Stocks, Gold, Credit, & Crypto Crushed As 'Hunt For Laggards' Hammers Mag7

US stocks traded lower Tuesday on a day devoid of any major macro or micro catalysts as investors digest the strong returns stocks have realized over the past 8 months.

Goldman's Ryan Sharkey suggests today's weak price action is driven by a negative combo of:

1/ valuation concerns (‘cautious’ bank CEO commentary)

2/ Negative EPS reactions (PLTR, UBER, SHOP) - theme remains of beats not being rewarded, and

3/ Weak breadth.

On the Seasonality front some questioning if November, historical the strongest month of the year, will be tested.

Goldman Partner Rich Privorotsky muses on the immediate catalysts...

-

Perhaps it’s Michael Burry’s latest 13F showing sizable put positions in NVDA and PLTR…

-

the breakdown in crypto…

-

the fact that U.S. bank reserves have now dipped below $3T…

-

the very low breadth and multiple Hindenburg-type signals…

-

the surge in repo and a positive SOFR-IORB spread…

-

the slide in consumer sentiment and restaurant stocks to 52-week lows…

-

the cracks in ORCL and META…

-

or maybe it was Amazon up ~5%, adding +$100bn of market cap on headlines of a new OpenAI–Amazon cloud deal worth around $38bn.

Simply put, Privorotsky says, there are just a lot of things about this market that haven’t been adding up for a while.

Weak start led by AI (GSTMTAIL Index) -330bps and high beta (GSP1BETA Index) -257bps.

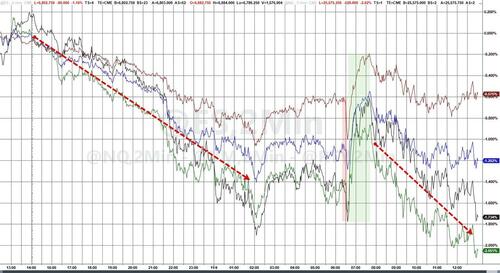

Ugly overnight as PLTR's solid earnings were met with investor selling (as Michael Burry's bearish positioning became more widely known)...

The cash open saw an immediate liquidation but a smaller than feared take-up of the Standing Repo facility sparked some relief off the lows. That lasted until around the European close upon which stocks started to see waves of selling pressure with Nasdaq and S&P testing back to the lows of the day. The Dow was the prettiest horse in the glue factory with the S&P and Small Caps hit harder. Nasdaq was the biggest loser, down over 2%...

While we were the first to warn the public about the machinations in the market's plumbing, Matt King warned today about the Standing Repo facility and ongoing tightness in liquidity:

What starts in repo never stays in repo.

With the temperature hotting up in US money markets in recent days – and having the potential to become hotter still – we seem on the verge of what started as a little local tightness triggering significantly broader attention.

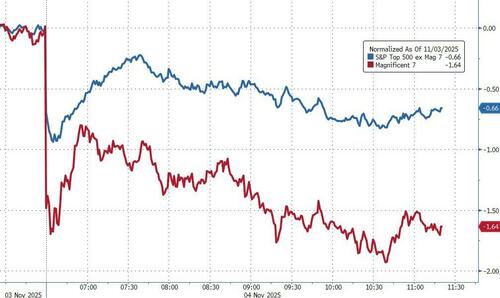

As Goldman's Chris Hussey pointed out, today's S&P500 performance has a bit of a laggard hunt quality to it with Healthcare, Consumer Staples and Real Estate among the best performing sectors.

Price action fueling risk/reward concerns (which had been bubbling up in recent days and weeks) and appears to be driving:

1) broad-based risk reduction across tech; and

2) rotational flow into other pockets of the market: Fins (GSXUFINA Index) +44bps, HC (GSXUHLTH Index) +50bps, Staples (GSXUSTAP Index) +9bps, and Utilities (GSXUUTIL Index) +33bps all higher)...

Source: Bloomberg

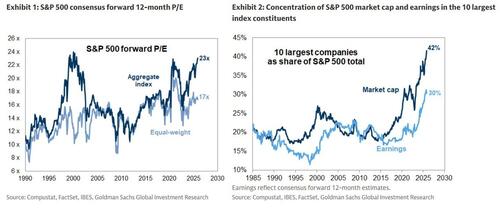

The move to find laggards comes after a month in which the S&P 500 Equal Weight index fell 1% in October, significantly underperforming the cap-weighted S&P 500 index, which climbed over 2% during the same period - all suggesting perhaps that investors may be wary of legging further into the mega-cap Tech trade now that earnings season is largely behind us.

Source: Bloomberg

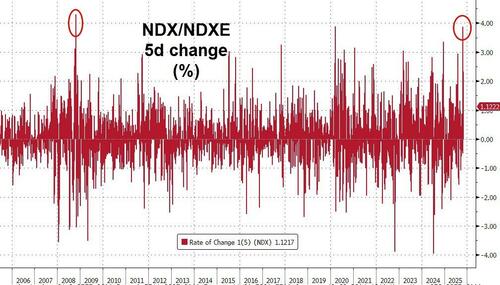

Goldman's Peter Callahan noted that the rolling 5-day performance spread of the NDX vs the NDX Equal-weight (NDXE) index hit ~4% last week, which (quietly) checked in as the widest 5-day spread since 2008...

Source: Bloomberg

Goldman's trading desk noted that their floor skewed slightly for sale on muted overall activity – desk is a 3 out of 10.

-

LOs are slightly better to buy driven by demand for Fins and macro products vs supply in industrials and tech

-

HFs also better to buy with demand for communication services and macro products vs sellers in financials

So, is retail finally leaving the party?

This is where the Mag 7 would step in with a powerful buyback blast, if only they hadn't already spent their $ on video cards that will be obsolete in 6 months.

— zerohedge (@zerohedge) November 4, 2025

Small Caps broke below their 50DMA for the first time in 3 months

Cyclicals have a long way to fall (again) relative to Defensives to catch down to bond market's views of the world...

Source: Bloomberg

Treasuries were bid as stocks were sold (unlike yesterday) with the whole curve down around 3bps...

Source: Bloomberg

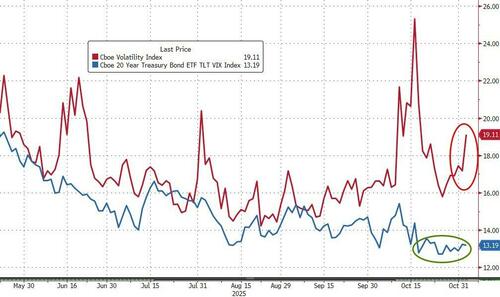

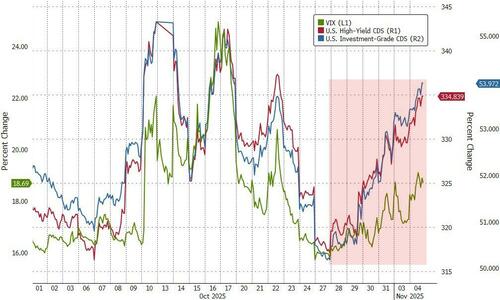

Notably, bond vol remains muted while equity vol is breaking higher. UBS warned earlier than a bond vol spike could be the trigger for the next pain trade down in stocks...

Source: Bloomberg

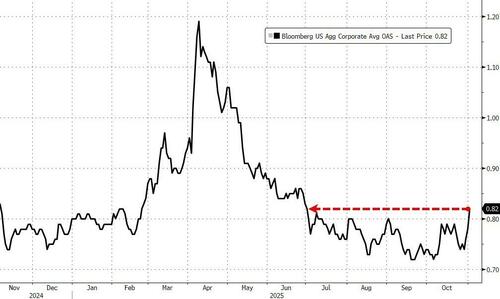

High-grade corporate bond spreads jumped notably in the past few days and are now the widest in months...

Source: Bloomberg

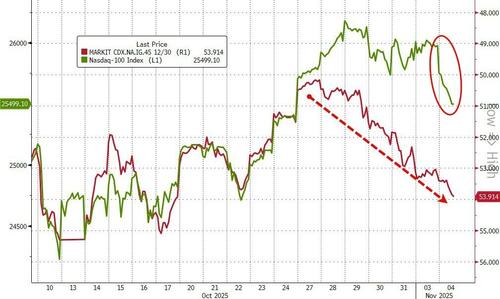

...and IG CDX spread-widening has led the broader market lower...

Source: Bloomberg

...as the major AI related names (ORCL, META, GOOGL) have issued a shit-ton of debt to fund their CapEx dreams. GOOGL's stock price is now extremely decoupled from its bond risk...

Source: Bloomberg

HY spreads are also surging alongside IG and VIX...

Source: Bloomberg

The dollar extended its post-Powell surge (also helped by liquidity demands) to its highest close since mid-May...

Source: Bloomberg

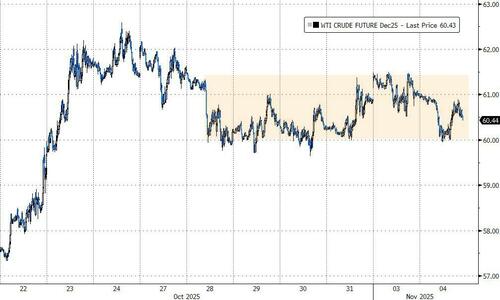

Crude traded down and found support at $60 (WTI) - the low end of its recent tight range...

Source: Bloomberg

Bitcoin was clubbed like a baby seal, breaking below its 200DMA and then breaking below $100k for the first time since June, not pretty at all...

Source: Bloomberg

Ethereum was hit even harder, down over 12% - its worst in 8 months...

Source: Bloomberg

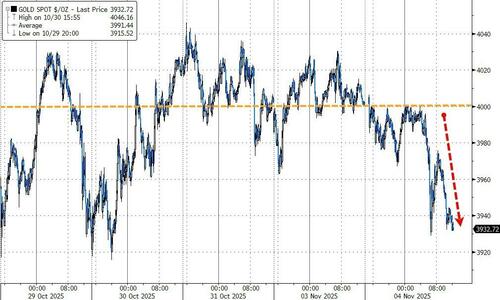

Gold was also monkeyhammered lower today, unable to hold $4000...

Source: Bloomberg

The BTC/Gold pair is back to significant support...

Source: Bloomberg

All one trade - Quantum, Drones, and Crypto...

Finally, as Goldman's Chris Hussey points out, the S&P 500 P/E multiple is nearing levels it has seen during each of the past two Tech bubbles (2001 and 2021). And much of the index's market cap and earnings are concentrated in its 10 largest constituents, highlighting the narrow breadth dynamic that we have seen as a result of continued big tech outperformance...

Tomorrow brings some actual catalysts including the ADP employment report and the ISM Services index.