Top Goldman Tech Trader Highlights 5 Key Factors Into 'Catalyst Heavy' Week

Ahead of a catalyst-heavy week - with the market closely watching Nov’s NFP on Tuesday (street at +52k) as well as a handful of central bank decisions: BOE (expected to cut by 25bps), ECB (expected to hold), BOJ (expected to hike by 25bps) - top Goldman tech trader, Peter Callahan, drops five key things to focus on:

1. Sentiment check

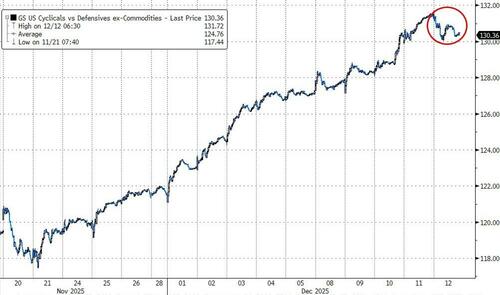

Another tricky week that saw the NDX re-test the 50-dma to the downside – taking the NDX to down ~1% on the month, lagging the R2K by ~3pts this month and pacing for back to back monthly declines as the market continues to wrestle with a choppy AI story vs budding signs of cyclical momentum (see GS Cycs v Defs up 14 days in a row, a record for that pair) as investors are seemingly ‘upgrading’ their views of the Consumer (/ US economy) as of late.

Alongside this debate, the market has gained some confidence in rallying without the mega-caps pacing us higher -- think MSFT, NVDA, META types breaking lower vs the equal-weight S&P, the X7 and R2K indices registering ATHs – which, to me, feels more rotational / broadening out driven (macro clarity, 2026 idea seeking, positioning), rather than a ‘break’ in convictions amongst Tech specialists.

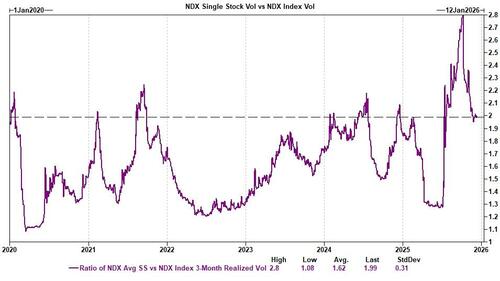

… beyond these dueling macro thematics, there has been an acute dynamic of elevated single-stock volatility (vs a relatively static index – think a 15-handle for the VIX), which, is raising questions about how much of the year-end movement is a “tell” on 2026 thematics (e.g. broadening out into HC + some cyclical momentum + pockets of growth/beta rallying) .. vs … how much is simply positioning driven & a reaction of Fed/Gov’t Shutdown ‘resolutions’ (shorts + laggards + value higher).

Consider this:

Over the last 3-months, the average single stock in the NDX has been 2x more volatile than the index itself.

Source: bloomberg. GBM public. Past performance is not indicative of future results

Outside of September/October of this year, this is one of the highest readings in the last 5 years.

2. Top inbounds last week

Feedback on AVGO’s move? Too much?

Thoughts into ACN + MU prints?

Mid-week meltdown in Gig Economy?

Break-outs in IT Services (EPAM, CSTH, etc)

Is the Analog Semis squeeze over?

Can AMZN work? (stock lower 4 of 5 wks)

What’s the ‘criterion’ for what works / doesn’t these days?

What’s the deal with Visa quietly having a top 5 day of o/p in 15+ years?

3. Apps, software, & IT services

Fresh off a couple of good weeks for “the rest” of the market, inbounds have started to pick up around “how real” the moves are in areas like IT Services and Apps Software – or, at least, how much is “left” in the tank here (e.g. think names like CTSH, EPAM, G, ACN, ADBE, RNG at/near overbought levels, per RSIs).

While we don’t speak to too many outright bulls in these areas (.. admittedly, some of these moves feel a bit “point in time” re: YE dynamics, cyclical optimism and lowered AI momentum) – there has at least been some engaged 2-way dialogue around IT Services in recent weeks (.. tactical bull framing points to potential efficiency gains from AI, recent beat-and-raises from the group, positioning tailwinds, cheap valuations, backlog visibility), and, some idea probing across Software into 2026 (inbounds around names like PCOR, MSFT, TEAM, MDB, SNOW, ADSK, CRM, SNPS, et al). will make for an interesting EPS print from ACN (and FDS) this week.

4. Internet

As we head into 2026, the internet sector feels as controversial and fragmented as it has in years … it feels hard to come up with a clean, consensus long outside of GOOGL right now – with TONS of 2-way debate and positioning across a number of once loved, secular growth stocks (think: DASH, AMZN, META, UBER, RBLX, SPOT, NFLX, ABNB / BKNG, RDDT, SE …. not even mention the TTWO, PINS, EBAY, SNAP cohort of names that don’t come up as frequently as they used to) – feels like debates across these names generally stem from some near-term uncertainty around the consumer (.. which is perhaps healing?) vs. debates on margins into 2026 vs. ongoing ‘platform shifts’ (GenAI / chatbots, Autonomous, etc). while the swift break-outs in CVNA or APP could give investors some confidence in being “early” to any of these ‘turnaround’ stories as we think about 2026 ideas.

It just feels like uneven price action & daily sector vol is keeping a lid on convictions.

5. Megacap stall-out …. what gives?!

While Megacap tech is set to put up another big year of performance and aggregate mkt cap appreciation (led by GOOGL adding $1.4T, NVDA adding $1.1T, AVGO adding +$700bn), the recent stall-out in momentum behind the Megas is starting to really stand out – think: META flat vs. mid-Feb … MSFT flat vs. mid-June … AMZN flat vs. mid-July … NVDA flat vs. mid-July … and AVGO is back to mid-Sep levels after Friday’s move.

History suggests it can be prudent to dig into the Megas when they are most out-of-favor [e.g. finding entry points when you have both multiple and revisions on your side -- think GOOG this past Summer].

That said, conversations on these names really highlight a challenge in identifying a singular ‘bear case’ for several of these names (other than source of funds), which, in turn, makes playing for an unlock or catalyst even harder (esp re: a MSFT or AMZN).

The week ahead...

Mon 12/15: US empire manufacturing

Earnings: Post: NAVN

Tues 12/16: US NFP + retail sales

Earnings: Post: Lennar

AFRM: CFO’s fireside chat @ 12pm ET

TikTok: the date that US Gov’t had extended sale deadline to (link)

FBN Virtual Technology Conference

Weds 12/17: FOMC speakers (Waller, Williams)

Earnings: Pre: JBL // Post: MU

Thurs 12/18: US CPI + initial jobless claims

Earnings: Pre: ACN, Carmax, CTAS, FDS; // Post: FedEx, Nike

NOW; ServiceNow to trade on the 5:1 split adjusted basis

Fri 12/19: US existing home sales

Earnings: Pre: Carnival (CCL), PAYX

Professional subscribers can find the full note at our new Marketdesk.ai portal