"What A F**king Day!": Tech Wrecks, Crypto Crashes, Bullion & Bonds Bounce

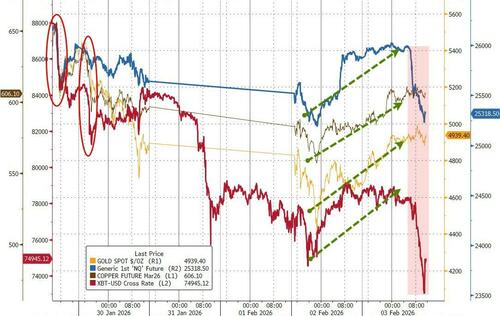

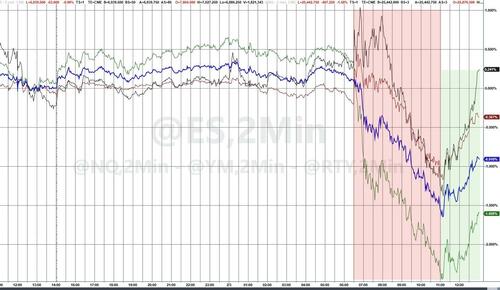

TL:dr: Equities were dumped led by a crash in Tech (led by software stocks) alongside private credit (heavily exposed to software). Small Caps outperformed. Momo ripped higher (correlated to PMs). USTs rallied in the US session to close lower in yield (Bunds ugly). Crypto was even worse, tracking tech lower (but a late-day surge rescued ETH). Oil was up a little on Iran tensions. Copper rallied (on China stockpiling HLs). Precious metals soared (as the big banks are still buyers)... and amid all that the dollar was modestly sold.

"Relentless" weakness... was how one veteran TMT trader described his day as US equities were a one-way street lower from the US cash open, led by a wreck in tech (specifically software)...

Software trading at its lowest since Liberation Day...with its biggest down-day since then too...

Goldman's trading desk cites:

1. Anthropic new launch capabilities for its agentic Cowork facility,

2. A couple EPS moves lower in AI at risk company’s across the mkt (Publicis -10% in France, IT -26% on earnings), and

3. Current momentum dynamics… Pro-Momentum tape = bad for Software

Not coincidentally, Private Credit stocks were also destroyed today with OWL now down 18% over the last couple of days...

To find more details on the specifics behind the Software-Private Credit collapse, read here...

"What a f**king day!" said one cross-asset-class derivatives trader (and that was the cleanest sentence in his MSG).

Let's go back to Thursday's opening flush (that was allegedly triggered by the copper markets) for a quick cross-asset comp... Crypto stands out (but so does the Nasdaq which seemed to snap at the same time)

Goldman Sachs trading desk said "we are extremely busy" assigning an 8 out of 10 in terms of overall activity levels with a 9% sell skew across the floor.

That is their highest sell skew YTD. Both HFs and LOs have outsized sell skews

-

LOs are skewed 30% better for sale with outsized supply in info tech, cons disc, and industrials vs demand in comms services

-

HFs are skewed 17% better for sale (driven by long sales) with supply in info tech, financials, healthcare, and consumer discretion vs insignificant demand in comms services and materials

The OpenAI-Nvidia tensions continue (not happy with chips vs not investing). Despite Huang's denial of tensions, AI stocks were under pressure...

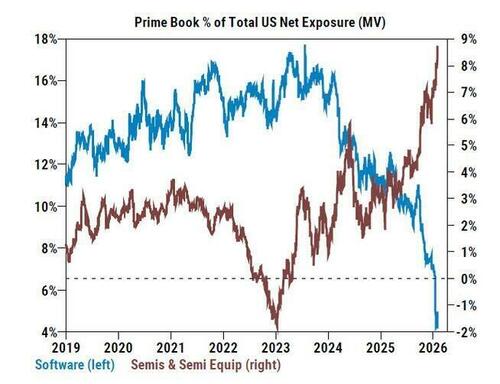

Software stocks, as we detailed earlier, continued their collapse (AI Uber Alles). The following chart puts the level of weakness in context as Software has MASSIVELY underperformed (-82%) Hardware (Semis) over the past 10 years...

Remember, hedgies have been hammering this trade for weeks...

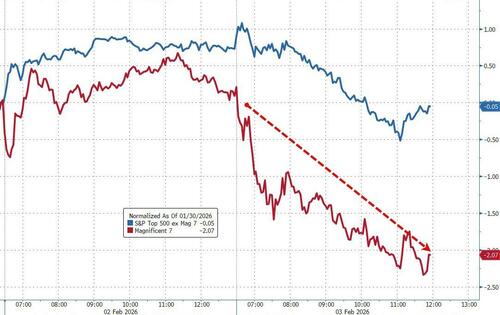

Mag7 massively underperformed the S&P 493...

...as Goldman's Chris Hussey notes that while several Mega-cap Tech stocks are trading down today, we are also seeing solid gains from some Mega-cap stocks that are not Tech, including WMT, JPM, XOM, and JNJ as investors look for stocks that may be tied into the next stage of the AI trade (implementation beneficiaries) or are just trading on something else altogether...

All in all, a late-day lift put some lipstick on the pig of a day with Small Caps ripping back into the green. But, Nasdaq was still the day's biggest loser...

If you're looking for a catalyst for the bounce, perhaps it was the S&P 500 finding support at its 50DMA...

And Nasdaq bounced off its 100DMA...

Small Caps outperformed the S&P 500 for the 2nd day in a row (after underperforming for 6 straight days... after outperforming for 14 straight days)...

As MegaCap Tech was monkeyhammered...

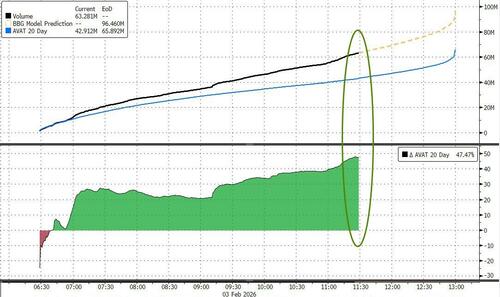

Morgan Stanley's Quant Desk offers some insights into today's action: Lots of questions on how such a seemingly rotational market is ending up in broadly lower equities today.

-

While there are big gaps between winners and losers (dispersion is in 99th %ile), part of the issue is that the other natural side of Software – i.e. Semis – is already very, very full per MS PB content – and so is failing to rally (MSXXSEMI at -4% is underperforming it’s beta by almost 1%).

-

In addition, HFs are coming off one of the biggest days of long adds over the last year per MS PB Content, and investors have been quick to reverse recent flows this year when there is volatility. The retail bid also slowed some since noon (although showing some signs of life in the last few minutes) which is weighing on broader markets.

-

With equities lower, supply from systematic macro strategies (CTAs, vol control, risk parity) has the potential to grow given elevated equity leverage sitting in the 90th %ile vs the last 5 years. If SPX ends the day at -1%, equity supply in the next week is modest at -$8bn (-0.3 z-score magnitude), but at -1.5%, that grows to $20bn (-0.8 z-score magnitude), and at -2% that grows to $35bn in the next week (-1.1 z-score magnitude), some today but mostly spread over the next few days.

-

QDS flagged earlier that S&P 500 option dealers are long ~$8bn of gamma / 1% move at spot and marginally longer on down moves (or about $10bn of delta demand with SPX at -1.4%), which can provide some intraday cushion to US equities...

-

...but levered ETF rebalancing flow is expected to be larger, given much of the levered ETF short gamma is benchmarked to Tech, which is underperforming. With NDX -2.3% and SPX -1.4%, levered ETF rebalancing supply is est. to be over $11bn today (with $8.5bn of that supply in NDX/Semis/Tech). $11bn of levered ETF supply would be in the top 50 largest days on record on QDS’s estimates.

It wasn't just tech stocks either...

Tech credit markets were seriously under pressure...

...and Tech credit continues to trade wide of the overall IG credit market...

Goldman's traders (Alisha Pasi and Christian Degrasse) confirm what the credit market is saying?

Spreads in High yield software and tech are both moving higher... Further, software loans make up ~16% of the leveraged loan markets – KEEP AN EYE ON SPREADS HERE, as our credit team is noting that software’s ~16% mix of the leveraged loan market is similar to energy in ‘15/16, or Utilities post ’02...

Read the full breakdown of this circular firing squad here.

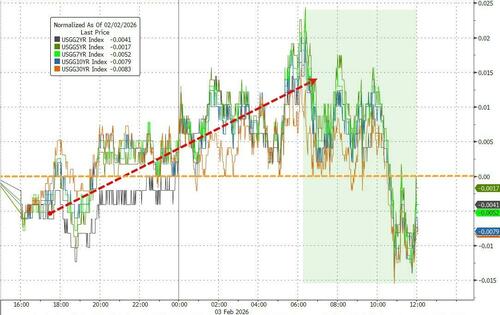

US Treasury yields were lower on the day - but only marginally - as the early weakness (sparked by European pain - see below) gave way to rotational buying as US equities collapsed...

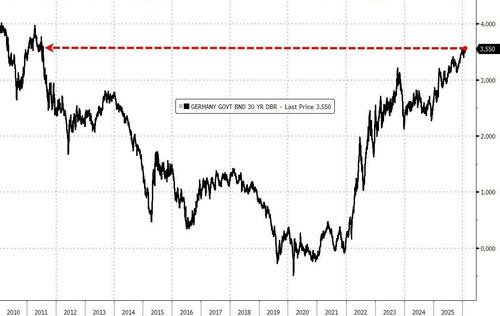

Germany’s long-end yields are starting to matter again as record debt issuance collides with a market that now demands a genuine term premium.

Bloomberg's Brendan Fagan notes that the 30-year Bund yield pushed to the highest level since 2011, underscoring how decisively Berlin has stepped away from its fiscal orthodoxy.

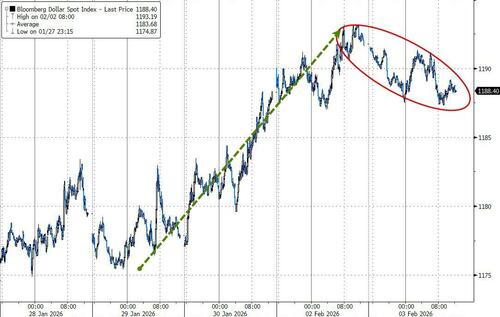

The dollar drifted lower (but, like USTs, only marginally) amid the chaos elsewhere...

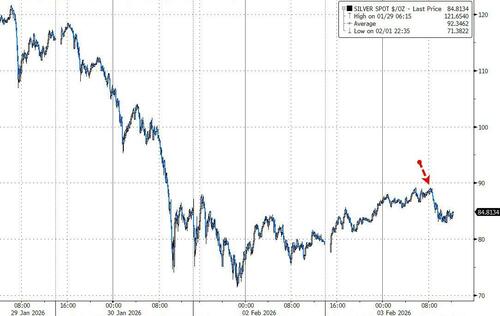

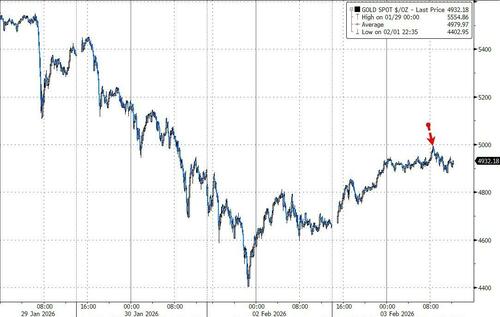

But it wasn't all red... precious metals extended yesterday afternoon's bounce (but remain well down from Thursday's close)...

Source: Bloomberg

On the day, Silver soared by over 12% at one point before falling back to match Gold's gains...

Source: Bloomberg

Gold and Silver ended 'off their highs' on the day with Silver stalling at $90 and Gold stalling at $5000...

Source: Bloomberg

Notably, there was some serious catchdown overnight in China as the Shanghai premium over The West's price for Silver reverted...

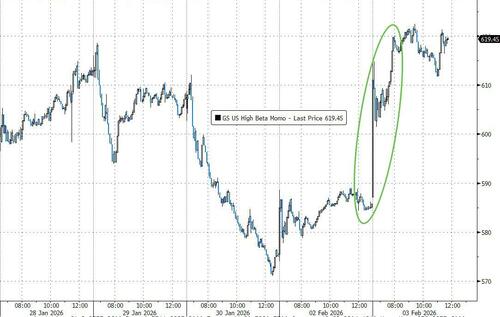

Momentum stocks were at the top of the leaderboard today...

Goldman recently highlighted the correlation between Momentum and Gold is at multi-year highs which is driven by the surge in mining stocks.

The Metals and Mining Industry is at the highest weight in their Unconstrained Long/Short Momentum in years.

Bitcoin was an utter shitshow, crashing to its lowest level since President Trump was elected (taking out the Liberation Day lows)...

Bitcoin did bounce late on, scrambling back above those Liberation Day lows...

...but that still left 'digital' gold at its weakest relative to 'real' gold since Oct 2023...

Interestingly, late in the day, as the selling pressure abated in stocks (and bitcoin), panic-buyers emerged in Ethereum, erasing the day's losses briefly...!!!???

Black gold was green on the day as US forces blew an Iranian drone out of the sky and reignited some modest geopolitical risk premia...

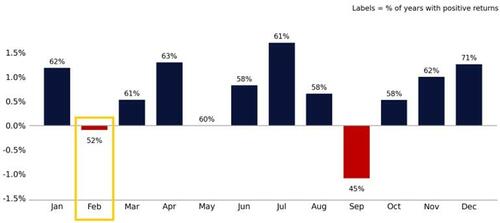

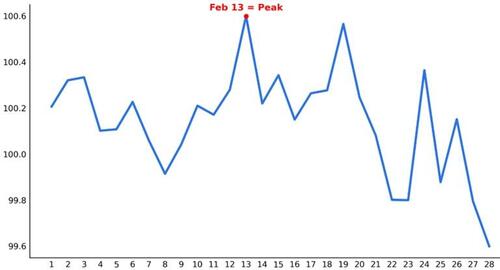

Finally, as we detailed earlier, historically, February has been the second weakest month of the year, with the S&P 500 averaging -9bps since 1928 and posting the second-lowest hit rate of any calendar month.

2H February has historically seen more uneven price action, with early gains often giving way to consolidation or pullbacks as early-year positioning settles.

Which is one of the reasons behind Citadel's Scott Rubner's call that he has "higher first, then lower vibes for US equities" in February.