Three Years Since The Launch Of ChatGPT, Here Are The Biggest Winners And Losers

To mark the three-year anniversary of ChatGPT’s launch, Deutsche Bank has declared this week AI Week, where all the Charts of the Day will be created - at least in part - with the help of our AI tools (with DB's strategist explaining where AI was used, how he prompted it, and why he made any edits along the way).

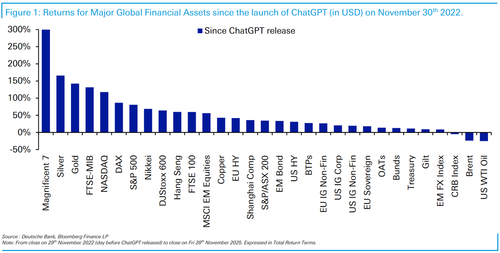

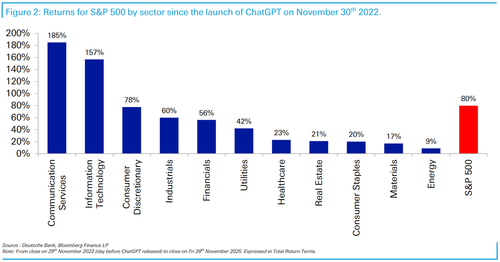

To set the scene, the DB team first looks at how major global financial assets have performed over these three years, along with S&P 500 sector returns over the same period as the second chart.

The charts speak for themselves. The Mag-7 have returned roughly +300% since late 2022, with some extraordinary individual performances. Among the top S&P 500 names, Nvidia leads with a staggering +1,020%, followed by Broadcom (+712%), Western Digital (+500%), and Meta (+499%).

On the downside, First Republic was shut down by regulators, and SVB collapsed amidst the regional banking turmoil of early 2023. But of the remaining stocks in the index, the second-worst performer has been Moderna, down -85% (and -95% from its 2021 peak). It wasn’t long ago that Covid vaccine makers were celebrated around the world—reminding us how quickly sentiment can shift.

In a similar vein, Pfizer is now trading at levels first breached in early 1998 and is nearly -60% off its 2022 all-time high. At the 2000 market peak, Pfizer traded on a PE of ~54 and was the 8th-largest U.S. company. Today, despite earnings more than three times higher than in 2000, it trades on a multiple below 10 and is around -45% lower than its 2000 equity price peak.

If nothing else, it’s a vivid reminder of how dramatically market leadership can change over time.