Will Trump's Efforts To Help Affordability Work: Morgan Stanley Explains

By James Egan, US Housing Strategist and Co-Head of Securitized Products Strategy at Morgan Stanley

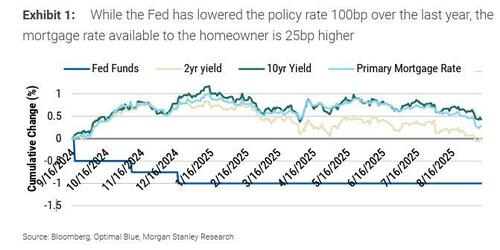

Last September, we discussed the US housing market's affordability problem, which can't be solved simply by the Fed cutting rates. Since then, the Fed has cut 75bp, but that move has only translated into a 20bp decline in mortgage rates.

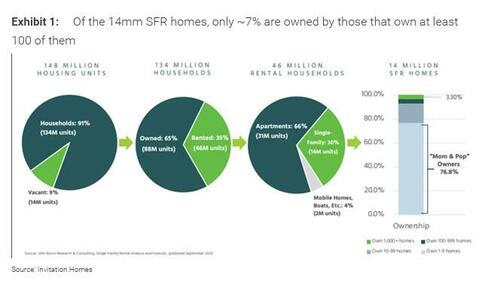

While a flurry of recent announcements has aimed at helping prospective homebuyers, a major improvement in affordability remains challenging. For instance, we don't think that the potential ban on large institutional investors buying more single-family homes will have a significant impact on home prices. They simply do not own enough homes and likely have been reducing their holdings recently.

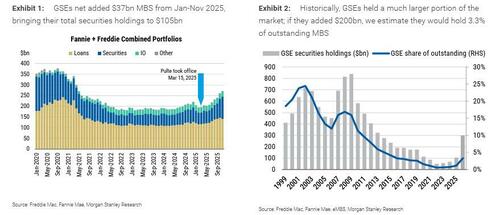

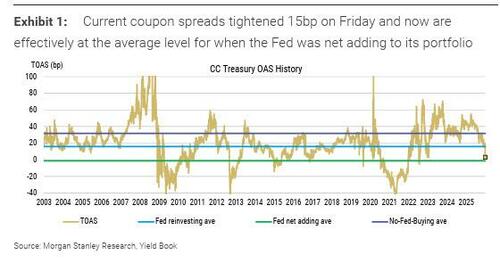

On the other hand, President Trump directing Fannie Mae and Freddie Mac to buy $200 billion in mortgage-backed securities elicited an immediate reaction. Mortgage spreads tightened 15bp the day after the $200 billion buy program was announced as investors priced in the sizeable demand. This move in mortgage spreads drove 30-year mortgage rates below 6% for the first time since 2022.

To put GSE buying into context, they once owned 25% of the outstanding agency mortgage market, but their share has shrunk to less than 1% in the past few years. While we await more information on this program (e.g., are the purchases outright like Fed QE programs or duration hedged as the GSE's portfolio has historically been run; how will they be they funded?), we think that the market has efficiently priced in the response to the program as announced.

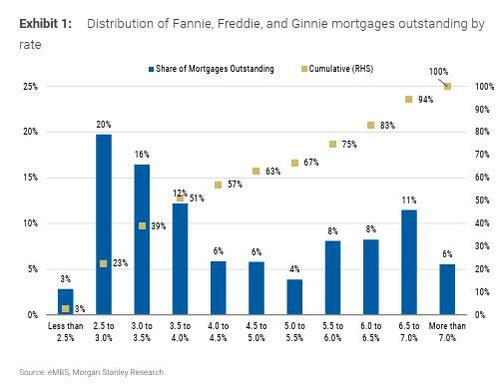

A 15bp decline in mortgage rates is positive for affordability, but only marginally. When assessing the implications for the US housing market, we think about changes in affordability with respect to sales volumes and home prices. The stand-alone impact of this move on our numbers is small. We had expected mortgage rates to end 2026 at 5.75%. Recent news only lowers our forecast to 5.6%. This change would push our +3%Y forecast for existing home sales in 2026 fractionally higher without affecting our expectation for 2%Y home price appreciation. The limited impact stems from the current distribution of mortgage rates: roughly two-thirds of mortgages still carry a rate below 5%. While affordability might be improved for the buyer, it won't necessarily 'unlock' substantial additional supply to be purchased.

What else can be done to bring down mortgage rates? The GSEs could reduce the fee they charge to guarantee timely principal and interest to investors (their loan-level pricing adjustments), and Ginnie Mae could lower its mortgage insurance premium. Regulators could reduce the risk weights on conventional mortgages, increasing bank demand for MBS. New Fed board members may be willing to end mortgage run-off from their balance sheet. Alone, none of these steps would have a meaningful impact on the mortgage rate or mortgage spread, but in combination we could see them lowering the mortgage rate by another 50bp.

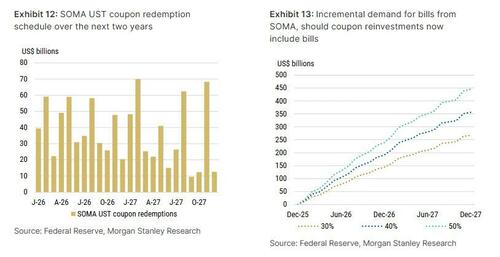

However, no single action from the GSEs could bring mortgage rates down to the 4% they averaged in the 2010s; this would require a move in Treasury rates. Our rates strategists conducted a thought experiment about shifting Treasury issuance to 30% bills, which they hypothesized would reduce coupon issuance by $1.5 trillion over two years, bringing down medium-to-longer-term Treasury rates. This is not their base case.

Housing affordability is about more than mortgage rates. Tax credits have been successful in the past, though they pull forward demand and their impact tends to be temporary. An increase in new supply could improve affordability by softening home prices, but new inventory is at its highest levels since 2007. This dynamic has already driven new home prices below existing home levels and has depressed building volumes to the tune of a 7% decrease in single-unit starts this year. Falling home prices would also impair a large asset on the balance sheet of 65% of the country's households. Affordability in US housing is a tricky issue that lacks a silver bullet.

Putting it all together, the recent announcements are modestly helpful for homeowner affordability. While in agency mortgages this announcement is largely priced in, we expect this tightening to support other high-quality assets like securitized and corporate credit through the portfolio-channel effect. While other announcements could improve affordability and/or demand, we think that the near-term improvement would be marginal and would entail more risk. Like potential homebuyers, we await more news, perhaps as soon as the Davos meetings in a week.

More in the full Morgan Stanley Sunday Start note available to pro subs.