NS

NSWeekend News Roundup - Newsquawk Asia-Pac Market Open

- US President Trump is to be briefed on Tuesday on "some kinetic and many non-kinetic" options in Iran, Politico reports, citing two administration officials.

- US President Trump has now committed to some kind of US intervention in Iran, according to the Jerusalem Post.

- Over the weekend, Ukraine targeted three drilling platforms in the Caspian Sea owned by Lukoil.

- US President Trump on Friday said there may be another government shutdown on January 30th, "we'll see”.

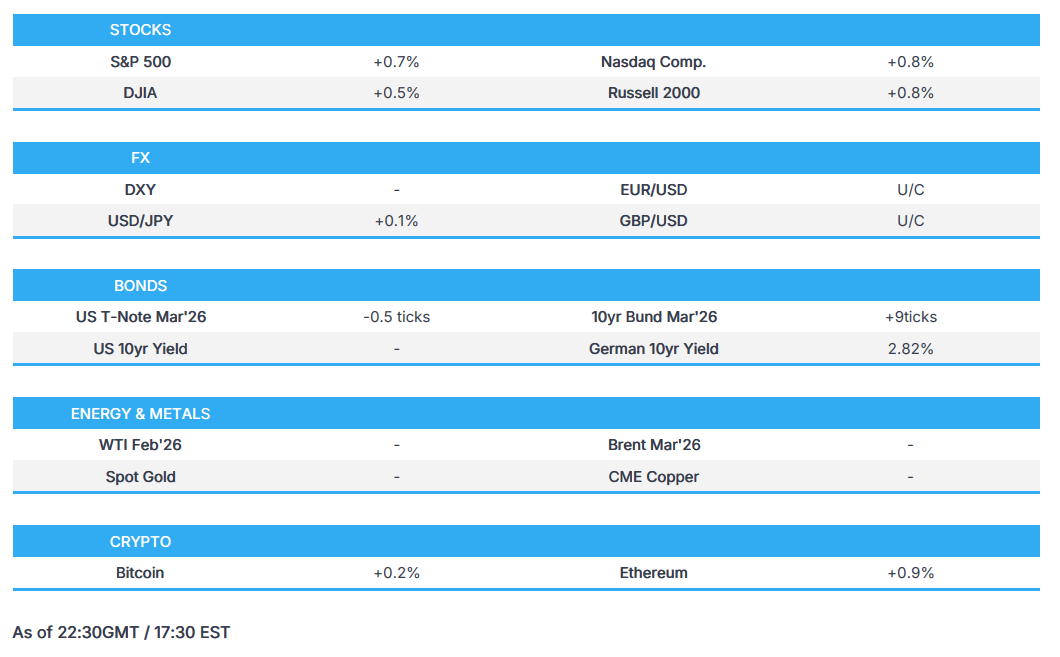

- US stocks were bid to end the week with outperformance in the Nasdaq after the underperformance on Thursday, with gains broad-based.

- Looking ahead, highlights include Australian ANZ Job Advertisements and a holiday in Japan (Coming of Age Day).

More Newsquawk in 2 steps:

1. Subscribe to the free premarket movers reports

2. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

SNAPSHOT

US TRADE

- US stocks were bid to end the week with the Nasdaq outperforming after Thursday’s underperformance, with gains broad-based; Equal-weight S&P +0.6%, and the majority of sectors closed green with materials and utilities outperforming, the former buoyed by metal prices and the latter buoyed by gains in Vistra (VST) and other nuclear power stocks after Meta (META) signed a deal with Vistra for its power.

- SPX +0.65% at 6,966, NDX +1.02% at 25,766, DJI +0.48% at 49,504, RUT +0.78% at 2,624

NOTABLE US HEADLINES

- US President Trump said on Friday that jobs report was an amazing report; on posting data early, they gave me some numbers, and when they do, I post.

- US President Trump on Friday said there may be another government shutdown on January 30th, "we'll see".

- US Supreme Court expected to issue rulings on Wednesday January 14th.

- US White House Economic Adviser Hassett said there is a detailed back-up plan for tariffs. The Fed needs to cut more. A lot of work done on getting reliable BLS figures.

- US President Trump is said to be considering issuing an order on California home building, CNBC reported.

- White House Economic Adviser Hassett said if the administration doesn't win the SCOTUS decision on tariff, then there will be other tools they can utilise to reach their goal, via CNBC. Adds that he has a high level of confidence that SCOTUS will side with the President. Administration is keeping a close eye on mortgage rates and said Trump is set to announce big, comprehensive housing plan. Increased labour supply will drive growth this year. Was with the president last night and they discussed GDP growth. Productivity is through the roof. There's a heck of a lot of economic growth does not necessarily mean huge jobs growth.

- The DOJ announced on Friday that it is creating an AI task force to challenge state-level regulations, CBS reports, citing an internal memo. The task force aims to allow AI firms to "be free to innovate without cumbersome regulation".

- White House said it is reviewing protocols regarding economic data releases; said there was an inadvertent public disclosure of aggregate data that was partially derived from pre-released information.

NOTABLE US EQUITY HEADLINES

- Beijing reportedly set to approve imports of NVIDIA (NVDA) chips, according to Semafor.

- EU is looking at potentially designating Meta's (META) WhatsApp as a very large platform.

- Meta (META) signs a multi-gigawatt nuclear deal to power AI data-centers, reported Bloomberg TV.

DATA RECAP

- US Non-Farm Payrolls (Dec) 50K vs. Exp. 60K (Prev. 64k, Rev. 56k); Two-month net revisions -76k.

- US Average Hourly Earnings MoM (Dec) M/M 0.3% vs. Exp. 0.3% (Prev. 0.1%, Rev. 0.2%).

- US Unemployment Rate (Dec) 4.4% vs. Exp. 4.5% (Prev. 4.6%, Rev. 4.5%). Unrounded: 4.375% (prev. revised 4.536%).

- US Michigan Consumer Expectations Prel (Jan) 55.0 vs. Exp. 54.2 (Prev. 54.6).

- US Michigan 5-Year Inflation Expectations Prel (Jan) 3.4% vs. Exp. 3.1% (Prev. 3.2%).

- US Michigan Consumer Sentiment Prel (Jan) 54.0 vs. Exp. 53.5 (Prev. 52.9).

- US Michigan Inflation Expectations Prel (Jan) 4.2% vs. Exp. 4.2% (Prev. 4.2%).

- US Michigan Current Conditions Prel (Jan) 52.4 vs. Exp. 50.5 (Prev. 50.4).

- US Building Permits Prel (Oct) 1.412M vs. Exp. 1.35M (Prev. 1.415M ).

- US Building Permits MoM Prel (Sep) M/M -0.2% vs. Exp. 0.8% (Prev. -2.3%).

- US Average Hourly Earnings YoY (Dec) Y/Y 3.8% vs. Exp. 3.6% (Prev. 3.5% ).

- US Building Permits Prel (Sep) 1.412M vs. Exp. 1.35M (Prev. 1.330M, Rev. 1.33M).

- US Building Permits MoM Prel (Oct) M/M -0.2% vs. Exp. 0.7% (Prev. 6.4% ).

- US CES Total Net Birth-Death Forecast (Dec): -67k (prev. -5k).

- US Average Weekly Hours (Dec) 34.2 vs. Exp. 34.3 (Prev. 34.3).

- US Housing Starts (Sep) 1.246M vs. Exp. 1.33M (Prev. 1.307M).

- US U-6 Unemployment Rate (Dec) 8.4% vs. Exp. 8.8% (Prev. 8.7%).

- US Housing Starts MoM (Sep) M/M -4.6% vs. Exp. 1.0% (Prev. -8.5%).

- US Participation Rate (Dec) 62.4% vs. Exp. 62.6% (Prev. 62.5%).

- US Nonfarm Payrolls Private (Dec) 37K vs. Exp. 64K (Prev. 69k, Rev. 50K).

- US Manufacturing Payrolls (Dec) -8K vs. Exp. -5K (Prev. -5K, Rev. -2K).

- US Government Payrolls (Dec) 13.0K vs. Exp. -10.0K (Prev. -5k, Rev. 6K).

- Atlanta Fed GDPNow (Q4): 5.1% (prev. 5.4%), following metrics from the BLS and Census Bureau.

TARIFFS/TRADE

- US Commerce Dept. drops plan to impose restrictions on Chinese-made drones, according to a filing.

- Japan's Finance Minister said Japan needs to take away China's power to 'weaponize' rare earths. "We want to create a [rare earth] market of proper democracies and market economies.". "If we don't take away China's means" of monopolizing and weaponizing the metals, "it will become a constant threat in areas with nothing to do with security.".

- EU Ambassadors have voted by a qualified majority to support the EU-Mercosur trade deal, RTE's Connelly reported. France, Poland, Austria, Ireland and Hungary expressed opposition. Belgium abstained. The remaining nations' ambassadors approved the deal.

- US GOP is reportedly pushing ahead to prevent China from getting access to US tech such as chips, via Axios.

- On rare earths, Bessent is expected to urge G7 nations and others to increase their efforts to reduce their reliance on critical minerals from China, according to a senior official.

CENTRAL BANKS

- Fed's Barkin (2027 voter) said the drop in the unemployment rate is welcome and that it may take until April for inflation data to be fully caught up. Hard to find firms outside of Healthcare or AI who are hiring. Job growth is modest, very much in line with low-hiring and low-firing continuing. Narrowness of hiring is "uncomfortable". Does not hear cost of interest being cited as a major problem for businesses. In theory, lower labour supply and lower job growth is a reasonable balance. It is not clear whether the job market will break towards more hiring or more firing. Believes there is actual change in productivity. Demand growth still seems quite healthy. Coming data will be important, it is still not trivial that the Fed is still trying to catch up with gaps from the shutdown. Real solution to housing is supply, more homes need to be built. Jobs data can now be taken at face value. On inflation, it will take more time to make up for missing reports from last fall.

- Fed's Bostic (Retiring) said high end consumers have been spending, in many ways, US has long had a K-shaped economy; economy has been resilient, speaking via WLRN radio. Important they get inflation under control, inflation issues are still one of the economy's main challenges. Cost pressures are not just from tariffs. No hire, no fire continues to be a key labour market dynamic. Fed's job and inflation mandates are somewhat in tension. Inflation is 'a lot' above the 2% target. Need to be 'laser focused' on lowering inflation. This is a time for the Fed not to lose sight of its inflation mission. Hearing about stress from sectors that depended on foreign workers.

- Morgan Stanley expects the Fed to cut by 25bps in both June and September (prev. saw 25bps in both January and April).

- Citigroup (C) expects Fed to deliver 25bps rate cuts in March, July, and September each vs prior forecast of cuts in January, March, and September this year.

- Eurogroup receives six candidates to replace ECB VP de Guindos after May 2026; Centeno (Portugal), Kazaks (Latvia), Muller (Estonia), Rehn (Finland), Sadzius (Lithuania), Vujcic (Croatia). On January 19th, Eurogroup will discuss the candidates.

COMMODITIES

- Trafigura CEO expects to load first vessel for Venezuelan oil exports to the US next week.

- China buys at least 10 cargoes of US soybeans for April-May shipment, according to traders.

- US President Trump said US oil companies will have security guarantees; Venezuela seems to be an ally; tells oil companies they'll start with "even plate".

- US President Trump said China and Russia we don't want them in Venezuela; China can buy all the oil they want from the US and Venezuela. We'll be "open for business" almost immediately.

- US President Trump said the US, in coordination with Venezuela, seized an oil tanker which departed Venezuela without approval; the oil will be sold through the energy deal they have created.

- US Baker Hughes (9th Jan): Oil -3 at 409, Natgas -1 at 124, Total -2 at 544.

- Reliance is reportedly in talks with the US government for authorisation to import crude from Venezuela, according to sources.

- US Interior Secretary said Venezuela will help lower gasoline prices in the US. To add, US Energy Secretary Wright said so far oil companies have not asked the administration for money; on whether US will take stakes, no talk about that yet.

- UAE's ADNOC lowers crude OSP to USD 63.06/bbl for February (vs January's 65.53).

- Thailand could reportedly limit online gold trading by THB 100-200mln per person.

- BofA raises its 2026 average palladium price forecast to USD 1725/oz. Raises platinum price forecast to USD 2450/oz.

- Russian crude oil production came in at 9.33mln BPD in December, Bloomberg reported; over 100k BPD below November's level due to drone activity and the impact of sanctions.

GEOPOLITICAL

MIDDLE EAST

- US President Trump is to be briefed on Tuesday on "some kinetic and many non-kinetic" options in Iran, Politico reports citing two administration officials.

- US President Trump has now committed to some kind of US intervention in Iran, according to Jerusalem Post.

- Iran, in letter to UN, said US is to blame for the transformation of peaceful process into violent subversive acts and widespread vandalism.

- US President Trump said capturing Putin not necessary; we are watching Iran very closely; US will get involved if Iran started killing people, that doesn't mean boots on the ground. Iran is in big trouble. Don't want Russia or China going to Greenland. Not talking about money for Greenland yet. We'll do something on Greenland whether they like or not; will make a deal the easy way or hard way.

- Iran prosecutor said rioters causing damage face the death penalty.

- Iran's IRGC said the continuation of the current situation is unacceptable.

- Downing Street Spokesperson said the leaders agreed on the need for close coordination as events evolved in Iran and PM Starmer reiterated his support for those who exercised their right to peaceful protest.

- Iran's foreign minister said possibility of foreign military intervention in Iran is very low.

- Iran UN Mission said US and Israel are trying to engineer a civil war.

- US President Trump posted on Truth Social platform on Saturday, suggesting the US "stands ready to help" Iran as the country looks for freedom "like never before".

- The US Central Command, CENTCOM, announced that the US and partner forces conducted a series of airstrikes on ISIS targets throughout Syria on January 10th.

- Israel is considering a new round of clashes with Hamas as the militant group refuses to disarm, WSJ reports. Within the report, it states that the Israeli army has prepared plans for a new ground operation inside the areas controlled by Hamas in Gaza. Furthermore, Israeli PM Netanyahu has ordered the preparation of an emergency plan for Gaza due to doubts about the possibility of success in efforts to disarm Hamas.

- White House Deputy Chief of Staff Miller posted on X " In ten days, justice will be restored. Fully and absolutely."

RUSSIA-UKRAINE

- Over the weekend, Ukraine targeted three drilling platforms in the Caspian Sea owned by Lukoil. Elsewhere, Russian troops struck a Ukrainian military-industrial and energy facilities, according to TASS.

- US President Trump said he told China and Russia we don't want them in Venezuela; China can buy all the oil they want from the US and Venezuela. We'll be "open for business" almost immediately.

- Ukraine President Zelensky said US President Trump should enter a free trade deal with Ukraine.

- Russia has, according to Ukraine, hit two vessels in ports in the region of Odesa.

- UK PM Starmer said Russia was using fabricated allegations to justify the Oreshnik attack and the use of ballistic missile was escalatory and unacceptable.

- EU Foreign Representative Kallas said member nations must "dig deeper into their air-defence stocks and deliver now." and further raise the cost of the war for Russia, via tougher sanctions.

US-VENEZUELA

- US Treasury Secretary Bessent says the US is de-sanctioning the Venezuelan oil that is going to be sold. He adds that further sanctions may be removed next week. Furthermore, he states that the US is willing to convert Venezuela's SDRs to dollars to aid reconstruction and will meet with the World Bank and the IMF next week on the re-engagement with Venezuela.

- US President Trump said US oil companies will have security guarantees; Venezuela seems to be an ally; tells oil companies they'll start with "even plate".

- US President Trump said they are getting along well with the interim government in Venezuela. Venezuela supplied 30mln barrels of oil to the US yesterday worth USD 4bln. Will make decision about which oil companies will go into Venezuela. US to immediately begin refining and selling up to 50mln bbls of Venezuelan oil. Giant oil companies will spend USD 100bln of their money. Will have another meeting next week.

- Venezuelan minister said Rodriguez not expected to leave country soon; Rodriguez will not carry out an international trips in near future, must focus on domestic agenda.

- Venezuelan government said it has begun exploratory diplomatic phase with the US, with view to reestablishing diplomatic presence.

- US President Trump signed an Executive Order declaring a National Emergency to safeguard Venezuelan oil revenue held in US Treasury accounts.

OTHER

- The UK and Germany are pushing a joint NATO mission in Greenland to monitor and protect security interests in the Arctic region. To add, German Foreign Minster Wadephul said if there are security concerns in the North Atlantic, they must be discussed within the NATO framework.

- On Greenland, US President Trump has reportedly asked military commanders to prepare invasion plans, the Daily Mail reports.

- US President Trump believes he will always get along with Europe, NY Times reported; wants the US to own Greenland.

- Greenland floats meeting US alone without Denmark, according to FT.

- US President Trump will meet with Colombian President Petro during the first week of February; said he is sure it will work out very well for Colombia and the USA, but cocaine and other drugs must be stopped from coming into the US.

- Mexico President Sheinbaum said we will strengthen communication with the US government following US President Trump's comments on carrying out ground attacks on drug traffickers.

- US in the process of seizing the Olina tanker in the Caribbean, according to officials, seizure reportedly taking place near Trinidad.

- On Cuba, US President Trump has urged Cuba to "make a deal" or face consequences, warning that the flow of Venezuelan oil and money would now stop.

ASIA-PAC

NOTABLE HEADLINES

- Barclays cuts its CPI forecast for China in 2026 to 0.4% (prev. 0.8%).

- Ishin party leader Yoshimura says he met with Japan PM Takaichi on Friday and states that he would not be surprised if the PM calls for a snap election. This comes following media reports on Friday that PM Takaichi was considering an early general election.

- Chinese firms have applied to put more than 200,000 satellites in space as Beijing accuses SpaceX of crowding shared orbital resources, according to SCMP.

- China's MOFCOM says its key priorities are to strengthen legal frameworks, improve export controls, and enhance risk prevention to safeguard supply chain resilience and national security.

NOTABLE APAC DATA

- Indian Foreign Exchange Reserves (Jan/02) 686.80 (Prev. 696.61, Rev. 696.61).

- Indian Bank Loan Growth YoY (Dec/26) Y/Y 14.5% (Prev. 12% ).

- Indian Deposit Growth YoY (Dec/26) Y/Y 12.7% (Prev. 9.4% ).

EU/UK

NOTABLE HEADLINES

- Italy's PM Meloni rules out snap elections after justice reform referendum.

- France's budget minister warned that no budget will be adopted before March if the government is toppled in next week's vote of confidence. To add, French Finance Minister Lescure says President Macron would dissolve the National Assembly and call a snap election if the government falls.

- The EU is demanding a clause that any future British government pay significant financial compensation if it quits a post-Brexit "reset" deal, as part of a negotiation with UK PM Starmer, the FT reports, citing a draft text.

DATA RECAP

- Spanish Business Confidence (Dec) -3.5 vs. Exp. -2.8 (Prev. -3.2, Rev. -3.0).

- Italian 12-Month BOT Auction 2.112% (Prev. 2.181% ).

- EU Retail Sales MoM (Nov) M/M 0.2% vs. Exp. 0.1% (Prev. 0.3%, Rev. 0%).

- EU Retail Sales YoY (Nov) Y/Y 2.3% vs. Exp. 1.6% (Prev. 1.9%, Rev. 1.5%).