"This Year Really Made Investors 'Work For It'": Goldman's Flow Of Funds Gurus Wrap-Up 2025

The time for "buy everything" feels long gone... according to Goldman Sachs flow of funds gurus - Gail Hafif, Brian Garrett, Lee Coppersmith - as they wrap up their coverage for 2025 by noting that this year has really made investors "work for it".

There are just 9 full trading days left in the year (that means you’ve traded ~240 days, 48 trading weeks, 1560 hours).

Here's the 2025 Wrap:

1. A-list of the Index

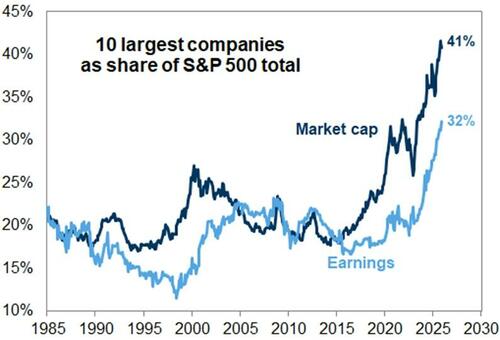

The top 10 largest companies in the S&P make up more than 40% of the index and contribute to almost a third of the earnings growth - this supports our house view that the S&P will go higher in 2026.

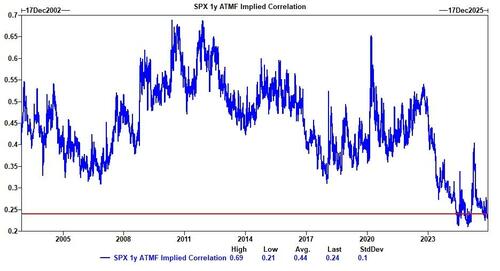

@stockpicker500: "Siri, play dispersion" - might as well, since dispersion has been the chart-topper. The SPX 1y ATMF implied correlation tells us that 2026 is set to be one of the lowest correlation years for SPX in our dataset = stock pickers rejoice!

Source: Goldman Sachs FICC and Equities as of 12/16/25

2. On mute: Gamma

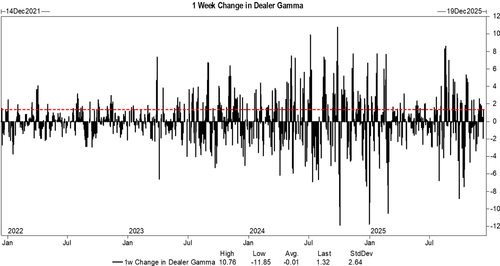

Dealer gamma positioning has kept market moves muted - we estimate dealers are small long gamma here which should continue to act as a market buffer.

The volume gets turned down on moderate selloffs which would flip dealers flat gamma and exacerbate those moves further down (short).

Source: Goldman Sachs FICC and Equities Futures Sales Strats as of 12/15/25.

3. Want to See More?

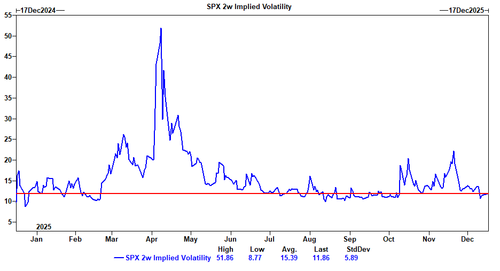

SPX 2w implied volatility is in the 21st percentile on a 1y lookback showcasing the "cheap" gamma levels for the index.

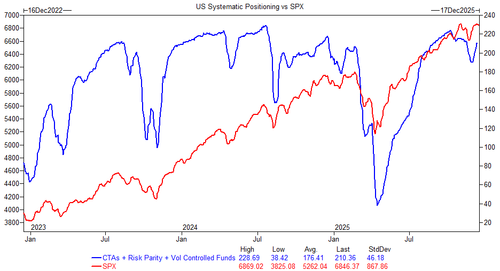

Broadly speaking, we still think there is room for vol to compress further on a drift higher. Lower levels of implied vol = gas to refuel systematic re-leveraging - we are watching our estimates closely here.

Source: Goldman Sachs FICC and Equities as of 12/16/25

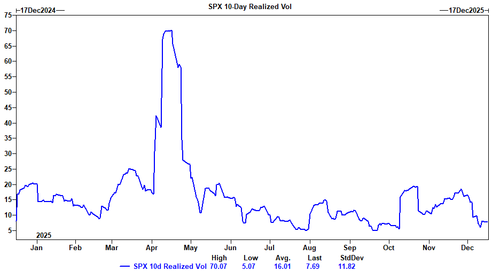

4. Late Cycle Trend: Realized Vol

SPX 10-Day Realized Vol is ~7.5% and in 14th percentile on a 1yr lookback.

Again, the relative "calmness" in the market despite price action tells us a better story about positioning than sentiment.

Source: Goldman Sachs FICC and Equities as of 12/16/25

5. Your Most Listened to Investors

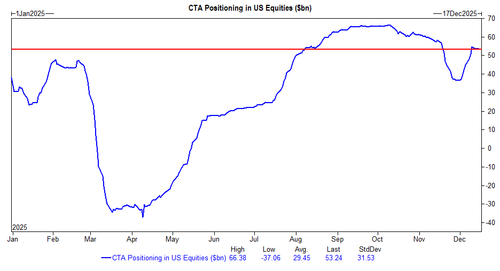

i. Systematics

CTAs net bought $23B of US equities this year and were long $66.38B at the highs this year in October. This length has since come in, but as stated earlier, lower levels of implied volatility can provide room for systematic cohorts to re-lever.

In the short term, the S&P closed ~22 handles above the short term trigger level. Per our estimates, a down tape would release $12.64B in supply of US equities.

Source: Goldman Sachs FICC and Equities as of 12/16/25

We are still well above the medium term threshold (6548) which would mark a notable shift in flows.

Over the next 1 week…

-

Flat tape: Buyers $2.13B ($475mm out of the US)

-

Up tape: Buyers $7.49B ($995mm out of the US)

-

Down tape: Sellers $36.47B ($12.64B out of the US)

Over the next 1 month…

-

Flat tape: Sellers $15.13B ($12.59B out of the US)

-

Up tape: Buyers $21.17B ($1.14B out of the US)

-

Down tape: Sellers $197.83B ($73.69B out of the US)

Source: Goldman Sachs FICC and Equities as of 12/16/25

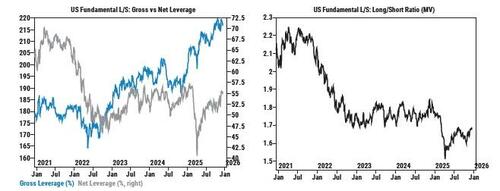

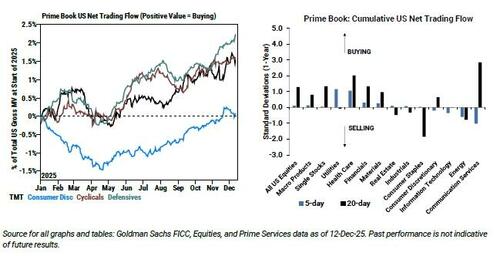

ii. Institutions

As of Friday, US Fundamental L/S Gross leverage fell -1.1 pts to 217.7% (91st percentile one-year), and US Fundamental L/S Net leverage rose +1.6 pts to 57% (98th percentile one-year). US Fundamental long/short ratio (MV) rose +1.9% to 1.710 (79th percentile one-year).

Single Stocks saw little net activity, as long buys were offset by roughly an equal amount of short sales.

Health Care, Utilities, and Financials were the most notionally net bought sectors, while Communication Svcs, Info Tech, and Energy were the most net sold.

Gross risk still exists but HF positioning is cleaner into year-end and has been marked by hedging activity in the low vol environment.

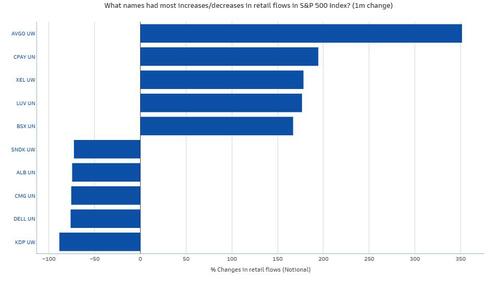

iii. Retail

Last but certainly not least, this cohort has run the show this year through "meme" trends and crucial "buy-the-dip" flows.

Source: Goldman Sachs FICC and Equities as of 12/16/25

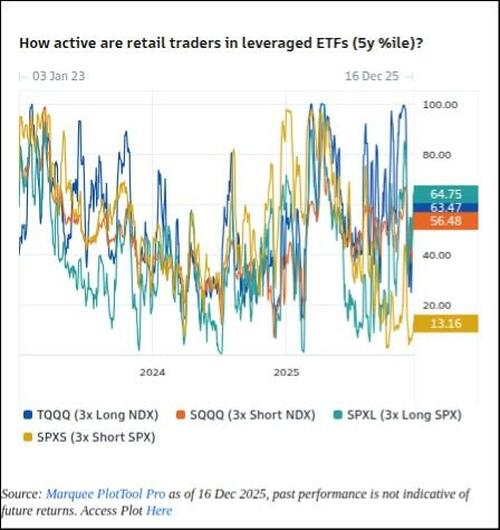

However, the insatiable bid for leverage has relaxed and - retail activity in the major levered ETFs sits in the mid-50/60 percentiles on a 5y lookback (apart from 3x Short SPX below the 15th percentile).

This has come in significantly from the earlier this year where retail reached at least the 90th percentile across the board. This is, in part, due to seasonal patterns, so we will watch out for a resurgence into next year.

Source: Goldman Sachs FICC and Equities as of 12/16/25

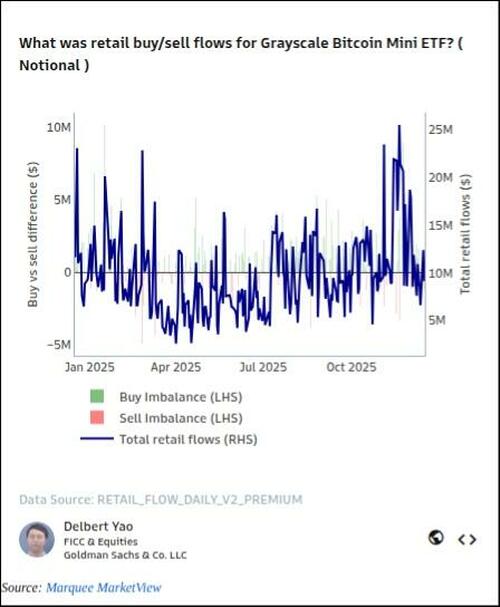

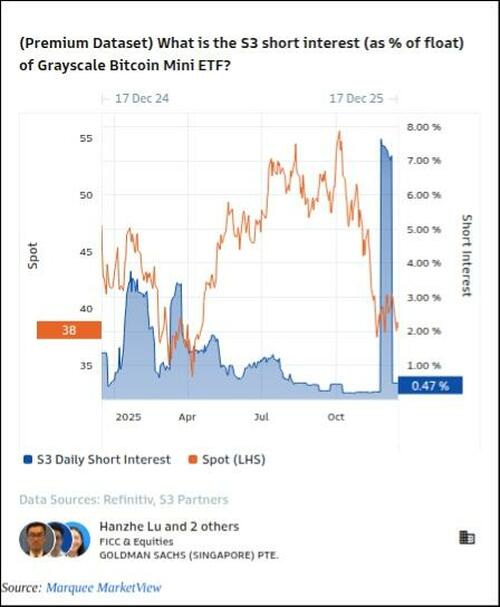

6. Retail Bellwether of the Year: BTC

Bitcoin has identified itself in recent weeks as retail's preferred instrument to express sentiment + positioning.

Source: Goldman Sachs FICC and Equities as of 12/16/25

Short interest in IBIT peaked to 7.62% of the float on the bitcoin meltdown - this has now normalized to a mere 0.47%.

Source: Goldman Sachs FICC and Equities as of 12/16/25

We expect this to continue to serve as a bellwether for retail next year.

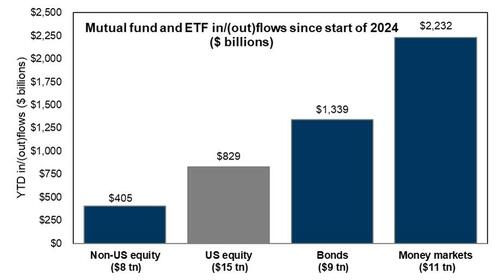

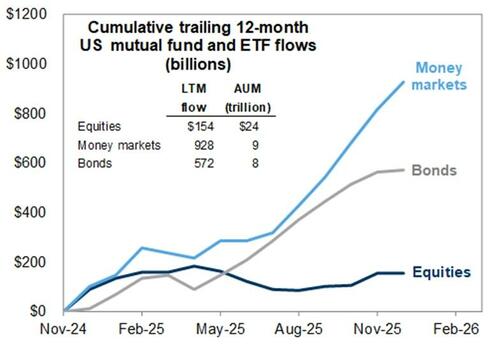

7. Comeback Genre: Fund Flows

i. Passive Funds

Current Passive AUM = $24 Trillion.

Source: Goldman Sachs FICC and Equities as of 12/16/25

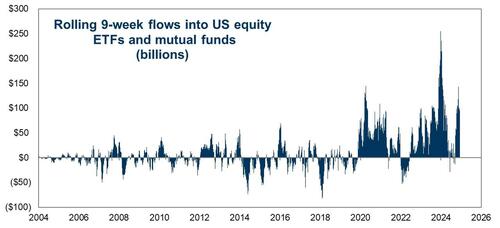

US equities saw almost +$100 Billion worth of inflows over the last 9 weeks, continuing the steady trend of inflows in 2025. SPY/QQQ as a holiday present?

Source: Goldman Sachs FICC and Equities as of 12/16/25

ii. $$$ Market Funds

Maybe not your guilty pleasure song coming on shuffle, but friendly reminder that money market funds have an AUM of $11tn (+2.2tn since the start of 2024) - and just when you thought there were no more incremental buyers of US equities.

Source: Goldman Sachs FICC and Equities as of 12/16/25

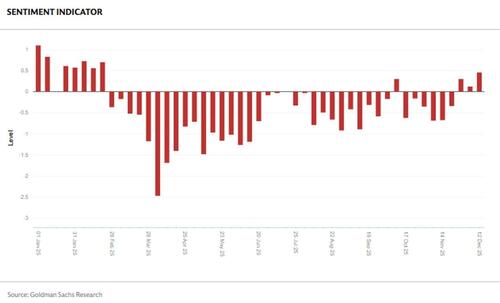

8. Sentiment by Month

Our positioning indicator has registered a year marked so bearish that you almost could not believe NDX was up +19.61% and SPX was up 15.62% YTD.

Apart from the lack of panic we've seen on this shakier price action, we also find our most bullish reading since April to be indicative of hedging activity the past few days rather than a structural narrative shift.

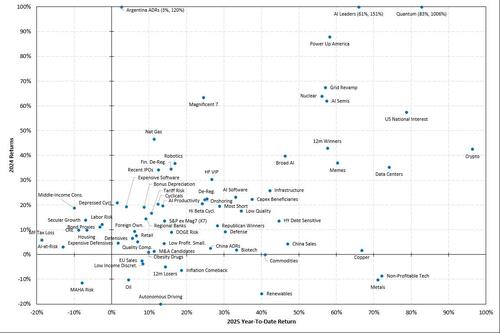

9. Your New Anthem: Baskets for '26

Top themes for ‘26:

The time for "buy everything" feels long gone, and we've already highlighted our case for themes going into 2026 - our baskets team made it easy for you:

-

Long Depressed Cyclicals (GSCBCYDP) vs Short Expensive Defensives (GSXUEDEF)

-

Long Middle-Income Consumer (GSXUMIDC)

-

Long US AI Productivity Basket (GSXUPROD) – the most important trade in 2026.

-

Long AI Volatility (GSVIAIV1) to hedge the risk of “AI politicization” as we approach the midterm elections

Source: Goldman Sachs FICC and Equities as of 12/16/25

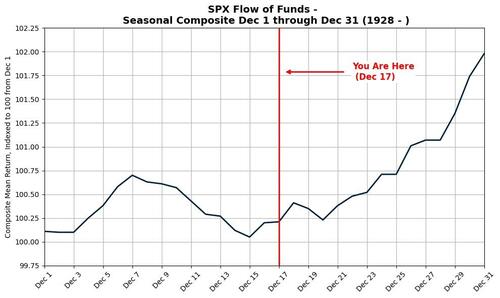

10. Historical Trends

This year has really made investors "work for it."

Barring any major shocks, it will be hard to fight the overwhelmingly positive seasonal period we are entering and the cleaner positioning set-up. To speak to how positive this two-week period has historically been, while the S&P mean return from Dec 1 to 31st has been 1.98%, the return from today to Dec 31st is 1.77%. While we don't necessarily see a dramatic rally, we do think there is room to go up from here into year end.

Source: Goldman Sachs FICC and Equities as of 12/16/25

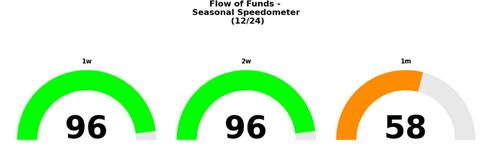

Have we not mentioned the Santa Rally yet? The 1w and 2w periods starting December 24th are in the 96th percentile for the S&P 500.

January can be more challenging, and we will be here to kick off another year.

Professional subscribers can read much more from Goldman's Sales & Trading team here at our new Marketdesk.ai portal