VIX Distortions Abound As BofA Notes 'Volmageddon'-Triggering ETPs Are On The Rise Again

Historically VIX exchange-traded-products (ETPs) were a force to be reckoned with and clearly distorted the VIX derivatives market at the time – a phenomenon most evident on 05-Feb-18, now famously known as “Volmageddon”, when in a single day 1m VIX futures roughly doubled, causing the inverse ETP complex to get wiped out.

In the years after Feb18, the short VIX products remained a shadow of their former self while many of the long VIX products also languished partly due to high costs of carry.

But now, as BofA's Global Equity Volatility Research team explain in a detailed note today (Pro subs can read the full note here), the richness of the VIX futures complex is becoming a hot topic of conversation with investors once again.

At the center of the conversation is the role VIX ETPs may be playing.

Below, BofA dives more into the facts around the growth of the VIX ETP ecosystem and the different channels through which these products may be impacting markets.

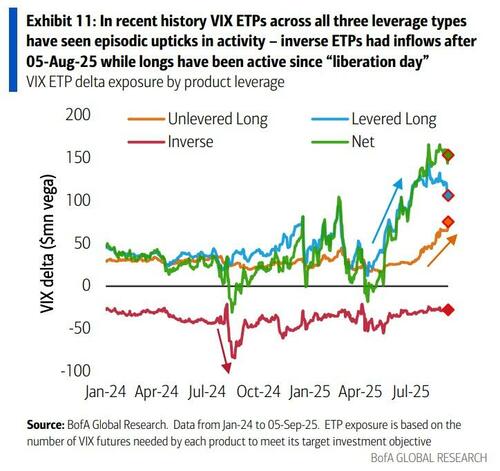

Over the last 1-2yrs there has been a notable (albeit sporadic) uptick in activity across all VIX ETP leverage types (and also VIX options).

On August 5th of last year, when the VIX index briefly touched 65 pre-market, some investors flooded into inverse VIX ETPs as one vehicle to sell the spike in vol.

On the other hand, in the wake of “liberation day” (02-Apr-25), levered-longs and unlevered-longs have seen material inflows.

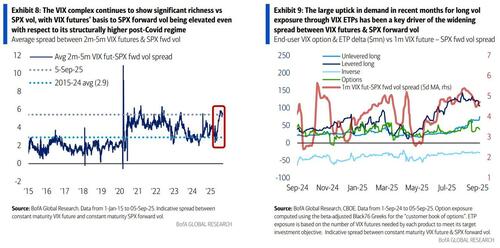

As we have also noted in prior weeks, the large inflows into long ETPs (especially levered longs) have coincided with the widening of the VIX futures basis to extreme levels.

While establishing causality is always challenging, there are compelling reasons to believe the ETP complex is in fact a key driver of the basis widening.

For example:

(i) the pace & size of the inflows to ETPs are historic in nature (>125mn increase in vega exposure from April to August, 96th %ile since 2014) and

(ii) the ETP user-base may be less price sensitive as ETPs often serve as an access product for many retail users to easily trade implied volatility.

Altogether these factors are the precise combination of ingredients one would expect to result in market impact and to potentially distort VIX futures away from “fair” value.

Beyond the VIX basis, the enlarged stature of the VIX ETP complex has important implications for both (1) the steepness of the VIX futures term structure and (2) the reactivity of VIX futures in a risk-off event.

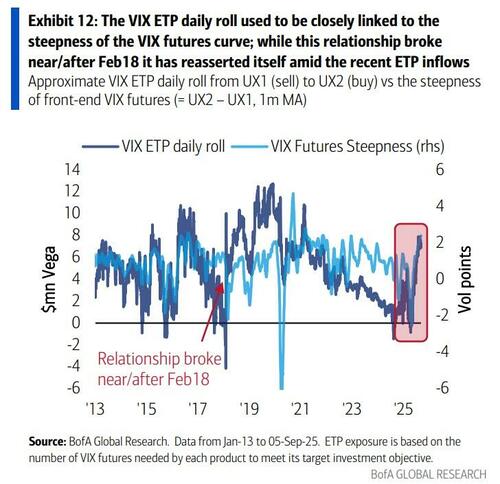

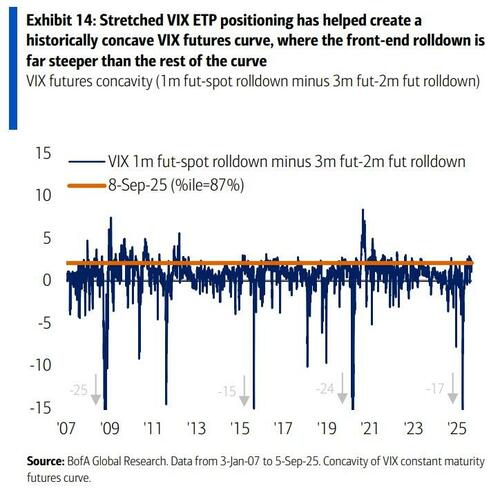

The daily ETP roll is steepening the futures curve: VIX ETPs typically seek to hold a combination of the front-two VIX futures contracts such that the weighted average maturity is 1-month.

In practice, this requires long ETPs (levered & unlevered) to each day sell a small portion of their UX1 holdings to buy UX2, thereby steepening the frontend of the term structure.

Short products meanwhile have the opposite impact. In the glory days of the VIX ETP market (pre-Feb18), the impact of this daily roll clearly made its mark on the futures term structure; while this relationship did break near/after Feb18 it has reasserted itself amid the recent revival of the ETP ecosystem .

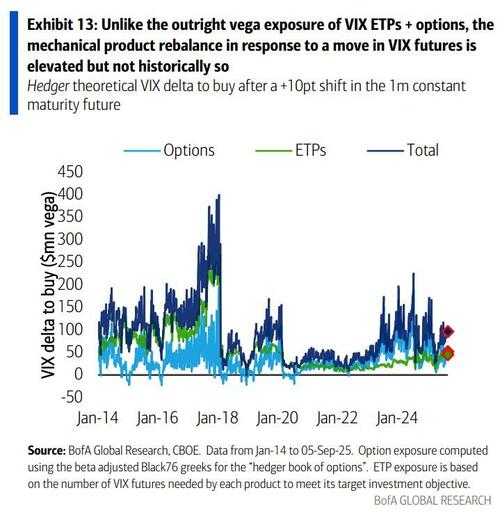

ETP impact on futures reactivity is both mechanical and behavioural: The impact of ETPs on the reactivity of VIX futures originates from two sometimes competing forces:

(i) the mechanical trading of VIX futures in response to a change in the futures level required for the ETPs to deliver their stated investment objective – buying VIX futures if futures have risen and selling if futures declined, similar to hedging a short gamma position in options; and

(ii) investors monetizing existing positions (outflows) or allocating new capital (inflows) to ETPs.

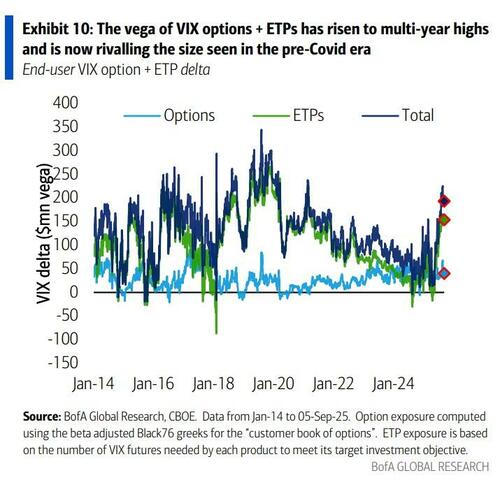

The mechanical rebalance of VIX ETPs & options in a +10pt vol shock is currently elevated (65th 10y %ile) but not to the same degree as the corresponding vega1 exposure which is at the highest level since 2021 (82nd 10y %ile).

This coupled with the fact that the majority of ETP exposure is in long products means that in a risk-off event the monetization of gains (which may result in the selling of VIX futures) may actually dampen the reactivity of VIX futures rather than increase it as one might expect purely from the mechanical rebalance.

As an interesting point, the vega of unlevered-long ETPs continues to rise (even with negative performance) due to inflows. Meanwhile the vega of levered-long ETPs peaked at the start of August and has been declining since.

This is relevant as both unleveredlong and levered-long ETPs may dampen vol reactivity through monetization, but the unlevered-longs do not need to mechanically rebalance in response to a move in VIX futures as the levered-longs do.

Consequently, insofar as investors may be substituting levered-long positions with unlevered-longs (a possibility consistent with inflows to unlevered-longs & outflows from levered-longs over the last week), the potential vol dampening from VIX ETPs in a risk off event may be growing.

Trading implications

How can investors take advantage of the risk premia and dislocations embedded in the VIX complex today?

BofA outlines several ideas below:

1. Fixed strike > vol-based hedges: Likely the most straightforward trading implication, as we have noted in recent weeks, is that fixedstrike equity option hedges (e.g. in S&P) should offer better value today than more convex, vol-based hedges, given the potential for unwinds of long VIX ETP positions to dampen vol reactivity in the next risk-off event.

2. VIX basis compression: At the other end of the complexity spectrum, investors can position for potential compression of the VIX basis to SPX forward volatility (see Exhibits 8 and 9 earlier) through short delta exposure to VIX futures and listed option replication of the long SPX forward vol leg.

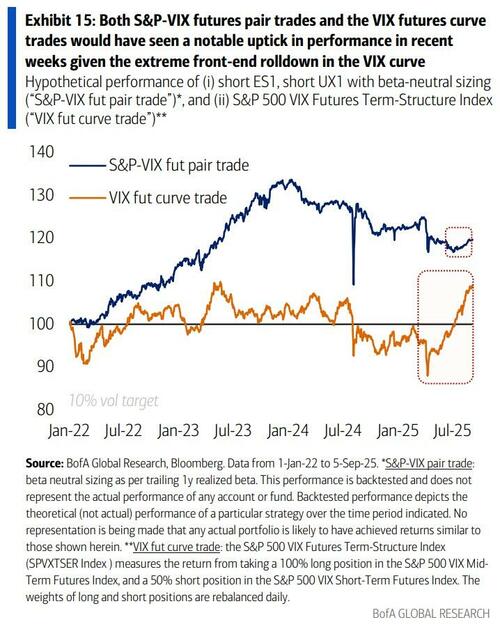

3. Short S&P, short VIX pair trade: Another relative value opportunity between SPX and VIX is to sell VIX futures, beta-neutralized by short S&P futures exposure. Such pair trades have seen an uptick in performance recently as VIX ETNdriven steepness at the front-end of the VIX curve has helped the “rolldown trade” outpace the US equity market rally. This strategy can also be an effective hedge against a grind lower in equities, as seen from the strong returns in 2022’s bear market.

4. VIX futures calendar spread: Within the VIX complex itself, the curve has become notably concave, with front-end rolldown (which is once again closely linked to the vega outstanding in VIX ETNs, as seen from Exhibit 12) far exceeding back-end rolldown.

Such curve trades have seen a strong revival in performance since Liberation Day and could have more room to run if (i) VIX ETP longs sustain term structure steepness at the front-end, and (ii) policy/macro uncertainty + Fed independence concerns sustain vol levels at the back-end. The trade is short tails/fragility as seen from its early-April drawdown, but with equity dip-buying seeing its second-best year since the GFC, and both Trump and the Fed likely to react to any material stress, we think an Autumn sell-off is likely to be a strong BTD opportunity that helps such curve trades recover quickly.

5. VIX curve trade in option format: Alternatively, one can express the VIX futures calendar trade via options, e.g., VIX put calendars that are long near-dated puts and short far-dated puts. This can reduce tail risk relative to the long-short futures implementation but comes with an uncertain buyback cost for the short VIX put (which can be high for longer-dated VIX options due to their slow time decay).

Professional subscribers can read the full BofA note here...