"Worst Day Since 2022": Wall Street's Top Traders Explain Why Momentum Suddenly Blew Up, And What's Next

Ever since mid-2022, they ruled markets with an iron fist, and a sharpe ratio that would make Bernie Madoff and Warren Buffett blush. Today, however, it all came crashing down as momentum traders suffered losses for the history books.

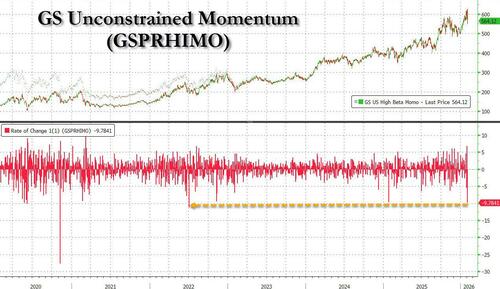

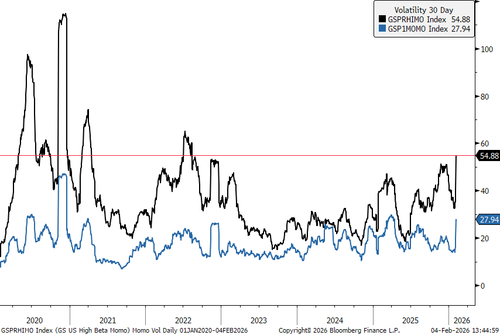

As we touched upon earlier, Goldman's “high beta” or unconstrained momentum basket (GSPRHIMO) just had its worst day since 2022 (and briefly since 2020, but in either case surpassing the post-Deepseek selloff last January).

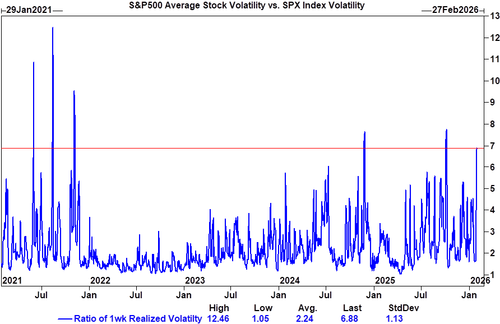

While yesterday’s drawdown was driven by capitulation of Software stocks amid fears of AI-disruption, today’s weakness was far more concentrated in factors and positioning, leaving headline index moves looking deceptively cordial relative to the magnitude of what unfolded underneath. It reminds us of what Goldman's Lee Coppersmith wrote this weekend: namely that the ratio of 1-week realized vol in the average S&P stock versus SPX vol just hit 6.88 on Thursday - 99th percentile since 2023 - and comparable to what we witnessed in 2021. Said another way, the average S&P stock is swinging ~7x the index, which is why the ramp over the past few sessions has been especially sharp even if the relatively smooth moves on the S&P's surface misrepresent just how volatile the moves below the surface are.

Yet despite the pain across consensus longs, activity on the Morgan Stanley trading desk was orderly, with little sense of panic. Notably, quant strategies fared better on the day, as the unwind skewed heavily toward Long/Short portfolios that had been most offside to Momentum.

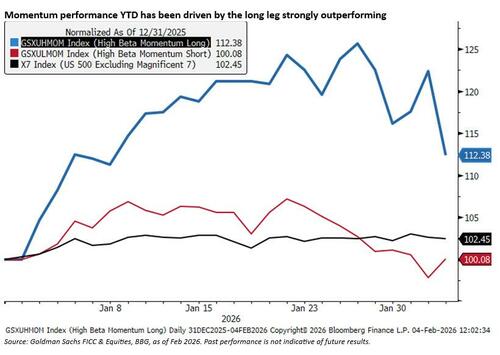

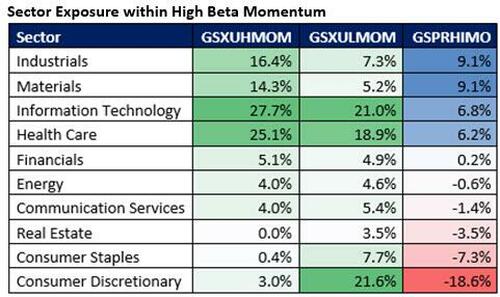

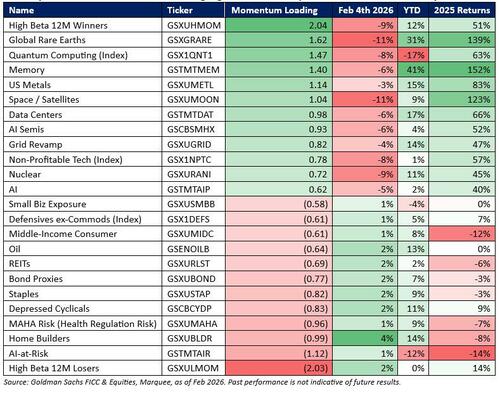

So what happened? The selloff today was primarily driven by the strong underperformance of the long leg (Past Winners, GSXUHMOM) which is skewed towards cyclical high flying themes with high beta and high volatility.

Echoing Goldman, Morgan Stanley's Bryson Williams writes in his EOD note (available here for pro subs) that the defining feature of today’s session was an extreme factor reversal, particularly in Momentum, which suffered its worst drawdown in over three years. Similar to Goldman's unconstrained momentum basket, the Morgan Stanley momentum basket (MSZZMOMO -7.65%) registered a multi–z-score decline driven primarily by long reductions rather than symmetric de-grossing, as investors aggressively trimmed YTD winners. Weakness was heavily concentrated in crowded themes (MSXXCRWD -1%) that had led performance earlier in the year: AI beneficiaries (MSXXAIB -6.5%), AI Power (MSXXAIPW -6.7%), National Security, Bitcoin Miners, and other high-beta, high-momentum pockets – while laggards rallied sharply across nearly every sector. This “contra-AI” dynamic echoed yesterday’s dispersion but flipped the leadership entirely, with Early Cycle Cyclicals (MSXXECYC +3.5%), Chemicals, Regional Banks (KRE +1.56%), and select mega-cap defensives outperforming as capital rotated out of the most consensus trades.

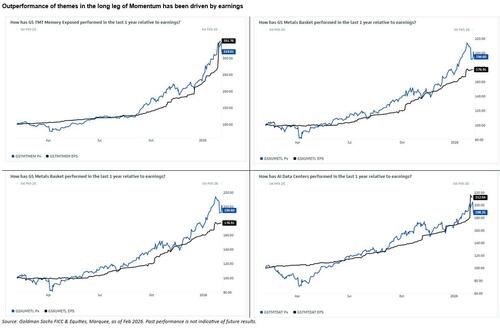

Notably, there was no smoking gun for today’s move, it just happens that the market was chasing the strongest earnings revisions possible, and in the midst of that, short term performance technicals got too extreme, according to Goldman.

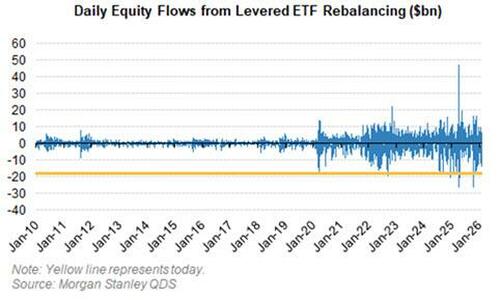

There's more: The extremely fragile market structure amplified the move. Levered ETF rebalancing emerged as a major driver, with Morgan Stanley QDS estimating roughly $18bn of US equity supply on the day — placing today in the top 10 largest levered ETF supply days on record. The bulk of that supply was concentrated in Nasdaq, Tech, and Semis, with significant single-stock pressure in names such as NVDA, TSLA, AMD, MU, PLTR, and MSTR. Dealer gamma dynamics offered limited relief: while dealers remain long gamma in options, that exposure has fallen meaningfully, and once offset by levered ETF short gamma, the street was effectively net short gamma, exacerbating intraday moves as selling pressure built. Looking ahead, systematic supply remains a risk, with ~$10bn estimated over the coming week, particularly if volatility remains elevated and equity leverage — still sitting near the upper end of historical ranges — begins to unwind more forcefully.

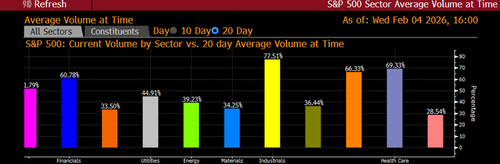

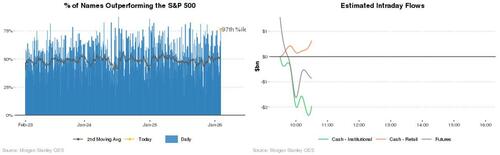

What made today particularly challenging was the disconnect between indices and internals. At points during the session, nearly three-quarters of stocks were outperforming the S&P 500 — an extreme reading historically — even as the index itself traded lower, underscoring just how narrow the pain had become.

Also notable: retail participation was notably absent compared to prior sessions as demand sat in the lower quartile, a sharp contrast to the aggressive retail bid seen during last week’s rallies and even during yesterday’s Software-led selloff. Institutional supply, meanwhile, was steady but not extreme in percentile terms, reinforcing the view that this was a positioning unwind rather than forced liquidation.

Cross-asset signals added to the noise but were not the primary driver. Oil spiked early on headlines suggesting nuclear talks with Iran were canceled, briefly lifting Energy (MSXXOIL +2.87%), before giving back some of the gains after confirmation that talks will proceed in Oman, easing geopolitical risk premium.

Taken together, Bryson writes, "today’s session represents a clear escalation of the rotation and dispersion themes that surfaced yesterday — less about Software specifically and more about a broader “re-risking to reversal” moment, where crowded Momentum exposure is being challenged aggressively, even as index-level damage remains contained for now."

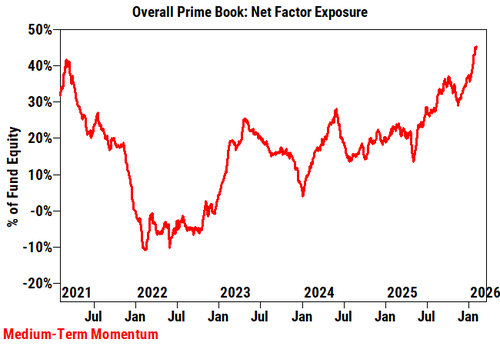

Next, we go back to Goldman which also writes that we have seen a strong reversal in what worked so far this year with Memory, Rare Earth, and Non-Profitable Tech (GSX1NPTC) all giving back much of their YTD gains (for rare earth and nuclear names, we laid out one reason why the selling may have been triggered, although it is one which the market will very soon gloss over). Heading into today's session, we flagged that Momentum looked stretched and was very crowded - 99th percentile over 1yr, 100th percentile over 5 yrs...

... and a larger unwind of the winners could cause more pain than a rotation given where nets are in Goldman's Prime Book (89th percentile over last year).

All the baskets having high momentum exposure were all in the red today, while the themes with negative momentum all rebounded.

Volatility of momentum is currently extremely elevated relative to history (95th percentile in the last 5y) and the factor was on track for its best start of the year until today. This is also consistent with the higher level of factor and thematic vol the market has been experiencing of late, with violent intraday and intraweek moves amidst more muted moves at the index level.

What’s Next? Here Goldman observes that on days like Deepseek Monday, following COVID Vaccines, or other high sigma days, there was a more fundamental shift in the story for the winners and losers. In comparison, today feels like more of a consequence of elevated vols, stretched technicals, and higher thematic dispersion with no changes in expectations for some of the higher flying themes.

As such the bank's traders conclude that historically, momentum dips like today's are good buying opportunities in the medium-term. However, aside from a few moments yesterday and today, we have not yet seen major signs of panic or capitulation, and given the very strong run for the factor and elevated positioning, short-term hedging still makes sense.

It's not very different at Morgan Stanley's desk: the bank's Short Momentum basket MSQQUMOS was +0.8% (in fact, every single sector short momentum basket was positive today). Yesterday, the desk MS saw shorts being pressed. As such, PnLs for US-based L/S funds held up relatively well (down just 10bps) as folks were setup on the right side of some of the volatile factor moves. Today, however, was quite different given longs were being sold across crowded parts of market i.e. AI - MSXXAI -8.5%, Memory – MSXXGMEM -6% and AI Power MSXXAIPW -8% .

In conclusion, Morgan Stanley's Bryson Williams says that everyone is asking why the selling (Williams doesn't buy the AMD narrative – results were actually very good). Maybe it's just a VAR shock, he wonders, which has forced some degrossing of longs. Similar to Goldman, the MS trader notes that that is usually a good opportunity to buy but he would caution against that and thinks there is risk to the downside on momo (MSQQUMOL) & crowded longs (MSXXCRWD)….even if we get a short term bounce tomorrow.

Much more in the full Goldman and Morgan Stanley notes available to pro subs.