TACO Thunder: Retail Investors Bought Tuesday's Dip In Record Amounts

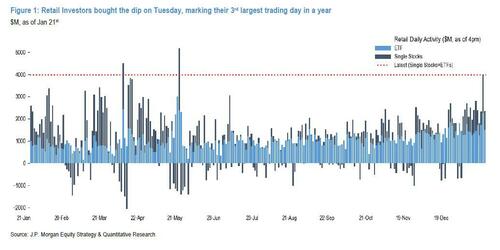

While the broader market was panicking on Tuesday ahead of Trump's Davos speech (where the topic of Greenland was sure to feature prominently) and following the historic rout in Japanese bonds, one group of investors - the same group that may have read our Monday article "Why JPMorgan's Desk Thinks The Greenland Standoff Ends In A Bullish "Negotiated Arrangement" - was furiously buying the dip in anticipation of yet another TACO turnaround. They were right.

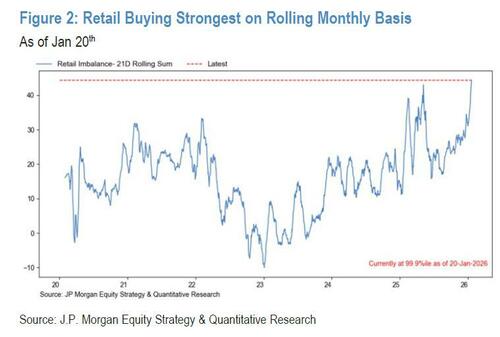

As JPMorgan writes in today's edition of its weekly Retail Radar note (available to pro subs), retail investors have continued to set new records this year, culminating with an impressive $12.9BN this week, largely due to near record buying during Tuesday's market rout. Looking further back, the 21-day rolling sum of retail buying just topped $45 billion for the first time ever as ordinary investors appear to no longer have any fear of the market.

According to JPM's Arun Jain, this level of buying is comparable to last year’s buy-the-dip episodes (post-DeepSeek, March Momentum Unwind and the V-Shape recovery in April); but unlike those prior episodes, which faded quickly, the current “new year” momentum has been sustained and has now pushed retail activity to an all-time high on a rolling monthly basis. Also, in contrast to last year when ETFs contributed to ~75% of retail buying, ETFs and Single Stocks are equally robust this year.

As geopolitical developments cast fresh uncertainty over market sentiment this Tuesday, JPM finds that retail investors responded by stepping in strongly to buy the dip, marking the 3rd largest single day buying event in a year, marking their 3rd largest trading day in a year.

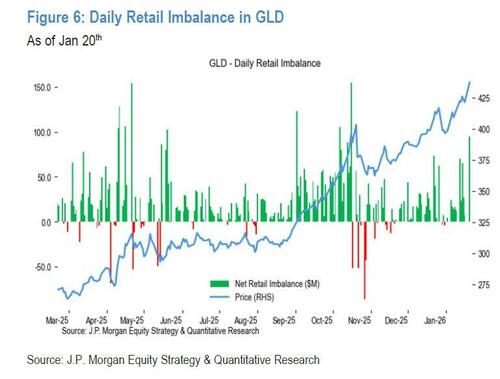

There were also some other interesting trends: following President Trump’s remarks regarding potential new tariffs on Europe over Greenland, precious metals reclaimed the second spot on the ETF category leaderboard while International Equity saw outsized buying (close to 100%ile).

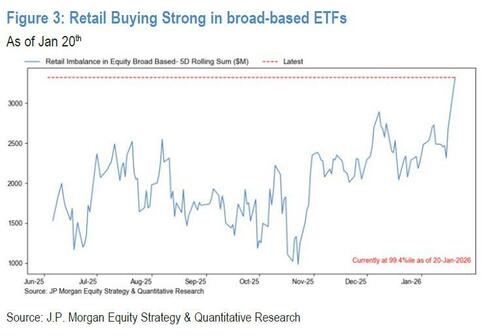

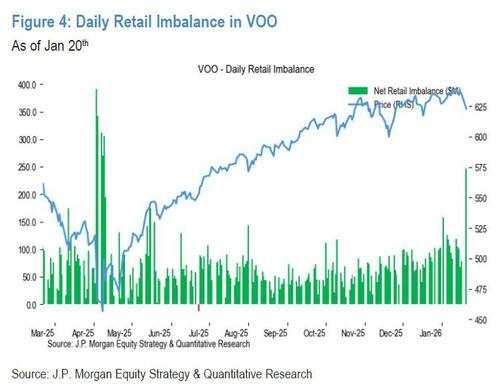

Within ETFs (98%ile), Broad-Based Equities - which accounts for ~40% of total ETF purchases - recorded their highest weekly purchases...

... driven by a surge in inflows into QQQ (2.4z), SPY and VOO.

On the flipside, fueled by a cold snap in the US, natural gas futures enjoyed a 50% jump in 2 days which prompted retail investors to accelerate profit-taking in BOIL and UNG.

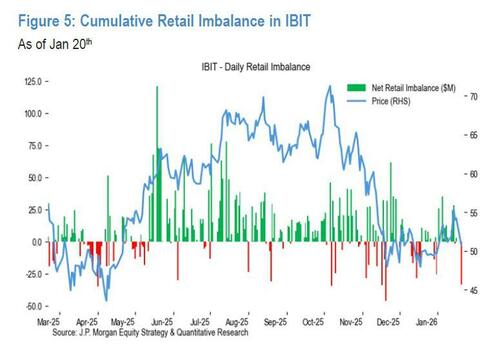

Unlike precious metals, ETFs in Crypto - which has started off 2026 as the anti-gold trade - also saw outflows, with Currency ETFs at their 4%ile yesterday.

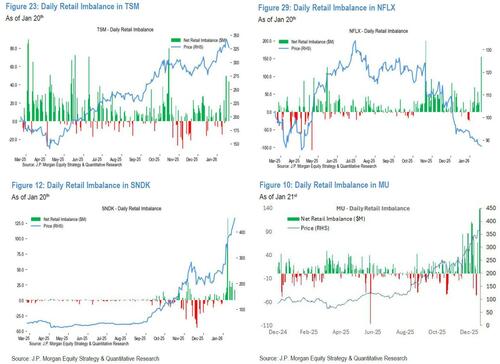

Within single stocks (84%ile), Tech continued to lead retail purchases, followed by Consumer Discretionary and Communications. While the Mag 7 dominated retail single names activity throughout 2025, investors have recently begun diversifying beyond these well-known names. This week, while TSLA and AMZN remained the top retail picks, they were followed by NFLX, MU , TSM and INTC.

Meanwhile, AAPL remains the least favored name that seems to consistently be funding other purchases.

It's not just stocks: retail option share continues to hover near highs in options as well. The most traded options were in the following names: TSLA, NVDA, META, AMD, GOOGL/GOOG, MU, MSFT and AAPL, along with the ETFs SLV and GLD.

Here are all the details:

- Retail flows were particularly strong, reaching $12.9B this week and well above the 12-month avg of $6.7B/week. Retail investors continued to favor ETFs (+$8.5B) over Single Stocks (+$4.4B).

- Outside of Broad Based Equity ETFs (+$2.8B), Retail ETF buying was influenced by Fixed Income ETFs —Multi Sector (+$408M)— as well as Precious Metals ETFs (+ $396M), Equity Style Call/put writing (+$293M, 3.3z), and International Equity Global (+$262M, 3.7z).

- This week, and in line with prior weeks, retail investors continued to buy Growth, Cyclicals, AI datacenters and electrification (JPAMAIDE), AI Software/Product/ Monetization (JPAMAISO), Top 30 AI/Datacenter Beneficiaries, along with OBBBA Immediate Expensing Beneficiaries.

- Activity in Mag7 this week: Retail investors bought TSLA (+$436M), AMZN (+ $366M), NVDA (+$143M), MSFT (+$125M), META (+$103M), GOOGL/GOOG (+$111M), and sold AAPL (-$160M).

- Outside of Mag7, retail stock activity was primarily driven by Tech (+$1.8B), along with Communications (+$353M), Materials (+$302M) and Health Care (+$270M).

Finally, a visual of retail activity by single stock sector and ETF theme.

Much more in the full Retail Radar note available to pro subs.