Stocks, Oil, & Gold Soar As Catalyst-Heavy Week Routs Rate-Cut Odds

The first full trading week of the new year anti-climaxed with from a risk catalyst perspective with a mixed bag for jobs...

US employers added fewer jobs than expected in December with nonfarm payrolls increasing by 50k vs 70k consensus. This is likely at the low end of an “okay print” without major sparking growth concerns, but...

Unemployment edged down to 4.4%

...and the tariff-can kicked.

Today was widely expected to be the decision day from SCOTUS on tariffs, but Wednesday (1/14) is now set as the next decision day (with the possibility of a decision to come after as well).

It is believed that the more time that the court takes to deliberate, the more nuanced of a decision they will make.

A decision today would have been considered very quick and likely negative for tariffs.

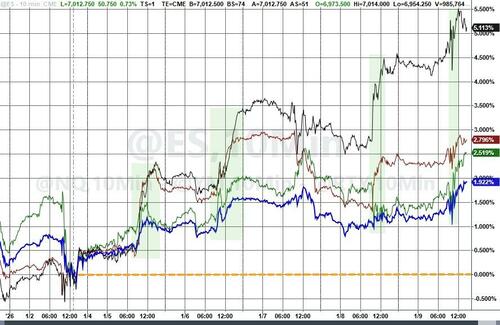

...but not from an equity risk-taking perspective as all the US Majors surged this week, with a yuuge 5%-plus gain for Small Caps...

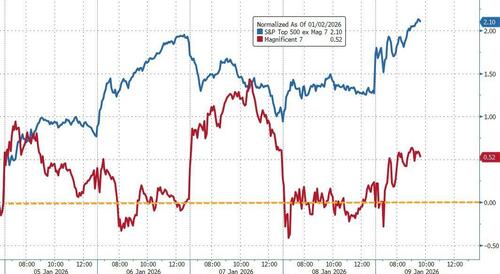

S&P and Nasdaq lagged their peers (but were still solid on the week) thanks to major underperformance by the Mega-Cap tech stocks...

Source: Bloomberg

Bloomberg's Michael Ball notes that while equities are near all-time highs, with very little hedging for immediate downside. The rotation trade driven by reacceleration hopes remains the driver - higher beta and riskier factors, cyclicals and economically sensitive names are outperforming defensives and mega-caps.

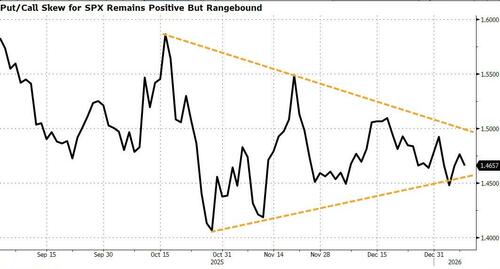

Option positioning leans constructive. Implied vol leaked lower on the benign jobs outcome while stocks edged higher. MenthorQ’s option score bounced back into the mid-range after last week’s dip, indicating steadier sentiment for now. Nomura said there’s “no fear” in 0DTE flows, with same-day implied vol historically low due to a steady bias to sell gamma, even as the payoff falls.

However, further out the curve there’s a better bid for vol, leaving put/call skew rangebound but still leaning bullish, holding near the middle of its post-November range. Hedging demand shows up on pullbacks through longer-dated index put buying and VIX and VVIX calls.

Source: Bloomberg

The risk is that more positive 0DTE positioning is keeping the tape pinned and calm, even as the broader setup feels more fragile. SpotGamma notes that above 6,850–6,900 on the SPX, positive gamma, supplied daily, can keep things quiet and grinding toward 7,000 into next Friday’s OPEX. But if spot breaks that support area - potentially on a rates-vol pop tied to the IEEPA ruling on Wednesday - the calm can unravel quickly as hedges are lighter and gamma flips from shock absorber to amplifier, forcing dealers to chase and speeding up the selloff.

S&P 7000 was a clear point of contention in markets today... and the bulls won...

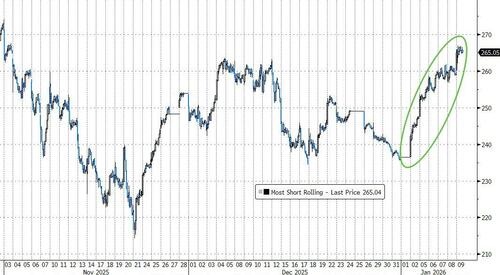

Small Caps dramatic YTD outperformance is thanks in large part to the massive short-squeeze we have witnessed. YTD, 'Most Shorted' stocks are up 12%... the best start to a year since at least 2008...

Source: Bloomberg

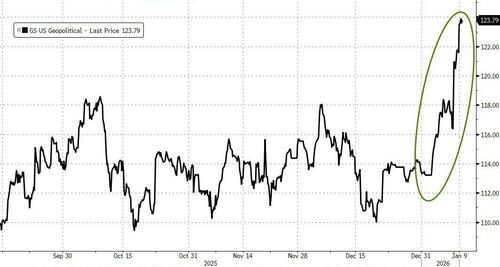

Goldman's Geopolitical Risk basket exploded higher this week as tensions sent defense stocks (among others) soaring...

Source: Bloomberg

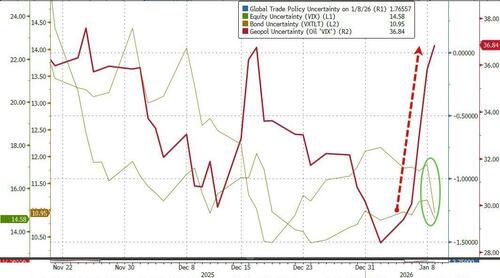

Meanwhile, equity and bond vol collapsed as geopolitical risk soared...

Source: Bloomberg

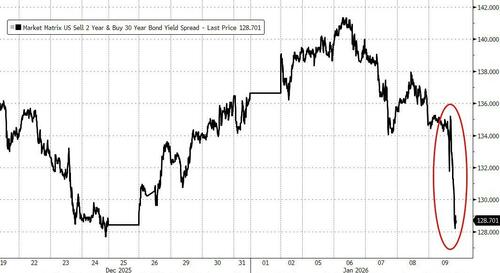

Treasuries were mixed this week too with the long-end dramatically outperforming...

Source: Bloomberg

...significantly flattening the yield curve...

Source: Bloomberg

As Trump's QE sent MBS (prices) soaring...

Source: Bloomberg

The dollar had a strong week, rising to one month highs...

Source: Bloomberg

And despite the dollar's gain gold also surged this week - back up near record highs...

Source: Bloomberg

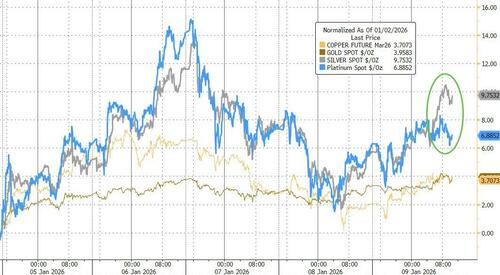

Silver soared 10% this week, followed closely by Platinum...

Source: Bloomberg

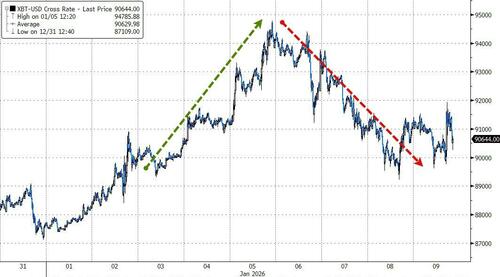

Bitcoin ended the week unchanged after a string start. However, 90k appears to be solid support... for now...

Source: Bloomberg

Crude prices surged to end the week, with its biggest daily gain since October, as Iran attempted to quell escalating protests and President Trump threatened repercussions if demonstrators were targeted.

“Crude remains caught in a complex dance between heightened geopolitical risk and rising inventory,” said Robert Rennie, the head of commodity research at Westpac Banking Corp.

Source: Bloomberg

Finally, Goldman's Delta-One desk head, Rich Privorotsky, summed things up succinctly: Net-net, this market feels like it’s chopping everyone up.

Dispersion is high. Tech isn’t working, and the consistent winners aren’t pure secular growth but cyclicals tied to nominal strength.

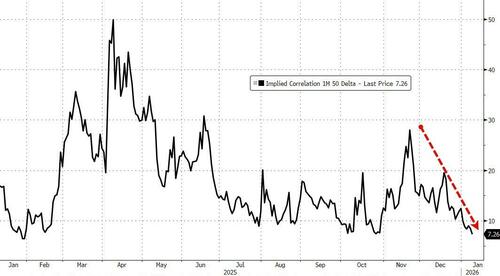

Correlation low => Dispersion high...

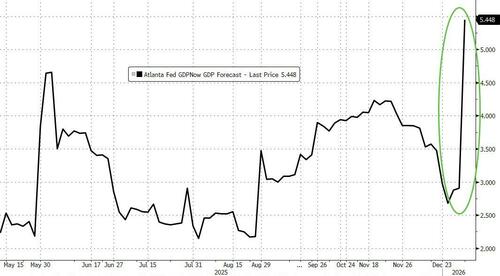

Atlanta Fed GDPNOW >5% means a run-it-hot economy is bulldozing secular narratives in favor of cyclical growth...

The key question is whether rates eventually spoil the party.

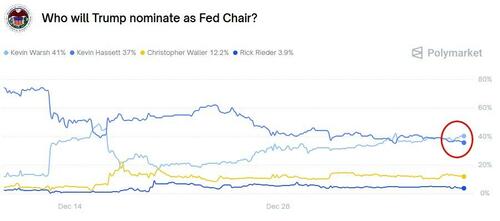

Notable in that context… “Bessent said Trump is expected to decide on a successor to Fed Chair Jerome Powell this month, possibly around the Davos forum.The president told the NYT that he’s made up his mind.”

Warsh and Hassett looks a coin-flip (actually Warsh is marginally ahead 41% vs 37%).

Privorotsky concludes by wondering if the market is carrying a bit of excess risk premium into weekend given oil moves.

Apologies for the tease image - it seems regulators don't like Grok enabling pubescent minds to imagine what attractive women in trading rooms look like... but they do seem ok with old, fat, drunk guys though...

This is a Grok-created image, not a selfie!