This Is What Hedge Funds Bought And Sold In Q3 '25: Full 13F Summary

By far the biggest news from the conclusion of this quarter's 13F season, was the in what may be his last act as CEO of Berkshire, Warren Buffett decided to buy a $5 billion stake in GOOGL with the stock at all time highs, and trading at a 28x PE. RIP value investing: an appropriate farewell now that markets are all just vibes, moment and central bank liquidity.

But what a senile, 95-year old billionaire does with his pocket change was just the highlight: there was quite a bit more action in Q3, when more hedge fund managers pared positions in Mag 7 stocks as the artificial intelligence-fueled rally in U.S. equities lost steam.

According to Bloomberg calculations, over 140 funds reduced their holdings of Apple, while 118 increased their stakes, according to the latest 13F filings. Berkshire also trimmed its position in the iPhone maker by 15%, leaving a $60.7 billion stake as of Sept. 30.

Holdings of CoreWeave dropped $5.83 billion, the biggest decrease by market value during a tough stretch for the company. In addition to pressure on AI stocks and weak guidance, Core Scientific shareholders rejected the company’s takeover bid, dealing a blow to its expansion efforts. Magnetar sold 13.83 million shares in CoreWeave shares, the biggest reduction by the investor group; Coatue sold 11.07 million shares.

The investment firms of hedge fund billionaire David Tepper and duty-free shopping tycoon Alan Parker cut their Oracle positions, with Tepper’s Appaloosa LP offloading its entire stake, which was valued at $32.8 million on Sept. 30.

Bloomberg has so far analyzed 13F filings by 909 hedge funds. Their combined holdings amounted to $1.098 trillion, compared with $ 1.021 trillion held by the same funds three months earlier.

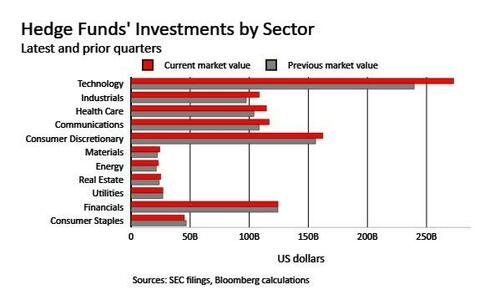

Technology stocks accounted for the biggest weighting in the investor group’s portfolios, at 26%, followed by consumer siscretionary, at 16%. The value of investments in consumer staples fell by the most for any industry. The biggest increase was in technology shares.

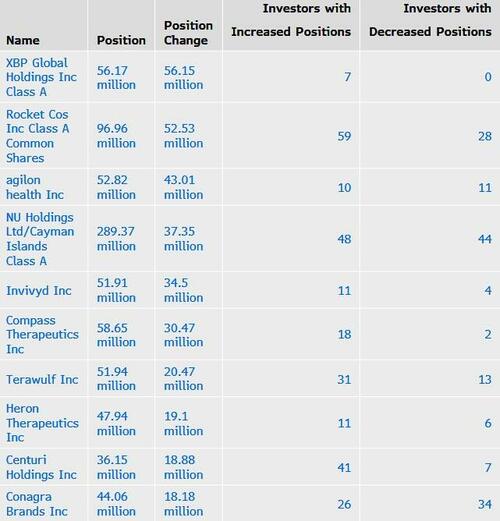

Biggest increase in aggregate position

Here are some of the highlights:

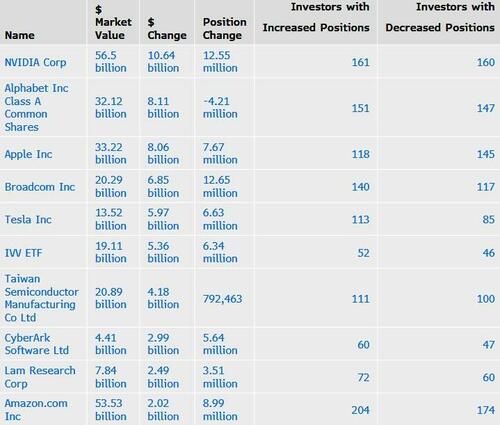

- NVIDIA was the most valuable overall holding at $56.5 billion

- Appaloosa also sold its entire stake in Intel Corp. and most of its position in UnitedHealth Group Inc. The health-care company was a popular buy among family offices in the second quarter of this year. It acquired new positions in American Airlines Group Inc. and KeyCorp.

- WIT LLC, an investment vehicle for the Walton family of Walmart Inc., increased its stake in the Vanguard FTSE Emerging Markets ETF.

- Positions also diverged for gold during a quarter when prices for the precious metal climbed by about 17%. Gruss & Co., an investment firm for the descendants of financier Joseph Gruss, boosted its stake in the SPDR Gold Shares fund, while Summer Road LLC, a Sackler family office, trimmed its stake in two gold-linked ETFs.

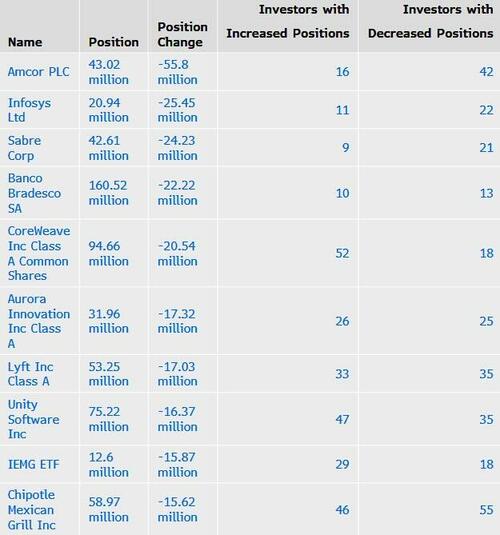

- Eminence Capital LP sold 14.17 million shares in Amcor PLC, the biggest reduction by the investor group; Two Sigma Advisers LP sold 8.17 million shares

- Millennium Management LLC/NY added 10.2 million shares in NVIDIA, the largest increase; Holocene Advisors LP added 7.11 million shares

- Gates Capital Management Inc added 31.93 million shares in XBP Global Holdings Class A, the largest increase; Avenue Capital Management II LP added 12.11 million shares

- Amazon.com was cut or reduced by 174 investors, the biggest such number; Amazon.com was also increased or initiated by 204 investors, the biggest tally

Biggest increase in aggregate position

Biggest Decrease in Aggregate Position

Biggest Increase in Market Value

Biggest Decrease in Market Value

* * *

Here is a detailed breakdown of all the marquee names:

TCI Fund Management discloses updated portfolio positions in 13F filing: Added to V MCO SPGI, Exited GOOGL, Lowered GOOG CNI CP MSFT holdings

Highlights from Q3 2025 filing as compared to Q2 2025 (all amounts are approximate):

- Increased: V (28.06 mln shares from 19.07 mln shares), MCO (13.31 mln from 13.25 mln), SPGI (11.19 mln from 11.09 mln)

- Maintained: GE (47.51 mln shares), FER (19.47 mln)

- Exited: GOOGL (3.16 mln shares)

- Decreased: GOOG (7.6 mln shares from 12.97 mln shares), CNI (18.77 mln from 22.99 mln), CP (49.87 mln from 52.83 mln), MSFT (16.59 mln from 17.57 mln)

* * *

Miller Value Partners (Bill Miller) discloses updated portfolio positions in 13F filing: New ITRN UPS CALM positions, Added to CNDT AXL JELD GCI NBR CTO

Highlights from Q3 2025 filing as compared to Q2 2025 (all amounts are approximate):

- New: ITRN (215K), UPS (87K), CALM (62K), UPBD (20K)

- Increased: CNDT (4 mln from 2.8 mln), AXL (1.7 mln from 1.4 mln), JELD (2.1 mln from 1.9 mln), GCI (3403K from 3285K), NBR (673K from 624K), CTO (429K from 399K)

- Maintained: GTN (3.6 mln), VTRS (619K), STLA (390K), VZ (198K), ARLP (127K), BMY (108K), CHRD (53K), MSTR (15K),

- Exited: DEA (147K)

- Decreased: FOSL (3.3 mlnfrom 3.5 mln), QUAD (2623K from 2710K), UNFI (73K from 137K), BFH (270K from 327K), OMF (92K from 149K), LNC (521K from 569K), BKE (72K from 105K), JXN (94K from

125K), CG (40K from 70K), UGI (262K from 292K), WAL (63K from 83K), BBW (98K from 105K), TPC (7K from 13K), BCC (37K from 40K)

* * *

Eminence Capital (Ricky Sandler) discloses updated portfolio positions in 13F filing: New THC NCLH SYY MDB SNPS STX positions, Exited AMCR FRSH JHX, Added to GPK CPNG JEF PINS DKNG

Highlights from Q3 2025 filing as compared to Q2 2025 (all amounts are approximate):

- New: THC (1.11 mln shares), NCLH (1.1 mln), SYY (522K), MDB (433K), FLR (405K), SNPS (163K), STX (39K)

- Increased: GPK (7.65 mln shares from 2.89 mln shares), CPNG (9.43 mln from 6.84 mln), JEF (3.36 mln from 1.46 mln), PINS (6.72 mln from 5.15 mln), DKNG (6.27 mln from 4.76 mln), WK (3.72 mln from 2.65 mln), GTLB (7.21 mln from 6.22 mln), LPX (3.12 mln from 2.89 mln), DT (3.4 mln from 3.23 mln), CF (1.34 mln from 1.18 mln), AMZN (1.55 mln from 1.51 mln), ATMU (6.52 mln from 6.45 mln), ELV (367K from 241K), FWONK (2 mln from 1.9 mln), AMD (1.5 mln from 1.4 mln), MGRC (945K from 895K), CRM (831K from 787K), LPLA (588K from 552K), FND (179K from 154K), META (59K from 55K)

- Exited: AMCR (from 14.2 mln shares), FRSH (7.3 mln), JHX (3.1 mln), SXT (1.0 mln), OKTA (980K), IBP (945K), EVR (447K), FRPT (339K)

- Decreased: S (2.1 mln shares from 7.1 mln shares), SGI (1.5 mln from 3.2 mln), Z (2.5 mln from 4 mln), WBD (4.8 mln from 6.2 mln), PTON (15.09 mln from 16.2 mln), RRR (2.4 mln from 3.1 mln), PFGC (1.7 mln from 2.25 mln), PLAY (2.36 mln from 2.91 mln), LEN (993K from 1.5 mln), BABA (866K from 1.1 mln), UNH (397K from 575K), CWH (4 mln from 4.1 mln), FERG (674K from 784K), FLUT (373K from 445K), SE (1.48 mln from 1.55 mln), ABG (972K from 1.0 mln)

* * *

Baupost Group (Seth Klarman) discloses updated portfolio positions in 13F filing: New COLD UNP GPC positions, Added to QSR ELV, Exited VSAT AMCR ICLR, Cut GOOG WCC CRH WTW

Highlights from Q3 2025 filing as compared to Q2 2025 (all amounts are approximate):

- New: COLD (3.6 mln shares), UNP (1.5 mln), GPC (1.4 mln)

- Increased: QSR (8.25 mln shares from 4.1 mln shares), ELV (1.3 mln from 0.6 mln), EXP (940K from 676K), FERG (1.16 mln from 1.13 mln)

- Maintained: FIS (3.8 mln shares), DG (2.7 mln)

- Exited: VSAT (from 9.2 mln shares), AMCR (5.5 mln) ICLR (0.4 mln)

- Decreased: GOOG (1.9 mln shares from 2.6 mln shares), WCC (1.5 mln from 2.2 mln), CRH (3.4 mln from 3.8 mln), WTW (1.1 mln from 1.3 mln)

* * *

Meritage Group discloses updated portfolio positions in 13F filing: New EFX position, Added to WDAY, Exited ABNB ADI

Highlights from Q3 2025 filing as compared to Q2 2025 (all amounts are approximate):

- New: EFX (170K shares)

- Increased: WDAY (1.49 mln shares from 1.28 mln shares), MSCI (415K from 311K)

- Maintained: QSR (3.28 mln shares), SGI (3.04 mln), PCOR (2.73 mln), COF (2.32 mln), AMZN (2.26 mln), A (1.33 mln), MSFT (1.12 mln)

- Exited: ABNB (from 1.3 mln shares), ADI (398K), SPY (106K)

- Decreased: TRU (5.5 mln shares from 5.9 mln shares)

* * *

Appaloosa (David Tepper) discloses updated portfolio positions in 13F filing: New AAL KEY TFC AMD positions, Exited INTC ORCL

Highlights from Q3 2025 filing as compared to Q2 2025 (all amounts are approximate):

- New: AAL (9.25 mln shares), KEY (2.02 mln), TFC (1.39 mln), AMD (950K), FISV (925K), CFG (600K), CMA (463K), ZION (285K), WAL (195K), OC (162K)

- Increased: WHR (5.5 mln shares from 266K), GT (5.14 mln from 862K), KWEB (7.4 mln from 4 mln), QCOM (1.25 mln from 350K), BIDU (1.05 mln from 625K), NVDA (1.9 mln from 1.75 mln), FXI (1.11 mln from 1 mln), MHK (161K from 65K), TSM (1.06 mln from 1.03 mln)

- Maintained: ET (4.96 mln shares)

- Exited: INTC (from 8 mln shares), BEKE (1.5 mln), ORCL (0.15 mln)

- Decreased: LYFT (5.6 mln shares from 8 mln shares), JD (6.23 mln from 7 mln), BABA (6.45 mln from 7.07 mln), VST (1.25 mln from 1.8 mln), UBER (2.4 mln from 2.8 mln), DB (3.8 mln from 4 mln), AMZN (2.5 mln from 2.7 mln), PDD (1.8 mln from 2 mln), GLW (1.6 mln from 1.8 mln), MPLX (535K from 579K), RTX (510K from 585K), MU (500K from 825K), DAL (463K from 550K), UAL (463K from 550K), MSFT (463K from 500K), XYZ (370K from 642K), LRCX (370K from 400K), META (370K from 400K), LHX (300K from 350K), IQV (285K from 300K), UNH (204K from 2450K), ASML (64K from 70K)

* * *

Leon Cooperman discloses updated portfolio positions in 13F filing: New AMRZ OXY positions, Added to DMAC MIR, Exited FISV

Highlights from Q3 2025 filing as compared to Q2 2025 (all amounts are approximate):

- New: AMRZ (880K), OXY (338K)

- Increased: DMAC (3.27 mln shares from 1.65 mln shares), MIR (8.38 mln from 7.13 mln), FIHL (6.66 mln from 5.81 mln), AESI (5.37 mln from 5.16 mln), GEHC (0.6 mln from 0.4 mln), SUN (1.6 mln from 1.5 mln), EPD (1.32 mln from 1.27 mln), CI (325K from 212K), ELV (341K from 281K)

- Maintained: ET (13.1 mln shares), STKL (6.67 mln), WSC (4.0 mln), COOP (2.9 mln), MANU (2.9 mln), VRT (2.2 mln), KBR (1.8 mln), ASH (1.7 mln), APO (1.3 mln), RRX (736K), SE (326K), LAD (318K), MSI (135K)

- Exited: FISV (0.39 mln shares)

- Decreased: OMF (840K from 1.1 mln shares), MP (3 mln from 3.2 mln), ABR (1.7 mln from 1.8 mln)

* * *

Long Pond (John Koury) discloses updated portfolio positions in 13F filing: New COLD JHX KREF positions, Exited PGRE AIV WH, Added to IRT LXP CPT CZR MHO, Cut SMRT FUN HGV

Highlights from Q3 2025 filing as compared to Q2 2025 (all amounts are approximate):

- New: COLD (7.8 mln shares), JHX (7.3 mln), KREF (2.3 mln), AMH (1.6 mln), NXRT (544K), PLYM (492K), SHO (485K), ELS (355K), CSR (213K), EQR (20K)

- Increased: IRT (12.3 mln shares from 5.5 mln shares), LXP (3.8 mln from 0.15 mln), NSA (3.85 mln from 2.5 mln), CPT (1.95 mln from 1.02 mln), CZR (959K from 91K), MHO (228K from 122K)

- Maintained: INN (9.4 mln shares)

- Exited: PGRE (from 2.3 mln shares), AIV (1.7 mln), WH (1.5 mln), DBRG (1.3 mln), RRR (903K), KRC (785K), DHI (745K), TOL (642K), SPG (209K), JLL (201K)

- Decreased: SMRT (6.07 mln shares from 10.07 mln shares), FUN (290K from 3297K), HGV (648K from 1311K), JBGS (3.3 mln from 3.8 mln), H (318K from 921K), TRTX (6.9 mln from 7.3 mln), MTH (47K from 278K), TMHC (1.4 mln from 1.6 mln), PLD (3K from 35K), MAA (68K from 94K)

* * *

Soros Capital discloses updated portfolio positions in 13F filing: New WULF NBIS GOOGL positions, Exited FXI SMH

Highlights from Q3 2025 filing as compared to Q2 2025 (all amounts are approximate):

- New: WULF (451K), NBIS (229K), GOOGL (126K), INOD (98K), BABA (69K), PLTR (40K), BWXT (39K), B E (37K), GEV (31K), ARES (27K)

- Increased: EWY (308K from 229K), AMAT (111K from 84K), AEO (40K from 18K), TSM (85K from 64K), ALC (80K from 68K), CP (62K from 51K), GDDY (37K from 29K), DHR (19K from 11K), FISV (37K from 31K)

- Maintained: PACK (4.6 mln)

- Exited: FXI (408K), SMH (113K), MU (86K), WDC (81K), PTLO (80K), STX (37K)

- Decreased: FLUT (12K from 85K), NVDA (78K from 103K), ASML (5K from 18K), AXON (0K from 13K), AVGO (25K from 37K), CASY (18K from 30K), BLDR (8K from 15K), NKE (67K from 69K), VRSN (59K from 61K), BSX (4K from 6K)

* * *

Senator Investor Group discloses updated portfolio positions in 13F filing: New UWMC TECK ETHA JHX CRWV positions, Exited CMCSA EQT SGI AA, Added to NU LTH

Highlights from Q3 2025 filing as compared to Q2 2025 (all amounts are approximate):

- New: UWMC (2.2 mln shares), TECK (2.0 mln), ETHA (1.7 mln), JHX (914K), CRWV (750K), SN (496K), PFGC (441K), UNP (321K), ULS (275K), PFSI (255K), BA (1 88K), IWM (182K), TER (130K), MRVL (105K), ET (64K)

- Increased: NU (1.96 mln shares from 1.34 mln shares), LTH (1.6 mln from 1.2 mln), WWD (475K from 292K), CVNA (291K from 161K), AMZN (475K from 355K), VRT (333K from 255K), SSNC (977K from 922K), BCS (59K from 47K), GLD (32K from 21K), SPY (114K from 104K)

- Exited: CMCSA (1.3 mln shares), EQT (455K), SGI (450K), AA (423K), APH (360K), IMSR (340K), AVGO (150K), CHTR (144K), MS CI (60K)

- Decreased: PRM (2.1 mln shares from 2.4 mln shares), WBD (3.8 mln from 4.1 mln) UAL (3.09 mln from 3.12 mln), FCX (30K from 1.1 mln), GLXY (144K from 1 mln), HOOD (405K from 1180K), FOUR (275K from 803K), H (10K from 464K), ATI (325K from 750K), CELH (331K from 672K), APO (337K from 541K), CCOI (483K from 632K), JPM (175K from 307K), ATRO (622K from 741K), COF (412K from 510K), HWM (98K from 180K), VST (160K from 240K), FLUT (165K from 231K), GE (168K from 230K), META (85K from 136K), COIN (7K from 56K), NVDA (378K from 402K), MSFT (200K from 208K)

* * *

Discovery Capital (Rob Citrone) discloses updated portfolio positions in 13F filing: New ORBS GDLC CLF VNET GDS positions, Exited NBIS, Added to METC PRMB

Highlights from Q3 2025 filing as compared to Q2 2025 (all amounts are approximate):

- New: ORBS (14.38 mln shares), GDLC (1.8 mln), CLF (1.8 mln), VNET (1.6 mln), MSOS (1.43 mln), GDS (1.1 mln), LBRT (904K), STUB (593K), SEI (569K), PPTA (526K), PCG (337K), BKR (213K), EPSM (154K), IBI T (142K), IR (123K), SATS (119K), DDOG (111K), ATI (105K), FISV (99K), JBL (98K), CI (91K)

- Increased: METC (5.5 mln shares from 1.3 mln shares), PRMB (1.79 mln from 225K), ECH (635K from 127K), AGRO (622K from 271K), EWW (369K from 30K), TKC (1.1 mln from 0.9 mln), SNAP (1.4 mln from 1.2 mln), GEO (1.4 mln from 1.3 mln), JPM (170K from 166K), ESTA (155K from 64K), EAT (189K from 99K), PINS (355K from 266K), NU (692K from 606K), JBS (480K from 418K), METCB (74K from 39K), APP (30K from 28K)

- Maintained: TV (18.1 mln shares)

- Exited: NBIS (1.8 mln), YPF (866K), FCX (695K), GGAL (500K), AR (288K), RRC (274K), TEO (259K), EQT (214K), CORZ (1 98K), VNM (175K), EXE (106K), VIK (100K), VOYG (100K), UNH (84K), CRWV (77K)

- Decreased: GENI (5.1 mln from 6.8 mln), AMTM (1.1 mln from 2.3 mln), IREN (3.4 mln from 4.2 mln), AMX (4.7 mln from 5.3 mln), QXO (1.8 mln from 2.4 mln), CLS (123K from 366K), CX (3198K from 3416K), HTZWW (4675K from 4877K), BABA (19K from 156K), GLNG (261K from 332K), COF (202K from 242K), VVV (80K from 109K), ABL (275K from 296K), PSN (438K from 458K), TTWO (129K from 132K), BAP (62K from 64K)

* * *

D1 Capital (Daniel Sundheim) discloses updated portfolio positions in 13F filing: New JHX KNX APG SE DIS positions, Exited TOL DHI VIK AMZN, Added to KRC FLS USFD

Highlights from Q3 2025 filing as compared to Q2 2025 (all amounts are approximate):

- New: JHX (19 mln shares), KNX (3.7 mln), APG (2.2 mln), SE (1.29 mln), DIS (1.2 mln), SATS (822K), AVGO (667K), NVDA (617K), WING (472K), META (271K), SNPS (157K), MELI (129K) , TDG (31K)

- Increased: PRMB (11.81 mln shares from 4.81 mln shares), KRC (8.48 mln from 1.89 mln), FLS (7.48 mln from 1.69 mln), USFD (3.36 mln from 1.03 mln), LINE (6.18 mln from 4.62 mln), CLH (2.45 mln from 1.44 mln), SCHW (3.82 mln from 3.52 mln), RDDT (2.02 mln from 1.93 mln), APP (837K from 790K), DHR (909K from 163K)

- Maintained: CART (22.6 mln shares)

- Exited: SGI (from 2.7 mln shares), TOL (1.6 mln), DHI (1.5 mln), VIK (1.2 mln), AMZN (701K), ANSS (654K), BDX (335K), ELV (326K)

- Decreased: NU (10.2 mln shares from 24.1 mln shares), ENTG (1.15 mln from 4.17 mln), BAC (5.52 mln from 7.97 mln), LPX (0.8 mln from 1.81 mln), CNM (5.2 mln from 6.0 mln), ALK (2.3 mln from 3.1 mln), XPO (2.5 mln from 3.1 mln), PM (0.7 mln from 1.2 mln), CRS (506K from 822K), APO (1.2 mln from 1.4 mln)

* * *

Engaged Capital (Glenn Welling) discloses updated portfolio positions in 13F filing: New CGNX BL positions

Highlights from Q3 2025 filing as compared to Q2 2025 (all amounts are approximate):

- New: CGNX (855K), BL (454K)

- Increased: VFC (5.9 mln from 5.4 mln), BRCC (13936K from 13536K), PTLO (5069K from 4832K), GXO (978K from 897K)

- Maintained: YETI (2.2 mln), FRPT (619K)

- Decreased: EVH (5.7 mln from 5.9 mln)

* * *

Tiger Global discloses updated portfolio positions in 13F filing: New NTSK MDB NFLX FIGR KLAR BLSH ARX GEMI FIG positions, Exits ZKH LLY NVO CRWD

Highlights from Q3 2025 filing as compared to Q2 2025 (all amounts are approximate):

- New: NTSK (500K), MDB (341K), NFLX (202K), FIGR (200K), KLAR (175K), BLSH (100K), ARX (75K), GE MI (70K), FIG (60K), VIA (15K)

- Increased: CPNG (15.84 mln shares from 13.59 mln shares), XYZ (4.42 mln from 3.94 mln), AMZN (11.04 mln from 10.69 mln), CPAY (1.77 mln from 1.5 mln), FLUT (3.66 mln from 3.45 mln), AVGO (2.89 mln from 2.7 mln), GEV (1.15 mln from 1.1 mln)

- Maintained: GRAB (92.92 mln shares), SE (16.04 mln), NVDA (11.71 mln), GOOGL (10.63 mln), MSFT (6.55 mln), APO (6.21 mln), TTWO (5.84 mln), LRCX (5.26 mln), TSM (4.58 mln), VEEV (2.42 mln), APP (2 mln), ZS (1.68 mln), SPOT (1.26 mln)

- Exited: ZKH (from 8 mln shares), LLY (1.51 mln), NVO (1.27 mln), CRWD (0.5 mln)

- Decreased: META (2.82 mln shares from 7.53 mln shares), RDDT (4.67 mln from 6.15 mln), Z (5.05 mln from 6.23 mln), SHW (330K from 1.2 mln), ZG (783K from 1 mln)

* * *

Duquesne (Stanley Druckenmiller) discloses updated portfolio positions in 13F filing: New STUB CLF FIGR AMZN CRH positions, Exited WBD ENTG BCS CZR COHR KMI CCC

Highlights from Q3 2025 filing as compared to Q2 2025 (all amounts are approximate):

- New: STUB (4.3 mln shares), CLF (2.7 mln), FIGR (2.1 mln), EEM (1.9 mln), AEVA (1.8 mln), PCG (1.65 mln), COGT (1.06 mln), KBE (482K), AMZN (437K), CRH (394K), SMTC (302K), FWONK (288K), SYF (262K), VST (234K), C MG (233K), POST (176K), ARM (168K), SNDK (166K), PTGX (160K), SEI (146K), GPC (144K), DKS (132K), GOOGL (102K)

- Increased: NAMS (1.9 mln shares from 0.8 mln shares), TBBB (1.18 mln from 0.36 mln), BAC (0.99 mln from 0.3 mln), TEVA (16.59 mln from 15.97 mln), CPNG (4.6 mln from 4.1 mln), ELVN (0.95 mln from 0.46 mln), DOCU (1.69 mln from 1.29 mln), QSR (1.1 mln from 0.75 mln), OPCH (978K from 637K), TWLO (513K from 200K), LEN (279K from 90K), WAB (302K from 171K), DHI (205K from 77K), CRS (220K from 127K)

- Maintained: VRNA (1 mln shares), TSM (0.77 mln)

- Exited: WBD (from 6.5 mln shares), ENTG (1.65 mln), BCS (1.55 mln), CZR (1.4 mln), COHR (1.16 mln), KMI (1.1 mln), CCC (1.0 mln)

- Decreased: NU (1.45 mln shares from 3.42 mln shares), DAKT (1.44 mln from 3.08 mln), U (0.88 mln from 1.77 mln), YPF (115K from 704K), CHYM (43K from 467K), EQT (895K from 1253K), FLUT (115K from 405K), ROKU (822K from 1101K), WWD (633K from 849K), C (515K from 666K), STX (86K from 197K), SE (274K from 310K), ARGT (254K from 268K)

* * *

Scopia Capital discloses updated portfolio positions in 13F filing: New NVRI BRZE AZTA positions

Highlights from Q3 2025 filing as compared to Q2 2025 (all amounts are approximate):

- New: NVRI (953K), BRZE (689K), AZTA (488K), BALL (436K), TRU (262K), KVYO (248K), KKR (234K), C AE (198K), ELV (38K),

- Increased: VVV (993K from 516K), ENS (371K from 239K), BATRK (300K from 187K)

- Exited: INDV (1655K), MAGN (1011K), MRCY (447K), AL (208K), TSM (122K), LESL (98K), BIO (95K), TPICQ (66K), MDB (57K), HUM (21K)

- Decreased: PTON (2.4 mln from 4.4 mln), KBR (444K from 1.2 mln), SGI (204K from 734K), CC (2886K from 3355K), HLIT (2563K from 3032K), CTVA (622K from 850K), SN (405K from 558K), PRMB (979K from 1111K), JBHT (106K from 235K), VSTS (2785K from 2897K)

* * *

Impactive Capital (Lauren Taylor Wolfe and Christian Alejandro Asma) discloses updated portfolio positions in 13F filing: New IWM position, Exited WDC

Highlights from Q3 2025 filing as compared to Q2 2025 (all amounts are approximate):

- New: IWM (0.61 mln shares)

- Maintained: CLVT (43.03 mln shares), CNXC (4.38 mln), VAC (4.05 mln), WMS (1.66 mln), ABG (1.25 mln)

- Exited: WDC (3.57 mln shares)

- Decreased: SLM (7.23 mln shares from 8.03 mln shares), ETSY (3.24 mln from 3.55 mln), WEX (2.2 mln from 2.4 mln)

* * *

Corvex Management (Keith Meister) discloses updated portfolio positions in 13F filing: New CX DIS CCL positions

Highlights from Q3 2025 filing as compared to Q2 2025 (all amounts are approximate):

- New: CX (8.6 mln shares), DIS (1.31 mln), CCL (1.29 mln), UNP (678K), CRM (15K)

- Increased: QSR (2.41 mln shares from 0.87 mln shares), IAC (2.79 mln from 2 mln), AMZN (0.98 mln from 0.68 mln), ORCL (0.35 mln from 0.1 mln)

- Maintained: VSTS (18.8 mln shares), AQN (6.18 mln), SWX (5.03 mln), FTRE (4.51 mln), MDU (4.18 mln), ILMN (3.83 mln), WGS (3.06 mln), LLYVA (1.01 mln), HSII (1 mln),

- Exited: IAS (from 2.62 mln shares), CSX (1.75 mln), SRE (1.06 mln), NSC (0.3 mln), GOOGL (0.23 mln), LNG (0.06 mln), IWM (0.01 mln)

- Decreased: DLTR (0.54 mln shares from 0.98 mln shares), MGM (5.39 mln from 5.63 mln)

* * *

Berkshire Hathaway (Warren Buffett) discloses updated portfolio positions in 13F filing: New GOOGL position, Added to SIRI CB DPZ LAMR, Exited DHI, Lowered AAPL BAC VRSN DVA NUE

Highlights from Q3 2025 filing as compared to Q2 2025 (all amounts are approximate):

- New: GOOGL (17.85 mln shares)

- Increased: SIRI (124.81 mln shares from 119.78 mln shares), CB (31.33 mln from 27.03 mln), DPZ (2.98 mln from 2.63 mln), LAMR (1.2 mln from 1.17 mln)

- Maintained: KO (400 mln shares), KHC (325.63 mln), OXY (264.94 mln), AXP (151.61 mln), CVX (122.06 mln), KR (50 mln), MCO (24.67 mln), V (8.3 mln)

- Exited: DHI (1.49 mln shares)

- Decreased: AAPL (238.21 mln shares from 280 mln shares), BAC (568.07 mln from 605.27 mln), VRSN (8.99 mln from 13.29 mln), DVA (32.16 mln from 33.8 mln), NUE (6.41 mln from 6.61 mln)

* * *

Carl Icahn discloses updated portfolio positions in 13F filing: New SATS MNRO positions, Exited BHC, Added to IEP CTRI IFF

Highlights from Q3 2025 filing as compared to Q2 2025 (all amounts are approximate):

- New: SATS (4.35 mln shares), MNRO (1.47 mln)

- Increased: IEP (518.93 mln shares from 494.78 mln shares), CTRI (10.85 mln from 6.4 mln), IFF (4.75 mln from 3.75 mln)

- Maintained: CVI (70.42 mln shares), JBLU (33.62 mln), UAN (4.16 mln), AEP (1.21 mln)

- Exited: BHC (34.72 mln shares)

- Decreased: SWX (6.03 mln shares from 7.53 mln shares)

* * *

Starboard Value (Jeffrey Smith) discloses updated portfolio positions in 13F filing: New BILL position, Exited PFE FTRE GDOT RBA. Added to RIOT TRIP ROG

Highlights from Q3 2025 filing as compared to Q2 2025 (all amounts are approximate):

- New: BILL (7.02 mln shares)

- Increased: RIOT (8.82 mln shares from 4.68 mln shares), TRIP (9.51 mln from 8.5 mln), ROG (1.68 mln from 0.9 mln)

- Maintained: AQN (63.49 mln shares), ACTG (61.12 mln), ALIT (45.87 mln), KVUE (20.93 mln), BLMN (7.98 mln), IJH (5.25 mln), CRM (1.24 mln)

- Exited: PFE (from 8.54 mln shares), FTRE (2.5 mln), GDOT (1.73 mln), RBA (0.25 mln)

- Decreased: HR (14.49 mln shares from 19.29 mln shares), MTCH (11.07 mln from 15.31 mln), BDX (1.21 mln from 2.62 mln), GEN (12.17 mln from 13.33 mln), NWS (6.02 mln from 6.86 mln), NWSA (6.38 mln from 6.8 mln), QRVO (7.51 mln from 7.87 mln), IWM (0.14 mln from 0.34 mln), ADSK (1.31 mln from 1.47 mln)

* * *

Pershing Square (Bill Ackman) discloses updated portfolio positions in 13F filing: Slightly boosted BN, lowered GOOGL while maintaining GOOG shares

Highlights from Q3 2025 filing as compared to Q2 2025 (all amounts are approximate):

- Increased: BN (41.02 mln shares from 41.16 mln shares)

- Maintained: CMG (21.54 mln shares), HHH (18.85 mln), GOOG (6.32 mln), AMZN (5.82 mln), HLT (3.03 mln)

- Decreased: UBER (30.27 mln shares from 30.3 mln shares), QSR (22.92 mln from 23 mln), GOOGL (4.84 mln from 5.36 mln)

* * *

DME Capital / Greenlight Capital (David Einhorn) discloses updated portfolio positions in 13F filing: New PCG PRKS KWEB positions, Exited TECK, Added to FLR VSCO KD ACHC CNC

Highlights from Q3 2025 filing as compared to Q2 2025 (all amounts are approximate):

- New: PCG (6.38 mln shares), PRKS (471K), KWEB (86K), NXST (74K)

- Increased: FLR (5.51 mln shares from 3.82 mln shares), VSCO (1.93 mln from 0.89 mln), KD (4.34 mln from 3.31 mln), ACHC (1.64 mln from 0.87 mln), CNC (1.56 mln from 0.84 mln), PTON (246K from 179K), SNX (39K from 33K), GLD (175K from 169K)

- Maintained: GRBK (9.47 mln shares), DHT (7.62 mln), LBTYA (5.22 mln), GPK (4.71 mln), TEVA (3.78 mln), BHF (2.79 mln), CNR (2.16 mln), SDRL (1.59 mln), WFRD (0.96 mln)

- Exited: TECK (2 mln shares)

- Decreased: HPQ (0.3 mln shares from 3.02 mln shares), ROIV (2.28 mln from 4.55 mln), CNH (5.9 mln from 7.87 mln), GPRO (1.69 mln from 2.82 mln), CPRI (2.69 mln from 3.48 mln), PENN (6.77 mln from 7.49 mln), SHC (181K from 234K), OIH (12K from 16K)

* * *

Glenview Capital (Larry Robbins and Mark Horowitz) discloses updated portfolio positions in 13F filing: New LION Z PINS BAX OSCR TECH CNC positions, Exited WDC W COO

Highlights from Q3 2025 filing as compared to Q2 2025 (all amounts are approximate):

- New: LION (5 mln shares), Z (890K), PINS (808K), BAX (743K), OSCR (408K), TECH (374K), CNC (372K), ICLR (371K), XYZ (322K), BRKR (320K), ONTO (271K), RTO (205K), EHC (168K), DD (128K), ILMN (102K), LAD (74K), SN PS (21K)

- Increased: DXC (8.34 mln shares from 5.87 mln shares), GTM (18.51 mln from 16.38 mln), SGRY (2.55 mln from 1.53 mln), TEVA (16.69 mln from 15.82 mln), GPN (5.14 mln from 4.32 mln), EYE (1.38 mln from 0.81 mln), PYPL (1.33 mln from 1.01 mln), MRVL (0.68 mln from 0.41 mln), DHR (0.26 mln from 0.05 mln), UBER (0.47 mln from 0.27 mln), TMO (283K from 100K), UHS (482K from 389K), AMZN (652K from 563K), IQV (175K from 100K), DKS (352K from 291K), MCK (56K from 26K), RH (80K from 66K)

- Maintained: VTRS (8.25 mln shares), CVS (8.2 mln), UAL (0.58 mln)

- Exited: WDC (601K), W (528K), COO (281K), JBTM (241K), ON (174K), SNDK (26K)

- Decreased: ALIT (20.38 mln shares from 24.38 mln shares), ESI (2.21 mln from 2.82 mln), THC (2.32 mln from 2.93 mln), BC (0.31 mln from 0.66 mln), USFD (1.07 mln from 1.38 mln), KNX (860K from 1170K), CI (188K from 372K), EXPE (360K from 508K), META (12K from 116K), MKSI (172K from 232K)

* * *

Third Point (Dan Loeb) discloses updated portfolio positions in 13F filing: New SRTA CORZ SGI NSC FND UNP positions, Exited SHCO FLS FTV ICE SABR RBA

Highlights from Q3 2025 filing as compared to Q2 2025 (all amounts are approximate):

- New: SRTA (5 mln shares), CORZ (3 mln), SGI (3 mln), NSC (1.65 mln), FND (1.33 mln), UNP (875K), MTZ (725K), CYH (150K), BHC (100K)

- Increased: MSFT (1.1 mln shares from 0.4 mln shares), SN (1.8 mln from 1.2 mln), KVUE (9 mln from 8.53 mln), CASY (0.5 mln from 0.36 mln), AMZN (2.81 mln from 2.71 mln), CRS (850K from 750K), META (220K from 150K), FLUT (1120K from 1070K), FIX (200K from 185K)

- Maintained: PCG (50.1 mln shares), TDS (6.71 mln), BN (4.68 mln), CSGP (3.02 mln), NVDA (2.85 mln), COOP (0.93 mln)

- Exited: SHCO (from 5.17 mln shares), FLS (1.2 mln), FTV (1.16 mln), ICE (0.95 mln), SABR (0.75 mln), RBA (0.7 mln), CPAY (0.69 mln), DOCU (0.63 mln), WDAY (0.3 mln), GTLS (0.22 mln)

- Decreased: RKT (4 mln shares from 4.75 mln shares), APO (0.65 mln from 1.28 mln), LYV (1.35 mln from 1.98 mln), DHR (0.05 mln from 0.5 mln), TLN (0.35 mln from 0.79 mln), CRH (2.17 mln from 2.59 mln), COF (1.39 mln from 1.8 mln), J (0.92 mln from 1.26 mln), TSM (1.1 mln from 1.43 mln), VST (0.94 mln from 1.25 mln)

* * *

Trian Fund (Nelson Peltz) discloses updated portfolio positions in 13F filing: Exited UHAL ALL, Maintained JHG WEN IVZ SOLV GE FERG holdings

Highlights from Q3 2025 filing as compared to Q2 2025 (all amounts are approximate):

- Maintained: JHG (31.87 mln shares), WEN (30.44 mln), IVZ (14.63 mln), SOLV (8.46 mln), GE (4.03 mln), FERG (1.09 mln)

- Exited: UHAL (353K), UHAL.B (338K), ALL (100K)

* * *

Lone Pine discloses updated portfolio positions in 13F filing: New NU ETSY APH positions, Exited WIX CRM UNH INTU ASML

Highlights from Q3 2025 filing as compared to Q2 2025 (all amounts are approximate):

- New: NU (25.41 mln shares), ETSY (3.88 mln), APH (3.02 mln), CIEN (2.01 mln), SE (1.87 mln), AVGO (1.55 mln), WING (1.49 mln), VMC (1.38 mln)

- Increased: BN (10.18 mln shares from 5.62 mln shares), PM (4.61 mln from 2.76 mln), EQT (8.36 mln from 7.52 mln), LPLA (2.26 mln from 1.87 mln), TLN (1.19 mln from 1.09 mln)

- Maintained: SBUX (5.56 mln shares), CVNA (1.77 mln)

- Exited: WIX (from 2.16 mln shares), CRM (1.86 mln), UNH (1.69 mln), INTU (0.77 mln), ASML (0.57 mln)

- Decreased: AMZN (2.81 mln shares from 5.03 mln shares), VST (4.7 mln from 6.47 mln), KKR (4.08 mln from 5.22 mln), MSFT (1.21 mln from 1.85 mln), COF (2.57 mln from 3.08 mln), TSM (3.05 mln from 3.44 mln), META (1.32 mln from 1.67 mln), APP (1.11 mln from 1.26 mln), FLUT (1.73 mln from 1.86 mln), BKNG (0.03 mln from 0.06 mln)

* * *

ValueAct (Jeffrey Ubben and Bradley Singer) discloses updated portfolio positions in 13F filing: New TOST position, Added to RKT MDB V META, Exited RDFN CCC EXPE, Lowered DIS RBLX AMZN holdings

Highlights from Q3 2025 filing as compared to Q2 2025 (all amounts are approximate):

- New: TOST (3.4 mln shares)

- Increased: RKT (25.4 mln shares from 15.13 mln shares), MDB (2.12 mln from 0.69 mln), V (1.57 mln from 1.24 mln), META (0.77 mln from 0.62 mln)

- Maintained: CRM (2.9 mln shares), COOP (0.9 mln)

- Exited: RDFN (from 5.81 mln shares), CCC (2.88 mln), EXPE (0.28 mln)

- Decreased: DIS (4.39 mln shares from 5.09 mln shares), NSIT (2.27 mln from 2.86 mln), LLYVK (3.52 mln from 3.99 mln), RBLX (4.28 mln from 4.73 mln), AMZN (3.5 mln from 3.87 mln), CBRE (0.23 mln from 0.59 mln), LYV (0.64 mln from 0.89 mln), SSD (1.21 mln from 1.41 mln), LLYVA (1.72 mln from 1.77 mln)

* * *

Jana Partners (Barry Rosenstein) discloses updated portfolio positions in 13F filing: New FUN COO ALKT positions

Highlights from Q3 2025 filing as compared to Q2 2025 (all amounts are approximate):

- New: FUN (4.05 mln shares), COO (2.43 mln), ALKT (1.89 mln)

- Increased: RPD (6.5 mln shares from 5.73 mln shares), FRPT (1.05 mln from 1.01 mln)

- Maintained: THS (5.82 mln shares)

- Exited: WEX (0.16 mln shares)

- Decreased: LW (5.01 mln shares from 7.23 mln shares), TRMB (1.88 mln from 3.61 mln), MRCY (5.96 mln from 6.75 mln), SPY (0.39 mln from 0.51 mln), MKL (0.15 mln from 0.15 mln)

* * *

Soros Fund (George Soros) discloses updated portfolio positions in 13F filing: New VMEO FIGR IAS PHLT INDV SCS CTLP HBI STUB RSP CMS DIS positions

Highlights from Q3 2025 filing as compared to Q2 2025 (all amounts are approximate):

- New: VMEO (2.85 mln shares), FIGR (2.23 mln), IAS(1.99 mln), PHLT (1.38 mln), INDV (1.35 mln), SCS(1.27 mln), CTLP (1.24 mln), HBI (1.18 mln), STUB(874K), RSP (830K), CMS (776K), DIS (656K), NIQ(652K), SPNS (603K), CTRE (526K), TGNA (475K), MRUS (405K), DD (400K), BR CB (386K), SFD(369K), SFNC (325K), LION (300K), VRNA (285K), ARX (225K), NTSK (215K), BLSH (205K), HOUS(200K), AIRO (198K), SRE (190K), RDN (179K), RDNT (178K), KLAR (156K), RAL (149K), EXC(135K)

- Increased: KDK (9.97 mln shares from 0.9 mln shares), AMZN (2.23 mln from 0.38 mln), BGC (4.4 mln from 3.6 mln), ARMK (2.27 mln from 1.55 mln),CRBG (2.01 mln from 1.69 mln), IPG (1.45 mln from 1.16 mln), SW (7.75 mln from 7.48 mln), GOOGL(658K from 27K), ALLY (738K from 406K), AAPL(350K from 21K), TKO (620K from 336K), AMRZ(600K from 390K), SHLS (750K from 610K), CVLT(218K from 90K), COOP (146K from 20K), KEY(880K from 771K), ADT (1222K from 1129K), CRM(464K from 390K), DDOG (429K from 357K), DASH(105K from 60K), SYF (159K from 115K), TEAM (70K from 28K), AAMI (457K from 416K), MNTN (129K from 100K), ACN (100K from 75K), GL (146K from 125K), CYBR (68K from 51K), TSM (136K from 125K), ADI (56K from 46K), CHYM (48K from 40K), CAI (56K from 50K), ETOR (165K from 160K), HNGE(79K from 75K)

- Exited: ETWO (from 4.9 mln shares), DNB (3.66 mln), AVDX (2.08 mln), TTAM (0.48 mln), AER(816K), PRMB (760K), CSX (593K), SNDK (527K), SWTX (502K), BPMC (250K), GOGL (250K), CTRI(400K), AZEK (384K), ATI (363K), JBTM (330K), SMA (328K), NKE (302K), CP (302K), ECVT (287K),K (280K)

- Decreased: SARO (0.69 mln shares from 2.68 mln shares), GFL (0.88 mln from 2.85 mln), CIFR (0.21 mln from 1.3 mln), BRO (0.01 mln from 1 mln),EVGO (4 mln from 4.98 mln), ETR (0.34 mln from 1.08 mln), IBKR (1.58 mln from 2.23 mln), SRAD(0.59 mln from 1.02 mln), CRH (0.18 mln from 0.59mln), UBER (253K from 538K), ULS (480K from 757K), AS (457K from 626K), JCI (3K from 164K),KKR (187K from 343K), CRCL (202K from 305K), KRMN (364K from 464K), TPG (276K from 336K), SAIL (1296K from 1352K), GLXY (274K from 311K),LAZ (125K from 161K), SNOW (258K from 273K)

* * *

Paulson & Co (John Paulson) discloses updated portfolio positions in 13F filing: Added to BHC, Exited EQX SA IAG

Highlights from Q3 2025 filing as compared to Q2 2025 (all amounts are approximate):

- Increased: BHC (70.76 mln shares from 32.79 mln shares)

- Maintained: THM (70.24 mln shares), PPTA (32.35 mln), NG (27.24 mln), TMQ (14.33 mln), THRY (4.28 mln), AEM (0.78 mln), HON (0.2 mln)

- Exited: EQX (from 2.5 mln shares), SA (2.07 mln), IAG (1.85 mln)

- Decreased: AAMI (7.74 mln shares from 8.95 mln shares), MDGL (1.91 mln from 2.09 mln)

* * *

Viking Global (Andreas Halvorsen) discloses updated portfolio positions in 13F filing: New DKNG DB CHWY EW KKR ORKA MAA MSFT STUB DECK positions, Exited USB CCL XYZ AMZN NVDA QCOM DHI

Highlights from Q3 2025 filing as compared to Q2 2025 (all amounts are approximate):

- New: DKNG (15 mln shares), DB (6.1 mln), CHWY(5.48 mln), EW (3.07 mln), KKR (2.71 mln), ORKA(2.67 mln), MAA (2.65 mln), MSFT (2.43 mln), STUB(2.04 mln), DECK (1.73 mln), CLS (1.72 mln), AON(1.41 mln), CBRE (1.21 mln), NFLX (0.5 mln), INTU(0.26 mln)

- Increased: UBS (13.1 mln shares from 2.58 mln shares), PNC (7.96 mln from 2.38 mln), JCI (6.8 mln from 1.45 mln), DIS (10.45 mln from 5.85 mln), FTV(20.48 mln from 15.91 mln), TRVI (5.13 mln from 1.54 mln), PRMB (23.03 mln from 19.6 mln), AS(6.34 mln from 3.88 mln), AMD (4.18 mln from 1.91 mln), NKE (9 mln from 6.97 mln), PEPG (3.48 mln shares from 1.48 mln shares), COF (7.39 mln from 5.67 mln), APD (3.67 mln from 2.15 mln), V (2.9 mln from 1.62 mln), CPT (3.85 mln from 2.72 mln), CVNA(2.1 mln from 1.08 mln), JPM (5.06 mln from 4.04mln), PM (4.43 mln from 3.45 mln), CMG (6.64 mln from 5.69 mln), SHW (2.88 mln shares from 1.96 mln shares), SCHW (16.58 mln from 15.77 mln), META(0.93 mln from 0.27 mln), SAIA (1.38 mln from 0.83 mln), RYAN (1.93 mln from 1.41 mln), TSLA (1.61 mln from 1.1 mln), BLK (0.62 mln from 0.2 mln), TMUS (3.26 mln from 2.85 mln), MASI (1.07 mln from 0.77 mln), MCD (3.37 mln from 3.13 mln), BA (3 mln from 2.8 mln)

- Maintained: TIC (34.36 mln shares), ADPT (29.99 mln), GM (13.03 mln)

- Exited: USB (from 24.09 mln shares), CCL (13.21 mln), XYZ (5.42 mln), AMZN (3.9 mln), NVDA (3.68 mln), QCOM (3.15 mln), DHI (2.83 mln), AMT (2.8 mln), TTD (2.67 mln), RPRX (from 2.6 mln shares),LEN (2.52 mln), FLUT (2.28 mln), AIG (1.82 mln), AJG (726K), RACE (721K), CME (597K), LLY(417K), MOH (267K), HQY (220K)

- Decreased: BAC (11.5 mln shares from 31.25 mln shares), ROIV (23.59 mln from 34.24 mln), TEVA(2.53 mln from 11.68 mln), APG (12.31 mln from 17.31 mln), BMRN (8.32 mln from 12.29 mln), CSX(15.95 mln from 18.87 mln), CART (0.83 mln from 3.75 mln), ROST (2.02 mln from 4.75 mln), BBIO(15.98 mln from 18.56 mln), FSLR (0.77 mln shares from 2.27 mln shares), CSGP (1.85 mln from 3.22mln), NAMS (6.48 mln from 6.98 mln), SE (3.04 mln from 3.54 mln), HCA (1.38 mln from 1.87 mln), BSX(2.64 mln from 3.05 mln), TSM (3.94 mln from 4.33mln), RRX (3.12 mln from 3.43 mln), COR (1.78 mln from 2.08 mln)

* * *

Marathon Partners discloses updated portfolio positions in 13F filing: New ATI LNWO GOOG positions

Highlights from Q3 2025 filing as compared to Q2 2025 (all amounts are approximate):

- New: ATI (28K), LNWO (13K), GOOG (8K)

- Increased: RELY (1388K from 925K), LION (250K from 225K), AMRZ (25K from 20K), FLUT (14K from 9K)

- Maintained: XMTR (278K), UBER (165K), TKO(110K), META (28K), TPB (25K)

- Exited: PRMB (38K), PTON (25K)

- Decreased: EWCZ (125K from 225K), HSIC (78K from 110K), ATMU (113K from 138K), SXT (40K from 43K)

* * *

Lansdowne discloses updated portfolio positions in 13F filing: New PRTC TECK B positions

Highlights from Q3 2025 filing as compared to Q2 2025 (all amounts are approximate):

- New: PRTC (14.11 mln shares), TECK (722K), B (266K), ARM (60K)

- Increased: IONQ (1.94 mln shares from 0.5 mln shares), DAL (2.28 mln from 1.55 mln), TSM (1.42 mln from 0.74 mln), UAL (1.1 mln from 0.86 mln),CRH (648K from 525K), AMZN (167K from 48K), LIN(365K from 309K), TXN (36K from 29K), ADI (151K from 146K), ROK (30K from 27K)

- Maintained: SHCO (2.57 mln shares), SW (1.29 mln), GOLF (0.53 mln)

- Exited: FCX (from 1.44 mln shares)

- Decreased: AEM FTV FLUT MAR (small holdings)

* * *

Softbank discloses updated portfolio positions in 13F filing: New KLAR CIGL positions, Exited CIFR ORCL (63.85 -0.14)

Highlights from Q3 2025 filing as compared to Q2 2025 (all amounts are approximate):

- New: INTC (86.96 mln shares**), KLAR (15.4 mln), CIGL (0.26 mln), AMBQ (0.15 mln)

- Increased: YMM (4.41 mln shares from 2.62 mln shares), NVDA (32.11 mln from 30.53 mln**)

- Maintained: INTR (64.51 mln shares), SYM (39.83 mln), WBTN (31.43 mln), TEM (5.41 mln), TSM (1.99 mln)

- Exited: CIFR (from 10.44 mln shares), ORCL (1.22 mln)

- Decreased: TMUS (45.17 mln shares from 63.86 mln shares), NU (17.84 mln from 21.01 mln), LMND (3.56 mln from 5.96 mln), MTSR (3.65 mln from 4.82 mln)

* * *

Elliott Management (Paul Singer) discloses updated portfolio positions in 13F filing: New BILL position, Added to UNIT, Exited WDC SNDK

Highlights from Q3 2025 filing as compared to Q2 2025 (all amounts are approximate):

- New: BILL (3 mln shares), PEP (1.28 mln, filed amendment that discloses previously held puts),OXLC (1.02 mln)

- Increased: UNIT (59.01 mln shares from 10.12 mln shares)

- Maintained: TFPM (133.82 mln shares), SU (52.67 mln), PINS (28 mln), PSX (19.25 mln), HPE (18.63 mln)

- Exited: WDC (from 2.25 mln shares), SNDK (0.75 mln)

- Decreased: LUV (51.13 mln shares from 53.98 mln shares)

* * *

Land & Buildings discloses updated portfolio positions in 13F filing: New FUN ESRT PLD positions

Highlights from Q3 2025 filing as compared to Q2 2025 (all amounts are approximate):

- New: FUN (1586K), ESRT (1015K), PLD (210K), CCI(130K), UDR (96K), AVB (19K)

- Increased: CSR (599K from 305K), AMH (981K from 790K), SKT (902K from 736K), AHR (1152K from 1079K), SPG (206K from 144K), SUI (235K from 194K), VTR (522K from 489K), RHP (107K from 102K)

- Exited: KRG (807K), REXR (561K), DHI (139K), EQR (86K), AMT (79K)

- Decreased: OUT (951K from 1435K), GLPI (442K from 541K), FR (711K from 766K), EXR (138K from 180K), MAR (74K from 104K), NHI (436K from 460K), CBRE (142K from 165K), EQIX (32K from 36K)