NS

NSUS jobless claims at 232k (w/e 18th Oct); US equity futures lower whilst USD is choppy - Newsquawk US Opening News

- US jobless claims at 232k in the October 18th week, via DOL; continuing claims 1.957mln.

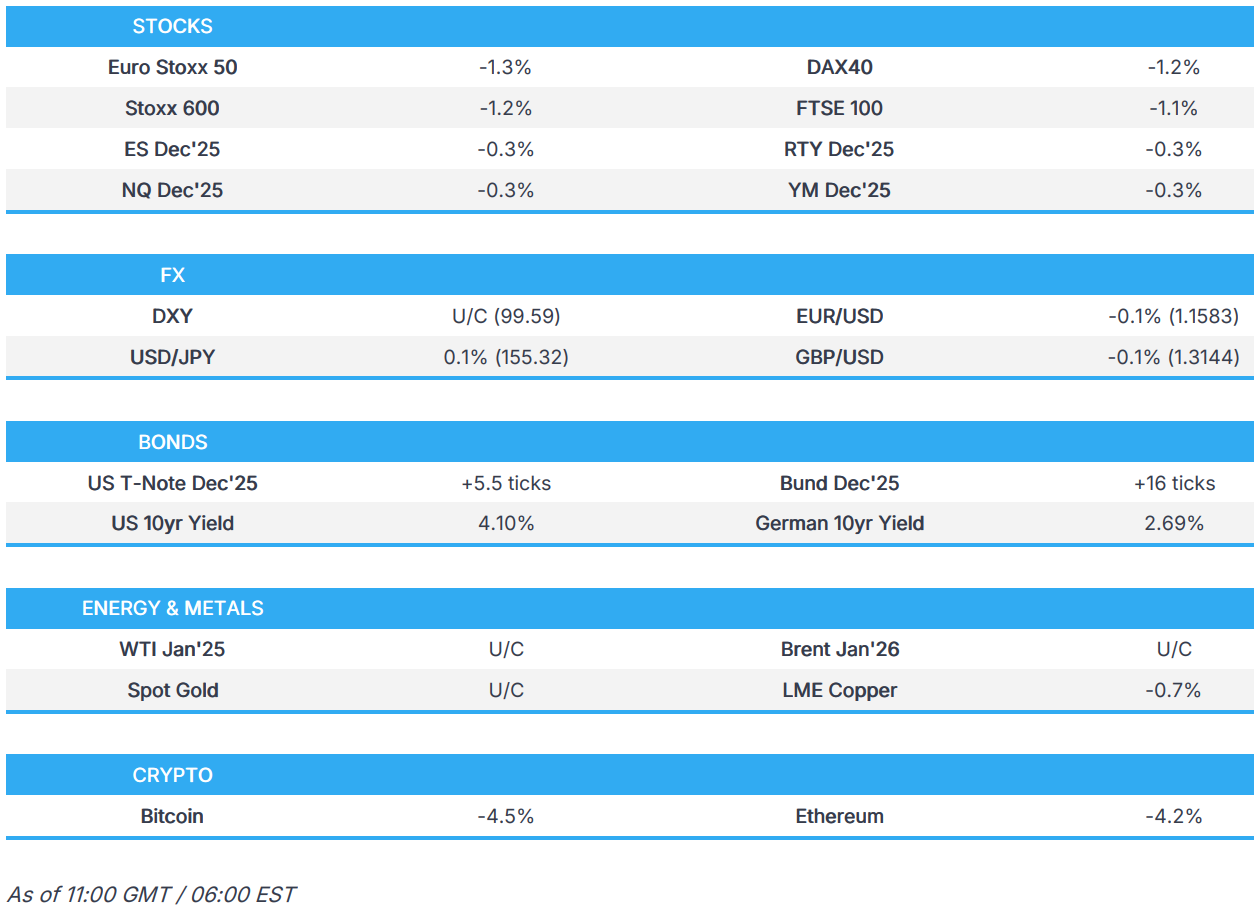

- European bourses are entirely in the red, US equity futures are modestly lower.

- USD is choppy amidst early release of weekly jobless claims, JPY digests more verbal intervention.

- Bonds are benefiting from the risk tone, with some modest price action seen on a surprise jobless claims release.

- Crude and Copper continue to be dragged by equity selloff as XAU bounces at USD 4k/oz.

- Looking ahead, US ADP Weekly Estimate, US Factory Orders (Aug), US Durable Goods (Aug), and Japanese Trade Balance. Speakers include BoE’s Pill, Dhingra; Fed’s Barr, Barkin.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

TRADE/TARIFFS

- EU Trade Commissioner Sefcovic says the EU plans to introduce restrictions on EU exports of aluminium scrap.

- German Finance Minister on rare earths says Germany must do its homework and diversify supply chains.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 -1.3%) opened lower across the board, in a continuation of the downbeat mood seen in Wall St and in APAC trade overnight. Indices found a base in early morning trade, where they have resided throughout the morning so far.

- European sectors are entirely in the red, and hold a clear defensive bias. Healthcare tops the pile, buoyed by strength in Roche (+5.6%), after a positive trial update related to a breast cancer pill. To the downside, Autos, Tech and Basic Resources are all pressured.

- US equity futures (ES -0.2%, NQ -0.2%, RTY -0.2%) are modestly lower across the board, albeit not to the extent seen in Europe. Traders count down their clocks till NVIDIA earnings on Wednesday, but before that markets will have some US data (Durable Goods, Weekly ADP Average Estimate) and a couple of Fed speakers. Earlier, a surprise jobless claims release (w/e 18th Oct) had little impact on contracts.

- EU Commission launches market investigations on cloud computing services under the Digital Markets Act; will determine if Amazon (AMZN) and Microsoft (MSFT) should be designated as gatekeepers for their cloud computing services. Two market investigations will assess whether Amazon and Microsoft should be designated as gatekeepers for their cloud computing services, Amazon Web Services and Microsoft Azure, under the DMA. The third market investigation will assess if the DMA can effectively tackle practices that may limit competitiveness and fairness in the cloud computing sector in the EU.

- Elliott Management has built a large stake in Barrick Mining (B), via FT citing sources; stake makes them a top 10 shareholder.

- Home Depot Inc (HD) Q3 2025 (USD): 3.62 EPS (exp. 3.85), Revenue 41.35bln (exp. 40.98bln).

- Barclays forecasts 2026 year-end target for Stoxx 600 at 620 Sector. Weightings: Mining upgraded to Overweight. Diversified financials upgraded to Overweight. Transportation downgraded to Underweight. Electricals downgraded to Market Weight. Business services downgraded to Underweight. Chemicals downgraded to Market Weight.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is currently choppy and trades within a busy 99.39 to 99.60 range. Initial action saw the index buoyed by the downbeat risk tone, where the USD was pressured by typical haven currencies such as the JPY & CHF whilst the Antipodeans lagged. Thereafter, the risk tone improved a touch and the Dollar dipped to make a session low – a move which also came amidst a surprise US weekly claims release. Do note that the weekly claims release is a delayed report for the w/e Oct 18th; it printed at 232k, whilst continuing claims printed at 1.957mln. Looking ahead, ADP will release its weekly US jobs gauge; last week, it reported that its average weekly estimate was -11,250. US factory orders are expected to have risen by 1.4% M/M in August (prev. -1.3%); durable goods revisions for August are also due today. NAHB's housing market index is seen unchanged at 37 in November. Fed's Barr (voter) and Fed's Barkin (2027 voter) are set to speak, while Fed's Logan (2026 voter) will deliver remarks after the close.

- EUR is currently flat/mildly lower and largely moving at the whim of the Dollar given the lack of pertinent European newsflow. Initially flat vs the Dollar, then caught a bid to make a fresh session high above the 1.1600 mark – before once again reversing. Bid seemingly in the moments preceding the US jobless claims figures. Currently towards lows at 1.1583.

- JPY is also flat vs the USD, but began the European session a little firmer, having benefited from the subdued risk tone seen overnight. That downbeat sentiment has remained this morning, with equities continuing to reside firmly in the red – albeit have stabilised just off worst levels. For Japan specifically, a number of key sticking points; 1) a meeting between BoJ Governor Ueda and PM Takaichi, 2) China-Japan tensions, 3) ongoing verbal intervention.

- GBP is steady vs the USD, but as above, was subject to some two-way action surrounding the US jobless claims data. Currently trading in a 1.3146 to 1.3176 range. Focus for the day will be on commentary from BoE's Pill and Dhingra this afternoon, and then will shift to the UK's inflation report on Wednesday. A dataset which has heightened focused, given BoE Governor Bailey highlighted inflation developments at the most recent confab - he is likely to be the deciding vote ahead in December; markets currently assign a 79% chance of a 25bps reduction at that meeting. More pertinent for the GBP are budget-related updates. Most recently, The Telegraph reported that UK Chancellor Reeves is reportedly considering a last-minute raid on banking profits in the budget. This would be a politically favourable move, but perhaps overshadowed by the growth-related implications of such a move, and boost concerns re. the UK’s investment attractiveness.

- Antipodeans were initially the clear underperformers vs the USD overnight and into the European morning – though as the session progressed, that move has since stabilised. AUD is essentially flat and trades within a 0.6466 to 0.6499 range whilst the Kiwi is marginally firmer and trades within a 0.5639 to 0.5669 range.

- PBoC set USD/CNY mid-point at 7.0856 vs exp. 7.1096 (Prev. 7.0816)

- Click for a detailed summary

FIXED INCOME

- USTs started the day on a firmer footing, buoyed by the risk tone, and have continued to grind higher as the morning progressed. USTs at a 112-19 peak, posting gains of nine ticks at most. Eclipsing Monday’s 112-24+ best but stopping just shy of a cluster from last week between 113-01+ to 113-04+. Upside this morning was also spurred by a surprise release from the Department of Labour, jobless claims at 232k in the October 18th week and continuing at 1.957mln (prev. 1.947mln); no direct comparison to initial, the last release was 219k for the week of September 20th. Notably, the move in US fixed income assets to the release was fairly muted in nature. Potentially a function of participants awaiting more timely series and/or the hard data to begin to be released in the next few days and weeks before reassessing their position in December. Ahead, we get the latest ADP series (not the BLS reference period), a handful of other prints and remarks from Fed’s Barr (voter) and Barkin (2026) on supervision and the economic outlook respectively.

- Bunds are bid, in-fitting with the above. Lifted across the early European morning before seeing a bit of a pullback just after the cash equity open and in proximity to the time of the discussed US jobless claims series. A pullback that was possibly a function of cash equity benchmarks opening slightly better than futures had implied at their worst and/or participants being caught off guard by the DOL release. Since, Bunds have resumed their climb and are towards highs of 128.90 as the European tone remains subdued overall and the fixed income complex generally moves higher.

- Gilts are also moving alongside peers. Currently at the top-end of a 92.41 to 92.60 bound. Specifics for the UK light today, as we count down to Wednesday’s CPI release for confirmation that inflation has peaked and early insight into the December meeting. UK specifics remain focused on the budget, and while there have been a handful of pertinent updates, primarily relating to domestic banking names, nothing has emerged to significantly change the narrative for rates at this point in time.

- UK sells GBP 1.25bln 4.75% 2030 Gilt by tender: b/c 3.75x, average yield 3.896%

- China began marketing a EUR bond sale to raise up to EUR 4bln; guidance was set at mid-swaps +28bps for the 4-year tranche and mid-swaps +38bps for the 7-year tranche, according to Bloomberg and the term sheet.

- Click for a detailed summary

COMMODITIES

- Crude benchmarks initially sold off during the APAC session as risk sentiment continued to sour but has pared back on earlier losses at the start of the European session. WTI and Brent dipped to a trough of 59.28/bbl and 63.62/bbl respectively before reversing higher to peak at 59.73/bbl and 64.07/bbl. Benchmarks currently continue to trade towards session highs, to make a fresh peak at USD 59.91/bbl and USD 64.25/bbl, for WTI and Brent respectively.

- Spot XAU has steadied above USD 4k/oz as the metal continues to struggle to act as a traditional safe haven during US equity selloffs. XAU fell throughout the APAC session from the open at USD 4044/oz to a trough of USD 4004/oz as the European session got underway. The yellow metal briefly dipped below US 4k/oz to a low of 3998/oz before attracting buyers that took price c. USD 45/oz higher to a high of USD 4042/oz as US data got released.

- Base metals have continued to drop, following the broader risk aversion. 3M LME Copper opened at USD 10.76k/t and gradually fell c. USD 100/t to a trough of USD 10.66k/t. The red metal has managed to find a base at these levels and currently, 3M LME Copper is trading in tight c. USD 70/t band at the lows of the day.

- Rio Tinto (RIO AT/RIO LN) reduced production at its Yawun alumina refinery to extend its operational life, with output set to decline by 1.2mln tonnes annually and the refinery’s production to be cut by 40% in 2026, according to Reuters.

- Goldman Sachs says as global LNG supply continues to rise faster than Asia demand, estimates that NW European storage will face congestion in 2028/29 which would pressure TTF and JKM low enough to reduce global LNG supply.

- Commerzbank expects copper and aluminium to reach USD 12,000/t and USD 3,200/t respectively in 2026. Zinc prices to settle around USD 3,000/t. Nickel prices to settle at USD 16,000/t.

- Click for a detailed summary

NOTABLE DATA RECAP

- US jobless claims at 232k in the October 18th week, via DOL; continuing claims 1.957mln. Note, the last release was for the week of the 20th of September at 219k for initial claims. The last release for continuing claims was for the week of October 11th at 1.947mln.

NOTABLE EUROPEAN HEADLINES

- EU Commission says definitive measures imposed consist of country-specific tariff rate quotas per type of ferroalloy, limiting the volume of imports to enter the EU duty free.

NOTABLE US HEADLINES

- JPMorgan COO Pinto says the US economy is not likely to enter a recession. On AI, says, there is likely to be a "correction" in AI valuations at some point. Upside for the S&P from here is relatively limited.

- US President Trump said he wants 1% inflation, according to Bloomberg.

- Apple (AAPL) iPhone sales surge in China, taking 25% share, according to Bloomberg citing Counterpoint.

GEOPOLITICS

MIDDLE EAST

- The UN Security Council adopted the US-led resolution establishing an international stabilisation force in Gaza, with 13 countries voting in favour while Russia and China abstained, according to Reuters.

- Hamas said the UN resolution imposes international trusteeship on Gaza, which is rejected by Palestinians and factions, and that the resolution does not meet Palestinian rights and demands, according to Reuters.

- US President Trump said the US will be selling F-35s (LMT) to Saudi Arabia.

RUSSIA-UKRAINE

- A White House official said President Trump would sign the Russia-sanctions bill if decision-making authority remains, according to Reuters.

- The US Treasury said sanctions against Rosneft and Lukoil are reducing Russian oil revenues and pushing Russian crude prices to multi-year lows, while Treasury OFAC analysis stated the sanctions may have a long-term negative effect on the volume of Russian oil sales.

- The Ukrainian military said a Russian missile attack targeted the east of the country, according to Al Arabiya.

- Ukraine's President Zelenskiy announces plans to go to Turkey on Wednesday to reinvigorate negotiations

OTHERS

- Japan’s Trade Minister Akazawa said there are currently no particular changes in China’s export-control measures on rare earths and other products, according to Reuters.

- North Korea said South Korea’s nuclear-propelled submarine will lead it to arm itself with nuclear weapons and said it will respond to the confrontational stance of the US–South Korea joint factsheet, via KCNA.

- The US Ambassador to Japan posted that the United States is fully committed to the defence of Japan, including the Senkaku Islands, and said nothing the China Coast Guard flotilla does can change that fact, via X.

CRYPTO

- Bitcoin briefly slipped below USD 90k overnight, but has since pared back towards USD 92k. Ethereum holds around the USD 3k mark.

APAC TRADE

- APAC stocks extended losses throughout the session following a similar lead from Wall Street, which had seen heavy losses on Monday. Overall newsflow in APAC hours was quiet, although tech stocks were among the laggards in the region.

- ASX 200 showed a clear defensive bias across its sectors, with tech the hardest hit. No obvious reaction was seen to the RBA minutes, which largely emphasised uncertainty and data-dependence.

- Nikkei 225 edged lower after the open and eventually surrendered the 49,000 level, falling as much as 3% intraday. Several additional factors on top of the global risk aversion could've exacerbated losses, including woes surrounding Japan–China relations and the recent JPY and long-end JGB weakness. Several Japanese officials verbally intervened throughout the session but failed to sway the index meaningfully.

- KOSPI lagged as the index joined the global stock rout, following the prior day's outperformance.

- Hang Seng and Shanghai Comp opened in the red and initially conformed to regional losses, with Hong Kong underperforming the Mainland amid its tech exposure.

NOTABLE ASIA-PAC HEADLINES

- BoJ Governor Ueda says he discussed the economy, inflation and monetary policy with Japanese PM Takaichi. Will decide on monetary policy while scrutinising various data. FX was discussed, won't comment on details. Desirable for FX to move to reflect fundamentals.

- Japanese Finance Minister Katayama said she is keeping an eye on markets with regard to fiscal policy and would not comment on FX levels, adding she is alarmed over FX moves; she said currencies should move in a stable manner reflecting fundamentals, and that the government will thoroughly monitor for excessive or disorderly forex fluctuations with a high sense of urgency. She noted concern over recent one-sided, rapid FX moves and said that while GDP avoided the worst, negative growth justifies a sizeable package, according to Reuters.

- Japan’s Economy Minister Kiuchi said long-term rate moves are determined by markets and that the government is watching market moves — including long-term rates — closely, according to Reuters.

- RBA November meeting minutes said it is appropriate in the current environment to remain cautious and data-dependent, with members determined they could remain patient while assessing incoming data on the extent of spare capacity. On rates, the minutes noted a mixed picture on whether policy remains restrictive — in contrast with the clearer signals seen in 2024 — and said the cash rate could be held at its current level if demand recovers more strongly than expected, while policy easing is still seen if the labour market weakens materially or growth disappoints; the Board said it is not possible to be confident about which scenario is more likely. The minutes said there may be a little more underlying inflationary pressure than previously assessed, noted the AUD remains close to equilibrium estimates, and said global growth is likely to slow in H2 2025, though the likelihood of a severe downside scenario has diminished, according to Reuters.

- Baidu Inc (BIDU) Q3 2025 (CNY): Adj. EPS 11.12 (exp. 8.16), Revenue 31.17bln (exp. 30.70bln).

- Xiaomi (1810 HK) Q3 2025 (CNY): Revenue 113.12bln (exp. 112.5bln), EV, AI, new initiatives profit 700mln.