These Are The Market's Hottest Trades: From AI Dispersion To Tech Tails

By Christina Dass, Bloomberg Markets Live reporter and strateigst

As investors are caught between fear of missing out on a further stock market rally and the building geopolitical risks, they can take a cue from the derivatives strategists at the biggest Wall Street banks.

Trades aimed at navigating through some of the biggest tensions of last year are still flourishing, starting with those aimed at the impact of President Donald Trump’s unpredictable shifts.

Among them: His threats to the Federal Reserve’s independence, attack Iran, take over Greenland and intervene in the electricity markets. The combination of rising volatility and climbing stock prices is seen continuing in 2026 as momentum trades are dogged by doubts about heady valuations, especially in stocks related to artificial intelligence.

“AI momentum and the US administration as a source of volatility are creating a supportive backdrop,” said Bloomberg Intelligence chief global derivatives strategist Tanvir Sandhu. “Both the S&P and volatility can be supported (spot-up-vol-up dynamic) by earnings growth, cyclical upswing and AI adoption driving the right tail while market fragility and risky policy add to instability.”

To play the shifts in volatility and headline risks, strategists are touting trades from vanilla tail hedges to bespoke dispersion baskets:

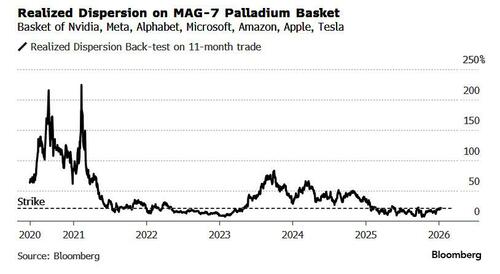

Mag 7 ‘Palladium’

Big Tech is still likely to lead the market higher, and Magnificent Seven options are not particularly cheap. That’s why Barclays Plc strategists say buying outright calls isn’t cost-effective and a so-called Palladium structure — which bets on how scattered gains or losses will be across a basket of stocks instead of the performance of the basket itself — is better.

It capitalizes on the dispersion of the top 10 S&P 500 Index names, offering greater upside to AI with lower volatility risk versus the Nasdaq 100 Index. The strategists suggest buying one such Palladium trade expiring in December with a strike set at 21% and a premium of 4%.

“Palladiums have been active with a broad spectrum of clients such as hedge funds, pension funds and asset managers,” said Joseph Khouri, head of equity-derivatives structuring for Europe, the Middle East and Africa at Bank of America Corp. “Baskets are typically built around investment themes such as cyclicals vs defensives, rate cut winners vs losers, AI and Robotics etc.”

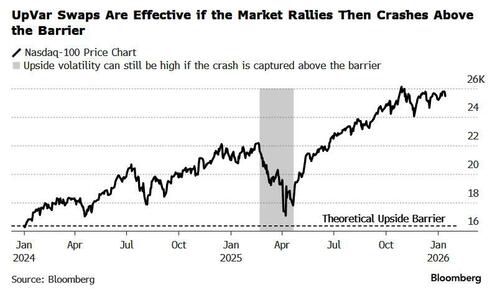

‘UpVar’ Swaps

As the spot-up/vol-up dynamic has gained traction, so have the trade ideas that play this market trajectory that has been common to the AI rally and other past periods of exuberance.

Several banks have been pitching so-called upside variance swaps, a bet on volatility rising as long as the underlying asset is above a certain level. Those tend to be profitable when there’s a significant market rally followed by a crash within a set time frame.

Strategists at Bank of America, JPMorgan Chase & Co. and Barclays have pitched either S&P 500 or Nasdaq 100 so-called UpVar swaps with a one- to two-year time frame. These offer a significant discount to vanilla variance swaps, since the pricing is focused on typically cheaper upside call strikes, and not the higher-volatility puts.

“With skew still relatively steep and absolute volatility at low levels, UpVar pricing remains compelling,” Khouri said. “Investors are expressing a range of views – from tactical 6-month-2 year US index trades aimed at capturing a vol‑up/spot‑up scenario, to carry structures such as selling a variance swap and buying an UpVar.”

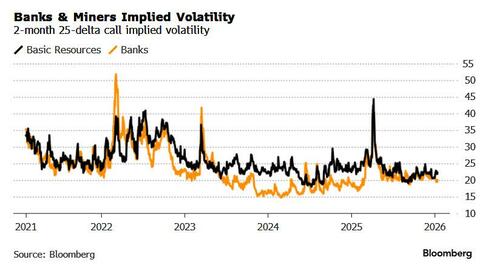

Europe Sector Upside

European banks remain a favorite play, with the sector staging a huge recovery in 2025 and many strategists expecting the outperformance to continue this year. Several versions of the trade focus on cheapening upside plays — for example, buying a call on the Euro Stoxx Banks Index with a knock-out at a higher level. The risk for the less expensive option is that it becomes worthless if the index reaches the set level.

European miners have also caught the attention of derivatives strategists, with upside plays on the Stoxx 600 Basic Resources Index. Barclays strategists wrote in a recent note that fundamentals may improve for the sector, thanks in part to potential Chinese support and demand for AI-led infrastructure. They see call spreads as attractive given the low volatility and flat call skews.

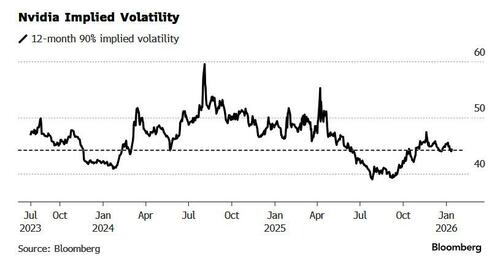

Hedging Big Tech Tails

Just like in April last year, investors are favoring buying vega on big tech to protect, betting that volatility will spike in a selloff. The Barclays strategists say “crash vol” on the sector is a cheap way to hedge against concentrated leadership risk and AI capex uncertainty amid concerns of a Taiwan invasion, as structural flows leave put pricing attractive. They favor buying December out-of-the-money puts on Apple Inc. and Nvidia Corp.

Similarily, Bank of America strategists recommend long-dated deep out-of-the-money Nvidia puts, delta hedged, betting volatility will increase if shares drop.

VIX Spreads

One of the big questions over the past two years has been whether to hedge macro risks with calls on the Cboe Volatility Index or puts on the S&P 500. While VIX calls tend to offer more potential for fast gains if the market sells off, spikes tend to reverse quickly. Also, the steep VIX futures curve has increased the cost to hold calls as pricier forward contracts roll down to converge with the spot index.

JPMorgan strategists recommend near term-call spreads to protect against headline risks while benefiting from the steep VIX call skew to limit cost.

“The VIX appears disconnected from policy risks, but it could see a rapid catch up if one boils over,” the strategists led by Bram Kaplan noted. “Systematic investor positioning is high, so if we see market momentum turn and volatility begin to rise, de-leveraging from these strategies, along with the hedging of convex products, could accelerate a market downturn and further stoke volatility.”