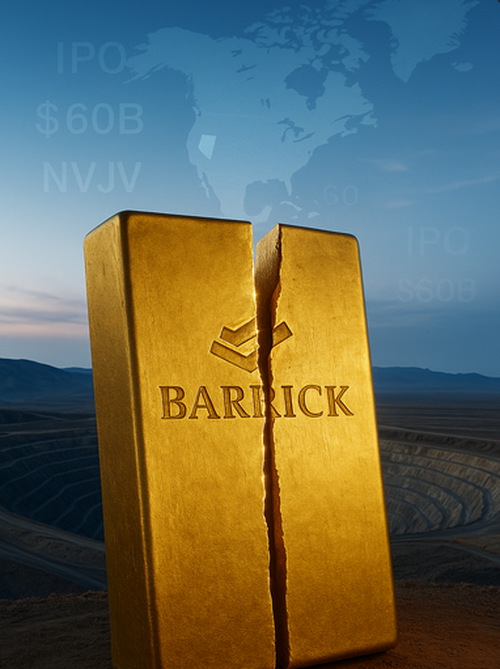

Barrick Seeks to Spin-Off US Operations, Hits 13 Year Highs on News

Authored by GoldFix

GFN – NEW YORK: Barrick Mining is exploring an IPO of its North American gold assets, a move that could value the unit near $60 billion as the company restructures following operational setbacks and management turnover.

-

Barrick is exploring an IPO of its North American gold assets, potentially valuing the unit near $60–62 billion while retaining majority control.

-

Shares hit a 13-year high as the move follows activist pressure, management changes, and a broader restructuring push.

-

The strategy separates high-quality Nevada assets from higher-risk global operations, with analysts noting possible M&A interest from Newmont.

According to Bloomberg, The FT, and Reuters The board has authorized management to pursue the sale of a minority stake in a newly formed unit anchored by Barrick’s joint-venture interests in Nevada and its large Dominican Republic mine, with the review process running through early 2026 and a market update planned for February. Barrick would retain a controlling stake following any listing, with the vehicle also housing the company’s wholly owned Fourmile discovery in Nevada, subject to final board approval. The announcement follows Bloomberg’s October reporting and comes after activist investor Elliott Investment Management disclosed a sizable stake in the Toronto-based miner.

Barrick shares rose as much as 4.2% Monday to $43.08, a 13-year high that values the company at more than $70 billion. Bloomberg Intelligence estimates the spinoff could be worth approximately $62 billion if investors apply a valuation premium similar to that of peer Agnico Eagle; however, analysts caution the company must still close an operating-performance gap to justify such a multiple. Under interim CEO Mark Hill, appointed after Mark Bristow’s abrupt September departure, Barrick has begun management changes and regional restructuring aimed at reversing underperformance that left its five-year annualized shareholder return of roughly 15% at about half the peer-group average.

Strategically, the proposed IPO would separate the company’s high-quality Nevada assets from higher-risk international operations, including projects in Mali, Pakistan, and Papua New Guinea that have weighed on results. National Bank Financial noted the structure could make the new vehicle a potential acquisition target for Newmont, Barrick’s JV partner in Nevada, which itself studied a pathway to control of the shared assets last year.

Worth noting: Global mining risks are increasingly being separated from US operations now