NS

NSUS equity futures closed weak following re-emergence of EU-US trade tensions over Greenland - Newsquawk Asia-Pac Market Open

- US President Trump would not say whether he would use force to seize Greenland, NBC reported. When asked if he will follow through on plans to hit the European nations with tariffs absent a Greenland deal, Trump said, “I will, 100%."

- Japanese PM Takaichi said she will formally call for a snap election on Friday, 23rd January 2025, with the election to be held on 8th February. On policy, she said they will end excessively restrictive fiscal policy and that fiscal spending will be strategic.

- IMF World Economic Outlook raised its 2026 Global GDP growth forecast to 3.3% (prev. 3.1%). US economy is forecasted to grow by 2.4% in 2026 (prev. 2.1%). Chinese economy is forecasted to grow by 4.5% in 2026 (prev. 4.2%).

- Eurogroup picks Croatia's Vujcic to be next ECB Vice President.

- Looking ahead, highlights include Chinese LPR (Jan) and supply from Japan.

More Newsquawk in 2 steps:

1. Subscribe to the free premarket movers reports

2. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

SNAPSHOT

US TRADE

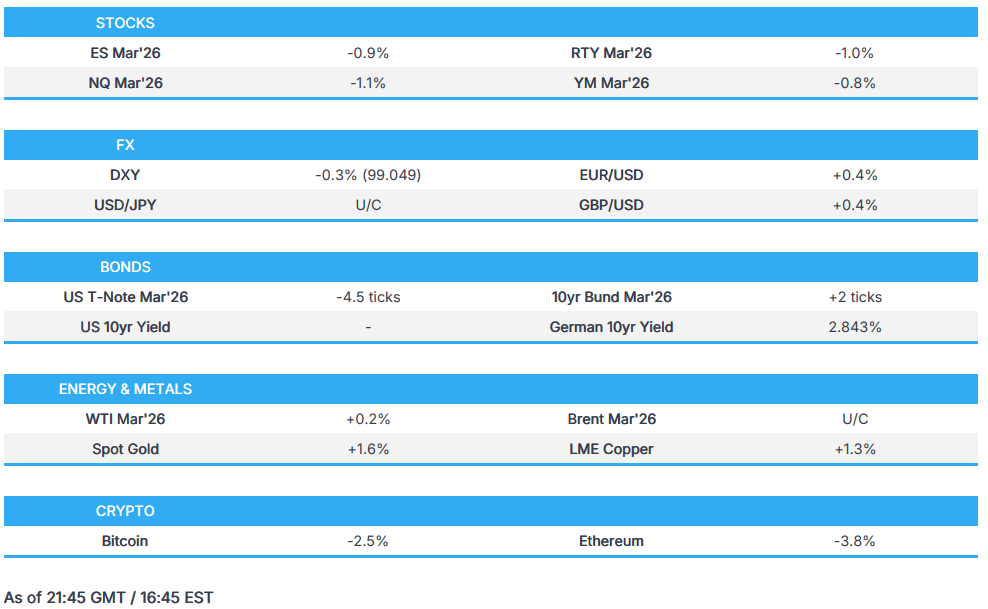

- US cash indices were closed on Monday due to MLK Jr. Day, but equity futures saw weakness, with NQ & RTY underperforming as geopolitical tensions with the US over Greenland weighed on sentiment.

- Markets have had a tumultuous start to 2026, with renewed uncertainty driven by Trump’s continued push for Greenland and his threats to impose tariffs on eight European countries. In response, EU nations have unsurprisingly been outspoken in saying they deem the tariff threats unacceptable, while the UK PM distanced himself from retaliatory measures.

NOTABLE US HEADLINES

- IMF World Economic Outlook raised its 2026 Global GDP growth forecast to 3.3% (prev. 3.1%). US economy is forecasted to grow by 2.4% in 2026 (prev. 2.1%). Chinese economy is forecasted to grow by 4.5% in 2026 (prev. 4.2%).

- The Bipartisan Health Package is likely to move forward, which would include an overhaul of the business practices of pharmacy benefit managers and new controls on how hospitals bill for outpatient services, Axios reports citing sources.

TARIFFS/TRADE

- Denmark's Foreign Minister said it is important to show Trump that this is not the way forward; it is Europe that will respond to the tariff threat, not Denmark. They have no intention of escalating the situation.

- US Treasury Secretary Bessent said European retaliation would be "very unwise"

- China’s top trade negotiator is slated to meet global CEOs in Davos, Bloomberg reported.

- Brazil's ABIEC to meet with federal government officials this week to discuss ways to mitigate Chinese safeguard measures.

- Dutch Finance Minister said tariff threats from the US are irresponsible.

- French Finance Minister said France and Germany agree on acting strongly in response to tariff threats related to Greenland. Best way to prevent threats from materialising is showing EU is ready to react strongly.

- EU's Dombrovskis said there is a need to work on finding a constructive solution and US tariff threats are not acceptable; do have tools at our disposal, nothing off the table.

- Germany's Braun said EU will react prudently to the latest US tariff threats.

- EU leaders' meeting to occur on 22nd January, taking every possible step to avoid an escalation. ACI is a deterrent, even mentioning its use can have the desired impact.

- EU Commission spokesperson said they will do everything necessary to protect EU interests. Extensive consultations are ongoing.

- Chinese importers purchased 60k/T of Canadian Canola, sources report.

- Japan's PM Takaichi said she hasn't changed her stance on China but reiterates that communication with China remains important.

- The US and Japan have reportedly shortlisted the first projects as potential candidates for the investment plan, Reuters reported citing sources. SoftBank Group (9984 JT) is mentioned in one project. Aim to formalise the project ahead of PM Takaichi's US visit in the Spring.

- German Finance Minister said there will be a strong response to US tariffs. Preparing countermeasures. No interest in an escalation.

- US trade negotiators are pushing for the UK to adopt US standards, Politico reports citing sources. A change that could derail the post-Brexit relationship with the EU.

- No EU majority in favour of using the Anti-Coercion Instrument (ACI), Playbook reported, despite the language from French President Macron on it.

CENTRAL BANKS

- Fed Chair Powell to attend Supreme Court hearing on Trump's attempted firing of Lisa Cook, AP reported.

- Eurogroup picks Croatia's Vujcic to be next ECB VP.

- ECB's Radev said current level of interest rates is appropriate and price risks are balanced.

- ECB Kazaks said market pricing for future rates is broadly reasonable and that current positioning is appropriate and no immediate adjustment is needed.

- BoC Q4 Canadian Survey of Consumer Expectations: Concerns over high prices and economic uncertainty related to the trade conflict continue to have a negative impact on consumers.

- BoC Q4 Business Outlook Survey: Business sentiment is subdued but remains above its survey low from Q2 2025.

DATA RECAP

- Canadian Inflation Rate MoM (Dec) M/M -0.2% vs. Exp. -0.3% (Prev. 0.1%).

- Canadian Average BoC Measures (Dec): 2.67% (Prev. 2.80%, Rev. 2.83%).

- Canadian Core Inflation Rate YoY (Dec) Y/Y 2.8% vs. Exp. 2.8% (Prev. 2.9%).

- Canadian CPI Trimmed-Mean YoY (Dec) Y/Y 2.7% vs. Exp. 2.7% (Prev. 2.8%, Rev. 2.9%).

- Canadian Inflation Rate YoY (Dec) Y/Y 2.4% vs. Exp. 2.2% (Prev. 2.2%).

- Canadian Core Inflation Rate MoM (Dec) M/M -0.4% vs. Exp. 0.0% (Prev. -0.1%).

- Canadian CPI Median YoY (Dec) Y/Y 2.5% vs. Exp. 2.7% (Prev. 2.8%).

FX

- In FX, the Dollar was weaker amid renewed trade tensions, with G10 FX gaining across the board. CHF was the favoured haven, and the Yen was the relative laggard as PM Takaichi announced that she will formally call a snap election this Friday once the Lower House reopens. Antipodeans benefited from the continued strength in metals prices.

- Japanese PM Takaichi will not comment on FX, but then added they will take appropriate action on FX.

FIXED INCOME

- T-Note futures were pressured as the "Sell America" trade has seemingly returned.

- Morgan Stanley wrote that the UK should target a doubling of government bill issuance over a five-year horizon, to increase flexibility, meet demand, reduce funding costs and reduce the weighted-average maturity of debt stock. i.e. additional issuance of as much as GBP 20bln/yr and a roughly similar reduction in Gilt sales.

COMMODITIES

- Oil prices were choppy, but were ultimately flat at the time of writing. Overnight, benchmarks gapped lower, however, the downside was markedly curtailed by the Iranian President threatening an all-out war if the Supreme Leader is attacked.

- Workers at Peru's PetroPeru start 72-hour strike.

- India Foreign Secretary signed long-term agreement with UAE for supply of 0.5mln T of LNG per annum and India and UAE to explore partnership in advanced civil nuclear tech. India and UAE aim to double bilateral trade to USD 200bln by 2032.

- Peru's Ministry of Energy and Mines announces copper production -11.2% Y/Y in November to 215,152 MT.

- Head of the Syrian Petroleum Company said ConocoPhillips (COP) is coming back to invest in gas fields and there are new American companies coming, including Chevron (CVX); Shell (SHEL LN) asked to pull out of the field and hand it over to us.

- Guangzhou Futures Exchange to raise lithium carbonate futures daily limit to 11% from January 21st.

- Cochilco reported that Chile's copper production is expected to reach 5.86mln T in 2034, peaking at 6.06mln T in 2033.

- Russia could lift the gasoline export ban applied to producers as of February, IFX reported.

- Polish operator to boost gas transmission capacity to Ukraine.

- Vitol Group offers Venezuelan cargoes to China at a discount of USD 5/BBL to ICE Brent, via Bloomberg.

- Asian oil refiners are switching from Abu Dhabi's Murban crude as other grades become cheaper, Bloomberg reported citing sources.

- Tengizchevroil announces a temporary suspension of oil production.

GEOPOLITICAL

MIDDLE EAST

- Israeli PM Netanyahu said if Iran attacks Israel, they will respond forcefully.

RUSSIA-UKRAINE

- US President Trump would not say whether he would use force to seize Greenland, NBC reported. “Europe ought to focus on the war with Russia and Ukraine, because, frankly, you see what that’s gotten, them”; “That’s what Europe should focus on — not Greenland.” When asked if he will follow through on plans to hit the European nations with tariffs absent a Greenland deal, Trump said, “I will, 100%."

- Polish operator to boost gas transmission capacity to Ukraine.

- Russia's envoy Dmitriev is reportedly to travel to Davos this week for meetings with members of the US delegation.

- Ukrainian energy company DTEK said its Odessa facility has suffered extensive damage due to an overnight Russian attack, via Sky News Arabia.

ASIA-PAC

NOTABLE HEADLINES

- Fitch affirms Japan at A, outlook Stable. "Bond yields continue to rise amid monetary tightening and we forecast fiscal deficits to rise steadily, but now-entrenched inflation and a strong fiscal performance in recent years should keep debt on a slightly downward trend and mitigate fiscal risks from a ratings perspective." and "Persistent current account surpluses, a large external asset position and the yen's reserve currency status also support the rating... The fiscal outlook is uncertain and risks remain that fiscal policy could be more expansionary than we project... We project yields to rise a bit further, but remain below nominal GDP growth... expect inflation to remain entrenched, though we forecast a slight easing in headline inflation to 2.3% by end-2026 from around 3% currently." BoJ: "..expect the policy rate to reach 1.5% by end-2026, from 0.75% following the BoJ's latest 25bp hike in December 2025. We anticipate the BoJ will also continue to taper its purchases of JGBs at its planned pace, despite pressures on longer-end yields over the past year."

- China's Premier highlights complexity of external environment and uncertainties facing China this year, via CCTV. The foundation for the long-term economy remains unchanged.

- Japanese PM Takaichi said she will formally call for a snap election on Friday, 23rd January 2025, with the election to be held on 8th February. On policy, she said they will end excessively restrictive fiscal policy and that fiscal spending will be strategic. On the sales tax, she intends to suspend the sales tax on food for a two-year period in order to lower the debt-to-GDP ratio.

- Vitol Group offers Venezuelan cargoes to China at a discount of USD 5/BBL to ICE Brent, via Bloomberg.

NOTABLE APAC EQUITY HEADLINES

- UK court will not permit BHP (BHP AT) to appeal the ruling relating to the Brazilian dam collapse in 2015.

- Tencent (0700 HK), Fidelity and Temasek are reportedly looking to invest in the IPO of Busy Ming, Bloomberg reported citing sources.

- Samsung Electronics (005930 KS) foundry fab utilisation rate in H1-2026 is expected to be in the 60% range, vs a 50% range in H2-2025, Zdnet reported citing sources. On other news, the Co. is reportedly reconsidering advanced packaging (AVP) investment, HankYung reported.

- Reports from Chinese media are that Xiaomi's (1810 HK) new phone will utilise TSMC's M3P process instead of 2nm node.

EU/UK

NOTABLE HEADLINES

- The UK Government is to take a GBP 25mln stake in Kraken, in an attempt to persuade the business to choose London for a future stock exchange listing.

DATA RECAP

- EU Inflation Rate YoY Final (Dec) Y/Y 1.9% vs. Exp. 2% (Prev. 2.1%).

- EU CPI Final (Dec) 129.54 vs. Exp. 129.56 (Prev. 129.33).

- EU Core Inflation Rate YoY Final (Dec) Y/Y 2.3% vs. Exp. 2.3% (Prev. 2.4%).

- EU Inflation Rate MoM Final (Dec) M/M 0.2% vs. Exp. 0.2% (Prev. -0.3%).

NOTABLE EUROPEAN EQUITY HEADLINES

- ASM International (ASM NA) Q4 (EUR): Revenue 698mln (exp. 654.2mln, prev. guided 630-660mln), Orders 800mln (Q3 indicated 637mln); above consensus orders due to rebound from China. "The stronger-than-expected bookings were driven by a rebound in orders from China toward the end of the quarter as well as solid bookings in the advanced logic/foundry segment". "The upside [in revenue] primarily reflects robust sales in the advanced logic/foundry segment, and strong spares & services sales". Outlook:Supported by the improved bookings trend in Q4, ASM expects Q1 2026 revenue at constant currencies to show a healthy increase compared to Q4 2025.