Stocks, Copper, Silver, & Gold Hit Record Highs As Surging GDP Slams Rate-Cut Odds

As one top Goldman Sachs trader noted, 2025 has felt like three years wrapped into one; whether that be the Deepseek scare, tariffs turmoil, renewed inflation concerns, government shutdown and a constant stream of geopolitical headlines.

But today saw GDP surging more than expected, stocks near record highs, but sentiment skulking along near record lows (big drop in Conference Board confidence today driven by Present Situation)...

Source: Bloomberg

There is a slew of good news...but sentiment slumped. Here's Goldman's discussion of that divergence:

One of the hallmarks of the post-pandemic echo-boom has been the divergence between how people feel (both consumers and executives) and how they act.

Surveys have generally not been predictive of recessionary forces as they have in the past.

For example, the ISM Manufacturing Index has been below 50 for the last 3 years (except 2 brief months earlier this year), yet the US economy has not slipped into a recession -- in fact, it has grown quite strongly.

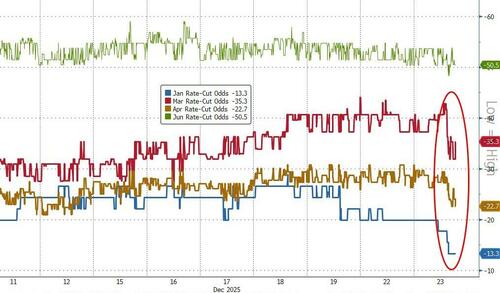

Today's "good" news on GDP (and solid ADP jobs data, better than expected industrial production, and strong YoY durable goods orders growth) sent rate-cut odds reeling (hawkishly lower) for January, March, and April (with only June holding on to a coin-flip - post-Powell)...

Source: Bloomberg

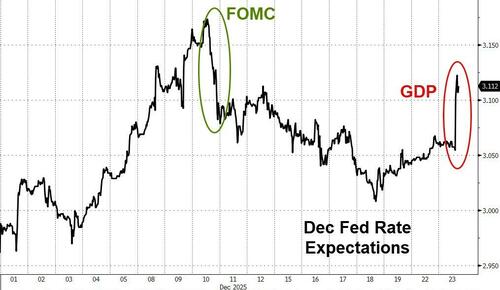

...raising Fed rate expectations for 2026...

Source: Bloomberg

This sent Treasury yields soaring, with the short-end underperforming...

Source: Bloomberg

...significantly flattening the yield curve...

Source: Bloomberg

...but boosting (some) stocks with Small Caps lagging (most sensitive to growth boosting rate-cuts).

The S&P reached back up to record highs...

Who could have seen that rebound coming in stocks...

Did Abu Dhabi Just Deliver A Santa Rally: OpenAI To Raise $100BN From Sovereign Wealth Funds https://t.co/7vx6JFof6s

— zerohedge (@zerohedge) December 19, 2025

Mega-Caps have rebounded almost back to record highs...

Source: Bloomberg

Cyclicals dipped relative to Defensives today after testing last week's highs...

Source: Bloomberg

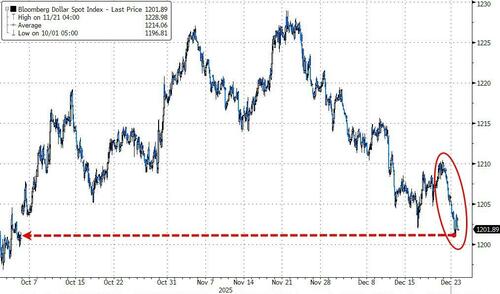

The dollar kept falling (despite the hawkishness), back to early October lows...

Source: Bloomberg

...and that juiced precious metals to new record highs.

Gold came within a tick of $4500 for the first time ever...

Source: Bloomberg

...and Silver soared above $71

Source: Bloomberg

Smashing the gold/silver pair down to 63x - the lowest since July 2014...

Source: Bloomberg

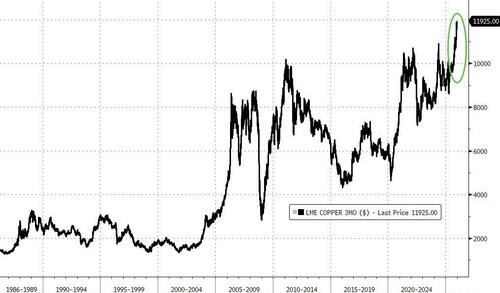

Copper also ripped to yet another record high today...

Source: Bloomberg

Bitcoin did not make a new record high as its recent demise continues... unable to gain support above $88,000...

Source: Bloomberg

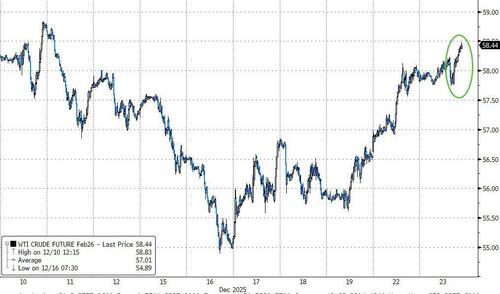

But crude oil did rally on the day with WTI back up at two week highs...

Source: Bloomberg

Finally, as Bloomberg's Michael Ball notes, the market’s mixed reaction to the GDP data feels less about the new information and more about framing - a hotter 3Q makes the shutdown-hit 4Q run-rate look like it will be softer by comparison, yet it also says momentum into the year’s final quarter was firmer than feared, dialing back the idea the Fed has been cutting into real weakness.

Additionally, Ball points out that options are doing more to explain the attempt to melt higher than fundamentals. With the December options expiry behind us, longer-dated positioning isn’t providing much of an anchor, so short-dated flows are setting the intraday lean higher in thin holiday trading conditions.

The VIX is making new year-to-date lows as front-end implied volatility has been crushed.

That keeps the near-term drift higher supported, but the curve is in historically steep contango...

...which is another way of saying the front end is calm while the market is pricing more uncertainty further out than normal.

So, enjoy the calm for now...

...because volatility is coming.