Why Retail Investors Blew Away Hedge Funds, The S&P And Nasdaq, In 2025

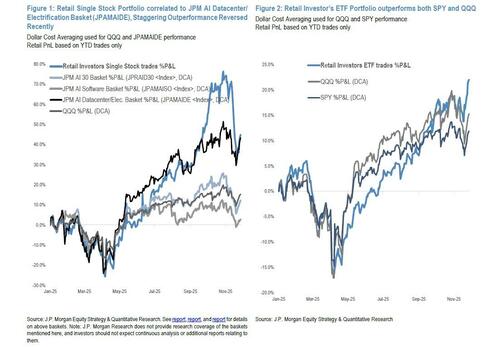

While 2025 was a very tough year for institutional investors in general, and hedge funds in particular, with sentiment turning apocalyptic - and extremely short - just after Liberation Day, with the subsequent rally resulting in significant MTM losses and forced covering, it was a much better year for retail investors who followed a much simpler script: they built substantial positions in AI/Tech companies, did not panic sell during drawdowns, and instead aggressively bought the dip during 3 episodes of weakness between Jan and Apr. Then, from May onward, they scaled back their stock purchases and shifted their focus to trading ETFs, chasing interesting trends such as GLD, which in turn proved to be one of the best investment of the year.

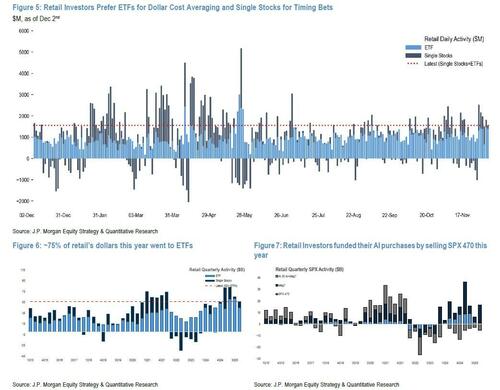

To analyze the performance of retail investors, JPMorgan's Retail Radar team looked their P&L across ETFs and Single Stocks. In ETFs - which represented 75% of retail’s invested dollars this year (see Figure 6 below) - retail investors outperformed both SPY and QQQ, thanks to their larger Tech bias and successful risk taking in precious metals during the September and October gold rush.

In Single Stocks, retail concentrated their bets on the AI theme, with their performance unsurprisingly closely matching that of JPM's AI Datacenter and Electrification Basket (JPAMAIDE, see Fig 1). There was some outperformance in September and October, which can partly be explained by renewed enthusiasm and accelerated inflows in TSLA, in addition to regular bets in NVDA.

2025 Retail Activity in AI-related Stocks

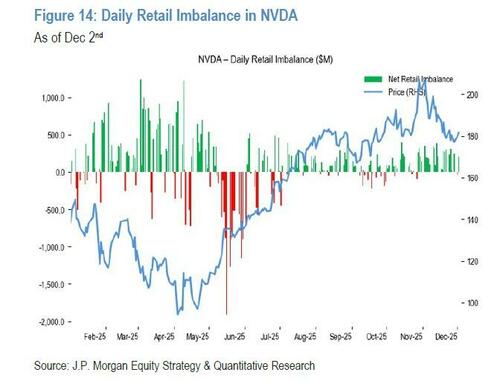

- Nvidia (NVDA): Retail buying-the-dip episodes occurred between January and April, coinciding with a downward trend in the stock price (Post-DeepSeek correction, Momentum Unwind and Liberation Day meltdown). Conversely, the most significant selling spikes were observed in May – around the time they released strong earnings results – aligning with periods of positive performance.

- Alphabet (GOOGL): Retail investors were stronger relative buyers of Alphabet during 2025, with pronounced activity in May, June, and late-November. The latter coincided with the release of Gemini 3, and reports that Meta were in discussions to purchase TPUs for their 2027 datacenters.

- Microsoft (MSFT): Microsoft’s retail imbalance showed more moderate fluctuations relative to other Mega caps throughout the year, with the most notable buying spike in late-October around the time of its 3Q earnings results where the company increased their capex guidance for the year.

- Amazon (AMZN): Amazon’s retail activity was more pronounced in the first half relative to the second, with a particularly substantial buying spike in May. Its largest selling spike occurred in late October and coincided with an earnings-driven price surge, when the stock jumped nearly +10% after effectively flipping the script on the AWS narrative with its fastest growth in 11 quarters.

- Meta Platforms (META): Meta had a major buying-the-dip episode in late-October, coinciding with a large 11% sell-off following its 3Q earnings release.

- Tesla (TSLA): Tesla exhibited pronounced retail imbalance swings, with its highest activity in the first half of the year and renewed enthusiasm since October. Strong selling spikes in March and May coincided with retail taking profits amid price increases.

- Apple (AAPL): Retail investors were consistent sellers of AAPL throughout the year.

- Oracle (ORCL): Oracle’s retail imbalances were generally more muted ,except for a few large events, including a substantial buying spike in mid-June and a very large selling spike in September that coincided with its price peaking on the back of a positive outlook for its cloud business.

- Advanced Micro Devices (AMD): Retail were strong buyers of AMD in the first half of the year, with the largest buying spike occurring in mid-May. Activity was more subdued in the second half, except for a profit-taking opportunity in October after the company announced a multi-year, multi-generation strategic partnership with OpenAI to deploy 6GW of AMD GPUs.

Lookback aside, we next turn to a snapshot of the latest retail trading activity:

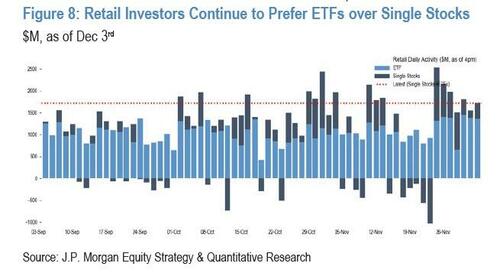

- In continuation to last week's actions, retail investors significantly bought into the rally during the holiday, posting a $8.6B weekly imbalance which far exceeded the YTD average of $6.3B.

- Defying the typical Thanksgiving slowdown, they actively turned to markets and consistently purchased cash equities in amounts exceeding their daily YTD average of $1.3B, being particularly active stock picking on Friday (Figure 8).

- Within single stocks, retail investors concentrated their bets on the Tech, Cons. Disc. and Communications sectors, continuing to favor NVDA, TSLA, and other Magnificent Seven names with the exception of AAPL. They reduced their holdings in Health Care, in particular in LLY, to fund these trades. Additionally, in line with last week’s trend, they slowly warmed up to crypto by purchasing limited amounts of MSTR (+0.5z) and IBIT (+0.3z).

Retail Trading Activity in Numbers for the week: Nov 26 to Dec 03

- Retail investors net purchased ~$8.6B this week, well above the 12-month avg of $6.0B/week and the YTD average of $6.3B. Retail investors continued to favor ETFs (+$6.2B) over Single Stocks (+$2.4B).

- Outside of Broad Based Equity ETFs (+$2.1B), Retail ETF buying was influenced by Fixed Income ETFs —Multi Sector (+$356M) and Investment Grade (+$228M) — and this week, Precious Metals (+$272M) and Equity Growth (Large Cap) ETFs (+$167M, 2.0z).

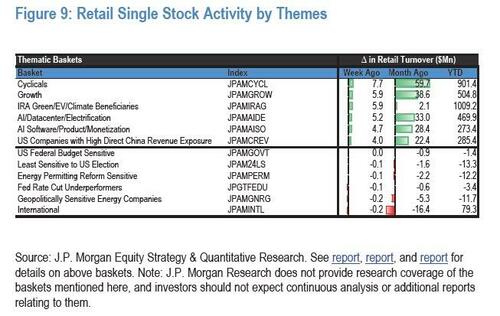

- This week, retail investors continued to buy Cyclicals, Growth, AI datacenters and electrification (JPAMAIDE), and AI Software/Product/Monetization (JPAMAISO), along with IRA Green/EV/Climate Beneficiaries. Conversely, they continued to sell International companies (Figure 9).

- Activity in Mag 7 this week: Retail investors bought NVDA (+$650M), TSLA (+$438M), AMZN (+$241M), GOOGL/GOOG (+$196M), MSFT (+$186M), META (+$135M) and sold AAPL (-$96M).

- Outside of Mag7 , retail stock bets were driven by Tech (+$1.1B) and Health Care (-$401M).

Non-retail order imbalance

- While retail bought the dip, non-retail investors net sold $18.0B last week, compared to a YTD weekly avg of -$9.4B and a 12m average of -$9.6B. Over the past week, Futures traders net bought ~$6.7B, which was driven by net buys in ES (~$7.7B) and partially offset by net sales in NQ (~$1.4B)

Retail Options Trading

Much more in the full JPM report available to pro subs.