Tech's "Monolithic Freight Train" Wrecked; Goldman Hedge Fund Honcho Reacts To 'Another Feral Week'

This was another feral week, with multiple standard-deviation moves across the asset-complex, again most pronounced within equities and commodities.

And, as Goldman Sachs head of hedge fund coverage, Tony Pasquariello, points out in his latest note to clients, while the temperature of certain markets will likely settle down - silver won’t deliver 200% volatility all year long - the dynamics in the game remain wide open and each day is its own distinct adventure.

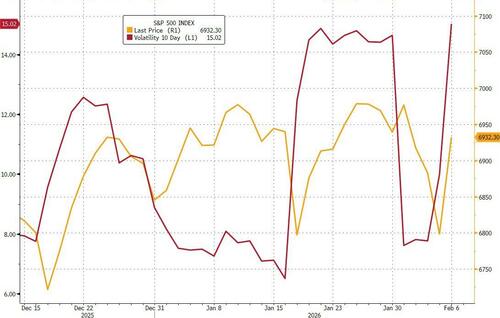

Looking back at the past five days, it’s almost hard to believe that S&P finished flat on the week, with realized vol rocketing to two-month highs...

Stepping back, a few broad themes have defined early 2026.

-

On the positive side of things, the reflation trade has bloomed.

-

On the other side of the draw, the AI trade has seemingly entered a new phase of seek-and-destroy.

-

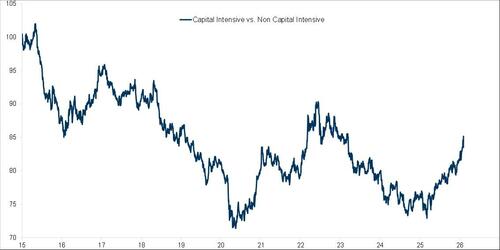

In the doing, a long running trend of cyclical, asset-heavy stocks underperforming secular, asset-light stocks has been upended.

This last point (that Pasquariello made earlier in the week), reportedly provoked quite a noticeable client reaction.

Zooming in and framing differently, this is the ratio of “capital intensive” versus “non-capital intensive” stocks over the past decade.

Digging into the specifics, here'swhat’s in each bucket:

* capital intensive: electricity, industrial materials, automobiles and parts, gas, water and multi-utilities, industrial metals and mining, telecommunications service providers, leisure goods, construction and materials, oil equipment and services.

* non-capital intensive: technology hardware and equipment, medical equipment and services, pharmaceuticals and biotechnology, household goods and home construction, beverages, food producers, retailers, tobacco, software and computer services, personal goods.

At various turns over recent years, when the chips were down for stock operators, US mega cap tech earnings were a catalyst to restore upward momentum.

Lest it be said, the cavalry didn’t really show up in recent weeks (or not in the way investors wanted it to).

If there was a takeaway from this week, it’s that GOOG and AMZN -- despite pockets of superb growth, e.g. search or AWS -- did NOT revise EPS higher, yet capex continues to push inexorably higher.

Furthermore, the “zero sum” pattern of price action within the tech space continues.

As Pete Callahan points out:

...over the past three months, within the NDX, you have 56 stocks up ... and 55 stocks down.

When compared with a year like 2023 or 2024, the tech trade has shifted from a monolithic freight train (that rewarded brute force) to a more nuanced dispersion trade (that favors stock picking).

I’m admittedly much less equipped to navigate the latter.

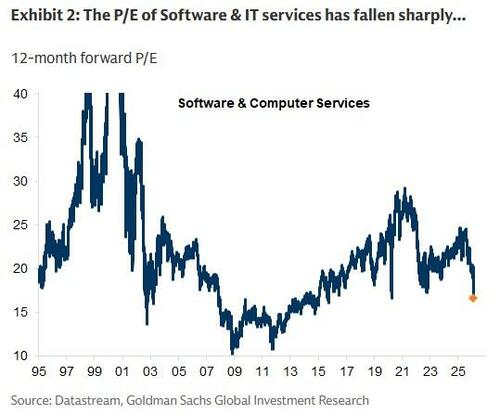

To say it again, I defer to the blackbelts on whether we’ve seen genuine capitulation in software that allows for some short-term stabilization.

Bigger picture, the question is whether this cohort can convince investors that it’s not as fundamentally challenged as the recent de-rating would suggest it is (from a forward P/E of 35x as recently as late last year to 20x now).

As Pete Bartlett pointed out to me, once the market makes its mind up that something has structurally changed, it becomes increasingly hard to fight the tape and break that perception (witness legacy media or brick-and-mortar retail).

Read here for a fundamental update.

At the index height of the market, the base level of volatility has clearly risen.

If anything, that understates what has taken place beneath the surface of the market.

For a vivid illustration, take a look at the moves in our flagship basket for the momentum factor, ticker GSPRHIMO: a scorching rip to fresh highs on Tuesday gave way to the second worst day in five years on Wednesday (only to finish the week marked higher).

Here’s one way to frame that degree of difficulty: a factor that measures in the 100th percentile of hedge fund ownership is realizing volatility that measures in the 95th percentile.

To be very clear - and as distinct from the prior few paragraphs - there’s plenty of pockets of strength.

To say it again: price action in the cyclical parts of the market has been impressive.

Don’t take my word for it, have a look at the charts for industrials, materials, transports, chemicals, metals & mining or energy.

I suspect part of this surge traces back, of course, to the upswing in nominal growth.

I also suspect that many of these companies are viewed as not particularly vulnerable to AI disruption (or, perhaps, as genuine beneficiaries).

In practice, it feels like capital is looking for some new homes outside of tech, and the old economy parts of the market are seeing that switch.

Another point of balance...

For as messy as the week felt, market breadth was fine and plenty of names made higher highs.

Here’s one way to frame it: as NDX was chopping down to 3-month lows mid-week, equal weight S&P was taking out the all-time highs (and it continued to fly on Friday).

Here I’d also flag the scorching outperformance of mid cap, which stands at the top of the leaderboard so far this year (a stark reversal from 2025).

On the technical side, the spec community has meaningfully reduced net portfolio risk.

For example, hedge funds have cut length in US equities for four straight weeks.

In addition, the post-earnings period should bring a resumption of corporate stock buybacks.

So long as the CTA community doesn’t unleash their stockpile of futures length, this all suggests positioning picture has improved.

Now the big question is how will US households respond to the recent pressure test.

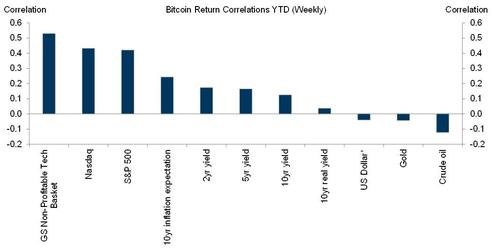

In the context of the selloff in BTC, I thought it would be worth revisiting this chart from Isabella Rosenberg.

In a carryover from last year, if you’ve been staring at screens in recent days, you’ll know that the behavior of BTC has closely matched that of non-profitable tech stocks (both on the down days and the up days).

Beyond that, compared to when we last ran this chart in December, the correlation to gold has turned net negative:

Finally, a simple chart of large cap US energy companies...

In the words of a client who has been-there-and-done-that, we’re moving into the “revenge of the dinosaurs” phase of the game now.

Super Bowl Prediction: Patriots 24, Seahawks 21.

Professional subscribers can read much more from Goldman's Sales & Trading team here at our new Marketdesk.ai portal