NS

NSUS stocks gained amid a softer dollar and lower yield environment - Newsquawk Asia-Pac Market Open

- US stocks trended higher throughout the session, although futures were initially knocked on reports in the Information that Microsoft (MSFT) is lowering AI software quotas as multiple sales teams failed to hit quotas for AI product sales last year, which hit MSFT and other AI names in the pre-market. However, stocks had started to pare before accelerating once MSFT denied the story and equities moved higher throughout the US session. The advances were led by the Russell 2000, while the majority of sectors were in green with outperformance in energy and financials, although tech and utilities closed in the red.

- USD was broadly sold against peers amid the prospect of a more dovish Fed Chair in 2026 (Hassett) remaining the driver for USD performance. US data sent mixed signals as ADP printed a surprise negative reading (-32k vs exp. 10k), marking the fourth consecutive contraction in private employment this year, while ISM Services PMI beat on the headline, supported by an uptick in employment, although the reaction in the dollar was fairly muted towards the said data.

- Looking ahead, highlights include Australian Trade Data & Supply from Japan.

More Newsquawk in 2 steps:

1. Subscribe to the free premarket movers reports

2. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

LOOKING AHEAD

- Highlights include Australian Trade Data & Supply from Japan.

- Click for the Newsquawk Week Ahead.

US TRADE

- US stocks trended higher throughout the session, although futures were initially knocked on reports in the Information that Microsoft (MSFT) is lowering AI software quotas as multiple sales teams failed to hit quotas for AI product sales last year, which hit MSFT and other AI names in the pre-market. However, stocks had started to pare before accelerating once MSFT denied the story and equities moved higher throughout the US session. The advances were led by the Russell 2000, while the majority of sectors were in green with outperformance in energy and financials, although tech and utilities closed in the red.

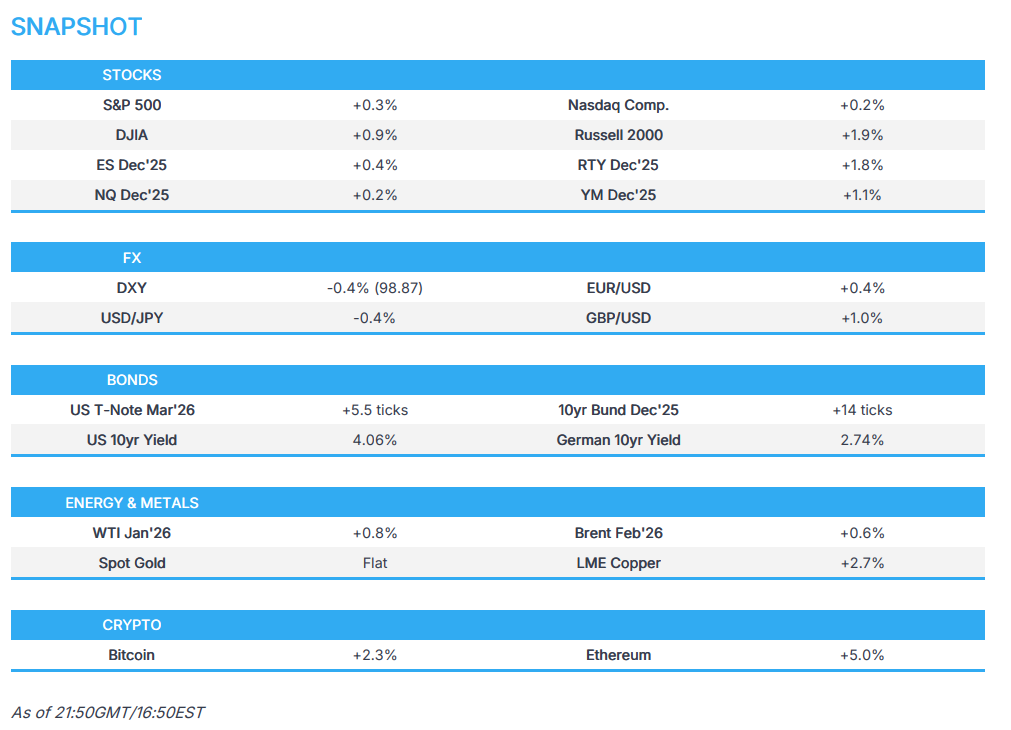

- SPX +0.30% at 6,850, NDX +0.20% at 25,607, DJI +0.86% at 47,883, RUT +1.91% at 2,512.

- Click here for a detailed summary.

TARIFFS/TRADE

- US Treasury Secretary Bessent said US President Trump has normalised the idea of a 15-20% tariff, while he added that tariffs have not set off an inflationary mindset and does not believe tariffs are a tax.

- NVIDIA (NVDA) CEO Huang said he met with US President Trump and discussed export controls generally in the meeting, while he supports export controls. Furthermore, Huang said they can't degrade chips that they sell to China, and he does not know if China would accept H200 chips.

- Brazilian President Lula said regarding the US potentially improving tariffs on more Brazilian products, that they can expect some good news soon.

NOTABLE HEADLINES

- US President Trump proposed to drastically slash fuel economy requirements through 2031, with the US proposing to require 34.5mpg average fuel economy by 2031, down from 50.4mpg under Biden rules.

- US Commerce Secretary Lutnick said tariffs aren't to blame for the negative ADP number, while he sees GDP above 4% in 2026 and noted there are idiosyncrasies in October due to the shutdown.

- Fox's Gasparino reported that Kevin Warsh's chances of becoming the next Fed Chair are "better than the media suggests", citing someone involved in the process. Gasparino also wrote that there is a last-ditch attempt by Wall Street and corporate America insiders to caution US President Trump about the selection of Kevin Hassett as Fed chair.

- Bond investors reportedly warned the US Treasury over picking NEC Director Hassett as Fed chair, according to FT. Some market participants were worried the candidate for the top central bank job will be swayed by President Trump on interest rates and were worried that Hassett could agitate for indiscriminate rate cuts even if inflation continues to run above the Fed’s 2% target, according to three people familiar with the conversations.

DATA RECAP

- US ADP National Employment (Nov) -32.0k vs. Exp. 10.0k (Prev. 42.0k, Rev. 47k)

- US Industrial Production MM (Sep) 0.1% (Prev. 0.1%, Rev. -0.3%)

- US Capacity Utilisation SA (Sep) 75.9% vs. Exp. 77.3% (Prev. 77.4%, Rev. 75.9%)

- US S&P Global Services PMI Final (Nov) 54.1 (Prev. 55)

- US S&P Global Composite PMI Final (Nov) 54.2 (Prev. 54.8)

- US ISM N-Mfg PMI (Nov) 52.6 vs. Exp. 52.1 (Prev. 52.4)

- US ISM N-Mfg New Orders Index (Nov) 52.9 (Prev. 56.2)

- US ISM N-Mfg Employment Idx (Nov) 48.9 (Prev. 48.2)

- US ISM N-Mfg Price Paid Idx (Nov) 65.4 (Prev. 70.0)

- US ISM N-Mfg Bus Act (Nov) 54.5 (Prev. 54.3)

FX

- USD was broadly sold against peers amid the prospect of a more dovish Fed Chair in 2026 (Hassett) remaining the driver for USD performance. US data sent mixed signals as ADP printed a surprise negative reading (-32k vs exp. 10k), marking the fourth consecutive contraction in private employment this year, while ISM Services PMI beat on the headline, supported by an uptick in employment, although the reaction in the dollar was fairly muted towards the said data.

- EUR benefitted from the weaker dollar, while there were several comments from ECB officials, including Lagarde who stated growth in economic activity should benefit from increased household spending and a resilient, more inclusive labour market, as well as noted they are not pre-committing to a particular rate path.

- GBP outperformed amid strength in cyclical currencies and reclaimed the 1.3300 status, while UK Services PMI data also topped forecasts.

- JPY strengthened amid the dollar selling and narrower US-Japan yield differentials, but with the downside in USD/JPY stemmed by support near 155.00.

- Polish NBP Base Rate (Dec) 4.00% vs. Exp. 4.00% (Prev. 4.25%)

FIXED INCOME

- T-notes settled higher but with price action choppy amid mixed data, including a weak ADP report and better-than-expected ISM Services PMI.

COMMODITIES

- Oil prices were marginally higher as further remarks from US/Russian officials were positive but suggested a lack of breakthrough at the meeting on Tuesday, while the EU said a legislative proposal to ban Russian oil imports will be put forward in early 2026, although Hungary oppose the proposal.

- US EIA Weekly Crude Stocks w/e 0.574M vs. Exp. -0.821M (Prev. 2.774M)

GEOPOLITICAL

MIDDLE EAST

- Israeli PM's office said Lebanon's ceasefire monitoring committee meeting saw agreement on formulating ideas to promote economic cooperation between Lebanon and Israel. Israel said it clarified that Hezbollah disarmament is obligatory, with no connection to promoting cooperation on economic issues, while parties agreed on holding a follow-up discussion.

- Israel's COGAT said the Rafah crossing will open in the coming days for Palestinians to exit from Gaza to Egypt.

RUSSIA-UKRAINE

- White House official said the US and Russia had a thorough and productive meeting, while Witkoff and Kusher briefed Trump after the meeting with Putin on Tuesday.

- Ukraine's Foreign Minister said US Special Envoy Witkoff spoke with Ukraine following talks in Russia, while Ukraine was invited for further talks in the near term in the US.

- Russia's Kremlin said it would be wrong to say that President Putin rejected the US peace plan. Kremlin stated that Russia highly values US President Trump's political will and is trying to find a resolution. Furthermore, it stated that they are ready to meet with the US as many times as needed to reach a resolution on Ukraine.

- Russian Kremlin aide Ushakov said the US has confirmed a willingness to account for Russian considerations and proposals, while he said talks with US representatives were very positive and hopes that Europe and Ukraine will take a "proper attitude", given recent battlefield developments. Furthermore, he said the question of Ukraine joining NATO was discussed, but made no further comment.

- European Commission President von der Leyen said the EU is proposing to cover two-thirds of Ukraine's financing needs for the next two years, which is EUR 90bln, with the remainder for international partners to cover, while the reparations loan would use cash balances from immobilised Russian assets in the EU.

- ECB's Lagarde said the third option in the EU proposal for Russian assets is 'stretched' and hopefully in compliance with international law and financial stability.

- Belgium's Foreign Minister said regarding the use of frozen Russian assets that the texts the Commission will table do not address their concerns in a satisfactory manner, and it is not acceptable to use the money and leave them alone facing the risks.

OTHER

- US imposed fresh Venezuela-related sanctions, according to the Treasury Department website.

- US reportedly mulls allowing Venezuela’s Maduro to relocate to Qatar, according to NY Post.

- UN Secretary General Guterres said regarding US strikes in Venezuela that international law is not compatible with that kind of strike and doesn't see military confrontations as a solution.

ASIA-PAC

NOTABLE HEADLINES

- China is reportedly likely to maintain the annual growth target of around 5% in 2026, while some advisors proposed a 4.5-5.0% target, according to Reuters citing sources.

- China's Foreign Minister Wang Yi met with his French counterpart in Beijing and said they should enhance communication and cooperation. Wang Yi hopes France will understand China's position on Japanese PM Takaichi’s remarks, while he said they should encourage parties to the Ukraine crisis to keep talking.

EU/UK

NOTABLE HEADLINES

- Spain's Economy Minister said they will only use about 25% of loans available from EU recovery funds, and that Spain has not seen any significant impact at a macro level from US tariffs, while Spain is confident that the EU-Mercosur trade deal can be signed by year-end.

- ECB's Lagarde said growth in economic activity should benefit from increased household spending and a resilient, more inclusive labour market, while she added that indicators of underlying inflation remain consistent with the ECB's 2% inflation medium-term target. Lagarde said they expect inflation to stay around their 2% target in the coming months, as well as noted that they will respond flexibly to new challenges as they arise and will consider as needed, new policy instruments in the pursuit of their price stability. Furthermore, she said they are not pre-committing to a particular rate path.

- ECB's Lane said inflation risk is not one-way, and they saw some upside surprise recently.

DATA RECAP

- UK S&P Global Services PMI (Nov) 51.3 vs. Exp. 50.5 (Prev. 50.5)

- UK S&P Global PMI Composite Output (Nov) 51.2 vs. Exp. 50.5 (Prev. 50.5)

- German HCOB Services PMI (Nov) 53.1 vs. Exp. 52.7 (Prev. 52.7)

- German HCOB Composite Final PMI (Nov) 52.4 vs. Exp. 52.1 (Prev. 52.1)

- French HCOB Services PMI (Nov) 51.4 vs. Exp. 50.8 (Prev. 50.8)

- French HCOB Composite PMI (Nov) 50.4 vs. Exp. 49.9 (Prev. 49.9)

- Italian HCOB Services PMI (Nov) 55.0 vs. Exp. 54 (Prev. 54)

- Italian HCOB Composite PMI (Nov) 53.8 vs. Exp. 53.2 (Prev. 53.1)

- EU HCOB Services Final PMI (Nov) 53.6 vs. Exp. 53.1 (Prev. 53.1)

- EU HCOB Composite Final PMI (Nov) 52.8 vs. Exp. 52.4 (Prev. 52.4)

- EU Producer Prices MM (Oct) 0.1% vs. Exp. 0.1% (Prev. -0.1%)

- EU Producer Prices YY (Oct) -0.5% vs. Exp. -0.4% (Prev. -0.2%)