These Are The Top Themes That Goldman Is Tracking For 2026

As we close the door on 2025 and step into 2026, Goldman's sector analysts have honed in on a number of themes to watch in the year ahead.

Here are a few...

1. AI & Power.

The AI infrastructure theme is showing signs of transitioning to a new phase with many of the dependable leaders -- NVDA, MSFT, AMZN -- seeing their stocks stall out since the summer as new companies make inroads (AVGO) and AI 'winners' (GOOGL among others) begin to emerge. Investors have poked their heads inside the data center to find companies that are supporting the build-out of the world's compute power regardless of which chip is being used.

Memory producers like MU have soared as have connector companies like APH and TEL. The 'power play' segment of the AI infrastructure build out is also transitioning with shares of Utility stocks stalling out even as gas turbine supplier GEV continues to gain ground and the companies that can install all this stuff (PWR, EME) also continue to thrive amidst scarcity both in the market and in the field for such companies and services.

Ryan Hammond dove into the next phase of the AI trade, including those companies that may become more efficient by implementing AI-driven tools, in a Nov-18 note, "The trajectory of AI capex and the next beneficiaries of corporate AI adoption."

2. Drug development.

On the GLP-1 front, the transition is even more pronounced, perhaps. LLY shares continue to outperform, but shares of NOVO have lost almost half their value in 2025 as a combination of price and volume headwinds have led to consensus 2026 EPS cuts of 33%.

From here, we look for the transition to extend to new products that are seeking approval next year (see Corinne Johnson's "The Obesity Evolution: Taking stock of the obesity landscape post a series of smid-cap updates").

We also see a transition from obesity drugs to the cardiology renaissance as a slew of drugs and therapies come up for approval in the year ahead. Asad Haider, Salveen Richter and team have kicked off a series to capture this transition in "The Cardiology Renaissance In Biopharma: Monitoring the Emergence of Large Potential Product Cycles."

3. Blurring lines between in-store sales, online commerce, and advertising.

Both Eric Sheridan and Kate McShane highlighted these blurring lines in their outlook notes. Sheridan has been calling out the blurring lines for quite some time but continues to see opportunities arising for eCommerce platforms to drive profitable revenue through advertising and marketing agreements as he details in "Internet: 10 Industry Themes for 2026 & Focus Stocks Going Forward."

McShane also continues to see retailers pushing into alternative revenue streams such as media, membership, and eCommerce, and also highlights how the speed of delivery and value alongside the introduction of agentic commerce solutions will likely shape the landscape in the year ahead in " Retail 2026 Outlook: Searching for what is underappreciated in Hardlines/Broadlines retail."

4. China rising.

Our economists forecast above-consensus growth fueled by advances in technology and sustained export leadership even in a tariffed world (see Andrew Tilton, Hui Shan and team's GDP growth upgrade on Oct-31 in “China Matters: Sticking with What Works”.

The impact China's growth resurgence may have on global trade as well as the technology landscape will be closely watched in the year ahead.

5. Productivity-driven margin growth.

Hatzius and team call out the risk of a jobless expansion as growth is propped up by Tech-driven productivity improvements in the year ahead.

Such productivity improvements, however, may be necessary to offset a shrinking workforce in the face of sustained immigration curtailment. And eventually, productivity improvement may be key to offsetting the combination of an aging workforce and declining fertility rates (see Joseph Briggs' Nov-5 note, “Demographic Dependency Looks Challenging, but Economic Dependency Does Not”).

6. Alternative investing.

Private credit markets rose above private equity in 2025 and continue to attract retail money.

And James Yaro highlights how brokers like COIN and HOOD are well positioned in expanding markets around cryptocurrencies, stable coin, prediction markets and more in two Dec-17 update, "COIN: System Update event takeaways: Expansion into stock trading, prediction markets, social trading, and more"

Want to learn all about Gold? Dive into Lina Thomas' Aug-17 "Gold Market Primer."

7. Evolving militarization.

In the US, the Space Force is leaning into innovators as we saw in a December contract award for a new satellite tracking system.

Companies with native drone and satellite technology cultures like AVAV and RKLB may find themselves particularly well positioned.

And in Europe, a remilitarization of the Continent is underway that could require a $160bn investment over the next 5 years just to catch up with Russia.

8. Humanoids and self-driving cars.

As technology advances, the ability to create hardware that can simulate common (and ubiquitous) activities improves. Mark Delaney assessed the potential for humanoid development to drive profit growth at well-positioned industrial tech companies, including TSLA, in an Oct-14 note, "Platforms & Power - Part II: Humanoids and profit implications for autos & industrial tech."

And in China, Jacqueline Du toured the ecosystem for robots and captures her findings in "China Humanoid Robot Supply chain field trip takeaways: Optimistic capacity preparation in advance, awaiting actual orders".

China is also leading the way with self-driving cars and Allen Chang sized the market for robotaxis in China at $47bn by 2035 (see also Mark Delaney's latest update, "TSLA: Thoughts as Tesla begins testing robotaxis in Austin with no safety monitor").

9. The re-emergence of nuclear power and the rise of rare earths.

A series of accidents that damaged nuclear power plants (Three Mile Island, Chernobyl, Fukushima) pushed the development of nuclear power to the back burner for decades.

But necessity can be the mother of resurgence, and the need for more and more power (preferably 'clean' power) to fuel the AI revolution has brought nuclear power back to the front burner.

Rare earth metals are also emerging as a critical component in technology -- a component that is currently dominated by China sources. Brian Lee, Paul Young, Daan Struyven and team dive into the rare earth opportunity in a series of notes, including "Managing Disruption Risk From Rare Earths and Other Critical Minerals" (Oct-20), and "MP: Domestic rare earths position and strategic alignment with US policy set to unlock significant value through vertical integration; initiate at Buy" (Nov-18).

10. Policy uncertainty.

OK, policy is always a theme, but as we leg into 2026, as it was in 2025, it feels like policy could have a bigger impact on markets than usual.

Why?

On monetary policy, the debate around what the Fed will do next and who will lead the Fed and what that means for monetary policy in the US more broadly is likely to be a dominant market theme in at least the first half of the year (see David Mericle's "December FOMC Recap: The Fed Estimates That Job Growth Is Negative," this week's update, "USA: FOMC Minutes Note 'Most' Participants See Further Rate Cuts 'Over Time,' While 'Some' See Policy 'Unchanged for Some Time' After December" and Allison Nathan's May-15 Top of Mind, “

As we leg into 2026, Goldman Sachs traders are watching a series of catalysts that could influence the direction of markets, including:

-

An expected ruling from the Supreme Court on the legality of the Trump Administration's tariff regime.

-

Fed meetings in January and March (and beyond of course).

-

The appointment of a new Fed Chair.

-

The mid-term elections in November.

-

The World Cup and the Winter Olympics.

One thing to bear in mind as you prepare for 2026...

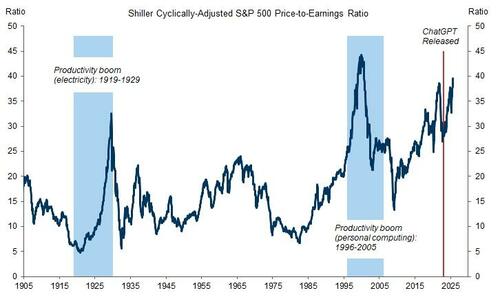

Equity valuations are at their highest since the late 1990s

Trade accordingly...

Full Goldman note available to professional subscribers.