NS

NSTrump threatens France with a 200% tariff on French wines and Champagne; European equity futures are lower - Newsquawk European Opening News

- US President Trump threatened to impose 200% tariffs on French wines and Champagne following France's intention to decline the invitation to join his 'Board of Peace'.

- US President Trump said he had a good phone call with NATO Secretary General Rutte about Greenland, and has agreed to meet various parties in Davos.

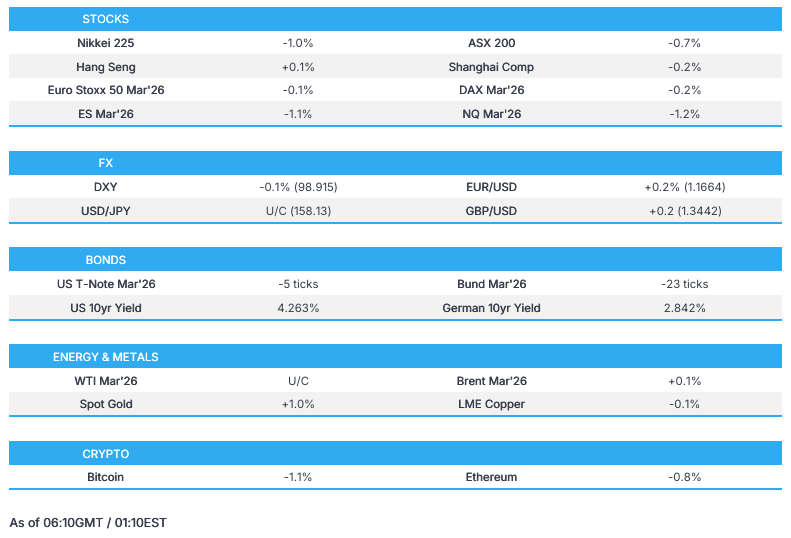

- Spot XAU extended beyond USD 4700/oz, and DXY eventually dipped below 99.00 amid a continuation of weakness.

- European equity futures are indicative of a modestly weaker open, with the Euro Stoxx 50 future down 0.1% after cash closed down 1.8% on Monday.

- Looking ahead, highlights include UK Unemployment Rate & Average Earnings (Nov), Swiss Producer Prices (Dec), German ZEW (Jan), speakers include Japanese Economy Minister Akazawa, Finance Minister Katayama, China Vice-Premier He Lifeng, ECBʼs Nagel, SNBʼs Schlegel, BoE's Bailey, Ramsden and earnings from Netflix.

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US cash indices were closed on Monday due to MLK Jr. Day, but equity futures saw weakness, with NQ & RTY underperforming as geopolitical tensions with the US over Greenland weighed on sentiment.

- Markets have had a tumultuous start to 2026, with renewed uncertainty driven by Trump’s continued push for Greenland and his threats to impose tariffs on eight European countries. In response, EU nations have unsurprisingly been outspoken about how they do not deem the tariff threats acceptable, while the UK PM distanced himself from retaliatory measures.

- Click here for a detailed summary.

TRADE/TARIFFS

- US President Trump said he will impose a 200% tariff on French wines and champagne, and then President Macron will join the Board of Peace.

- China's December rare earth magnet exports -3.2% M/M; rare earth exports to Japan -8% M/M; rare earth exports to the US -3% M/M.

- China said it hit its US soy purchase target of 12mln tonnes, Bloomberg reported citing traders.

- Taiwan's Vice President said Taiwan will balance the trade deficit between Taiwan and the US.

NOTABLE HEADLINES

- US President Trump is to deliver a special address at Davos at 13:30GMT / 08:30EST on Wednesday 21st.

- China deepens probe into PDD (PDD) after physical altercations with regulators, Bloomberg reported.

CENTRAL BANKS

- US President Trump said he knows who he wants to be Fed Chair, and that will be announced sometime.

- Fed Chair Powell to attend Supreme Court hearing on Trump's attempted firing of Lisa Cook, AP reports.

- Eurogroup picks Croatia's Vujcic to be next ECB VP.

APAC TRADE

EQUITIES

- APAC stocks traded mostly in the red, except the KOSPI, as the tech sector led the declines.

- ASX 200 continued to fall away from its 2026 peak of 8915, despite the positivity seen in the metals space as BHP upgraded its FY26 copper production guidance.

- Nikkei 225 neared 53,000, falling from its ATH of 54,522, as traders assess the policies put forward by the LDP and Centrist Reform Alliance going into the February 8th elections.

- KOSPI was set to snap its 5-day winning streak, falling from its ATH at 4924, as the tech sector weighs on sentiment. Samsung Electronics and SK Hynix briefly led losses, with shares down as much as 3% each before price gradually rebounded but remained in the red.

- Hang Seng and Shanghai Comp traded with modest losses, and little follow-through from the PBoC unsurprisingly holding LPRs steady. Global equities continue to price in the re-escalation of tariffs between the US and EU.

- US equity futures held onto Monday’s equity futures losses (ES -1%, NQ -1.1%).

- European equity futures are indicative of a modestly weaker open with the Euro Stoxx 50 future down 0.2% after cash closed lower by 1.8% on Monday.

FX

- DXY continued to hover around 99.00 but off last week’s peak of 99.479 as investors moved into havens amid re-emerging trade tensions.

- EUR/USD pulled back slightly, following Monday’s bid, to a trough of 1.1633 before the pair extended above 1.1650.

- GBP/USD oscillated around the U/C mark for the majority of the Asia-Pac session before lifting towards 1.3440 ahead of key UK employment data.

- USD/JPY traded choppy around the 158.00 handle despite the absence of news and amid the continued rise in JGB yields.

- Antipodeans outperformed their G7 counterparts, especially the Kiwi, despite no clear driver.

- USD/CNH briefly strengthened to a trough of 6.9522 at the PBoC’s Yuan fix.

- PBoC set USD/CNY midpoint at 7.0006 vs exp. 6.9576 (prev. 7.0064).

FIXED INCOME

- 10yr UST futures held onto losses seen in Monday’s futures session amid the absence of cash trade.

- Bund futures completely reversed the haven-bid seen in Monday’s session, as the OAT-Bund spread continued to tighten following the use of Article 49.3 by French PM Lecornu to push through the budget. The 10-year German debt hit the 128.00 handle as price broke Friday's low.

- 10yr JGB futures briefly dipped below the 131.00 handle, as 40-year JGB yields hit their highest point since its debut in 2007. JGBs bounced going into the 20-year auction before falling back towards 131 as the bond sale saw weak demand.

- Japan sold JPY 800bln 20-year JGBs; b/c 3.19x (prev. 4.10x, 12-month avg. 3.44x), average yield 3.2510% (prev. 2.916%). Tail 25bps (prev. 3bps).

COMMODITIES

- Crude futures oscillated in a tight c. USD 0.30/bbl range amid a lack of geopolitical updates, as tensions in Iran ease momentarily.

- Spot gold initially hovered below USD 4680/oz before extending to a fresh ATH of USD 4700/oz amid a lack of newsflow.

- Copper futures reversed the slight upside seen in Monday’s session, with 3M LME copper trading below USD 12.95k/t. This came despite BHP slightly raising its FY26 copper production guidance to 1.9-2.0mln tons (prev. 1.8-2.0mln tons) and positive commentary by the CEO stating “China’s commodity demand remains resilient, supported by policy measures and solid exports.”

- Venezuela's Acting President said it plans to boost gold and iron output in 2026 and attract metals investment for FX.

CRYPTO

- Bitcoin continued to trade below USD 93,000 as risk tone remained sour.

NOTABLE ASIA-PAC HEADLINES

- China's MOF extended personal consumption loan interest subsidies until the end of 2026. MOF is to expand the interest subsidies to tech re-lending, with the policy to run until the end of 2026. To add, the MOF announced it will give support to target NEVs, industrial machinery, pharmaceuticals and emerging fields, including AI. Will inject CNY 5bln into the government guarantee fund.

- China's NDRC Official Wang said China is to step up regulation on industrial capacity. Services become key to boosting domestic demand. More targeted support policies to be rolled out this year.

- China's NDRC Deputy Head said it plans to advance key high-tech projects under the 15th Five-Year Plan, alongside research and implementation of a 2026–2030 domestic demand expansion strategy. Authorities aim to address industrial bottlenecks through innovation and are studying the creation of a national-level M&A fund to accelerate the development of so-called “new quality productive forces”. The government will step up efforts to curb disorderly low-price competition and strengthen price supervision in key industries, while refining local investment attraction rules and promoting a market order focused on quality and branding. China will also standardise nationwide subsidies for vehicle scrappage, trade-ins and home appliance upgrades. Policymakers said China will pursue a more proactive fiscal stance and a moderately loose monetary policy, with restoring prices identified as a core objective.

- Japan's DPP Chief Tamaki said there is no need for sales tax if real wage growth is achieved and is closely watching the situation now. Adds that a consumption tax cut can stimulate the economy when there is a gap between supply and demand.

- Japan's Economy Minister Kiuchi said we will consider the impact of food sales tax cuts on yields and FX. On tax cuts, will discuss when Japan can realistically implement tax cuts, and that non-tax revenue can be a source for sales tax cut. Kiuchi adds that they will be mindful of fiscal discipline for sales tax cuts and that funding through reviewing excess subsidies is also an option. On markets, Kiuchi comments that yields are determined by the market, reflecting many factors, that it is vital for stocks and FX to move stably and will monitor market moves with a high sense of urgency.

- Banks in China are said to offer cheaper loans on a structural rate cut and also offer higher limits and longer loan tenors.

DATA RECAP

- Chinese Loan Prime Rate 1Y (Jan) 3.0% vs. Exp. 3.0% (Prev. 3.0%).

- Chinese Loan Prime Rate 5Y (Jan) 3.5% vs. Exp. 3.5% (Prev. 3.5%).

- New Zealand Composite NZ PCI (Dec) 53.7 vs. Exp. 49.6 (Prev. 48.8).

- New Zealand Services NZ PSI (Dec) 51.5 vs. Exp. 48 (Prev. 46.9).

GEOPOLITICS

EU-US

- US President Trump, on Truth Social, said he had a good phone call with NATO Secretary General Rutte about Greenland, and have agreed to meet various parties in Davos.

- US President Trump said he will talk about Greenland in Davos, does not think the EU will push back too much on Greenland.

- US President Trump conceded in a weekend phone call with UK PM Starmer that he was given bad information regarding troop deployments from European countries to Greenland, CNN reported citing a senior UK official.

- Finnish President said the EU has several tools that can lead to US threats on tariffs being withdrawn.

- Denmark's Defence Minister said we have had a good meeting with NATO's Rutte; have discussed a NATO mission in Greenland and in the Arctic.