NS

NSStocks grind higher, DXY trims earlier gain, and bonds steady post-FOMC - Newsquawk US market open

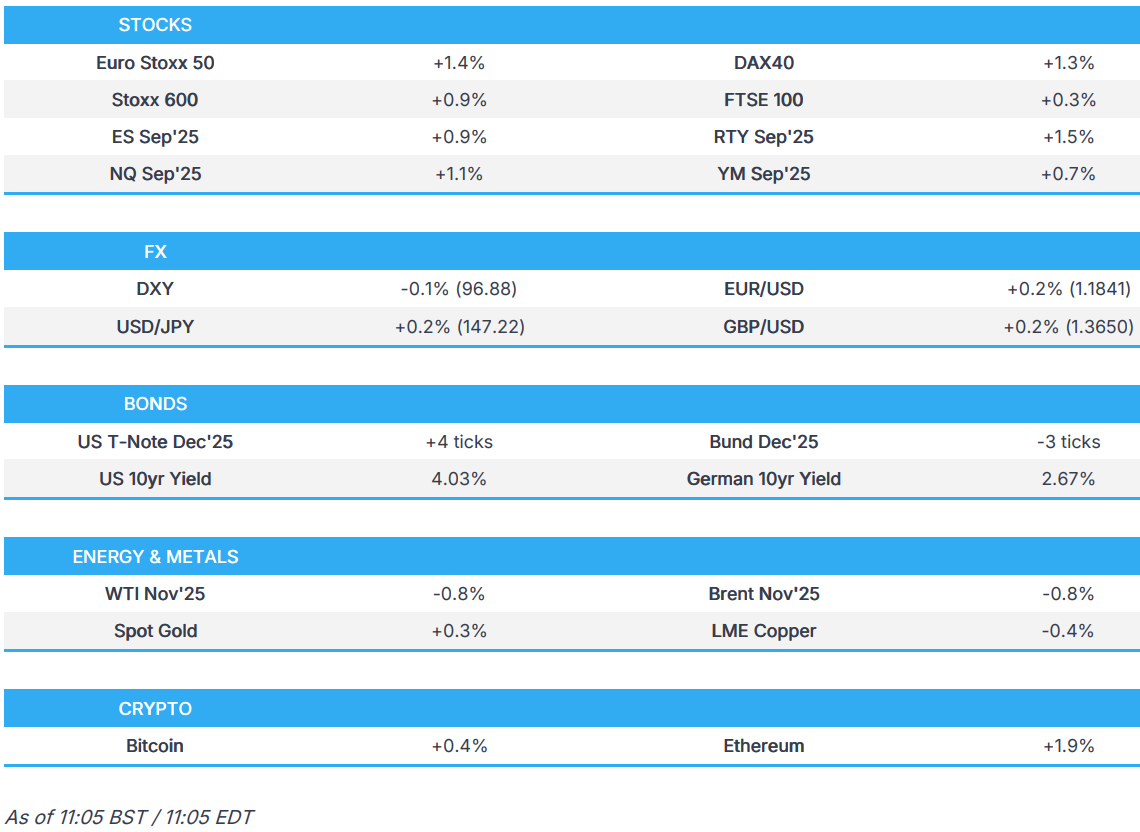

- European bourses are stronger today and trade just off highs; US equity futures also gain, with modest outperformance in the RTY.

- China drops Google (GOOG) antitrust probe during US trade talks, according to FT

- DXY trims some post-FOMC gains this morning; NZD plumbs the depths on GDP.

- Bonds are mixed in the aftermath of the FOMC; Gilts await the BoE.

- Crude is subdued and precious metals hold an upward bias.

- Looking ahead, US Jobless Claims, New Zealand Trade Balance (Aug), BoE Announcement, SARB Announcement, Speakers include ECBʼs Nagel, US President Trump & UK PM Starmer press conference. Earnings from FedEx & Lennar.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

TARIFFS/TRADE

- China is reportedly dropping the Google (GOOG) antitrust probe during US trade talks, according to FT.

- US House China Panel Chair said he's concerned regarding the TikTok deal.

- Brazilian President Lula said he has no relationship with US President Trump, while he described US tariffs as 'eminently political' and said US consumers would be facing higher prices for Brazilian goods as a result, according to a BBC interview. It was also reported that Lula signed an executive order that exempts some data centre equipment from federal taxes.

- Chinese Commerce Ministry says it will review approval for technology and intellectual property transfers linked to TikTok.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 +0.8%) opened firmer across the board and has continued to hold an upward bias throughout the morning. Positive sentiment which comes after the Fed decided to cut rates by 25bps, but it has been described as a “hawkish cut” by some analysts. Nonetheless, sentiment has been boosted across the equities complex.

- European sectors opened mixed but now has a very slight positive tilt. The cyclical sectors are all towards the top of the pile, with sentiment boosted following the Fed’s decision to cut rates by 25bps; Tech continues its past couple of days of outperformance, largely led by Dutch semi-conductor names; ASML (+2.5%), BE Semi (+2%). Industrials take the second spot, then followed by Construction & Materials. To the bottom of the pile lies Optimised Personal Care, followed closely by Media and Retail; the breadth of those in negative territory is very narrow.

- US equity futures (ES +0.7%, NQ +0.8%, RTY +1.1%) are firmer across the board, and with some slight outperformance in the economy-linked RTY.

- Meta (1.20% pre-market) has in recent months approached a number of media names about potentially licensing their articles for AI tools, via WSJ citing sources

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD trimmed earlier gains after ultimately strengthening in the aftermath of the FOMC with initial selling seen in reaction to the Fed's decision to cut interest rates by 25bps, which was as expected, and as the SEPs showed projections for two more cuts this year. The dollar rebounded during the post-meeting press conference, where Powell provided hawkish-leaning comments in which he noted that he feels they don't need to move quickly on rates. DXY resides in a 96.897-97.311 range at the time of writing.

- EUR is posting mild intraday gains in tandem with the dollar trimming earlier upside. Newsflow for Europe has been light, although ECB's de Guindos hit the wires and suggested the ECB needs to pay a lot of attention to NEER rather than just EUR/USD, whilst the risk of undershooting for the ECB is "not big" or "especially relevant", and risks to inflation are balanced and two-sided. EUR/USD resides in a 1.1780-1.1838 range.

- USD/JPY swung between gains and losses in reaction to the Fed, with USD/JPY eventually reclaiming the 147.00 status, while the Japanese currency was not helped overnight by disappointing Machinery Orders, and the BoJ also kick-started its 2-day policy meeting, where it is widely expected to keep rates unchanged. Elsewhere, Japanese LDP leadership candidate Hayashi, noted that Japan's consumption tax is an important source of revenue to fund social welfare costs, and added that "Abenomics" was an appropriate policy at a time when Japan was suffering. Hayashi also suggested that Japan's conditions have allowed the BoJ to raise rates, the economy is now at a new phase, and Japan's inflation is cost-push, not demand-driven. USD/JPY trades in a current 146.77-147.53 range.

- Cable faded the knee-jerk reaction to the FOMC and reverted to sub-1.3700 territory, while attention turns to the BoE. The BoE is expected to keep the Base Rate at 4.0% via a 7-2 vote, following August’s close-cut easing. Inflation remains above target, with further easing not fully priced until April 2026. Attention will focus on any guidance on future cuts and on quantitative tightening, where consensus expects a slowdown to GBP 70bln per annum from October. BoE is expected to slow the pace of QT, reducing gilt sales to GBP 70bln a year (from GBP 100bln) amid concerns that current sales are exacerbating bond market volatility, with limits also possible on long-dated gilt disposals, according to a Bloomberg survey. Cable trades in a 1.3586-1.3640 range

- Antipodeans are both softer with the Kiwi the marked G10 laggard following weak GDP data for Q2 in which the economy contracted by 0.6% Y/Y (exp. 0.0%) and resulted in money markets fully pricing a cut at the RBNZ meeting in October with an off chance for an oversized 50bps reduction.

- EUR/NOK knee-jerked higher on the Norges Bank's decision to cut rates by 25bps, but soon reversed as traders digested the hawkish MPR and commentary.

- PBoC set USD/CNY mid-point at 7.1085 vs exp. 7.1113 (Prev. 7.1013).

- Brazil Central Bank maintained the Selic rate at 15.00%, as expected, with the decision unanimous. BCB removed the reference to the continuation of the interruption of the rate hiking cycle and said it will remain vigilant, while it will evaluate whether maintaining the interest rate at its current level for a very prolonged period will be enough to ensure the convergence of inflation to the target. Furthermore, it stated that future monetary policy steps can be adjusted, and it will not hesitate to resume the rate hiking cycle if appropriate.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- A firmer start to the day for USTs. Following the two-way moves seen on the Fed with the 25bps cut and statement sparking a dovish move, however, this then reversed into and during the press conference from Chair Powell. As it stands, USTs are higher by a handful of ticks towards the upper-end of a 113-00 to 113-12 band. From the Fed, a few points of note worth briefly discussing. Firstly, the vote split saw just Miran dissent and push for a 50bps move, with the omission of Bowman and/or Waller from the 50bps camp of note, and potentially factoring into the initial reversal of the dovish move seen before Chair Powell began. Thereafter, Powell was much more hawkish than the statement suggested. Powell placed less emphasis on the dovish statement/SEP, described the cut as a risk management decision in response to “meaningful” downside risks to the labour market. Now attention turns to Jobless Claims.

- Bunds moved in tandem with USTs on Wednesday evening. This morning, the benchmark has been a little choppy. Initially held near the unchanged mark before picking up a little bit in the European pre-market, seemingly as European futures waned ever so slightly from best levels. However, this strength didn’t amount to much with Bunds only firmer by 10 ticks at best. Since, the benchmark has pulled back into the red and resides towards the lower end of a 128.75 to 129.02 band. No move in Bunds to the slightly softer than usual, but still robust enough, Spanish tap; and a strong French outing.

- For Gilts, the main event today is the BoE. Into it, Gilts are a touch softer moving in tandem with Bunds, at the low end of a 91.44-67 band. The decision is, all but certain, to be unchanged at 4.00%. On this, the vote split may draw some attention as we are likely to see dovish dissent from Dhingra (in-fitting with her known bias) and Taylor (voted for 50bps cut last time, changed to 25bps in order to attain a consensus). More pertinently, the balance sheet. The BoE is expected to provide an update on QT. The pace will undoubtedly be slowed from the current GBP 100bln per anum rate from October. Consensus is for a reduction to around GBP 70bln.

- Spain sells EUR 5.41bln vs exp. EUR 5-6bln 2.40% 2028, 3.20% 2035, and 4.00% 2054 Bono.

- France sells EUR 11.5bln vs exp. EUR 9.5-11.5bln 0.75% 2028, 2.40% 2028, 2.70% 2031, and 3.50% 2033 OAT.

- Click for a detailed summary

COMMODITIES

- WTI and Brent are subdued but confined to a tight range in the aftermath of the Fed and with notable energy-specific newsflow on the lighter side. WTI currently resides in a USD 63.14-63.91/bbl range while Brent sits in USD 67.37-68.01/bbl parameters.

- Spot gold began the European session in the red, pressured by the firmer Dollar in the aftermath of the Fed's decision to cut rates by 25bps, and the hawkish-leaning Powell presser thereafter. As the morning progressed, the Dollar did come off best levels, which has allowed XAU/USD to climb into modest positive territory; currently trading towards the upper end of a USD 3,634.28-3,671.67/oz range.

- Base metals subdued across the board despite firmer sentiment in Europe but following the losses seen across Chinese markets. 3M LME copper fell back under USD 10k/t and found resistance at the level, residing in a USD 9,931.55-9,999.95/t band.

- Peru's President signed a modification contract, allowing Chevron (CVX) and Westlawn's formal entry into Peru.

- Spot gold was contained after ultimately retreating as the dollar strengthened due to Fed Chair Powell's hawkish tone at the post-FOMC presser.

- Qatar raises November term price for Al-Shaheen oil to USD 3.61/bbl, via Reuters citing sources.

- Russian Finance Minister says they plan to lower the bar for oil and gas revenue formation when preparing the budget; plan to lower cut-off price of oil, currently at USD 60/bbl, by USD 1bln every year to 2030.

- Click for a detailed summary

NOTABLE DATA RECAP

- EU Current Account SA, EUR (Jul) 27.7B (Prev. 35.8B); Current Account NSA,EUR (Jul) 35.0B (Prev. 38.9B)

NOTABLE EUROPEAN HEADLINES

- Norwegian Key Policy Rate 4.0% vs. Exp. 4.0% (Prev. 4.25%); Committee judges that a somewhat higher policy rate will likely be needed ahead compared with the outlook in June. Updated MPR: Q4-2025 4.00% (prev. 3.98%), Q1-2026 4.00% (prev. 3.81%), Q2-2026 3.92% (prev. 3.62%), Q3-2026 3.85% (prev. 3.49%), Q4-2026 3.74% (prev. 3.39%). Q4-2027 3.34% (prev. 3.14%).

- Norges Bank Governor Bache says activity picked up more than expected The timing of the next move is not certain.

- German government to raise additional EUR 10.5bln via capital market in Q4.

- German Debt Agency Head says the nation will not issue 50yr bonds; seeing good demand for long-dated bonds from central banks German paper is benefiting from uncertainty regarding France.

- ECB's de Guindos says need to pay a lot of attention to NEER rather than just EUR/USD Risk of undershooting for the ECB is "not big" or "especially relevant". Risks to inflation are balanced and two-sided. Do not target a specific EUR level.

NOTABLE US HEADLINES

- US House cleared the procedural hurdle for a floor vote this week on the stopgap funding measure to avert a government shutdown.

- US President Trump's administration is drawing up plans to use tariff revenue to fund a program to support US farmers, according to FT citing US Agricultural Secretary Rollins.

- Punchbowl, on the possibility of a US shutdown, surmises "Republican and Democratic leaders are growing further apart rather than closer."

GEOPOLITICS

MIDDLE EAST

- Syrian President al- Sharaa told reporters that security talks with Israel could lead to results in the "coming days" and if a security pact succeeds, "other agreements" could be reached but "peace, normalisation" is not currently on the table, while he added there is no pressure on Damascus to reach a deal with Israel from Washington.

CRYPTO

- Bitcoin is a little firmer and trades above USD 117k, whilst Ethereum outperforms a touch and trades just shy of USD 4.6k.

- US SEC voted to approve generic listing standards for new crypto ETFs, which clears the way for a flood of new ETFs.

APAC TRADE

- APAC stocks traded mixed following the choppy reaction to the FOMC meeting, where the Fed cut rates by 25bps, as expected, and just about signalled two further rate cuts this year, although Fed Chair Powell provided some hawkish-leaning comments during the presser.

- ASX 200 declined with underperformance in energy as Santos shares suffered a double-digit percentage drop after the XRG consortium abandoned its USD 18.7bln takeover bid, while sentiment was also not helped by a surprise contraction in employment data.

- Nikkei 225 rallied back above the 45k level and printed a fresh all-time high amid currency weakness and with the index unfazed by disappointing machinery orders, while the BoJ kick-started its 2-day policy meeting where it is widely anticipated to remain on pause.

- Hang Seng and Shanghai Comp were mixed with continued tech strength seen after China's CAC reportedly informed firms such as Alibaba and ByteDance to terminate their testing and orders of NVIDIA's RTX Pro 6000D, in order to focus on China's domestic semiconductor industry, while Huawei unveiled its new AI chip tech to rival the AI darling. Nonetheless, the Hong Kong benchmark faded early gains despite the HKMA cutting rates in lockstep with the Fed, with a pullback seen after it briefly breached the 27,000 level for the first time in four years.

NOTABLE ASIA-PAC HEADLINES

- Hong Kong Monetary Authority lowered its base rate by 25bps to 4.50%, as expected, while HKMA Chief Executive Yue said the interest rate cut will have a positive impact on the property market and the economy.

- Huawei unveiled its new AI chip tech to rival NVIDIA (NVDA), with the Co. to launch its Ascend 950PR chips during Q1 2026 and plans new AI chips through 2028, while Huawei's Vice Chairman said the Co. will launch Taishan 950 SuperPod for general-purpose computing in Q2 2026.

- New Zealand Finance Minister Willis announced the appointment of Haley Gourley to the RBNZ Monetary Policy Committee.

- SoftBank (9984 JT) and OpenAI's Japanese AI joint venture reportedly delayed, according to Reuters sources.

- Japanese former digital minister Kono is to back Koizumi in the LDP leadership race, according to Kyodo News

DATA RECAP

- Japanese Machinery Orders MM (Jul) -4.6% vs. Exp. -1.7% (Prev. 3.0%); YY (Jul) 4.9% vs. Exp. 5.4% (Prev. 7.6%)

- Australian Employment (Aug) -5.4k vs. Exp. 21.5k (Prev. 24.5k, Rev. 26.5k)

- Australian Full Time Employment (Aug) -40.9k (Prev. 60.5k)

- Australian Unemployment Rate (Aug) 4.2% vs. Exp. 4.2% (Prev. 4.2%)

- Australian Participation Rate (Aug) 66.8% vs. Exp. 67.0% (Prev. 67.0%)

- New Zealand GDP Prod Based QQ SA (Q2) -0.9% vs. Exp. -0.3% (Prev. 0.8%, Rev. 0.9%); YY SA (Q2) -0.6% vs Exp. 0.0% (Prev. -0.7%, Rev. -0.6%)