The Biggest Liquidity Drain in the World is About to End…

The Fed’s Quantitative Tightening (QT) program ended yesterday.

If you’re unfamiliar with QT, it’s a process through which the Fed allows the bonds it owns to mature. Once the bonds mature, the money the Fed loaned out is paid back to the Fed. The Fed then transfers that cash to the Treasury, thereby shrinking its (the Fed’s) balance sheet and draining liquidity from the financial system.

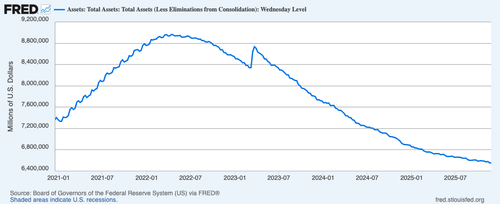

The Fed introduced this program in June 2022 as a means of draining liquidity from the financial system and to combat inflation. Since that time the Fed has drained a whopping $2.4 TRILLION in liquidity from the financial system. The Fed’s balance sheet declined from $8.9 trillion to $6.5 trillion where it sits today.

Put simply, one of the biggest liquidity drains in financial history has ended. And by the look of things, the Fed will soon be forced to flood the financial system with another round of liquidity via Quantitative Easing: the process through which it prints new money and uses it buy to bonds/ debt.

Why would the Fed do this?

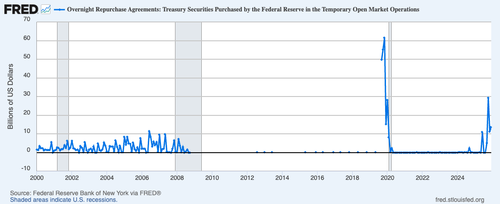

Because, behind the scenes, the U.S. banking system is experiencing a mini-funding crisis. Every night banks are turning to the Fed for overnight funding to the tune of $10+ billion (most recently it was $13 billion). As the below chart shows, this the first time this has happened since the pandemic.

Eventually this situation is going to force the Fed to start another QE program. And when it does, inflation hedges will EXPLODE higher. So, if you’re looking for a reason why gold and precious metals refuse to break down, this is it.

Gold has a clear Cup and Handle formation in place. This formation targets an upside target north of $4,600 per ounce.

Silver has already us shown what is coming.

If you want to profit from this, you need to put your money to work now.

On that note, we just published a Special Investment Report concerning FIVE secret investments you can use profit from the next major bull run in precious metals miners.

The report is titled Survive the Inflationary Storm. And it explains my top precious metals plays, including their names, their symbols, and the resources they own. These are HIGH OCTANE positions that are already up 40%, 120%, 120%, 140% and an incredible 450% this year alone!

Normally I’d charge $499 for this report as a standalone item, but we are making just 100 copies available to the public.

To grab one of the last remaining copies…

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research