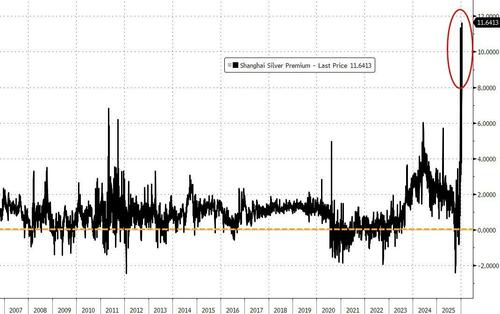

But, before we leave precious metals, we note that the Shanghai silver price premium over Western prices has literally exploded...

Source: Bloomberg

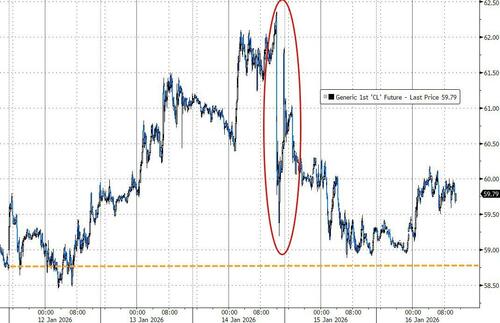

Oil ended up for the 4th week in a row (despite being 'off the highs' to end the week as Trump backed off from Iran threats)...

Source: Bloomberg

Bitcoin surged to it best week in 3 months, reaching its highest in 2 months this week before fading a little to $95k...

Source: Bloomberg

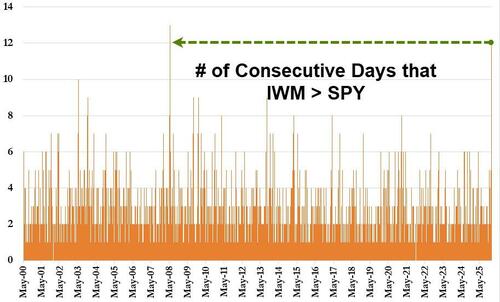

Finally, the "broadening out" trade continues to march on in 2026, with IWM outperforming SPY every one of the 11 trading days so far this year...

Source: Bloomberg

That is the longest winning streak (up 12 days in a row) since June 2008...

Following the 2008 streak, IWM underperformed for a few weeks before reaccelerating...

Source: Bloomberg

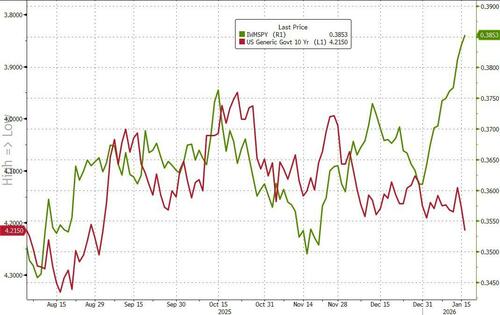

With yields higher and rate-cut odds sliding...

Source: Bloomberg

...how long can Small Caps maintain this optimism?