NS

NSUS equity futures are lower; the Trump admin is reportedly looking to scrap the USMCA in favour of bilateral deals with Canada and Mexico - Newsquawk US Opening News

- US President Trump and his advisors have reportedly indicated that the USMCA could be scrapped, NY Times reports. Instead, the US could have bilateral deals with Canada and Mexico.

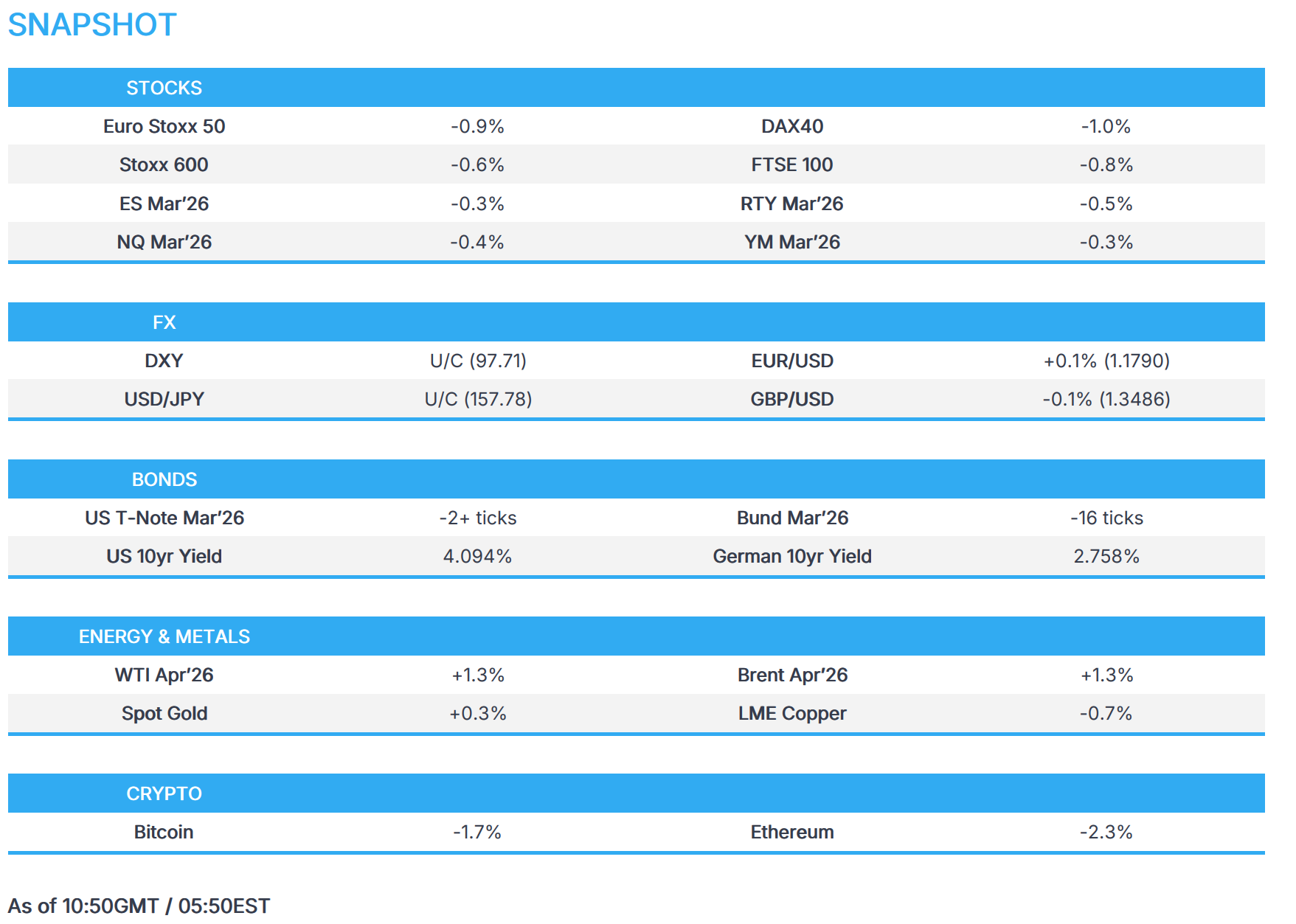

- European equities lower as Airbus misses on 2026 aircraft deliveries; US equity futures slip.

- Antipodeans gain following recent losses; DXY flat after Wednesday's advances.

- Bonds hold a bearish bias, continuing the pressure seen in the prior session due to various factors.

- Crude benchmarks and precious metals benefit from growing US-Iran tension, whilst copper lags on weak European sentiment and Chinese holiday.

- US President Trump is scheduled to deliver remarks on the economy at 16:00EST/21:00GMT on Thursday.

- Looking ahead, highlights include US Trade Balance (Dec), Weekly/Continuing Claims, Philadelphia Fed (Feb), Pending Home Sales (Jan), EZ Flash Consumer Confidence (Feb), New Zealand Trade Balance (Jan), Australian Flash PMIs (Feb), Japanese CPI (Jan). Speakers include ECB's de Guindos, Fed’s Bostic, Kashkari, Goolsbee & Bowman. Supply from the US. Earnings from Walmart, Deere, Wayfair, Klarna, Opendoor, Newmont Mining, Southern & Constellation Energy.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 -0.7%) are entirely in the red. The FTSE MIB (-1.2%), DAX 40 (-0.9%) and CAC 40 (-0.8%) are the clear underperformers after a flurry of corporate news.

- European sectors are mixed, with a slight tilt to the downside. Food, Beverage and Tobacco (+0.7%) is outperforming following earnings by Nestle (+2.5%), which announced that it is in advanced negotiations to sell its remaining Froneri stake. At the bottom sits Basic Resources (-2.8%), Autos and Parts (-2.1%) and Utilities (-2.2%). The former continues to have a choppy week, this time catalysed by Rio Tinto (-4.6%) as FY profit failed to grow and a drag on its iron ore unit in China. For the latter, Italian utilities (A2A -3.7%, Enel -4.1%, Italgas -2.1%) have been hit after Italy approved a 2bp hike in its IRAP corporate tax. Renault (-5.9%) has been weighing on the Autos sector after posting a net loss worse than expected.

- US equity futures (NQ -0.4%, ES -0.3%, RTY -0.5%) are coming under modest pressure, following their European counterparts.

- Nestle (NESN SW) FY 2025 (CHF): Net Profit 9.03bln (exp. 10.08bln), Revenue 89.5bln (exp. 89.7bln), Organic growth +3.5% (exp. 3.4%), sees FY26 organic growth between 3-4%; in advanced negotiations to sell remaining ice cream business to Froneri.

- Renault (RNO FP) FY25 (EUR): Net -10.7bln, Revenue 57.9bln (exp. 57.7bln), operating margin 6.3% (prev. guided around 6.5%), sees FY26 operating margin around 5.5%.

- Airbus (AIR FP) Q4 (EUR): Revenue 25.98bln (exp. 26.32bln), Adj. EBIT 2.98bln (exp. 2.85bln), sees 2026 deliveries at about 870 aircraft (exp. 896) and Adj. EBIT about 7.5bln (exp. 8.91bln).

- Rio Tinto (RIO AT/ RIO LN) FY (USD): Revenue 57.6bln (exp. 57.0bln). Adj. net 10.9bln (exp. 10.8bln). Underlying EBITDA 25.4bln (exp. 24.7bln). Net 9.97bln (-14% Y/Y).

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

FX

- DXY has waned from overnight highs after advancing yesterday and overnight amid better-than-expected data and as oil prices surged after sources noted the Trump administration is closer to a major war with Iran than people realise. On the US docket ahead, weekly initial jobless claims (which coincide with the traditional survey window for the BLS' February jobs data) are expected little changed at 225k (prev. 227k), while continuing claims (this week does not coincide with the BLS window) are seen unchanged at 1.87mln. Most recently, a NYT report suggested that the Trump administration indicated that the USMCA could be scrapped, in favour of bilateral deals with Canada and Mexico. DXY resides in a current 97.572-97.777 range at the time of writing.

- JPY is narrowly softer but off worst levels, with USD/JPY hovering around its 100 DMA (154.744), with some fleeting strength seen yesterday in wake of the FOMC minutes in which the Fed confirmed it did a USD/JPY rate check on behalf of the US Treasury in January. Analysts at ING highlight that "Something like this is extremely rare in foreign exchange markets and is a sign of a more activist White House when it comes to FX. The move was clearly designed to deliver maximum impact and reflects the shared desire from both Washington and Tokyo that USD/JPY does not sustain a move through 160".

- EUR trims some of yesterday's losses after briefly slipping beneath the 1.1800 level (to a 1.1782 low on Wednesday) as the buck strengthened, and with the single currency not helped by conflicting reports about ECB President Lagarde's future. Recent reports suggested ECB President Lagarde reportedly tells colleagues that she would tell them first if she were to step down, according to sources; colleagues reportedly interpreted this to mean her departure is not immediate, but the door is not closed. EUR/USD resides towards the top end of a 1.1781-1.1808 range.

- Antipodeans outperform amid recent underperformance and following positive risk appetite in APAC (before waning in European hours), with AUD/USD supported following the mixed jobs data, which showed headline employment change slightly missed expectations, although the unemployment rate printed lower than expected, and the increase in jobs was solely fuelled by full-time work.

FIXED INCOME

- USTs are lower by a handful of ticks this morning, and currently trade within a 112-24+ to 112-31 range. Moved lower for much of the morning, before picking up a touch as US/European equity futures dipped lower.

- The bearish bias follows on from; a) the prior day’s stronger-than-expected US data, b) rising energy prices (spurred by geopolitical tensions), c) JGB pressure overnight, following strong Machine Tool Orders and a weak 20yr JGB auction, d) a poor 20yr auction; on the latter point, desks highlight that the 20yr has historically not been the markets favoured outing. On the geopolitical narrative, there have been continued reports that the US is upping its presence in Iran, with a US Senior Official telling Axios that US-Iran talks have been a “nothing burger”, and that is why POTUS is close to deciding on the issue of going to war with Iran. As it stands, US paper appears to be pricing in the inflationary impacts (higher oil prices), but an outright attack could lead to some haven-related demand.

- Bunds are also pressured alongside global peers. Currently holds towards the lower end of a 129.05 to 129.31 range. Newsflow for German paper is lacking today, aside from ECB-related reporting. Source reports suggest that President Lagarde told her colleagues that she would tell them before she leaves; her colleagues reportedly interpreted this to mean her departure is not immediate, but the door is not closed. De Cos and Knot have been touted as potential replacements once President Lagarde leaves her role, though Rabobank cautions that the process is highly political and difficult to predict, noting markets should largely ignore speculation for now.

- Gilts are trading in-fitting with peers, and trading around the 92.00 mark within a 91.96 to 92.03 range. UK data slate has paused for today, ahead of Retail Sales/PMIs on Friday. This follows on from dovish jobs/wages and mixed inflation metrics earlier this week, which confirmed the disinflation process but Services and Core topped-expectations, leaving the more hawkish MPC members cautious. Markets are currently torn between a cut in March or April; analysts at ING see a cut in March and then another by June.

- France sells EUR 13.497bln vs exp. EUR 11.5-13.5bln 2.40% 2029, 2.70% 2031, and 2.00% 2032 OAT.

- Spain sold EUR 5.43bln vs exp. EUR 4.5-5.5bln 3.50% 2029, 2.60% 2031 and 3.30% 2036 Bono.

- Japan sold JPY 608bln 20-year JGBs; b/c 3.08x (prev. 3.19), average yield 2.968% (prev. 3.253%).

COMMODITIES

- Crude benchmarks remain elevated amid heightening geopolitical tension between the US and Iran following the Axios report on Wednesday which noted that the US President Trump’s administration is closer to a major war with Iran than people realise. Tensions continue to persist, with an overnight report from CNN that the US military is ready to strike Iran as early as this weekend and the WSJ reporting that the US has gathered the greatest amount of air power in the Middle East since the 2003 Iraq invasion. WTI and Brent are trading at the upper end prices of USD 64.84-66.27/bbl and USD 70.18-71.60/bbl, respectively, with Brent touching the USD 71/bbl, which marks the first time since August last year.

- Precious metals are firmer, benefiting from haven demand from the ongoing geopolitical tension between the US and Iran, with the yellow metal crossing the USD 5,000/oz mark. The weaker USD ahead of the FOMC minutes also spurred demand for the yellow metal. XAU and XAG are trading at the upper range of USD 4979.14-5040.21/oz and USD 76.355-79.355.

- Copper price action is moving contrary to the trend seen in precious metals. Risk sentiment in the early European session as well as subdued activity from Asia due to the Chinese holiday has seen the red metal trading lower thus far. 3M LME copper trades at the lower price range of USD 12.846-12.937k/t.

- US Energy Secretary Wright said the US could leave the IEA if the group does not change.

- Hungarian PM Orban's Chief of Staff said they would take steps in the scenario that Ukraine continues to halt Druzhba oil shipments.

- US Treasury Department issues general license authorising transactions related to oil and gas sector operations in Venezuela.

- US Private Inventory Data (bbls): Crude +0.6mln (prev. +13.4mln), Distillate -1.6mln (prev. -2.0mln), Gasoline -0.3mln (prev. +3.3mln), Cushing -2.4mln (prev. +1.4mln).

TRADE/TARIFFS

- US President Trump and his advisors have reportedly indicated that the USMCA could be scrapped, NY Times reports. Instead, the US could have bilateral deals with Canada and Mexico. US officials have been increasing pressure on Canada. Canadian officials cited add that their expectation for a full renewal of the USMCA is very low. Officials believe Trump is trying to weaken Canada economically to force it to give up some protectionist policies. The article reminds us that in 2018, the US proposed a bilateral deal with Mexico and told Canada to get on board or be left out.

- US-ASEAN Business Council said US and Indonesian companies signed trade and investment deals covering critical minerals, semiconductors, agriculture and forestry, while deals include a USD 4.89bln semiconductor joint venture involving Essence Global Group. Indonesian firms are to purchase 1mln tons of US soybeans, 1.6mln tons of corn, and 93,000 tons of cotton over an unspecified period.

- US President Trump posted that the US trade deficit has been reduced by 78% because of the tariffs being charged to other companies and countries, adds it will go into positive territory during this year for the first time in many decades.

- Canadian minister responsible for Canada-US trade LeBlanc said Canadian companies from various provinces have signed 15 commercial partnerships in Mexico.

NOTABLE EUROPEAN HEADLINES

- UK's ONS on ongoing data issues, reported the "Latest steps reaffirm commitment to quality over quantity".

NOTABLE EUROPEAN DATA RECAP

- Italian Current Account (Dec) 3109M (Prev. -1594M, Rev. From -1333M).

- EU Current Account (Dec) 34.6B (Prev. 12.9B, Rev. From 12.6B).

- Swiss Balance of Trade (Jan) 3.6B (Prev. 3.0B); Swiss Watch Exports -3.6% (Prev. +3.3%).

- Swiss Industrial Production YoY (Q4) Y/Y -0.70% (Prev. 2.40%, Rev. From 2.4%).

CENTRAL BANKS

- WSJ's Timiraos noted regarding the January Fed meeting minutes that it was interesting there was no date specified for when inflation gets to 2%, and instead minutes states that forecast is "slightly higher, on balance".

- Japan Bank Lobby said markets expect a BoJ hike as soon as March; Lobby Head believes there is a reasonable possibility of a hike as early as March or April.

- ECB President Lagarde reportedly tells colleagues that she would tell them first if she were to step down, according to sources; colleagues reportedly interpreted this to mean her departure is not immediate, but the door is not closed.

- RBNZ Assistant Governor Silk said the easing cycle is likely over and there are risks on either side, adds maintaining accommodative policy for a while aligns with economic conditions.

- SNB has defined a standardised and scalable process for the ELF that will enable participating banks to quickly obtain liquidity support against collateral as necessary.

- Riksbank takes measures to facilitate banks’ liquidity management.

GEOPOLITICS

RUSSIA-UKRAINE

- Ukrainian President Zelensky said he is aware that the US and Europe have been talking to Russia and we must be prepared to react to surprises.

- Russia's Kremlin on the Iran situation said they see unprecedented escalation of tensions and on Ukraine talks, said there's nothing to add following comments from the likes of Medinsky yesterday. Reiterates that no date has been set for the next Ukraine talks.

MIDDLE EAST

- IAEA Director Grossi said Iran discussed a potential IAEA return to bombed nuclear sites, adds there is no deal unless the IAEA was in a position to verify and there is not much time to reach an Iran nuclear deal, via Bloomberg TV. His role is to get the nations into a position to come to a deal without the need for force. IAEA has proposed a few solutions.

- Russian Foreign Minister Lavrov warns of any new US strike on Iran.

- Israeli raid reported on areas of deployment of occupation forces east of Gaza City, according to Al Jazeera.

- Two Israeli defense officials said that significant preparations were underway for possibility of a joint strike with the US against Iran, according to NYT.

- US gathers the greatest amount of air power in the Middle East since the 2003 Iraq invasion and President Trump is being briefed on military options for striking Iran, even as aides hold talks with the Iranian regime, according to WSJ.

- Iraqi Foreign Minister said any alternative to US-Iran deal would be disastrous, and they may not be able to export their oil if war breaks out in the region.

- US military is ready to strike Iran as early as this weekend, although President Trump has yet to make the final decision, according to sources familiar with the matter cited by CNN.

- US senior official said US expects Iran to submit a written proposal on resolving standoff in the wake of Tuesday's talks.

OTHERS

- US is pushing NATO to cut many foreign activities, including ending a key alliance mission in Iraq, according to four NATO diplomats cited by POLITICO.

- Israeli Defense Forces announced they struck Hezbollah infrastructure sites in southern Lebanon, according to Sky News Arabia.

- US Southern Command Commander Donovan met with Venezuela's interim President Rodriguez and defence officials in Caracas.

- North Korea's Kim Yo Jong said military will take measures to strengthen its vigilance on border with South Korea; she appreciates South Korean Unification Minister's official recognition of South Korea's drone provocation. Border with the enemy should be solid.

CRYPTO

- Bitcoin slips below USD 67,000 as global risk tone sours.

APAC TRADE

- APAC stocks traded higher following the positive handover from the US and with South Korea outperforming amid tech strength on return from the Lunar New Year holidays.

- ASX 200 rallied to a fresh record high with the gains led by strength in telecoms and energy, as the former was boosted alongside Telstra, which reported a 9.3% increase in H1 net profit, while energy stocks benefitted from the rise in underlying oil prices amid geopolitical frictions.

- Nikkei 225 gained with sentiment underpinned by a weaker currency and stronger-than-expected Machine Tool Orders.

- KOSPI outperformed on return from the Lunar New Year holiday closure as tech stocks played catch-up to the rebound in their US counterparts, including index heavyweight Samsung Electronics, as its shares rallied by around 5% to a record high.

NOTABLE APAC DATA RECAP

- Australian Unemployment Rate (Jan) 4.1% vs. Exp. 4.2% (Prev. 4.1%).

- Australian Employment Change (Jan) 17.8K vs. Exp. 20K (Prev. 65.2K, Low. -5K, High. 40K).

- Australian Part Time Employment Chg (Jan) -32.7K (Prev. 10.4K).

- Australian Full Time Employment Chg (Jan) 50.5K (Prev. 54.8K).

- Australian Participation Rate (Jan) 66.7% vs. Exp. 66.8% (Prev. 66.7%).

- Japanese Stock Investment by Foreigners (Feb/14) 1424.2 (Prev. 591.4, Rev. From 543.2).

- Japanese Machinery Orders YoY (Dec) Y/Y 16.8% vs. Exp. 3.9% (Prev. -6.4%, Low. -1.1%, High. 10.6%).

- Japanese Machinery Orders MoM (Dec) M/M 19.1% vs. Exp. 4.5% (Prev. -11.0%, Rev. From -11%, Low. 1%, High. 11.2%).

- Japanese Foreign Bond Investment (Feb/14) -489.5 (Prev. -359.5, Rev. From -365.7).