NS

NSTrump teases Hassett as next Fed Chair; European bourses set to open green ahead of PMIs - Newsquawk EU Market Open

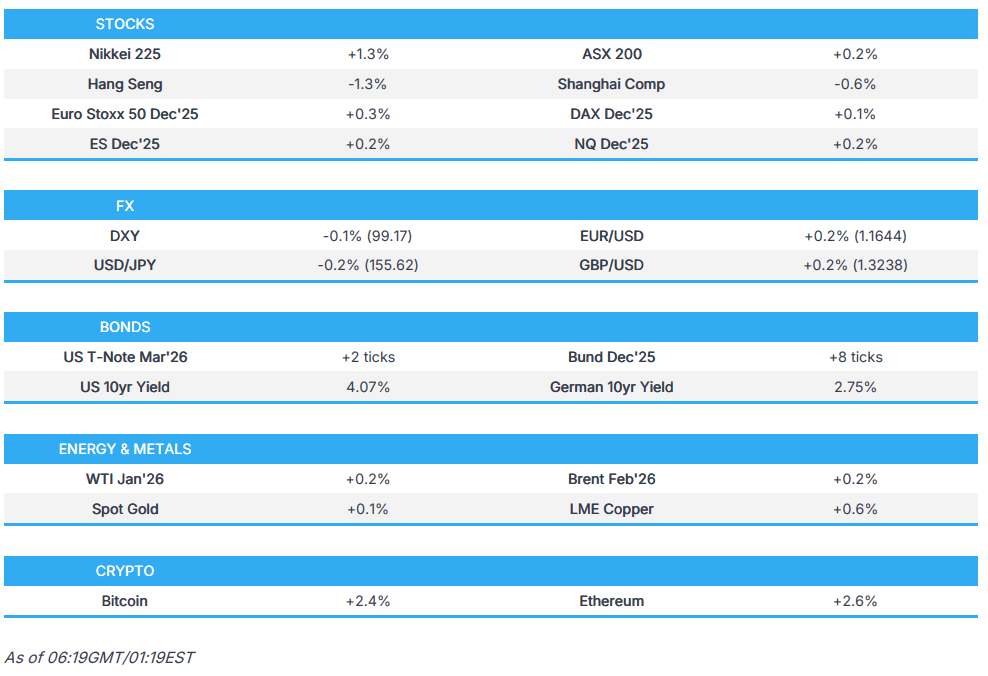

- USD hit and US yield curve steeper as Trump referred to Hassett as the "potential" next Fed Chair

- APAC stocks mixed, only partially sustaining the Wall St. handover, where the NQ outperformed

- EUR and GBP both edged higher, AUD shrugged off disappointing Q3 GDP

- Crude contained, Kremlin said talks with the US were constructive but are no closer to resolving the situation

- Looking ahead, highlights include EZ/UK/US Services/Composite PMI Final (Nov), Swiss CPI (Nov), US ISM Services PMI (Nov), ADP National Employment (Nov), Import Prices (Sep), Industrial Production (Sep), NBP Policy Announcement, Speakers including BoE's Mann, ECB’s Lagarde & Lane, Supply from UK, Earnings from Salesforce, Snowflake, Dollar Tree, Macy's & Inditex.

- Click for the Newsquawk Week Ahead.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks closed the day mostly in the green with outperformance in the Nasdaq, while Industrials, Tech and Communications outperformed. There were several developments on AI, with OpenAI declaring a "code red" for workers to shift focus to improve ChatGPT in the face of threats from other chatbots. Meanwhile, Amazon (AMZN) announced its new AI chip, which some labelled as rushed but others labelled as a threat to NVIDIA (NVDA). The Amazon AI chip announcement led to downside in US equities, but that later reversed. Aside from AI, focus was on the potential next Fed Chair. US President Trump announced he would name Powell's successor in early 2026, which led to a brief Dollar strength and a flattening of the Treasury curve as participants speculated whether Hassett is still the front-runner. However, Trump later announced he had narrowed his choice down to one, and then referred to Hassett as the "potential" next Fed Chair, which in turn saw the Dollar move to lows while the curve steepened again.

- SPX +0.25% at 6,829, NDX +0.84% at 25,556, DJI +0.39% at 47,474, RUT -0.17% at 2,465.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump said they will give refunds out of the tariffs and believes they won't have income tax to pay in the near future.

- US President Trump thanked Chinese President Xi for soybean purchases. It was separately reported that at least six shipments of US soybeans for China are to load at Gulf Coast terminals through mid-December, while the first US sorghum cargo to China since March is also loading at the Gulf Coast terminal, and a second cargo is due next week.

- US President Trump posted that he had a very productive call with Brazilian President Lula and "Among the things discussed were Trade, how our Countries could work together to stop Organized Crime, Sanctions imposed on various Brazilian dignitaries, Tariffs, and various other items." Trump added he believes "it set the stage for very good dialogue and agreement long into the future... Much good will come out of this newly formed partnership!"

- Brazil's Presidential Palace said President Lula told US President Trump that Brazil wants to progress in tariff talks regarding other products and that both countries need to strengthen cooperation to fight internal organised crime.

- EU is said to be pushing for 70% of critical goods to be made in Europe, according to FT.

- Dutch economy minister cancelled a plan to travel to China in December but has "arrangements" with China on a possible visit to discuss Nexperia.

NOTABLE HEADLINES

- US President Trump said he will be announcing Fed Chair in early 2026, while he commented that even JPM's Dimon said Powell should reduce rates and reiterated that US Treasury Secretary Bessent doesn't want the job. It was later reported that President Trump said they looked at ten Fed candidates and have it down to one, while he referred to NEC Director Hassett as a potential Fed chair.

- US President Trump posted that "Any and all Documents, Proclamations, Executive Orders, Memorandums, or Contracts, signed by Order of the now infamous and unauthorized “AUTOPEN,” within the Administration of Joseph R. Biden Jr., are hereby null, void, and of no further force or effect. Anyone receiving “Pardons,” “Commutations,” or any other Legal Document so signed, please be advised that said Document has been fully and completely terminated."

- US President Trump said Trump Accounts are to start on 4th July 2026 and that eligible children born in 2025–2028 may receive a USD 1,000 government contribution to jump-start long-term savings.

- US President Trump to hold the White House meeting with auto executives on Wednesday to announce the rollback of vehicle fuel standards, with Ford (F), General Motors (GM), and Stellantis (STLA) to be at the event. It was separately reported that Trump said something is going to happen on health care, but it won't be easy.

- US Treasury Secretary Bessent said the US will have low-inflationary growth and that inflation is going to roll next year.

- USDA Secretary Rollins said a bridge payment will be announced next week to help farmers.

- US judge blocked the Trump admin from enforcing a law depriving Planned Parenthood of Medicaid funding in 22 states.

- US paused all immigration applications filed by immigrants from 19 countries it restricted from travel to the US earlier this year, according to NYT.

APAC TRADE

EQUITIES

- APAC stocks were mixed, with the region only partially sustaining the positive momentum from Wall St, where tech and crypto rebounded.

- ASX 200 traded marginally higher but with gains limited as participants also reflected on disappointing Australian GDP data.

- Nikkei 225 rallied to back above the 50k level as it benefitted from tech-related momentum.

- Hang Seng and Shanghai Comp declined after the Chinese tech giants failed to join in the spoils seen in global peers and after the PBoC continued to drain liquidity through its daily open market operations, while participants also digested the latest Chinese RatingDog Services and Composite PMI data, which continued to show an expansion in activity, albeit at a slower-than-previous pace.

- US equity futures extended on the prior day's gains but with further upside limited amid the mixed risk appetite in Asia.

- European equity futures indicate a positive cash market open with Euro Stoxx 50 futures up 0.3% after the cash market closed with gains of 0.3% on Tuesday.

FX

- DXY marginally softened with trade confined to relatively tight parameters, while there were remarks from US President Trump who said he will announce his pick for Fed Chair in early 2026 (was expected by year-end) and referred to NEC Director Hassett as the "potential Fed Chair".

- EUR/USD gradually edged higher after rebounding yesterday from a brief dip beneath 1.1600, while the recent inflation data from the bloc was mixed and, along with the latest ECB rhetoric, had little impact on rate expectations.

- GBP/USD eked slight gains after breaking out of yesterday's range on what had been a choppy performance, but with the upside capped by a lack of major catalysts and after rhetoric from BoE Governor Bailey provided very little incrementally.

- USD/JPY mildly eased back following a brief return to the 156.00 handle, but with the downside cushioned in the absence of any tier-1 data from Japan and amid the positive sentiment seen in Tokyo stocks.

- Antipodeans were firmer, AUD/USD ultimately shrugging off the disappointing Q3 GDP data from Australia, which initially pressured the currency pair in a knee-jerk reaction, although the moves were then reversed shortly after as the data had little influence on money market pricing, which continued to lean heavily towards the RBA keeping rates unchanged at next week's meeting.

FIXED INCOME

- 10yr UST futures remained afloat after the prior day's steepening and with upside facilitated by comments from US President Trump, who said he will be announcing the next Fed Chair pick in early 2026, but then later introduced NEC Director Hassett as the potential Fed Chair.

- Bund futures were rangebound following yesterday's indecision and mixed EU inflation, while participants await ECB rhetoric.

- 10yr JGB futures demand was subdued amid upside in yields and outperformance in Japanese stocks.

COMMODITIES

- Crude futures were contained after ultimately trickling lower yesterday, and with demand not helped by the mostly bearish private sector inventory data. On the geopolitical front, the five-hour meeting between Russian President Putin and US Special Envoy Witkoff was described by Kremlin aide Ushakov as useful, constructive and meaningful, in which they discussed several options for Ukraine's settlement plan, although they were said to be no closer to resolving the Ukraine crisis, while it was also reported that the EU reached a deal on phasing out Russian gas imports by 2027.

- US Private Inventory Data (bbls): Crude +2.5mln (exp. -0.8mln), Distillate +2.9mln (exp. +0.7mln), Gasoline +3.1mln (exp.+1.5mln), Cushing -0.1mln.

- EU reportedly reached a deal on phasing out Russian gas imports by 2027.

- Spot gold rebounded from the prior day's trough and reverted to above the USD 4,200/oz level, but later faltered and gave back its gains in tandem with the late selling pressure in silver, despite the lack of news catalysts behind the move.

- Copper futures edged mild gains but with the upside capped amid the ultimately mixed risk appetite and as Chinese markets lagged.

CRYPTO

- Bitcoin steadily climbed throughout the session and returned to above the USD 93,000 level.

NOTABLE ASIA-PAC HEADLINES

- China was reported to unveil a plan to boost tourism and aviation sectors and will strengthen inbound tourism air routes, while it will continue to ease entry and travel for foreign tourists and will boost tourism through coordinated consumption policies.

DATA RECAP

- Chinese RatingDog Services PMI (Nov) 52.1 vs. Exp. 52.1 (Prev. 52.6)

- Chinese RatingDog Composite PMI (Nov) 51.2 (Prev. 51.8)

- Australian Real GDP QQ SA (Q3) 0.4% vs. Exp. 0.7% (Prev. 0.6%)

- Australian Real GDP YY SA (Q3) 2.1% vs. Exp. 2.2% (Prev. 1.8%)

GEOPOLITICS

RUSSIA-UKRAINE

- Russian President Putin's envoy Dmitriev described talks with the US in Moscow as productive after Russian President Putin's meeting with US Special Envoy Witkoff and Jared Kushner lasted for five hours.

- Russian Kremlin aide Ushakov said the conversation between Russian President Putin and US Special Envoy Witkoff was useful, constructive and meaningful and that they discussed several options for Ukraine's settlement plan, although he stated that they are no closer to resolving the crisis in Ukraine, and there is much work to be done. Ushakov said Putin asked to convey a number of important political signals to Trump and they agreed with their American colleagues not to disclose the substance of the negotiations that took place with the discussion confidential. Furthermore, he said American representatives will return to the US, present their findings to President Trump and contact the Russian side, while they also discussed prospects for economic cooperation between Russia and the US.

- Ukrainian President Zelensky said he can see some optimism in the speed of the negotiations and US interest in the process, while he added they don't have alternatives to the use of Russian assets to finance Ukraine. Furthermore, he responded 'yes' when asked if he is afraid that the US might lose interest in the process, and noted the goal of Russia is for the US to withdraw from engagement with Ukraine.

- Ukraine's Foreign Minister said Russian President Putin made statements that demonstrate he does not plan to end the war, and it is time to force Russia to end the war.

- US President Trump said Ukraine is not an easy situation and commented, "what a mess", while he added that their people were over in Russia trying to settle it.

- European Commission is to make a legal proposal this week to use Russia's frozen assets for a Ukraine loan, according to sources cited by Reuters.

OTHER

- US President Trump said they still haven't gotten a lot of information and did not know about the second strike on the Venezuelan boat, while he also commented that if they have to attack drug traffickers on land, they will, and are to start strikes on land soon which is much easier. Furthermore, he said any country drug trafficking to the US is subject to attack.

- US War Secretary Hegseth said they've only just begun striking narco traffickers and there had recently been a pause on strikes because it's difficult to find boats right now.

- Colombia's President said any US attack on its sovereignty would be a declaration of war.

- US President Trump signed into law a measure forcing the State Department to review guidelines for the country’s engagement with Taiwan, according to the White House.

- South Korean President Lee said communication is completely cut off between South Korea and North Korea, while he added that North Korea keeps refusing our efforts to talk. Lee also commented that South Korea can look into the issue of joint exercises with the US to help create grounds for dialogue between the US and North Korea, as well as stated that they will not veer off the road towards denuclearisation of the Korean peninsula.