Wall Street's Biggest Bull Capitulates, Slashes S&P Target From 7000 To 6150

Exiting 2024, Deutsche Bank’s chief equity strategist Binky Chadha did what every (non) self-respecting sellside analyst does every November: he published a lengthy, repetitive report full of goalseeking charts which really did one thing: it applied a ruler to where the S&P had been in the past 12-18 months and extrapolated where the S&P would close the year (this extrapolation exercise - even though it may not be called that - it's an annual tradition among Wall Street strategists, one which inevitably wastes lots of vice presidents' and associates' time since it is virtually always wrong but bank clients have to see that their soft dollars end up encouraging their delusions, so everyone is bizarrely happy with the outcome).

What made Binky's forecast unique is that unlike his peers, he decided to position his extrapolating ruler in such a way that it showed the highest number among all his peers: indeed, his forecast that the S&P would close out 2025 at a price of 7,000, made quite a few headlines at the time (and making headlines is the only point of this insipid, shallow annual exercise in futility - it has nothing to do with being right or correctly predicting the future).

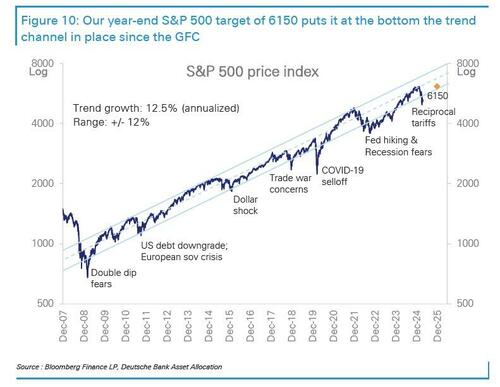

Well, this morning, Chadha finally capitulated and joined all of his fellow trend-following lemmings in slashing his S&P year-end price target by a whopping 12% to 6,150 from 7,000; In doing so, Wall Street's biggest permabull made even more headlines for having been the most wrong of all his peers. And he could be even more wrong: while his new target

still implies 14% upside, the DB strategist warned that a “credible relent” on trade policies is needed to get there.

To goalseek the dramatically lower new forecast, Chadha’s team also ended up forecasting that S&P 500 earnings would now slide by 5% this year, compared with a consensus expecting 8% growth.

In other words, having been dead wrong to the upside, Chadha is now hoping to be only modestly wrong to the downside, while really admitting he - like all his "predicting" peers - has no idea what is comign.

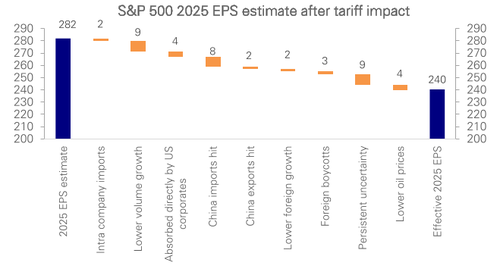

“With the potential impact of the announced tariffs large and likely to fall disproportionately on US companies, we lower our S&P 500 EPS estimate for 2025 from $282 to $240,” he wrote in a note, adding that the consensus view is at risk of further downgrades.

So what does the German bank sees now that it couldn't see in December, when it came out with its 7,000 original forecast, even though it already knew Trump will be president and also knew (or should have known) that tariffs were a bedrock of Trump's economic program (maybe it knew, it just had no idea that Trump would actually incorporate them, either way, why would anyone bother listening any more to what they, or anyone else have to say, remains a mystery). Well, the "strategists" now estimate that Trump's tariff (which they didn't believe believe before, but sure do now), would raise the rate on goods imports from 2.3% to 26.4%, effectively implying an $800 billion tax increase. That compares with a total US federal corporate tax revenue of about $500 billion in 2024.

Here are some more excerpts from the report:

- With the potential impact of the announced tariffs large and likely to fall disproportionately on US companies, we lower our S&P 500 EPS estimate for 2025 from $282 to $240, implying a decline of -5% from last year. We quantify the impacts of various channels: foreign supplier ability to absorb tariffs; the importance of intra-company imports; price increases traded off against volume declines; lost earnings from China imports and exports; slower foreign growth; potential backlash on US sales abroad; and persistent uncertainty.

- Looking for a wide range in equities near term (S&P 500 4600-5600). With equity positioning at the bottom of its historical range, the market is vulnerable to squeezes. While there have been several attempts at deescalation there has not been a credible relent on trade policy, while macro concerns have been mounting. The bottom of the range corresponds to the pricing in of a typical recession decline (-25%), while the upper end is in line with positioning returning close to neutral. We see successful passage of the fiscal package as potentially prompting a rally, but with any direct benefits for corporates dwarfed by the hit from tariffs, we see the rally as short lived.

- Further out, our base case remains for a significant rally on a credible relent on trade policies, with a target of 6150 by year end. A credible relent likely needs a significant decline in approval ratings. After the initial honeymoon period, approval ratings tend to align with what is happening in the economy and particularly with consumer confidence. Approval ratings have been falling but very slowly as growth has remained solid and inflation has not picked up yet. A move to the low 40s is likely necessary, while a full catch down would see them down to the mid-30s. The risk to our view is we don’t get a relent before the nonlinearities of recession kick in.

And just in case that Cramersque flip-flop wasn't funny enough, the bank added comedy to injury (for those who believed it the first time), and added that it there may be violent short squeezes... or there may be not. In any event, "in the absence of a credible relent on trade policy, macro concerns are mounting" and the bank sees the S&P 500 remaining in a wide range between 4600 and 5600.

But how do they get from a a low 5100 median price target to a year-end S&P that is 1000 points higher? Simple: they expect Trump will do their job for them, adding that for things to improve durably, the president will need to back down on his current trade policy, something Chadha sees likely to happen as pressure mounts on the government with the economy starting to deteriorate (although the longer it takes, the higher the chances of recessionary signs starting to manifest.)

“A credible relent likely needs a significant decline in approval ratings,” Chadha and his team wrote. “After the initial honeymoon period, approval ratings tend to align with what is happening in the economy and particularly with consumer confidence.”

Translation: stuff may happen... but it may not, it all really depends on what Trump does. Which of course the DB strategist could have just as easily said last December when he published his original report. Only he didn't. But this time he will be right.

To this we will only add: we may spend more time discussing the note... but we will not as we fully expect this to be yet another paperweight in 2-4 months time when stocks ramp higher and DB "unexpectedly" reverts back to its original 2025 price target.

And speaking of paperweights and wasting time, anyone who wishes to read the full DB report can do so here.