These Are The 5 Big Trends To Be On The Right Side Of In 2026; Goldman

With major indices essentially back at the highs and with the FOMC & Oracle earnings now behind us, the market’s done a significant amount of work to unwind the risks priced in through the first 3 weeks of November:

“Investors have been digesting a combination of concerns on the US labor market and consumer, AI capex and releveraging, and less Fed resolve to ease policy into next year” (as written by Goldman's research team on 24th November).

Recent strength has been a pretty straight forward retrace of that – especially easing fears about the labour market, AI debt and the trajectory of the Fed

The US government shutdown and the associated data gap have interrupted the usual market macro cadence, but with the FOMC & NFP behind us, top Goldman Sachs trader Mark Wilson says the bigger story at play is really next year’s changing of the guard in Fed leadership (which inevitably devalues & undermines the importance of the current leaderships forward guidance at remaining meetings)

So with the macro & micro calendar thinning out, and as is always the temptation & natural inclination at this time of year, thinking about the big trends to be on the right side of for 2026 – here are 5 themes that stand out to Wilson and his team:

1) We're At The End Of The Beginning Of The AI Story In Markets

Last week I flagged the White House Executive Order ‘Launching the Genesis Mission’. Evidence is increasingly clear that the AI investment cycle we’re currently living through is a modern day ‘space race’.

As suggested before, if you buy into this thesis, then there’s a very real risk that those spending the greatest quantum of investment dollars to ‘win’ this race may have highly uncertain ROIs for some time. On the flip side, those facilitating that build (compute hardware / datacentre / power / & the builders of that ‘infra’) and those successfully deploying & harnessing AI in their business & successfully evidencing productivity gains - are likely to remain attractive.

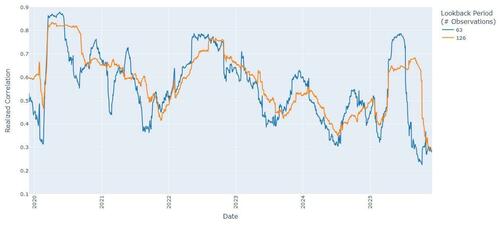

Even with the benefit of hindsight we’ll debate the timeline of this, but - I’d argue we’re now at the end of the beginning of the AI story in markets : the idea that a majority of AI value creation accrues to LLMs, and the omni-bull market in everything “AI-discussed” are likely at an end. Discernment about the beneficiaries is about to get much greater; in fact, in reality, it already has – below is the rolling realised correlation of the Mag6 [telling in of itself that its only 6 ..] ; thank you Shawn Tuteja for the chart.

One additional & important point to make, is that as a consequence of this investment “space race” – the investment $$s spent today will almost certainly guarantee scientific & technology breakthroughs that are a step-change beyond what’s consensus today; never has there been a better time to be structurally long ’innovation’ ! Even this week’s proliferating discussion of datacentres in space would have seemed like SciFi not so long ago …

I wrote the below line as a prediction for the year ahead on 6th January 2023, but it will prove just as applicable today :: “For investors, after of a long period of ZIRP & NIRP monetary policy, the bursting of the worst Covid-market excesses have left plenty of lasting scar tissue. However, the flip-side of that free-money period is that a never-before-seen quantum of capital was ‘invested’ (?) in innovation & ‘moon shot’ projects which tested the limits of human & scientific ambition. Partly as a consequence of that staggering excess of prior capital deployment, 2023 proves to be a year of significant & historic scientific breakthrough, continuing the theme of late 2022 where scientists made groundbreaking strides around subjects as transformative as fusion energy & practical delivery of cancer gene editing.”

Source: GS FICC & Equities as of 12/5/2025. Past performance is not indicative of future results.

2) The Imminent Fed Chair Appointment Could Be A Pivotal Event In FX Markets

In many instances through this last 12mths of the new US administration, their policy intent and action has been very well telegraphed. And so it seems likely that the widely speculated move to install Hassett as the next Fed Chair will come to pass. If that’s the case, then it also seems likely the Fed will let activity “run hot”, that inflation will be a secondary consideration to nominal growth, and there may be a sustained period of US$ weakness.

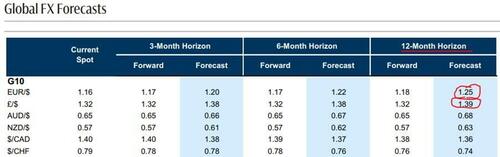

The upcoming Fed Chair appointment may prove to be a pivotal event in markets : for growth, inflation, for the USD & for risk appetite. Even before any official announcements have been made, our FX team’s 2026 forecasts call for a significant weakening of the US$ (forecasts copied below, click on the table for the full report), and I can’t help but reflect back on a recent trip to Geneva & Zurich where every client conversation centred on the challenge of managing Swiss Franc currency strength.

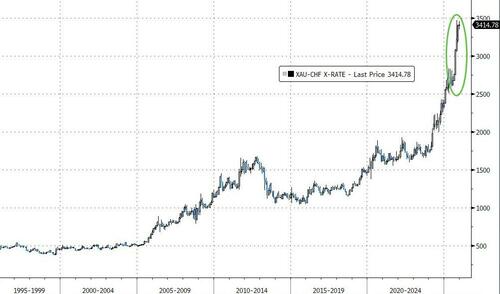

Yet … even for the strongest currency in the world, look at the purchasing power degradation in ‘real’/’hard’/gold terms over the last 20 years (chart below, Gold price in Swiss Francs – the “hardest” fiat currency in the world has lost 80%+ of its purchasing power !) ::

Back on 4th July post that Swiss trip, I wrote the below. Given the changes afoot at the Fed, both points seem even more relevant today:

“Apart from the obvious conundrum this creates for Swiss domestic investors, I was left with 2 broad thoughts that really reinforce two of the structural themes that have permeated these notes for many months :

1. If fiscal policy is on an unsustainable path, but the timing of when discipline's enforced is unknown, it seems intuitive that the global US$ totem should be tested. Furthermore, when the supply of credible currency alternatives is so small (CHF, precious metals, bitcoin) that diversification's likely to have outsized price impact, but also lead to a logical repricing of broad nominal assets (ie equities); and

2. dollar weakness was a leading feature of 1h'25; but for that period the Fed was a stubborn hold out versus other CBs who were cutting into tariff fear. We forecast 3 cuts from the Fed in the next 6mths and 2 more in 1h'26. As rate differentials ease over the next 6 months, it's worth staying open minded to where still-rich US$s may trade (and what kind of a tailwind that may be for equities).”

3) Copper Is The New Gold?

Precious metals performance this year is reason enough to examine the broader case for hard assets, but in a weak $ world - with a notable tightening in S/D - the case for specific commodity exposure gets more compelling.

Copper broke out to new all-time highs for good reason last week (chart below).

As our latest copper research states:

“Copper is a major beneficiary of investments in grid and power infrastructure globally, as AI and defence heighten the need for robust and secure energy networks” – and yet the market seems slow to embrace the arguments about strategic value, the premium required for supply surety, and the scale of new demand drivers (“Grid & power infrastructure drives over 60% of copper demand growth in our forecast out to 2030, adding the equivalent of another US to global demand” …).

Supply complications are certainly a headwind to copper equity valuations, but they’re also a key feature of current price support; even with ongoing M&A, valuations haven’t re-rated – which is surprising and unlikely to persist through next year. Reply back for best ideas.

4) Diversification Is The Price You Pay To Keep Playing The Game

Given the US equity market’s trading as rich (in absolute terms & relative to the rest of the world) as it has in 25yrs, its a tough starting point from which to sustain ongoing outperformance. Add to that the index concentration phenomena that we’re all acutely aware of, plus the possibility of a strucutral weakening in the US$, and it makes me even more fond of our research team’s recent refrain to “ ‘buy the dip’ and focus on diversification opportunities to protect your Equity OverWeight”.

That last point is crucial :: given the set-up in markets, diversification is now the price worth paying to keep you fully invested in Equities

I can send you compelling investment write-ups from the Brain Trust across GS on ‘why now’ for Korea, or Japan, or China, or broad EM – but the fact is, this strategy has served you well already throughout 2025; its easy to forget 2 full quarters on, but its served you especially well around the March/April trauma.

See the table below for a reminder of just how good non-US market returns have been in US$ in 2025 (the last column). Yep, even the UK & France have trumped Nasdaq’s stellar returns. And to really emphasise the point : over 20% of the S&P500 YTD return is accounted for by GOOGL … !

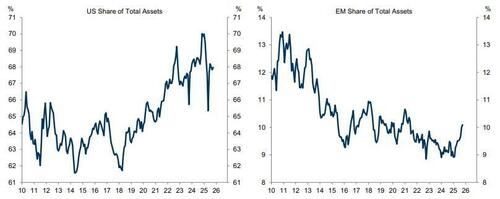

As we’re all acutely aware, starting points matter – and the US as a proportion of global assets has rarely been higher, EM assets as a share of total are just moving off multi-decade lows...

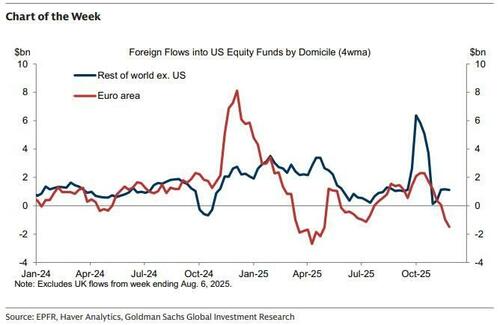

... and foreign flows into US markets are weakening (flows from Euro area investors have flipped to outflows again).

5) Global Inflection Points & European Markets

For so many reasons, we’ll look back on 2025 as a uniquely action packed year; in fact, the World Economic Forum just referred to 2025 as a year of “global inflection points”.

Amid all the action of the year, I can’t help but think that the US policy paper published last week was specifically significant; sorry to again highlight another White House report, but the “National Security Strategy of the United States of America” is absolutely required reading. If the ‘Genesis Mission’ frames the new US industrial strategy, then the ‘National Security Strategy’ is a Trump regime socio-geo-political blueprint which is notable for many reasons, including its preference for long form (over soundbite) and strategic focus (over tactical)

Linking this point to the prior discussion on diversifiction, no region in the world is as controversial for investors as making the investment case for Europe …

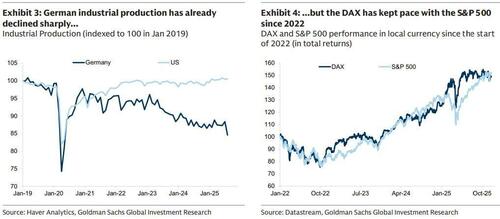

Of course Jamie Dimon’s comments last week that “Europe has a real anti-business problem” are 100% correct. If we were to extrapolate Buffett’s great axiom of “the ABC of business decay” (arrogance, beauracracy & complacency) to nation states then all of greater Europe would rightly be under scrutiny. The latest well documented Euro-area headwind is a renewed China export focus (we cut German GDP ests by 0.2% pa for the next 4 years, and Europe growth broadly by 0.2% for 2yrs as a consequence) – but its also not that linear in impact to European equities : yes, German IP will be lower, and chemicals & mass market autos will suffer; but it doesn’t change the fact German fiscal’s inflected, Europe’s recognising their chronic underinvestment, and attempts at addressing punitive regulation are in motion (as per last week’s EC proposals re capital markets, and the slow creep of consolidation across EU telcos, and the beginnings of cross-border intra-Europe consolidation – from Subsea7/Saipem to Thales/Leonardo/Airbus satellite JV etc etc).

Of course Europe has a lot of things not to like (as argued in the national security note); that’s not new news. And despite the Dimon & Buffett references above, they’d both no doubt be quick to point out – money made in markets is about living in the future, not the past. Time and again over the last 5 years, I’ve argued that forcing mechanisms are required to drive substantive change in Europe: Covid, the Russia/Ukraine conflict, the energy crisis, Chinese competition, Trump tariffs & the new US National Security Strategy are all such forcing mechanisms.

I worry about European politics, an unnecessarily hawkish ECB, a strong Euro, the lack of demand for long-dated govt paper & the woeful fiscal situation across many of the largest economies. But these too are forcing mechanisms to more pro-growth policy, to better policy making, and greater focus on competitiveness.

Our strategists do a good job breaking down the equity market impact of China’s export-led growth on Europe Equities; but the key lesson is illustrated in the charts below – European equities are not a clean expression or barometer of the domestic European political outlook.

Instead, Europe’s leading companies & private sector are very much part of the solution; as per page 26 of the NSS paper : “European sectors from manufacturing to technology to energy remain among the world’s most robust. Europe is home to cutting-edge scientific research and world-leading cultural institutions.”

Wilson concludes: without wanting to be too cute, the big picture is this:

-

growth is accelerating,

-

disinflation is reasserting itself,

-

the incoming Fed chair is likely to be unconventionally dovish,

-

we have a similarly unconventional US President who has one eye on the mid-terms 11 months away,

-

and we’re in the middle of a cornucopian explosion in radical innovation

The key line from all of the above is simple: “stay fully invested”.

Professional subscribers can read much more from Goldman's Sales & Trading team here at our new Marketdesk.ai portal