Why The Fed Will Cut (Much) More Than Expected In 2026

Authored by Philip Marey, Senior US Strategist, Rabobank,

While the new Fed Chair has not been nominated yet, the shortlist has been reduced to five: Hassett, Warsh, Waller, Bowman and Rieder.

However, President Trump said that he has already made up his mind. Markets think that Kevin Hassett is the most likely candidate. However, the name of the nominee may not be particularly relevant.

President Trump has made clear he wants the incoming Chair to cut rates. On Tuesday, in an interview with Politico, when asked whether it is a litmus test that the new Chair lowers rates immediately, Trump answered “yes.”

Treasury Secretary Scott Bessent, who is leading the selection process, has also made the targets for the next Chair very clear: lower rates, deregulation and a reorganization of the Fed.

In fact, the White House already put a quartermaster on the Board of Governors.

Stephen Miran, then Chairman of the Council of Economic Advisers (now on leave), was appointed to serve out Adriana Kugler’s seat on the Board, after she unexpectedly resigned effective August 8, 2025.

In this special we discuss the political pressures on the new Fed Chair, possible tensions with the dual mandate of the Fed, the impact on interest rates and inflation, and the role for government policies if monetary policy diverges from the dual mandate.

Midterm pressure on the Fed

Politicians like lower interest rates because they stimulate the economy and this improves their chances in the elections. Although President Trump is in his second term, his ability to implement his policy agenda could be seriously limited if the Republicans lose their majority in either the Senate, the House of Representatives or both.

At present, with the federal funds rate above its neutral level, monetary policy is actually restrictive. This means that it is slowing down the economy.

Consequently, Trump needs rate cuts before the midterm elections on November 26, 2026.

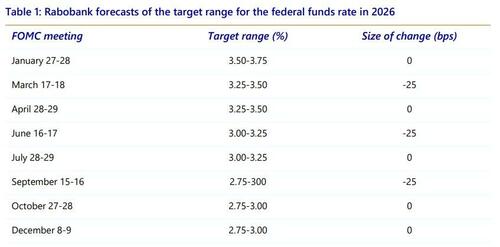

This means that a cut at the December 8-9 meeting would be too late.

The Republicans need rate cuts no later than October 28 and preferably sooner if we take into account the lagged impact of rate cuts on the economy.

Therefore, we expect the FOMC to cut rates to the neutral level or even below it before Election Day.

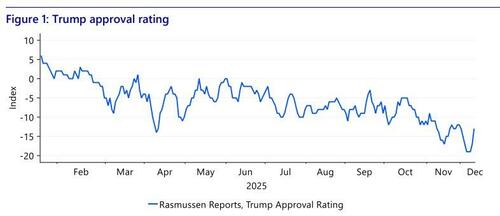

Figure 1: Trump approval rating

Source: Macrobond

That’s why we have a forecast of 2.75-3.00% for the target range of the federal funds rate by September 2026.

Temporary alignment of incentives

Cutting policy rates should, ceteris paribus, also lead to lower rates at the longer end of the curve. However, all other things won’t be equal if the Fed’s cuts raise concerns about inflation. Higher expectations or risk of inflation could at the same time exert upward pressure on longer-term rates. Depending on the relative strength of the opposite effects, we could actually see an upward shift in the longer end if inflation worries become large enough. The degree of concern about the Fed’s commitment to the 2% inflation target is likely to be proportional to the divergence between the actual amount of Fed rate cuts and the amount of easing that is warranted by the economic data in the eyes of the markets.

When the Fed resumed its cutting cycle this year there was a temporary alignment of incentives between Trump’s desire for lower rates and the FOMC’s assessment that downside risks to the labor market had increased. In fact, break-even inflation rates fell as the Fed cut rates, so did longer-term rates. If the labor market remains weak in 2026, and inflation contained, the Fed’s incentives derived from the dual mandate will remain aligned with Trump’s preferences. This should keep break-even inflation rates contained and prevent upward pressure on the longer end of the curve.

However, if we were to get stronger economic data in 2026 and the FOMC continues its cutting cycle, because the Fed is including other incentives than the dual mandate, we could see rising break-even inflation rates and upward pressure on longer-term rates.

If the divergence becomes strong enough, it could be enough to offset the downward impact from the Fed’s rate cuts and lead to a rise in the longer end of the curve.

Figure 2: Market reaction to aligned incentives

Source: Macrobond

In this case, large scale asset purchases could be an option for the Fed and we may see the Treasury Department start pushing for this if the longer end rises more than desired. In fact, the Fed just ended the balance sheet runoff on December 1 and yesterday decided to start purchases of Treasury bills (and if needed other Treasury securities with remaining maturities of 3 years or less) for reserve management purposes on December 12. This is still at the short end of the curve, but the longer end could also become in focus if longer term yields become too high.

Perhaps more importantly than causing higher longer-term interest rates, Fed decisions to cut policy rates when inflation remains elevated, could also raise inflation expectations among workers. This could lead to higher wage demands and cause higher inflation. This is the reason why central bank independence is seen as a crucial factor in stabilizing inflation. As long as economic data warrant rate cuts, such as in the present situation, there is no conflict between the wishes of the White House and price stability. However, if inflation turns out to be a more persistent problem, the next Fed Chair will face a tough test of choosing between the price stability leg of the dual mandate and loyalty to President Trump.

This underlines the importance of government policies aimed at easing inflation. We have already seen some reversals in tariffs on food imports, as we discussed in Outlook 2026. These policies could reduce the probability that the new Fed Chair is going to face a loyalty test. It is also possible that they will have to do the heavy lifting in the fight against inflation rather than central bank policies.

Shadow chair

At the moment, Kevin Hassett’s comments about the Fed are already followed with interest. Once President Trump makes his nomination of the new Fed Chair, the nominee will immediately become the de facto shadow chair of the Fed. Powell’s term as Fed Chair expires on May 15, 2026. This will make any comment by the nominee about Fed policy after May 15 highly relevant to financial markets. The new Chair will lead the FOMC meetings starting on June 17-18. That’s why we have pencilled in a rate cut at that meeting, because the new Chair is likely to want to demonstrate loyalty to President Trump from the beginning.

If either Waller or Bowman gets the nomination for Chair, they would immediately become a de facto shadow Chair operating from within the Board of Governors. If it’s Hassett, Warsh or Rieder, they are likely to fill the Kugler-Miran spot on the Board of Governors, which ends on January 31, 2026 (three days after the January 27-28 meeting of the FOMC). In this case, the nominee for the Chair could start as an “ordinary” Governor as soon as February, and be part of the March 17-18 meeting, if confirmation is fast enough.

However, he would be the de facto shadow chair immediately after nomination, for the time being operating from outside the Board and Fed altogether.

Current Chair Powell is still declining to answer whether he will give up his seat on the Board once his term as Chair ends. At yesterday’s press conference it was the same story. Therefore, his seat on the Board is less likely used for the next Chair. However, if he sticks to the tradition that the departing Chair voluntarily quits the Board, Trump will have another seat to fill and strengthen his grip on the Fed.

In this case, Trump-loyalists will have 4 to 3 majority in the Board of Governors. What’s more, the Trump administration is trying to create another vacancy on the Board by pressuring Lisa Cook to step down prematurely because of alleged mortgage fraud. This would open the door to a 5-2 majority in the Board by mid-2026. In other words, the new Fed Chair could see substantial support from other Trump-loyalists in the Board of Governors. This may not be enough to guarantee a majority in the FOMC, but it could be a powerful voting bloc that is aligned with the White House.

Table 1: Rabobank forecasts of the target range for the federal funds rate in 2026 FOMC meeting

Source: Rabobank

Incentives after confirmation

Is our assumption that the next Fed Chair will push the FOMC into cutting rates to neutral before Election Day and even below that realistic? And if inflation remains persistent, will the Chair continue to cut rates? Or could Trump’s second pick disappoint him, just like Powell did?

First of all, this year’s selection process has been focused on this type of loyalty, exactly to prevent another “Powell” slipping through.

It’s no wonder that Kevin Hassett is seen as the top contender, being part of Trump’s current inner circle as director of the National Economic Council.

Treasury Secretary Scott Bessent also knows he will be held accountable, as will the new Chair. It remains questionable if the new Fed Chair can be fired by the US President.

The White House has not made a formal attempt to do so with Powell, despite Trump bringing up this issue repeatedly. So perhaps the legal justification is deemed insufficient by his advisers.

However, the Trump administration could make the new Fed Chair’s life unpleasant as we have seen with Powell.

So the incoming Chair knows the repercussion of not cutting rates in line with White House preferences.

What’s more, if the Trump administration is successful in pushing out Governor Lisa Cook for mortgage fraud, the next Fed Chair has a strong incentive to deliver because the Chair is a governor too.

However, even if the attempt to oust Cook fails, it serves as a warning for the Chair that the Trump administration is willing to explore all options.

Conclusion

In 2026 we expect a closer alignment between the Fed and the White House.

For monetary policy this means that the FOMC is likely to cut rates to neutral or even below it prior to the midterm elections in November.

If inflation remains persistent, government policies – including tariff reversals – will have a larger role to play to get it under control.

Professional subscribers can read much more here at our new Marketdesk.ai portal