Oil & Gold Jump, CyberSec Dump Amid Mullahs, Macro, & Mmm... Tariffs

'Head on a swivel' was the theme of this holiday-shortened week as geopolitical headlines battled domestic data and earnings with a sprinkle of global trade chaos late on by The Supremes.

CNBC's Rick Santelli pointed out - while surveying the actions over the last week that "if you were looking at the market - and the actual data - you'd have no idea there was a court ruling against tariffs today."

Here's what markets chewed through this week:

- Geopolitical risk spikes (Trump rhetoric and actions in the MidEast)

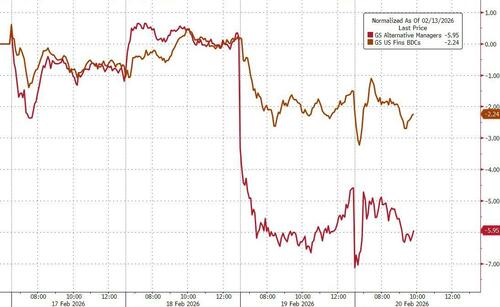

- Private credit fears surged (as Blue Owl blew up)

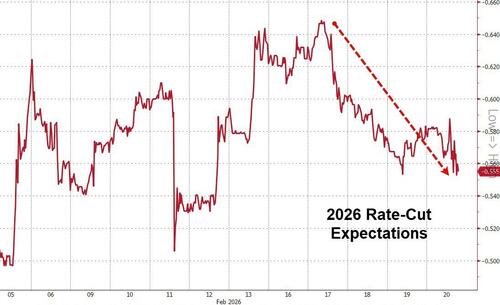

- Fed Minutes (very divided with a hawkish tilt)

- Stagflation fears reignited (disappointing GDP - thanks to govt, hot PCE - thanks to Services, mixed housing - sales down in December, 'no hire, no fire' labor market - claims near multi-decade lows while PMIs signal problems)

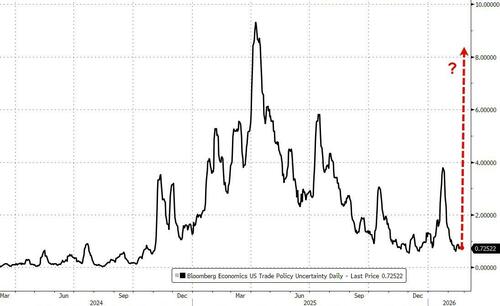

- Tariffs trampled (lack of clarity after Supremes strike down IEEPA)

Soaking all that in left stock broadly higher on the week with Nasdaq and S&P leading (although today made it clear no one has a bloody clue what the implications of the Supreme Court's decision will be). Trump's address at 1320ET perhaps eased some of the uncertainty, but it was a very noisy data to end a short-week.

Bloomberg macro strategist noted that two uncertainties took over after the initial bullish reaction...

-

First, refunds. The high court’s opinion did not address whether importers, wholesalers and retailers are eligible to get tariff money back. With pending cases now in the hundreds — and likely rising — it’s unclear when, or even how cleanly, any lost revenue gets returned to US importers.

-

Second, the tariff risk is not gone. The administration could still attempt levies under different methods, even if this route has been blocked.

That’s why the ruling is risk-positive in theory.

Future margins should face less pressure, which explains the knee-jerk bid higher in equities for firms affected.

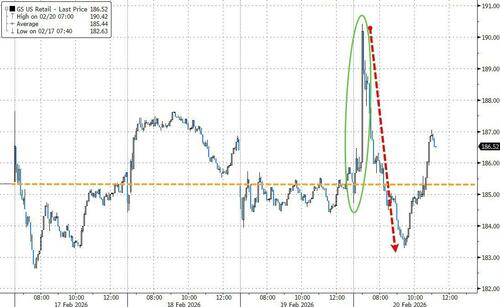

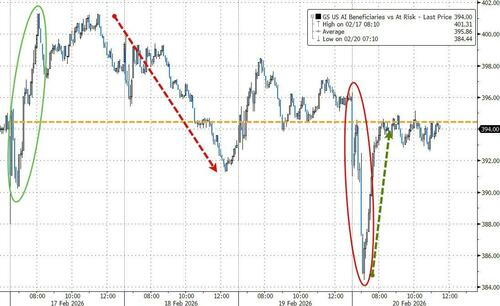

But the market can’t yet price the winners and losers with confidence. Retail stocks (who faced many of the biggest tariff pressures) spiked on the ruling, then dumped, and then as trump spoke on his options, they rallied again (no one knows!)

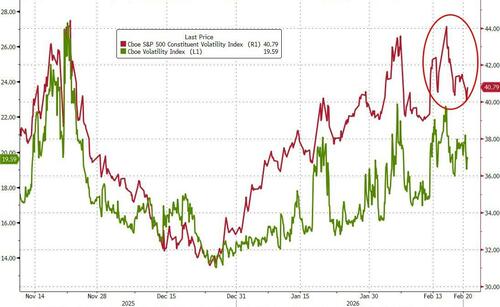

The uncertainty is still the story, and given the recent AI angst and Friday’s more stagflationary data, the macro backdrop still supports a higher volatility regime, especially at the single-name level...

The S&P ramped up to the 50DMA once again (around the key options risk pivot of 6900) and battled there for the rest of the day...

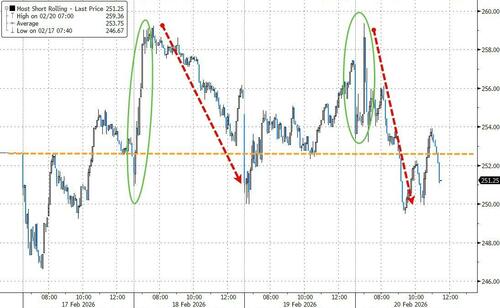

There was no sustained short-squeeze this week

Under the hood, SaaS stocks ended down on the week after getting whacked today...

Mega-Cap tech was bid as software was dumped...

But AI Winner and Losers ended the week equally matched...

Skew remains extremely steep (especially relative to VIX and VVIX) and hedgers remained active this week, despite the relative stability in the index...

Realized vol has reverted to 'normal' this week...

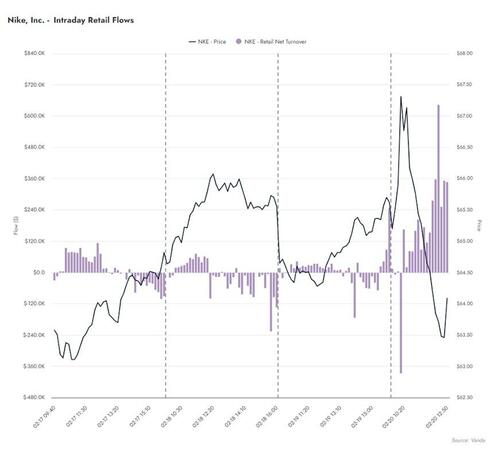

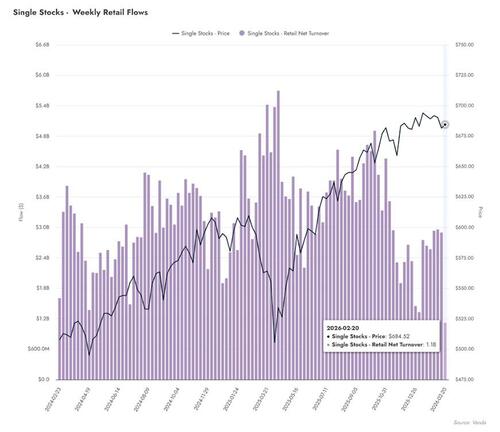

Retail flows were weak, according to Vanda Research:

Retail flows were mixed following the SCOTUS tariff ruling. Overall activity has been solid, but we have not seen a sustained uptick in participation since 10:00 ET once the news dropped.

Bellwether tariff names such as Nike (NKE) saw retail step in to buy the intraday dip, while we also observed abnormal buying in TLT following the knee-jerk sell-off in bonds. The cross-currents capture the broader mood – uncertainty, and perhaps apathy to the tariff news, rather than conviction.

Stepping back, this week has shown once again that retail sentiment remains muted.

Net weekly buying across single stocks is on track to register one of the weakest readings over the past few years (~$1.4bn including today’s flow so far).

Even though it was a shortened holiday week, this reinforces the absence of broad-based retail enthusiasm that characterised last year’s rallies.

It is no surprise that the S&P 500 has traded in a tight sideways range during this relatively quieter period of retail activity in single names.

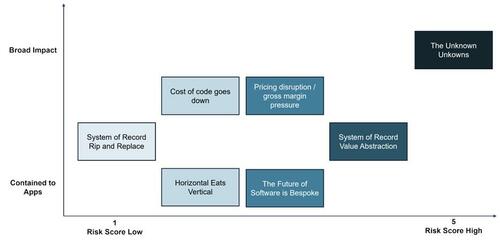

Before we leave equity land, here's Goldman's Gabriela Borges discussing software moats and 'unknown unknowns'. She frames the bear cases and structures a complex debate simply in the following chart (more on this over the weekend)...

As she highlights, the past few weeks have shown us how quickly the agentic technology ecosystem is evolving which makes it hard to put a floor on valuations but one sign of stabilisation we should watch out for: proof that domain experience drives higher quality agentic outcomes.

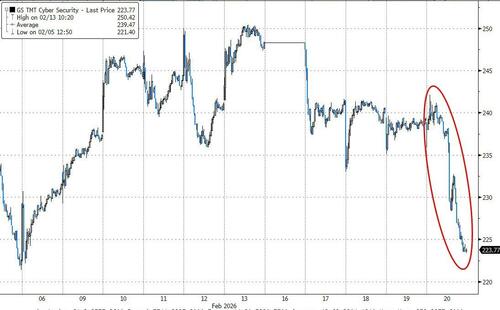

By way of example, Cybersecurity stocks were monkeyhammered after Anthropic introduced a new security feature into its Claude AI model.

Anthropic said the new tool “scans codebases for security vulnerabilities and suggests targeted software patches for human review.”

Anthropic added: "This is a pivotal time for cybersecurity. We expect that a significant share of the world's code will be scanned by AI in the near future, given how effective models have become at finding long-hidden bugs and security issues."

Treasury yields were higher on the week with the short-end underperforming. The long-end was today's worst performer after a hot PCE (and warnings from PMIs and tariffs)...

With the yield curve flattening on the week (despite a spike steeper today) to its flattest since Jan 27th (pre-FOMC)...

The dollar dipped today after the tariff ruling and weak GDP, but was higher on the week...

Despite the dollar's gains, metals prices surged on the week with Silver and Platinum outperforming (led by a big jump after today's tariff ruling)...

Gold pushed back above $5000 today...

...nearing $5100 in non-stop buying following an initial spike below $5000 on the SCOTUS ruling...

Furthermore, Precious Metal vols fell this week (despite a small uptick today after the tariff decision)...

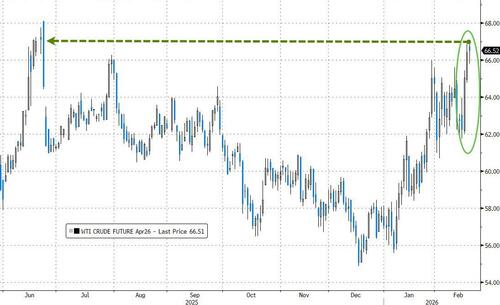

Crude prices surged this week to six-month highs (on the heels of Iran tensions and mildly supported by large inventory draws - biggest drop since early Sept).

President Trump said he’s mulling a limited military strike on Iran and forces gather in the Middle East, warning Tehran had 15 days at most to reach a deal over its nuclear program.

“Despite this morning’s minor pullback, we continue to see room for further upside under the current geopolitical backdrop,” said Ole Hvalbye, an analyst at SEB AB.

Oil timespreads are reacting to the increased risk. Brent’s one-year spread moved to the widest backwardation — a market structure that signals tighter near-term supply — since June. The six-month gap has also pushed further into backwardation. Options skews for both Brent and WTI are in a deeper bias toward bullish calls, signaling rising expectations for price gains.

A sustained campaign against Iran could see prices jump further, which would feed through to gasoline costs at the pump and risk angering US voters ahead of midterm elections later this year.

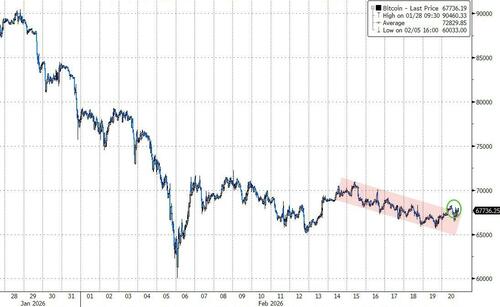

Bitcoin had a rough week, but ended to the upside, potentially breaking out of its recent downtrend-channel...

Finally, in a week where hedgers were active as evidenced by a steep skew and rich VIX/high rVol...

Source: Nomura Vol

...Nomura cross-asset strategist, Charlie McElligott pointed out the ever-increasing popularity of Hedging “Crash” -risk with VIX Calls (they give off so much payout due to Convexity, bc VIX is already the square root of Variance, PLUS then the Optionality-component too of course... and in addition, the VIX Options space tends to see VIX Options Dealer “Negative Gamma” Squeezes then self-fulfill due to the painful risk-management realities and difficulty recycling)... making for a product that is ever-increasingly stacking “Convexity on Top of Convexity”.

Source: Nomura Vol

As such, the VIX motion is “kinetic” at the ends of its spectrum:

-

...tending to Overshoot up of course...

-

...but then too, increasingly getting slapped-down quickly as well i.e. those sharp “Vol of Vol” resets lower.

McElligott's point-being that IF we can get Spot Equities to continue this stabilization, those popular VIX Calls are gonna melt and have plenty of room to go lower, which knocks-into the virtuous feedback loop: $Delta to buy in Equities futs as hedges roast, Vol-scalers mechanically then need to add-back Leverage / Exposure as VIX resets lower, and under-exposed / recently Netted- and Grossed- Down Investors then risk turning “Buyers Highers,” potentially bidding-up “Cheap” Calls and driving “Spot Up, Vol Up” potentials.

McElligott concludes: “Volatility is the exposure toggle in modern market structure”

And that’s the point of this whole ramble... these recent SPX daily changes ~ + or -30 to 40bps only of the past 1w are exactly what is required to see Vol reset lower... because Index just is not moving enough (in addition to the offsetting “Extreme Dispersion” keeping Correlation low)... which supports stocks virtuously from here.

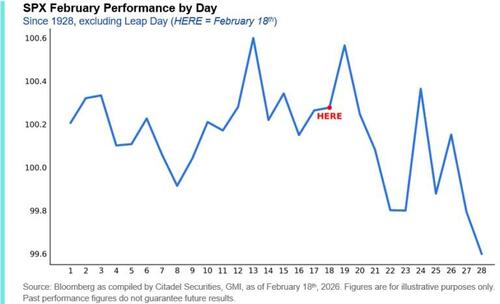

But that would be ignoring the seasonals...

...and don't forget NVDA EPS next week!