Top JPM Trader: "Repo Stress Has Been Main Reason For The Market Reversal... And What Happens Next"

Two weeks after we first discussed the looming TGA cash flood once the government reopens, this morning JPMorgan macro futures and options sales trader Marissa Gitler echoes all of our key talking points and writes that "perhaps the most important update last week week has been the end to the government shutdown. Why? Because it'll take a stressor away from the repo-market."

In an almost verbatim repeat of what we said, Marissa writes that "overall accessibility of cash in the system has been worse because the US Treasury sucked in capital due to a combination of the Gov't shutdown, TGA build up and QT. While re-opening the government may not solve the issues entirely.... It'll help."

And while there has certainly been noise around the AI narrative, Gitler "would go so far as to say repo market stress has been the main reason for the equity market's reversal this month. There's been a lot of takes on the SOFR/repo markets recently ... but this is how I'd best relate it to the broader market/equity dynamics."

BOTTOM LINE: when you have SOFR stress you'll see less risk taking by levered funds

Gitler then picks up on what we said last week in "Repo Locking Up Again As Market Tries To Force Fed's "Reserve Management Purchases" and says that in the most recent NY Fed conference on Wednesday (Nov 12), they discussed the concept of how in the current stress period private sector repo rates rose above the IORB (Interest on Reserve Balances).

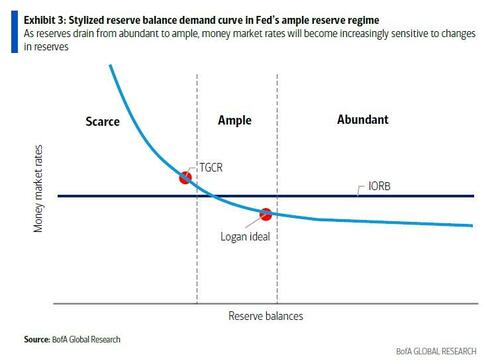

This is because financial institutions sought more liquidity (cash) in the private market than the Fed intended. This, to Marissa, suggests the supply of reserves in the banking system has been lower than the aggregate demand for them recently, making competition for reserves more intense, or as we put it, this "signals that reserves are not Ample, and certainly not Abundant, but once again well in Scarce territory."

According to JPMorgan, this happens because financial institutions that are not eligible to earn IORB (such as money market funds/hedge funds), will bid up rates in the repo market to attract cash.

Marissa takes this a step further, saying that "stressed SOFR rates likely means that levered funds have received a message from counterpart banks that they cannot get the same repo line as previously available."

Stated more simply, levered funds don't have the same availability of cash via repo transactions, which is the key device they use to gain leverage. This then mutes the velocity of investing as the lack of cash availability can lead to position unwinds.

As an aside, JPM agrees with us that "repo is the lifeblood that ensures the dollar money market works as intended. So... As we see SOFR retracing lower vs the FF rate it's a good thing and it's a symptom of LESS scarcity."

Functionally, the EFFR is an unsecured rate of lending between banks, while SOFR is a secured rate between a bank and a fund. Usually, you'd see a secured rate below the unsecured rate. While there is still stress (else you'd see SOFR below the EFFR) the movement lower in SOFR presently is a positive dynamic.

All this is to say, the downtrade in JPM's Beta factor {JPBPURE Index} and highly concentrated AI-plays after the funding stress witnessed into Oct month/quarter end is likely no coincidence (as ZH first pointed out two weeks ago).

So where do we go from here?

Here Gitler turns to the somewhat more cheerful, second part of our post from Nov 4, and says that "hopefully the unwind of the TGA build and (soon-to-be) end of QT will release some liquidity stress from the equation." Indeed, with the Treasury Cash Balance (USCBOPBL on BBG) rising another $19BN on Friday to $961.9BN, we expect the aggressive drain to begin as soon as today, which could be just the catalyst the market is waiting for.

That's because "this will allow clients to go back focusing on investing as opposed to liquidity management," according to JPM. That said, Marissa concedes that the risk picture still isn't entirely optimistic at this point in time, and while positioning metrics align with the story of leverage takedown noted above, JPM's Positioning Intel team (full note here for pro subs) sees a bit more to go before triggering an attractive 'buy' setup.

To wit, the bank's TPM (tactical positioning monitor) is still at the 65th %-tile with a 4wk change of -0.8z (vs. -1.5z to trigger attractive set-up). Meanwhile, the market is continuing to test/approach levels of potential systematic trader triggers (as we reported earlier, according to Goldman the 6725 is the key level the S&P has to hold).

Essentially the market has reached index levels where if there is a move lower 'mechanical' selling will drive the market down another leg. JPM concludes by saying what we also said, namely that "watching the technical supports/triggers is going to be important in this regard."

More in the full must read JPM note available to pro subs.