Where Are The Risks To The Benign US Outlook; Goldman

Authored by Cosimo Codacci-Pisanelli and Rikin Shah, Goldman Sachs FICC & Equities,

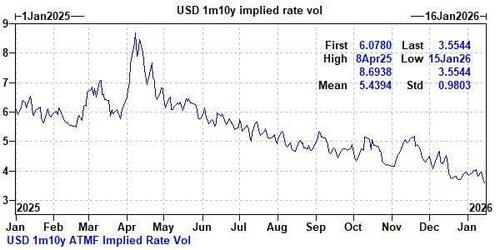

CPI this week did little to arrest the vol slide for US rates and the benign, risk friendly outlook.

Core printed at 24bp MoM, below consensus, but with a breakdown that was a little firmer raising GIR's core PCE forecast to 37bps MoM. Ultimately this was nothing to alter the longer term forecast for continued inflation normalisation, with GIR below consensus for their year-end forecast of core CPI falling to 2%.

As has been outlined at length now, tailwinds to growth are hitting through H1 from the fiscal impulse, FCI impulse, fading tariff impacts and AI productivity gains.

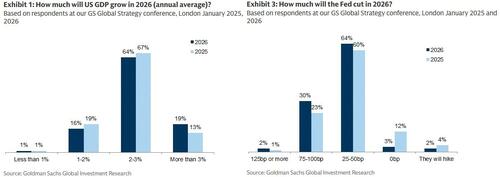

GIR forecast 2026 growth at 2.8%, materially above the 2.1% consensus.

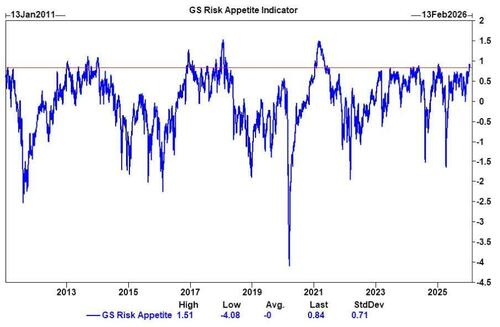

Higher than expected growth, lower than expected inflation with a Fed that has room to cut is clearly a supportive one for risk and carry.

The question is how much of this is already in the price.

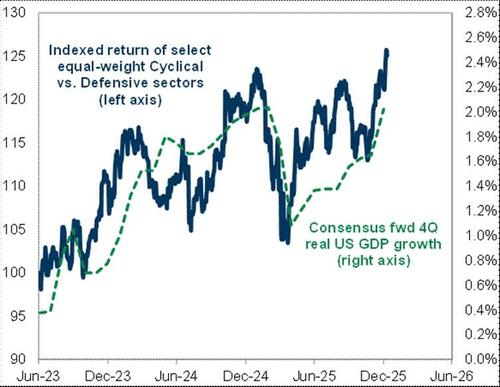

Cyclical and defensive equities imply to us a ~2.5% real growth rate, which is solid, but improving the implied growth forecast towards 3% would imply a roughly 8% upside to S&P over the next 3 months.

We remain long growth, bullish stocks, with the year so far showing the necessity to breadth in that long outside of the US, namely EM.

A short in 10y US duration can work nicely alongside that too, providing some protection to the scenario in which the economy overheats.

That raises the question of assessing and hedging the tail risks to what is the now heavily subscribed long risk and carry view.

The two key risks in our view are an accelerating deterioration in the labour market or re-emerging inflation which causes a hawkish Fed pivot.

Risks around the former have dissipated at the margin with the unemployment rate ticking back down to 4.4%. If these risks do re-emerge though, the room for the Fed to cut given the benign inflation profile should help support risk.

The bigger downside scenario for the risk/carry backdrop to us is inflation risks re-emerging.

There is good reason why this tail is not priced – as illustrated by most inflation forecasts, supported by a number of factors including the declining forward in global goods prices.

However, with the bullishness on the growth forward, are there risks of the economy overheating? Or an exogenous inflation shock – Iran risks subsided quickly this week, but this feels an obvious source, or semi-conductor supply chains given the speed of AI growth and limited capacity of power infrastructure.

The playbook for us remains to be long global growth and carry, short US duration, coupled with risk hedges that don’t decay too badly against you. Front end rate longs have been an obvious choice when the focus was on downside labour market risks.

However, these have decayed a bit quicker than expected as assumptions around the new Fed Chair dovishness has fizzled following the Powell push back and Warsh probability going up.

A hawkish Fed is the real tail in our mind for risk; wingy dollar calls, oil upside or US breakeven longs (which are priced near the fed target) all make sense in that context.

IN SUMMARY...

We believe in US growth.

That means a combination of long equities and short 10y US rates.

We do look for hedges against this central scenario.

Whether its USD FX upside or US belly breakevens.

Professional subscribers can read much more from Goldman's Sales & Trading team here at our new Marketdesk.ai portal