These Are Goldman's Top Rates Traders' Tactical Moves Ahead Of "Lukewarm" Fed Statement

With inflation sticky but not accelerating, the labor market cooling without collapsing, and fiscal stimulus set to support growth in early 2026, policy rates likely need to return to neutral, but not below, according to Seema Shah at Principal Asset Management.

"With a leadership change approaching, the Fed is likely to place slightly more emphasis on the employment side of its dual mandate,” she said.

“We expect two Fed cuts in 2026, taking rates close to neutral. Timing will be data-dependent, but a rising unemployment rate could prompt the cuts to be brought forward.”

As we detailed earlier, Goldman Sachs said the meeting is likely to be "uneventful" (full Goldman note here), with no change to the Federal Funds Rate, only minor statement tweaks, and few clues on the future policy path.

The bank expects Chair Powell to stress that the FOMC has already delivered three cuts to help stabilize the labor market and is well positioned to assess the impact.

As in recent meetings, guidance is likely to matter more than the decision itself, particularly around how long policymakers intend to remain patient before easing eventually comes into view, according to Newsquawk,

With all that in mind, here are the tactical views of Goldman Sachs top rates traders as we head into the 2pmET witching hour...

TL;DR:

1) Brian Bingham (Short Macro Trading): Today’s FOMC meeting is pricing zero probability of policy rate adjustment, and expectations are commensurately low for volatility driven by either the statement or Powell’s press conference. Looking forward, we think the convergence of front-loaded fiscal stimulus, accommodative financial conditions, and a stabilizing labor market punctuated by a downtick in the unemployment rate to 4.4% has not only extinguished the modal path for a continuation of the cutting cycle, but also cut the risk premia associated with a more rapid deterioration to the lowest levels in recent memory.

2) Brandon Brown (UST Trading): The last few weeks have seen the US front end cheapen, now pricing a touch less than two cuts this year, while the back end has round-tripped, returning to near year-end levels. As we head into the FOMC meeting, our bias is that it will be difficult for the front end to materially cheapen in the near term, given there is very little priced thru April meeting, and June thru December should keep more than 25 bps priced with a new Fed Chair.

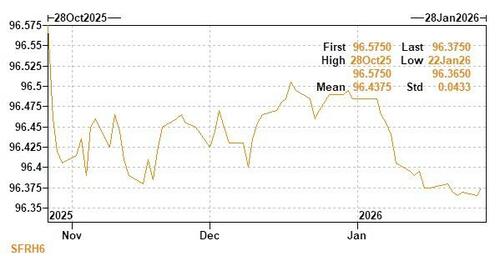

3) Victoria Otero (Swaps Trading): Expectations for today are probably as lukewarm as they’ve been this cycle, with a hold basically a foregone conclusion. Powell is likely to try to toe the line between remaining downside risks to employment, while still acknowledging the more favorable stronger data the economy has shown recently. Think longs in H6 looks attractive at these valuations, and think with USD stabilizing and a stable JGB auction overnight, spreads could find their footing ahead of today's Fed.

4) Julien Thomas (Exotics Trading): Since liberation day last year, implied rate volatilities have decreased significantly, and since the beginning of this year, the street has seen a large supply of vol callable bonds. Given this dynamic, we think buying a Forward Volatility Agreement on 1y10y look attractive, given the low level of implied vols.

The details...

★ Brian Bingham (Short Macro Trading) ★

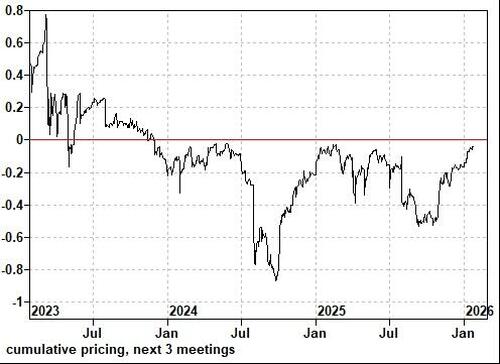

Today’s FOMC meeting is pricing zero probability of policy rate adjustment, and expectations are commensurately low for volatility driven by either the statement or Powell’s press conference. While speculation abounds regarding selection of the new Chair, timing of both the announcement and the future tenure(s) of Powell and/or Miran remain highly ambiguous. Yet in spite of the lowest levels of realized volatility and ff1/ff4 slope since the hiking cycle began in 2022, the opportunity set in front end rates remains as fertile as ever.

Our views on the meeting and policy outlook:

1/ Front-end rates have cheapened meaningfully since the start of the year, with 48bps priced to year end and just 11bps cumulatively through Powell’s final meeting as Chair in April. The convergence of front-loaded fiscal stimulus, accommodative financial conditions, and a stabilizing labor market punctuated by a downtick in the unemployment rate to 4.4% has not only extinguished the modal path for a continuation of the cutting cycle, but also cut the risk premia associated with a more rapid deterioration to the lowest levels in recent memory.

2/ At 4bps priced, March FOMC was our preferred front end long given optionality over two nfp releases, but an impending second gov’t shutdown will almost certainly erode the favorable calendar effects. We view SFRH6 longs as a high quality expression, premised on the view that Apr meeting can retain premia if data releases are backloaded into the start of q2, and/or SOFR/FF (and by extension FF within the band) can richen meaningfully as the near-term TGA rebuild is reversed by mid-February. But in an environment where vol continues to compress, we fully acknowledge that tails and wingy options remain just that.

3/ We agree with the consensus that Rieder has ‘out-doved’ Warsh out of the gate, but we are more skeptical on the willingness of market participants to extrapolate and generalize isolated commentary. The 2026 regional president voting bloc is more hawkish and far more vocal than 2025’s cohort, base effects will muddy progress on the inflation front until at least mid-year, and proximity to neutral substantially raises the bar for incremental cuts. If the new Chair does seek to build consensus in a credible fashion, his/her actions will reflect the data…and singularly, in our view, the extent to which the UER stabilizes below 4.5%.

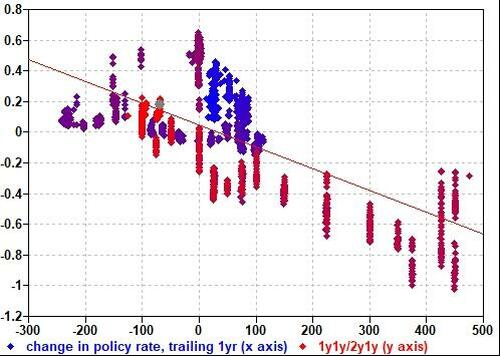

4/ In light of the prospect for meticulous data-dependency, the lack of discussion regarding the inflation trajectory into 2h ‘26 is perplexing. GIR projects YoY Core CPI to fall 60 basis points over 5 readings from May to September to 2.08% (two point zero eight percent, not a typo), leaving core inflation ex. tariffs below the 2% target. While the case for long z6 is fairly straightforward – if both crowded and noisily path dependent as the OBBBA consumption boom hits the economy full force by q2 – we view z6z7 flatteners as a terminally higher quality expression. Conditional on a 3.25% Dec ‘26 starting point & core inflation at target, the modal expectation (as well as the gap risk) for subsequent action will almost certainly err towards further cuts. Term premia is most certainly the trade du jour, but as we roll towards 2027 the trilemma of a restrictive starting point, benign inflation outlook, and dovish committee will grow all the more important.

Trades we like:

-

Rec Jun/Jul FOMC @ 7.5bps

-

Rec USD 1y1y/2y1y @ 18bps

-

Paid 2y MMS @ 16bps

-

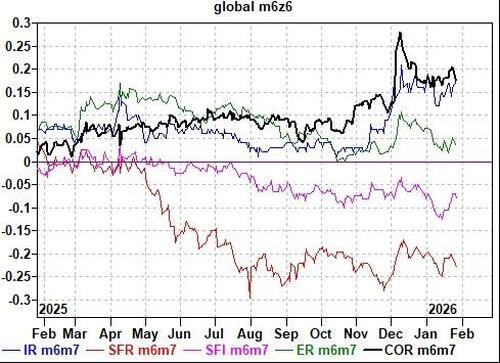

Rec CAD m6z6

★ Brandon Brown (UST Trading) ★

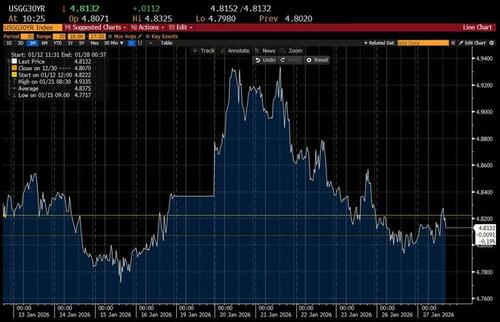

The last few weeks have seen the US front end cheapen, now pricing a touch less than two cuts this year, while the back end has round-tripped, returning to near year-end levels. A somewhat stronger payrolls report coupled with a stronger growth outlook have driven the front end cheapening (Atlanta Fed now forecasting 5.4% Q4 GDP growth).

Headed into the FOMC meeting, our bias is that it will be difficult for the front end to materially cheapen in the near term, given there is very little priced thru April meeting, and June thru December should keep more than 25 bps priced with a new Fed Chair. For a bigger front end move, a more neutral stance would be required, allowing hikes into the distribution. Despite the most recent jobs report, we expect rhetoric to continue to focus on labor market downside, preventing a large selloff near term.

A few factors drove the cheapening and subsequent rally in the long end:

1/ Increasing tensions between the US and Europe driven by Trump’s rhetoric around Greenland; Trump’s comment the US would not use force deescalated the situation.

2/ Weakness in the Japanese long end on an illiquid MLK day, driven by a proposal to lower the sales tax on food to zero; subsequent comments from Finance Minister Katayama coupled with headlines SMBC would sponsor the long end turned the market around.

3/ Increased probability of a Rieder nomination has buoyed the back end as Hassett odds have fallen. Market participants have viewed Hassett’s dovishness as a longer run back end risk, while they view Rieder as someone focused on keeping control of the back end.

★ Victoria Otero (Swaps Trading) ★

Expectations for today are probably as lukewarm as they’ve been this cycle, with a hold basically a foregone conclusion. Powell is likely to try to toe the line between remaining downside risks to employment, while still acknowledging the more favorable stronger data the economy has shown recently. Front end pricing now looks relatively cheap through the first half of the year, with the probability of Fed opening up hike distribution, especially as Powell's term approaches its end, very unlikely. Think longs in H6 looks attractive at these valuations, especially in a portfolio with other risks that may trade short vol or long risk.

Source: Goldman Sachs Global Banking & Markets, as of 28Jan26. Past performance is not indicative of future results.

Another imminent concern for the park is the impending announcement of Trump's pick for new Fed chair, with Rick Reider recently taking the lead from Kevin Warsh. Expect a lot of questions today for Powell on his thoughts on continued central bank independence, the DOJ subpoenas and his possible successors. Additionally, given this administration intense focus and frustration with what they view as too high interest rates, would not be surprised if they were to try and somehow steal the spotlight by potentially announcing a chair today.

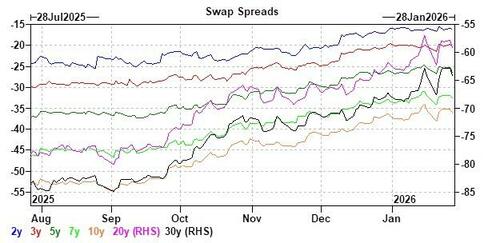

The market had somewhat started to do a Reider as chair trade, with duration bull flattening and spreads richening, but a wrench was thrown into that yesterday, with weakness in the USD seemingly spilling over into rates as a sell America moment, with duration bear steepening and spreads tightening. On spreads, I think we have seen a bout of more intense volatility the last two weeks, with the market showing some signs of vulnerability and crowding. Last week, weakness in JGBs, an increase to Warsh's odds, and increased geopolitical uncertainty around Greenland, had led to 30y spreads to tighten from their then highs of the year around 6bps to -68bps, before bouncing back aggressively as Greenland de-escalated, and odds of Reider increased.

All this for sell America to rear its head again yesterday and cause a little bit of a ruckus. The heightened sensitivity of spreads in particular, continues to point toward a relatively concentrated positioning and arguably crowded trade. As carry trades continued to increase in popularity coming into this year, we have continued to see FM and RM interest to add to spread longs on any dips, and these dips felt like they were getting shallower and shallower, but as risk jitters permeate, and people feel like they are now closer to their target long positions, especially after the experiences in the first half of last year, there is a lot of fear and lingering callbacks to that era.

To me, the move yesterday in particular was more a reflection of generally long and consensus positioning as well as memories from last year. That said, spreads have been hovering near their highs of the year, and there increased correlation to risk makes sense given how popular they have become as a carry trade, so any risk jitters naturally translate into the market. With USD stabilizing and a stable JGB auction overnight, think spreads could find their footing ahead of the Fed.

Source: Goldman Sachs Global Banking & Markets, as of 28Jan26. Past performance is not indicative of future results.

★ Julien Thomas (Exotics Trading) ★

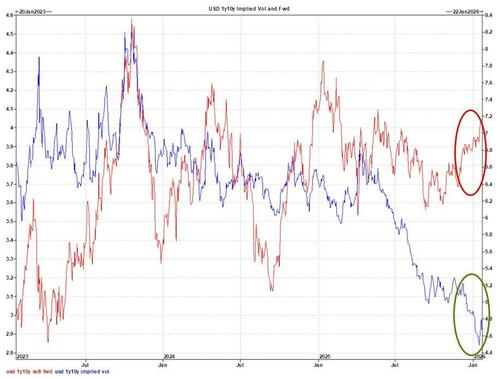

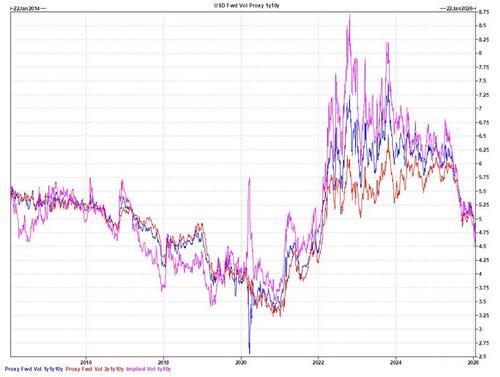

Since liberation day last year, implied rate volatilities have decreased significantly. 10y treasuries remained in a relatively tight range, and are now back to similar yield levels while realized volatility has been low. Systematic gamma supply had been a large source of supply during that period, and have since decreased, given the low levels of implied gamma vol.

Since the beginning of this year, the street is getting a large supply of vol from a new source: callable bonds. The most popular structure we have seen is 10NC1y fixed rate, which is impacting mainly intermediates expiries on 5y-10y tails. Financial institutions and Supranational issuers have sold ~$18bn notional of callable bonds so far this year, which translates to ~$8mm Vega annual. To put this in perspective, this size is ~3x what was issued in the market during the same period last year.

Buyers of these callable bond are mainly retail clients, with a larger concentration coming from Asia (specifically China). Chinese local banks are buying structured notes for the yield pick that they provide compared to USTs. Usually, January is the most active month for callable issuance as issuers and real money clients tend to start the year off very active.

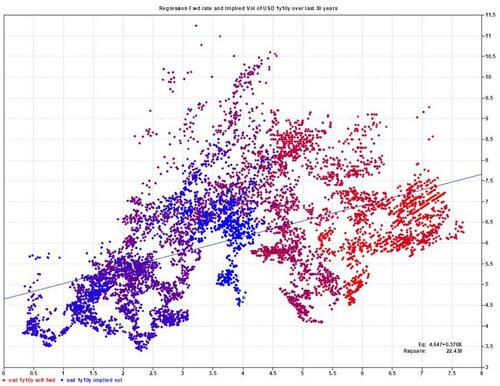

Following the flows we’ve seen in callables, USD intermediate expiries implied vols have decreased significantly. USD 1y10y and 2y10y implied vols are historically cheap given the current forward rate level of 1y10y.

In the current macroeconomic environment, geopolitical context, and at those implied volatility levels, we recommend buying a Forward Volatility Agreement (FVA) on 1y10y given the low level of implied vols. The 1y10y structure allows one to be long Convexity/Vega without paying decay until the date of the swaption delivery. Since there is no strike fixed, there is no gamma or delta to manage so this option contract has relatively low maintenance when compared to vanilla swaptions...

FVA Indications (for $100mm)

1y1y10y: Mid 496 fp in 2y Vol 4.76bp/d Offer 501

2y1y10y: Mid 492 fp in 3y Vol 4.77bp/d Offer 498

Ref 1y10y at 467 fp in 1y Vol 4.45bp – indicative as of 28Jan26

This structure stands to benefit from many different scenarios: geopolitical tensions, large global bond supply (US fiscal, AI financing, European bond supply...), USD diversification, AI risks, Inflation risks...

Professional subscribers can read much more from Goldman's Sales & Trading team here at our new Marketdesk.ai portal