These Are Goldman Traders' Top Four Themes For 2026

It's that time of year again; when we look back at what was and forward to what's next... what worked, what didn't, and what we think will play in 2026.

Top Goldman Sachs trader Faris Mourad summarizes the year as follows:

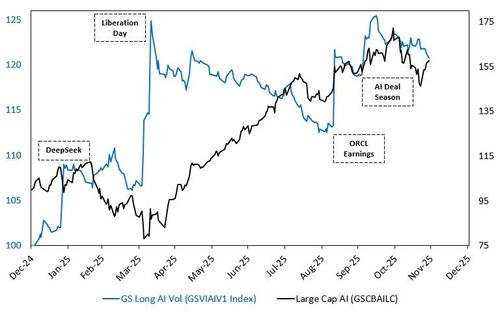

The week leading up to President Trump’s inauguration was one of the best weeks for AI, only to be followed by DeepSeek Monday that shocked global conviction on US leadership in this space.

Markets sold off through Liberation Day, unwinding the bullish sentiment equity investors had in the new administration.

That only lasted one week.

Since then, markets rallied and started pricing in rate cuts mid-summer onwards.

Momentum has been the most traded factor on our desk amidst the recent market wobble.

While at the index level it looks like things may be starting to calm down into year end, it’s worth highlighting that volatility in factors is currently extremely elevated...

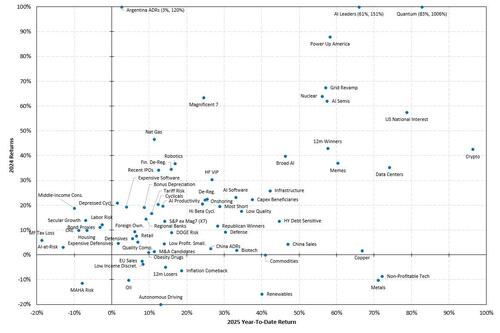

What a rollercoaster of a year it has been, this is how we are ending things relative to the prior year:

And with all that in mind, here are the four top themes that Mourad and his colleagues see for next year.

Our favorite 2026 trades:

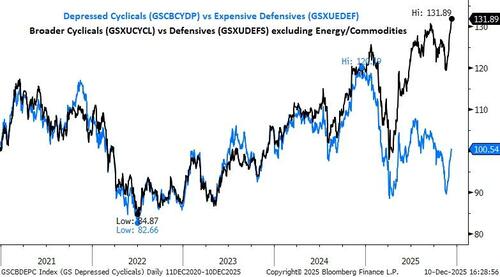

Long Depressed Cyclicals (GSCBCYDP) vs Short Expensive Defensives (GSXUEDEF):

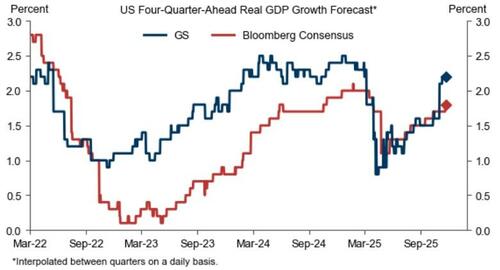

At a broader scale, our economists expect US growth to reaccelerate to 2-2.5% in 2026 because of reduced tariff drag, tax cuts, and easier financial conditions. Standard models suggest that this should boost job creation and stabilize the unemployment rate at a level only modestly above September’s 4.44%. Under this forecast, their working assumption is that the FOMC slows the pace of easing in 2026H1, pausing in January but 3 still delivering two more cuts in March and June which push the funds rate down to a terminal level of -3.25%.

The divergence between the depressed cyclicals (GSCBCYDP) vs the expensive defensives (GSXUEDEF) relative to the broader cyclicals vs defensives pair (GSPUCYDE) has diverged significantly in 2025, driven by multiple reasons including companies refraining from investing post OBBB due to growth fears and equity investors pricing in further weakness in the US consumer. We expect this divergence to revert back based on our research and economist forecasts:

GS Economists have higher expectations to US growth relative to the rest of the street:

Source: Goldman Sachs Global Investment Research

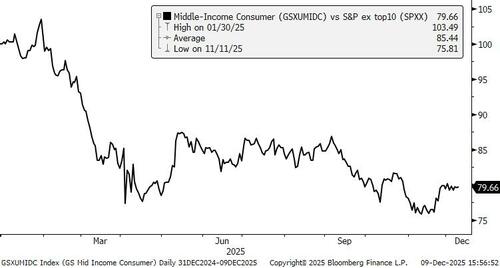

Long Middle-Income Consumer (GSXUMIDC):

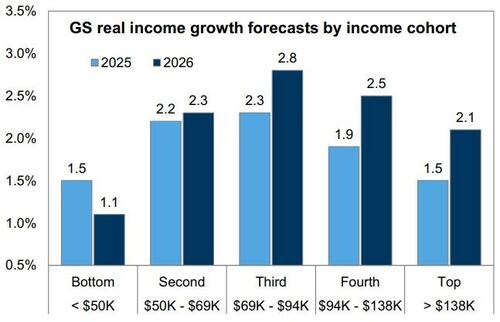

Our economists expect real income growth will pick up next year on the back of a pickup in job growth, new tax cuts, and a fading inflation headwind from tariffs, and forecast 2.3% real income growth in 2026 on a Q4/Q4 basis. We anticipate that new tax cuts included in the One Big Beautiful Bill Act will lead to outperformance among middle-income households in 2026. This is in line with positive commentary from different sectors: banks and card companies called the consumer healthy and resilient, while Q4 spend trends were also talked up with big banks, some pointing to a modest acceleration in YoY during Q4 early holiday seasons. Retail research mentioned consumer traffic trends were healthy in November.

GSXUMIDC has underperformed the S&P ex top10 (SPXX) by ~20pp year-to-date:

Our economists expect slow job growth and elevated inflation have weighed on consumer income growth in Q4, but expect a reacceleration in early 2026 as a result of a diminishing inflation impulse from tariffs, tax cuts passed in the One Big Beautiful Bill Act, and a stabilization of the labor market. They forecast a particularly strong fiscal tailwind to income growth for the middle income consumer. The lowest income households will likely experience a deceleration in income growth due to SNAP and Medicaid cuts.

Income ranges estimated based on 2022 BEA data in current dollars.

Source: US Bureau of Economic Analysis (BEA), Goldman Sachs Global Investment Research.

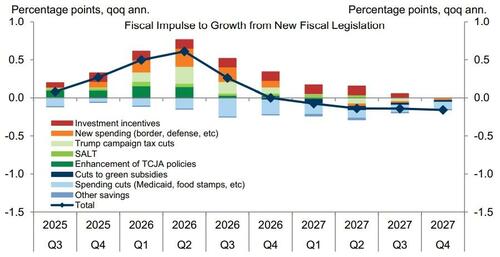

The new fiscal legislation is expected to provider a larger boost in 2026H1:

Source: Goldman Sachs Global Investment Research, link in text above.

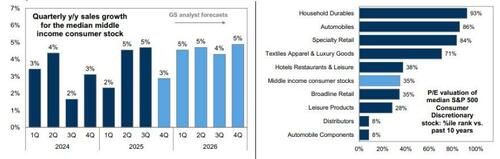

GS equity analysts expect accelerating sales growth for middle income consumer stocks in early 2026. Valuations of middle income consumer stocks are low relative to the last several years even after the recent share price rebound. The median stock in our screen of middle income consumer stocks trades at just 15x forward EPS, which ranks in the 35th percentile vs. the past 10 years and compares with a 19x P/E multiple for the median S&P 500 stock.

Source: Goldman Sachs Global Investment Research.

Long US AI Productivity Basket (GSXUPROD) – the most important trade in 2026:

It’s been three years since the launch of ChatGPT and some companies, in non-tech related industries, are successfully implementing AI into their businesses. Equity investors face challenges in figuring out who the real beneficiaries of AI are. Our AI productivity basket (GSXUPROD), launched in November, is composed of non-Tech and non-AI companies that have mentioned specific plans to implement AI into their workflows, allowing them to reduce costs and improve margins, across:

(1) banks and insurance companies,

(2) retailers and warehouse operators,

(3) transportation and logistics sector,

(4) health care services, and

(5) restaurants.

GS research continues to point out company commentary during earning seasons focusing on AI adoption. Earlier this year, CHRW announced the arrival of the Agentic Supply Chain: an intelligent ecosystem that continuously thinks, learns, adapts and acts. More recently, WFC noted significant opportunities in AI as the firm roll out tools across the organization over time. They see areas across the business to deploy AI, including tech, compliance, legal, call centers, investment banking and others. The company expect headcount reductions heading into 2026, with more severance charges in 4Q than the first part of the year as they plan for a lower cost base.

Year-to-date, GSXUPROD underperformed SPX and only recently crossed the S&P ex top10 (SPXX):

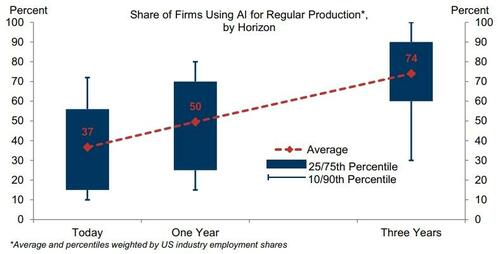

GS investment banker survey suggest that AI adoption among large US companies will rise from 37% today to 50% in one year and 74% in three years:

Source: Goldman Sachs Global Investment Research.

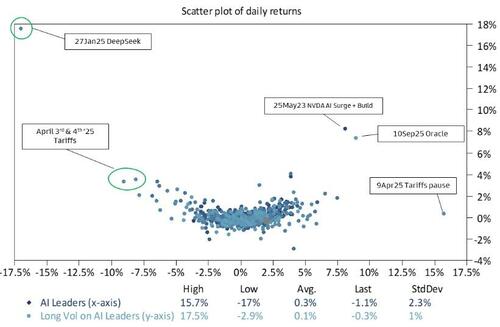

Long AI Volatility (GSVIAIV1) to hedge the risk of “AI politicization” as we approach the midterm elections:

A number of US policy makers have publicly raised concerns about the energy consumption of data centers, especially as AI-driven data-center build-outs accelerate: Edward J. Markey (MA Senator) wrote a letter to the Federal Energy Regulatory Commission (FERC) calling on it to prevent data-center growth from “dramatically hiking energy costs for American families” in November, noting that data centers are driving rising demand for electricity, which could burden households via increased utility bills. The letter was signed by six other senators. DeSantis, who backed state law changes in 2024 to make cost and reliability the focus of Florida's energy goals, has blasted data centers and artificial intelligence driving energy use in remarks throughout the summer. BusinessInsider also reported on the impact data centers have on US households.

Our equity research team explains residential utility bill inflation has accelerated in certain regions, raising concerns about customer affordability. A few states in the Northeast/Mid-Atlantic have seen accumulated bill inflation of 29% in the past three years (20pp above CPI), which has been a function of (1) tighter regional power markets as demand inflects from electrification, data centers, and reshoring, and as coal units are retired, driving higher capacity prices that are passed onto customers, (2) volatility in natural gas prices as well as supply constraints on domestic natural gas flows in certain regions, (3) public benefits charges that support state/federal mandates around energy efficiency, wildfire mitigation, and clean energy goals increasing on bills, and (4) higher delivery charges, as utilities invest in aging grid infrastructure. In the states that have seen lower inflation, robust local resource availability (coal/wind/gas) have helped keep electricity rates lower with ample supply.

While our conviction on AI’s infrastructure remains bullish considering the demand for hardware and power continues to grow, we also do expect the midterm elections to focus on this topic. Our favorite implementation to hedge this dynamic is going long AI volatility (GSVIAIV1): the strategy aims to provide convexity regardless of direction of the moves of the underlying stocks by purchasing delta-hedged strangles on the 10 most liquid AI companies. This offers a better cost of carry over time than rolling puts as it neutralizes exposure to underlying stocks via daily delta-hedging, while continuous trading of options mitigates path dependency associated with a static rolling options position.

Data: 1Jan23 – 18Nov25. Source: Goldman Sachs FICC and Equities, as of Nov25.

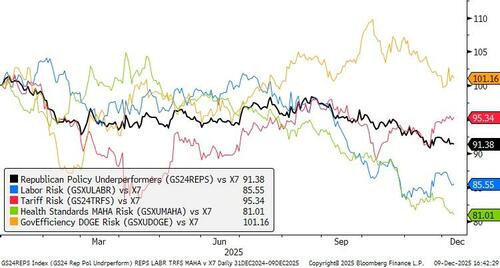

Policies of the new administration have impacted unexpected pockets of the equity market…could AI become one too?

This overlay provides convexity to gaps regardless of direction.

Professional subscribers can read much more from Goldman's Sales & Trading team here at our new Marketdesk.ai portal