There's More To US Capital Flows Than "Sell America"

Authored by Simon White, Bloomberg macro strategist,

Sell America remains a reductive phrase. The latest TIC data, however, show a more nuanced picture.

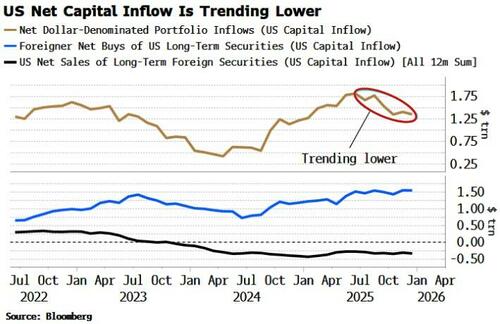

Net capital inflow to the US is trending lower but is not negative.

Underlying this is that foreigners are still buying US stocks and bonds but, especially with the latter, at a lower rate, and that at the same time the US is accumulating more assets in the rest of the world.

December’s TIC report, released Wednesday, showed a small net capital inflow, but that masked a decline in foreign purchase of Treasuries and an increase in overseas buying of US stocks.

Yet monthly data is noisy. Better to aggregate over a rolling 12-month period to discern the trend.

The headline number is the brown line in the chart below, showing the rolling 12-month sum of net portfolio inflows to US long-term assets (stocks and bonds).

We can see it is trending lower, but it is still much higher than where it was 18 months ago.

But it’s not simply a case of foreigners becoming less enthusiastic about owning as many US securities. It’s also driven by the US continuing to on net accumulate more foreign assets, which constitutes a capital outflow.

The bottom two lines in the chart above show the breakdown: foreigners are accumulating US assets, but at a lower rate, and the US is selling fewer foreign assets - in other words it is buying more of them - and this is capital that leaves the country (the TIC nomenclature can be confusing).

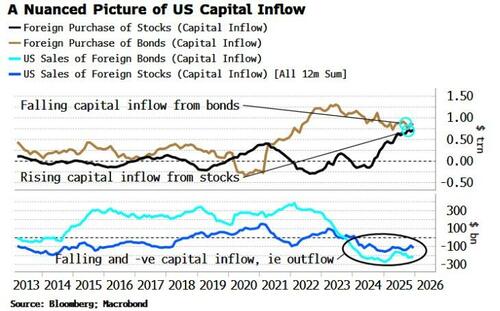

Going further we can break this down to stocks and bonds, as in the chart below. Here we can clearly see the drivers of US capital flows from portfolio assets.

Foreigners continue to buy less US debt, mainly Treasuries, for all the reasons now everybody is aware of. But their zeal for US stocks is barely dimmed, even if it is now rising at a less dramatic rate.

And in the bottom panel of the chart we can see the US is on net accumulating more foreign stocks and bonds, leading to capital outflow.

The dollar amounts are smaller than for foreign flows, but are non-negligible.

If the US continues to buy more foreign assets while domestic opportunities look less attractive, and foreigners continue to cool on America even if they don’t become active sellers, then net capital inflow to the US will keep falling.