Top Goldman Trader Remains "Responsibly Bullish" But Warns "The Tails Are Getting Fatter"

Just three weeks ago, various measures of investor sentiment were downbeat.

S&P violated the 50-day moving average and trading desks saw a heavy dose of risk transfer (which marked some form of short-term capitulation).

Flash forward to today:

Implied volatility has melted, length has been re-loaded and S&P is 30 bps away from taking out the highs.

In the doing, Goldman Sachs head of hedge fund coverage, Tony Pasquariello, says there are two patterns to underline here:

-

Recent weeks have again shown that if you want to express a bearish tactical bias, your timing needs to be very precise (if not impeccable).

-

It’s a bull market and the primary trend is higher (this is true of US equities, but the same should be said of non-dollar indices).

Net Positive

The short-term technical picture looks supportive.

After selling over $70bn of global equity index futures in November, CTA supply is not a threat anymore (if anything, the models now argue for $30bn of demand over the next month, all else equal).

Alongside this, core fund flows remain healthy and buybacks are running above average.

Still sticking out: GS PB data suggests clients have bought healthcare stocks for 12 straight weeks.

I’m not saying the picture is perfect, as there are slivers of speculative excess that are gathering; I’m saying that supply-and-demand for stocks should be healthy from here to the turn.

Looking forward, my baseline view is net positive.

Why?

The Fed is increasing liquidity ... into an upswing in growth ... and the flow of capital is supportive.

That’s the core of my simple calculus. at the same time, I’m wary of sounding blasé about managing risk along the way.

For example: if the FOMC delivers a hawkish cut next week, and that’s followed by poor labor market data the very next week (e.g. UER > 4.6%), stocks will be unhappy.

I’m not sure what to do with it, but would register that every single person I saw this week expects a HAWKISH bent to next week’s Fed cut.

So, I’m aware that risk / reward is not overly inspiring from current location.

Durable Growth

Stepping back: for all of the reasonable worries about growth at various turns this year, the US economy has again proven to be impressively durable.

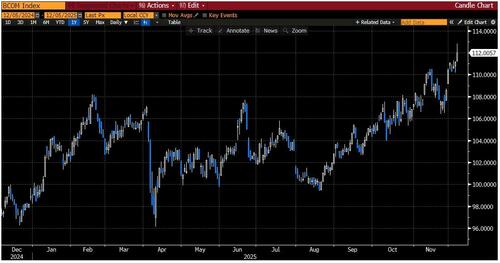

Thinking ahead: one could reasonably argue that nominal GDP growth will be north of 5% next year. It’s here that I find local price action to be noteworthy: rates have backed up on steeper curves ... global cyclical stocks have outperformed ... as have many cyclical currencies ... and commodities have broken out. said another way, as you can see clearly in the charts below, this week was one big growth trade (slash reflation trade)

I’ve been biased towards steeper G-4 rate curves this year. that view had some good moments and some tough moments. looking forward, if I take stock of the prior paragraph -- and if I assume the next Fed chair will be more dovish than the current chair -- I come out with the same bias. while this position isn’t helped by the shortening of WAM (a trend that will likely extend to an increasing number of countries), I still believe there are a lot of paths to win. in addition, as we saw at various turns in 2025, the steepener has provided ballast to a long equity portfolio.

Europe vs US

Back to stocks. while in Europe this week, I found the bias towards US equities to be quite favorable. it’s here that I’ll underline a data point from Bobby Molavi that surprised me: the past twelve months have seen record foreign demand for US stocks (call it $650bn). while it’s been an uneven path along the way -- with April, not surprisingly, seeing net outflows -- the broader trend of strong demand for US assets remains intact.

Here’s an interesting contrast with the prior point: as we came into this week, GS PB reported four straight weeks of inflows to US equities ... and four straight weeks of outflows from European equities. in fact, relative to quasi benchmark, this is the lightest engagement in European equities in more than two years.

To put another line under it, here’s what worries me about Europe, and I’m surprised it’s not getting more attention:

We estimate that the Chinese government’s determination to double down on export-led growth to achieve its growth targets will increase China’s current account surplus to 1% of global GDP by 2029 (from 0.4% currently) -- the highest level on record for a single economy. this could negatively impact manufacturing output and employment in China’s trading partners, with Europe -- and Germany in particular -- most affected. Indeed, we expect more intense export competition with China to weigh on European growth, and, accordingly, recently lowered our 2026/2027 Euro area growth forecasts to 1.2%/1.3%.

Despite this worry about the impact of the China shock on European economic growth, it’s not a straightforward negative for European equities. As detailed by our European strategy team this week, consider that the DAX has been one of the best performers this year -- despite the rise in China exports and the weakness in German industry (this is not a one-off, the same was true in 2024).

Japanic

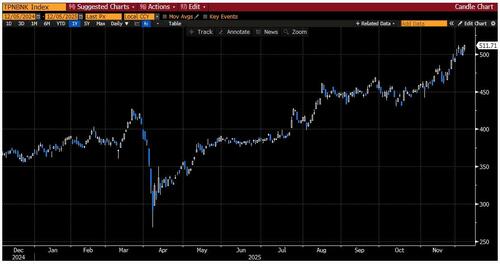

Another highly interesting week in Japan. TPX took out the highs and the banks are up 13% in the past month.

Also notable was the rip in our automation basket (see ticker GSXAJATO) following headlines around a potential US executive order to boost the robotics industry; as I learned this week, Japan delivers 40–50% of the global industrial robot market.

Now, with the BOJ seemingly set to go in a few weeks, I’m very curious to see how stocks trade on the follow (I still have the scars of July 2024).

Where I’m going with that: given the strength in Japanese financials (below), I like the idea of pairing a paid rates position with your equity length.

Illustrating the local cyclical impulse

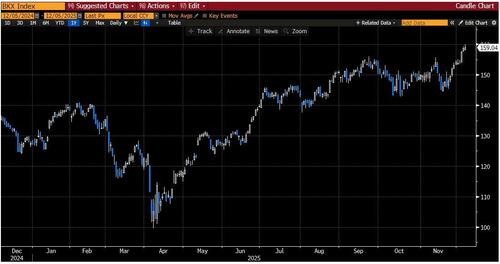

First off is the big US financial institutions:

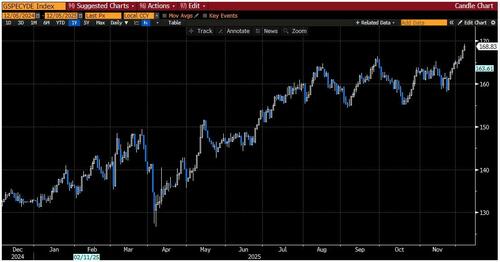

Next is cyclicals-vs-defensives in Europe (this is an ATH):

Next up is commodities:

This is the Japanese banking sector:

Last is the front end of the Japanese bond market.

While the back end gets all the attention, note the trend of the COVID era (also that note that 2-year JGB yields closed over 1% for the first time this cycle):

AI

Back in the US: while it increasingly feels like we’ve entered a new chapter in the AI sequence -- where simply riding the revenue freight train of the providers offers less convexity than it did. with that said, I admit that the Genesis Mission is cause for contemplation. don’t take my word for it -- the White House frames Genesis as “the largest mobilization of federal scientific capability since the Apollo era”.

To repeat an axiom that I’ve come to respect, governments bring to bear overwhelming force. while the details are still unclear, if this is the union of our best tech companies with the sovereign muscle of the federal government, at the very least it argues for some open-mindedness. in a related context, ORCL reports next week, which should be an interesting mark-to-market on various moving parts in the AI debate.

The most interesting GS note that Pasquariello read this week asked the following: what did Q3 earnings tell us about how AI could impact the workforce?

A line that stood out to me:

“while we still find a limited impact from AI on the labor market at the economy-wide level, the companies discussing AI in the context of their workforce or layoffs indeed appear to be pulling back disproportionately on hiring.”

The most interesting external note that he read this week, asked the following question: how does the AI revolution compare with the US shale revolution?

A line that stood out to me:

“energy and technology are arguably the two most important sectors in the economy.

If you cannot turn the lights on, nothing can happen and if you don’t innovate you will never progress, rendering important sectors like finance and healthcare useless without the other two. this is why market leadership has rotated between energy and technology for decades.

At the end of the 1970s-80s commodity cycle, Exxon was the world's largest company. by 2000, Microsoft held that crown. by 2010, ExxonMobil and PetroChina vied for it. today, the top three are Nvidia, Apple, and Microsoft.”

The best line that I heard this week. Cue senior trader Rich Privorotsky:

“AI remains a blur. DeepSeek rolled out two upgraded models, with claims they perform on par with GPT-5 ... and supposedly cost 25x less than GPT-5 and 30x less than Gemini 3 Pro (unverified, via X). every day there’s a new leader ... one day GOOG, then Kimi K2, then Anthropic ... TPUs… no GPUs. a rolling ball of creative destruction. hard to know where the value actually settles. feels like the true winners are adopters … a margin-creep story at labor’s expense (maybe ... banks?) but broadly the value accretion is to corporate margins (equal weight SPX ... EM).”

Responsibly Bullish

Pulling it together, I come out in the same boring place that I have for a few months: responsibly bullish.

In practice, I’d keep your length in high quality exposures (don’t be tempted by small cap) and protect that core via short-dated options.

Said another way: even if it’s a bull market, the next few months will likely be noisy, and the tails are getting a bit fatter (on both sides of the distribution).

So, when the market offers you inexpensive gamma (which it is right now), avail yourself of it.

In this spirit, I like a strategy of systematically buying strangles on US mega cap tech names.

Professional subscribers can read much more from Goldman's Sales & Trading team here at our new Marketdesk.ai portal