What's Priced In? Goldman Says Tech Wreck Leaves Software 'Cheapest Since 2010'

Unless you've been living under a rock recently, you will know that the launch of a legal automation tool and a new LLM by Anthropic, along with broad ramping of AI capacity and services, has led to a sharp rotation out of software and related sectors globally.

The crash in the stocks of data-services and software companies extended to publishers, financial services, alternative asset managers and gaming stocks. Any company which collates, aggregates, disseminates software and data as a service are seen as increasingly vulnerable to disruption from AI-driven tools.

The Anthropic announcement was just a catalyst to realize fears that have been growing.

While, from a macro perspective, we can offer little on the ultimate outcome of this battle - some of the incumbents will prove to have resilient moats and some won’t but will adapt.

However, we can digest the recent moves and what follows is Sharon Bell and the Goldman Sachs Portfolio Research team's look at what the market is now implying in value terms in these sub-sectors.

The weight of these capital-light sectors where investors fear disruption (broadly defined) has collapsed while the mirror of this has been the rise in the weight of Financials (benefit from steeper yield curves) and Commodity-sectors (benefit from increased demand).

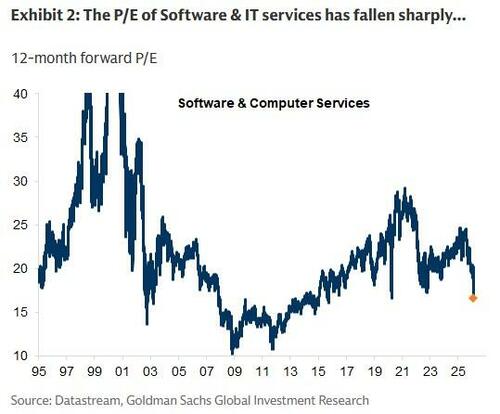

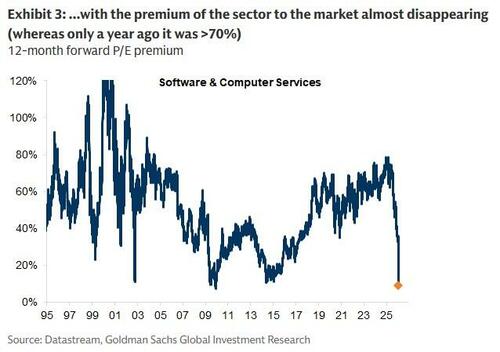

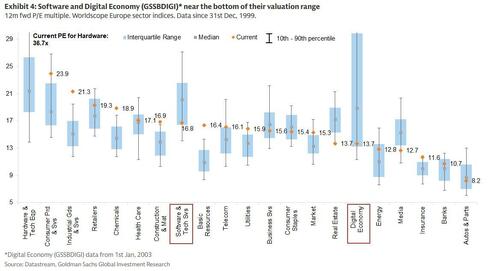

Software valuation multiples have fallen to the bottom end of their recent ranges, although the analyst growth estimates embedded in those multiples remain elevated...

The forward P/E multiple for software has declined from 35x in late 2025 to 20x currently, representing the lowest absolute level since 2014 and the smallest premium to the average S&P 500 stock since 2010.

However, current profit margins and consensus revenue growth estimates each register at their highest levels in at least 20 years of data history, and roughly 2x the comparable fundamentals for the average S&P 500 stock.

Implicitly, the decline in valuations indicates an expectation that these estimates will also decline.

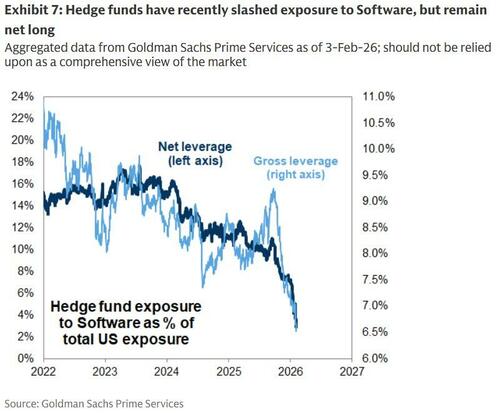

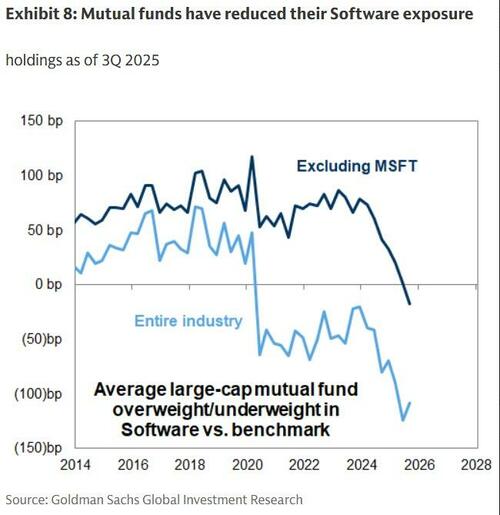

Like valuation multiples, investor positioning data indicate further room to fall but suggest that most of the volatility is likely behind us.

GS Prime Services data show a sharp recent decline in hedge fund exposure to software, although funds remain net long the industry.

In contrast, large-cap mutual funds had moved underweight software in the middle of last year.

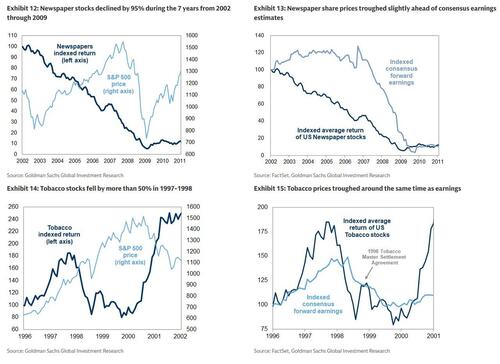

With 'disruption' in mind, the multi-year decline of newspaper stocks ended only as earnings estimates bottomed, and the litigation disruption of tobacco followed a similar pattern.

In this case, the uncertainty around the eventual impact of AI means near-term earnings results will be important signals of business resilience, but in many cases insufficient to disprove the long-term downside risk.

The investor search for insulation from AI disruption risk has accelerated the ongoing cyclical rally.

After years of focus on identifying stocks with the greatest potential AI exposure, concerns about disruption have pushed investors back toward "real economy" industries, including those leveraged to recent signs of accelerating economic growth.

Although the volatility of recent moves appears exacerbated by technicals, we continue to recommend Value as a factor and select cyclical pockets of the US equity market, but Goldman's analysts also see opportunities in some of the stocks caught up in the recent sell-off.

What are post‑selloff valuations now implying?

Finally, Goldman's research team notes that one could argue that much of the risk is already reflected: at 16.8x P/E, Software & IT Services now trade broadly in line with sectors growing revenues at around 6%, even though analysts still expect them to grow closer to 9% annually over the coming years.

However, history shows that Software & IT Services typically bottom only once EPS has troughed and begun to recover; with similar results seen when looking at examples of disrupted industries historically.

Professional subscribers can read much more from Goldman's Sales & Trading team here at our new Marketdesk.ai portal